Trader Buys all LNG from Ophir Project

The host government of Equatorial Guinea and the Fortuna LNG project partners have picked the commodities trader Gunvor as the buyer of the plant's output, operator Ophir said August 21.

The deal marks a significant shift in the market: normally the buyers of production have been utilities or majors with deep pockets and existing customers needing supplies whereas Gunvor will be relying on trading expertise to find a home for its output.

All parties have agreed the principal commercial terms subject to finalising the sale and purchase agreement ahead of the final investment decision.

Gunvor is committed to taking the full contract capacity of the Gandria floating liquefaction (FLNG) vessel of 2.2mn mt/yr, on a Brent-linked, free on board basis for ten years. The contract structure allows flexibility for up to 1.1mn mt/yr to be marketed on an alternate basis. This gives the Fortuna partners and government the potential to sell volumes to higher priced gas markets in Africa and beyond, retaining a share in the profits of such sales.

Government not about to repeat its error

This splitting of proceeds suggests the government is not about to repeat the error it made in its first and only LNG offtake deal, where BG – now Shell – bought all the output of the pioneering plant at a low fixed price and sold it to high-priced markets in Asia, making an enormous profit. That 17-year, 3.3mn mt/yr contract with Shell runs until 2023.

Gunvor, Vitol and Shell were announced this June as the shortlisted candidates for the contract that has now been awarded to Gunvor,

The last step before FID of this Ophir-led Fortuna project is the completion of project funding, with FID remaining on track for later in 2017.

Energy minister Gabriel Mbaga Obiang Lima said: "The selection of Gunvor sets a landmark moment in the development of the Fortuna Project. The partnership with Gunvor also paves the way for the government's objective to deliver important projects that monetise our gas, promotes local content and brings world-class petroleum technology to Equatorial Guinea. The Fortuna Project will target becoming the first choice supplier of LNG for the LNG to Africa initiative, furthering Equatorial Guinea's leadership position in Africa as an LNG exporter."

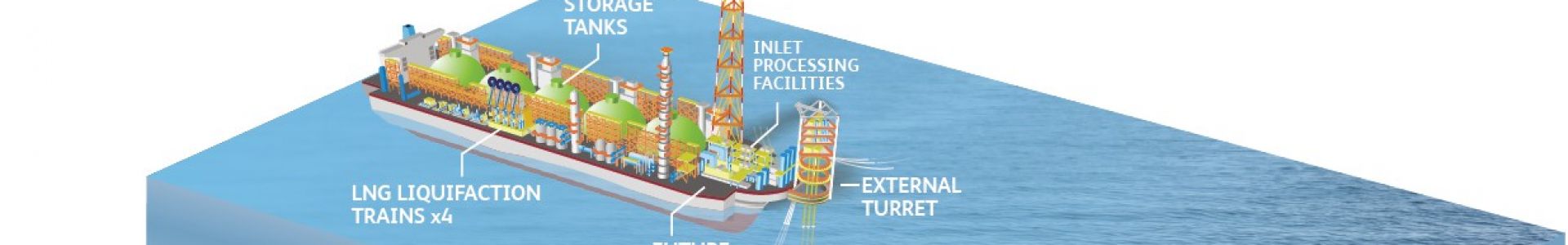

Ophir CEO Nick Cooper thanked the other bidders in the tender, saying that Gunvor's involvement is "a further addition to a strong partnership along the Fortuna value chain. Our focus is now on completing the financing package and debt facility. With Golar's sister vessel, the Hilli Episeyo, nearing completion and with Petronas FLNG having recently delivered commercial cargoes, FLNG is now entering the mainstream."

Progress in Cameroon too

Separately, Golar, Keppel Shipyard and Black & Veatch said August 16 they are to sell a 25% stake in Hilli Episeyo -- to be deployed offshore Cameroon as West Africa's first floating liquefaction unit -- for a net purchase price between $178mn and $190mn to Golar LNG Partners. The stake represents half of the two liquefaction trains, out of a total of four, that have been contracted to Perenco and Cameroon's state SNH for an eight-year term. The Hilli is scheduled to leave Singapore for Cameroon at the end of September or early October. The mooring system has been installed in Cameroon and is ready for hook up of Hilli. Golar expects to tender the FLNG vessel's "notice of readiness" to operate during the first half of November. It added that Perenco/SNH remain on track with their scope of works.

William Powell