Total To Pay $7.45bn for Maersk Oil

Total is to buy Maersk Oil for $7.45bn in a deal expected to close in 1Q 2018. The latter’s parent, AP Moller-Maersk will receive $4.95bn in the form of Total shares, representing a 3.75% stake in the French major, and Total will also assume $2.5bn of Maersk Oil’s debt.

AP Moller-Maersk CEO Soren Skou said it will become the third largest shareholder in Total, but said it has yet to decide on the offer of a seat on Total’s board. There is no lock-up on the shares it will own in Total. The deal is already approved by both boards and expected to close in 1Q 2018 and have an effective date of July 1 2017.

Total said it expects to generate operational, commercial and financial synergies of more than $400mn/yr, in particular by the combination of North Sea assets at both firms. CEO Patrick Pouyanne said: “Total will become a 3mn boe/d major by 2019 to the benefit of all Total shareholders.”

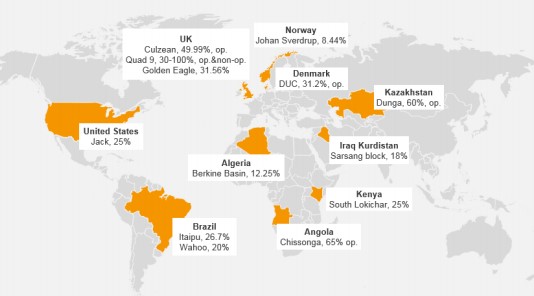

As regards gas, Total will add Maersk Oil’s operated UK gas field Culzean (49.99% Maersk stake) near the Total-operated Elgin-Franklin hub, plus Maersk’s operatorship and 31.2% ownership of the DUC producing assets offshore Denmark (with some net 60,000 boe/d gas and oil production in 2018). Total will also get Maersk’s 8.44% stake in the giant Johan Sverdrup oil development offshore Norway and become the second largest independent in Algeria through Maersk's oil interests there.

AP Moller-Maersk CFO Jakob Stausholm said the development of Culzean and Sverdrup would have meant a lot of negative free cash flow in the near-term for the Danish group, which following the deal it will no longer have.

Significantly the Danish group also said that Total will take over all Maersk Oil's decommissioning obligations currently amounting to $2.9bn.

Total said the deal gives it around 1bn barrels of oil equivalent 2P/2C reserves to Total, 85% of which are in OECD countries (80% in the North Sea). It also means the addition of 160,000 boe/d of mainly liquids production in 2018, acquired "at an average price of 46 k$/boepd," offering high margins with an estimated free cash flow break-even of less than $30/b and growing to more than 200,000 boe/d by the early 2020s.

Maersk Oil's partners at Culzean, a $4.5bn project due to produce first gas in 2019, are BP with 32% and Japan's JX Nippon 18.01%.

Total will maintain Maersk Oil’s strong position in the North Sea with Copenhagen and Esbjerg bases and with Denmark being the operating hub for Total's combined operations in Denmark, Norway and the Netherlands. The deal is subject to regulatory approval from relevant authorities including the Danish energy minister and competition authorities as well as required consultation and notification processes with Total’s employee representatives.

Pouyanne said the combination of Maersk Oil’s northwest Europe businesses with Total's existing portfolio would create "strong production profiles in UK, Norway and Denmark" while elsewhere "in the US Gulf of Mexico, Algeria, East Africa, Kazakhstan and Angola there is an excellent fit between Total and Maersk Oil’s businesses allowing for value accretion through commercial, operating and financial synergies."

He later told analysts that the Maersk Oil split of expected 2018 production is 70% liquids, 30% gas.

Assets that Total will acquire under the Maersk Oil takeover (map credit: Total)

Mark Smedley