Turkey pushes for first Black Sea gas this quarter [Gas in Transition]

Turkish Petroleum (TPAO) announced on January 5 that it expects first gas from its Sakarya gas field in the Black Sea to start flowing by the end of March. This is a key date for Turkey’s president Recep Tayyip Erdogan as he tries to drum up support in time for presidential elections in May.

2023 is also the 100th anniversary of the declaration of the Turkish Republic and Erdogan is determined to mark the occasion with a great success, ahead of the elections.

Phase one of the project involves a subsea gas production system from 10 subsea wells. The gas will then be transported through a 165-km pipeline to an onshore processing plant at Filyos in Turkey’s Zonguldak province. When fully developed, the project is expected to meet more than 30% of Turkey’s domestic gas demand.

Sakarya gas field

The Sakarya gas field was discovered in August 2020 when TPAO drilled the Tuna-1 deepwater exploration well at a water depth of 2,115 m. It is located in the western part of Turkey’s EEZ in the Black Sea, about 165 km offshore (see figure 1). Based on the Tuna-1 results, Sarkaya was estimated to hold 320bn m3 of gas.

Subsequently, TPAO made a second discovery in October 2020, close to Tuna-1, that increased the estimated reserves to 405bn m3.

Further drilling in June 2021 in the northern part of the Sakarya gasfield produced another discovery at the Amasra-1 well, estimated at 135bn m3, increasing the total reserves to 540bn m3.

By the end of 2022, following drilling a number of appraisal wells, the Sakarya reserves estimate rose to 652bn m3. In addition, the discovery of another 58bn m3 at Caycuma-1, an adjacent gasfield, increased this total to 710bn m3.

The continued discovery of new, small, gas fields around Sakarya points to a high probability that eventually total discoveries may be much larger than originally thought. Turkey’s energy minister, Fatih Donmez, confirmed that drilling will continue, both offshore and onshore. In announcing the new estimates in December, President Erdogan said “This new discovery will open the door for new ones. We’ll start drilling new wells as soon as possible.”

This is Turkey’s first deepwater gas discovery and holds by far the country’s biggest gas reserves.

The development

The project is being developed in two phases. Phase 1 will achieve an annual production of 3.65bnn m3, to be raised to about 15bn m3 in Phase 2. Peak production is scheduled to be reached by 2028. This is expected to meet about 30% of Turkey's current annual consumption. But that is not based on the latest, rising, reserves estimates. The 30% increase in reserves announced in December is likely to lead to further revision of the project development plans.

The Phase 1 integrated engineering, procurement, construction and installation (EPCI) contract was awarded to a consortium of Schlumberger and Subsea 7 in October 2021.

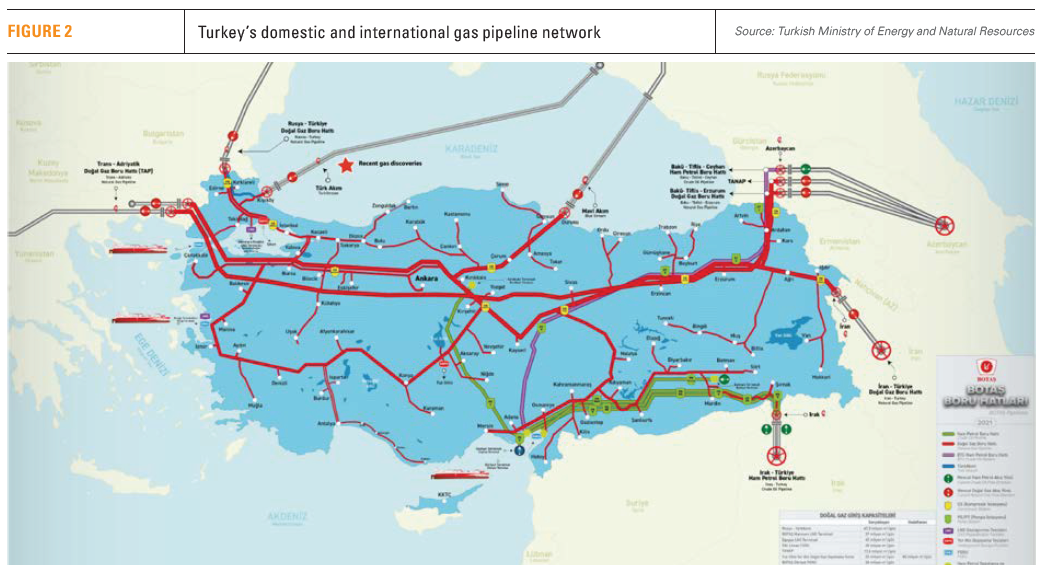

The development concept is based on producing the gas through subsea production facilities at 2,200-m water depth and transporting it through a 165-km subsea pipeline – a 16-inch pipeline for Phase 1 and a 24-inch pipeline for Phase 2 – to be processed at an onshore facility at Filyos. From there, it will be connected to the country's national gas distribution network (see figure 2) through a new 36-km pipeline.

Ten production wells have already been drilled for Phase 1, with 30 more to follow for Phase 2. The fast-track project is progressing to schedule.

What this means for Turkey

When first announced, in August 2020, Turkey’s plan to bring Sakarya onstream early in 2023 was met with considerable scepticism. But two years and eight months after the first discovery, Turkey is about to achieve just that.

With inflation exceeding 85% in 2022 and energy prices skyrocketing, the start of gas deliveries from Sakarya cannot come too soon and will be much-welcomed by Turkey’s energy consumers.

By the end of 2022, electricity prices for households increased by about 105% – in US-dollar-terms – in comparison to the end of 2021, causing much hardship. Electricity prices for industry increased even more, by 127%.

By the end of 2022, electricity prices for households increased by about 105% – in US-dollar-terms – in comparison to the end of 2021, causing much hardship. Electricity prices for industry increased even more, by 127%.

Using the discovered gas to offset imports and cover domestic demand will eventually bring energy prices down, improve Turkey’s energy security, diversify its energy sources, improve its foreign currency balances and help improve its economy.

Turkey imported about 59bn m3 gas in 2022, with just under half of that from Russia. The total cost of gas imports was close to $100bn, double that in 2021. When Sarkaya reaches full production, it could bring this cost down by 30%, providing welcome relief to Turkey's beleaguered economy.

Apart from Russia, Turkey is importing pipeline gas from Azerbaijan and Iran, and LNG from Qatar, the US, Nigeria and Algeria, as well as from the spot market.

But the Black Sea gas discoveries also provide Turkey with other strategic options. If Turkey obtains a price discount from Russia – 25% was requested in December – and given that it is bound by long term contracts, another option is to export some of this gas – likely to Europe – reaping political benefits, as well as profiting from the foreign currency revenues it will receive.

President Erdogan said in October 2022 that he had agreed with President Putin to develop a natural gas hub in Turkey. Endorsing the proposal, he said “Turkey will be a hub for natural gas…In our last meeting, we agreed with Putin on this issue. We will create a hub here with Turkish gas coming from Russia.”

Confirming his keenness on the project, president Erdogan said in December “We are determined to turn Türkiye into an energy hub of the Caspian, Mediterranean and the Middle East regions.” In support of this, he pointed out that Turkey has “seven international pipelines, four LNG terminals, and two underground natural gas storage facilities,” concluding that the country has “all the infrastructure to become an energy hub.” (see figure 2).

Russia and Turkey have instructed their respective energy regulators to immediately begin technical work to make the Russian proposal a reality. Russian deputy prime minister Alexander Novak said that decisions will be taken this year.

In any case, president Erdogan confirmed that the government will continue to search for more hydrocarbon reserves both at sea and on land, but the primary focus will be the Black Sea. However, exploration in the East Med continues, mostly driven by geopolitics rather than a serious hope for gas discoveries. None have been made so far.

To a certain extent, since the Black Sea gas discoveries Turkey has toned down – but has not abandoned – its aggressiveness in the East Med, especially directed against Greece and Cyprus. But it is not clear that the two are linked. Turkey’s regional maritime geopolitics and intentions may start becoming clearer after its presidential elections in May.