The Other Contenders: Coal and Nuclear versus Natural Gas [GGP]

For large-scale dispatchable electricity generation, coal and nuclear are the main global contenders with gas (due to constraints on hydropower). Each of these three energy sources has strengths and weaknesses regarding costs, safety, public acceptability, greenhouse gas emissions and other important criteria. With standard forecasts suggesting a stagnation or decline of coal, and only slow expansion of nuclear, gas appears well-placed. But this picture varies significantly by geography. Furthermore, technological advances could bring coal and/or nuclear forward. Major gas exporting countries ought to maintain a watching brief on the coal and nuclear markets, tracking public opinion, regulatory developments, and new designs.

Executive Summary

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

- There are three main forms of non-renewable power generation: natural gas, coal and nuclear. Each has varying strengths and weaknesses.

- Typical predictions for the global power sector see gas growing strongly, nuclear slowly, and coal flat-lining or shrinking.

- Scenarios of strong climate action do not help nuclear much, are negative for coal, and quite negative for gas.

- A strong nuclear revival is probably dependent on the deployment of new reactor designs; continuing major coal growth would require large-scale, low-cost carbon capture and storage (CCS). Neither of these possibilities can be ruled out, but they do not appear very likely.

Implications for leading oil and gas producers

- Gas h as the opportunity to gain significant market share from ageing coal and nuclear plants, if relatively inexpensive.

as the opportunity to gain significant market share from ageing coal and nuclear plants, if relatively inexpensive.

- Conversely, if gas is priced expensively, it will encourage countries such as China and India to develop and deploy nuclear and cleaner coal.

- The emergence of low-cost CCS still probably favours gas more than coal, though it would boost both over nuclear.

- Leading gas exporters should monitor technological progress on coal CCS and on advanced nuclear, and keep an eye on the regulatory landscape and public opinion concerning nuclear in key growth markets.

Forecasts suggest strong growth in gas and renewables, but slow growth in nuclear and shrinkage in coal

There are four main forms of large-scale dispatchable power generation: hydro, coal, nuclear and gas. Hydropower has environmental impacts and is constrained by suitable locations and often weather conditions (drought). Therefore, the future of the world energy system, natural gas demand, and greenhouse gas emissions, depend heavily on how much coal and nuclear power is used.

In 2017, 38% of global electricity came from coal, 23% from gas and 10% from nuclear; hydropower, a renewable source, was the other big contributor with 16%.

Nuclear power is used only to provide electricity, and a small amount of direct heat. By contrast, coal and particularly gas are more versatile, featuring as feedstock for chemicals and a reducing agent in steelmaking, a source of home heating, and industrial heat. But with greater electrification, for instance home heat pumps, nuclear could expand into markets currently dominated by gas.

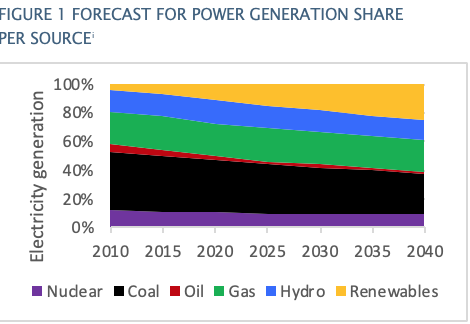

FIGURE 1 shows a typical forecast for the use of each energy source in power generation. The use of both nuclear and coal grow in absolute terms (nuclear at a compound average growth rate of 1.7% from 2015-2040 and coal 0.7%), but they lose market share to gas (2.1% annual growth rate) and renewables.

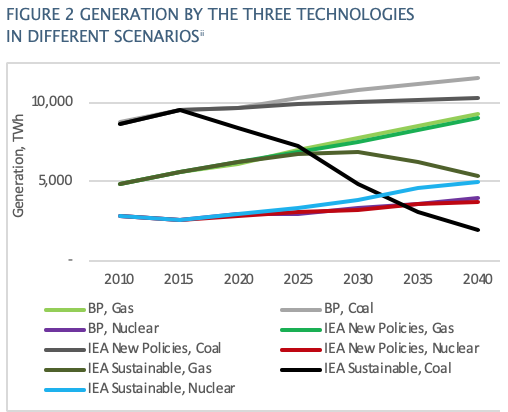

In a scenario with much more aggressive action on climate change, coal use suffers (FIGURE 2). However, even in this case, the IEA’s projection shows only a moderate increase in nuclear, and a significant loss for gas – the reduced coal and gas use being replaced by renewables and greater efficiency.

Other climate-compatible outcomes could include much stronger growth in nuclear or CCS, the prospects for which are discussed below. Or, gas could strongly replace coal in the medium-term (as it has in the US and UK), before giving way to renewables in the 2030s, with nuclear playing only a secondary role.

The three main non-renewable power sources have strengths and weaknesses

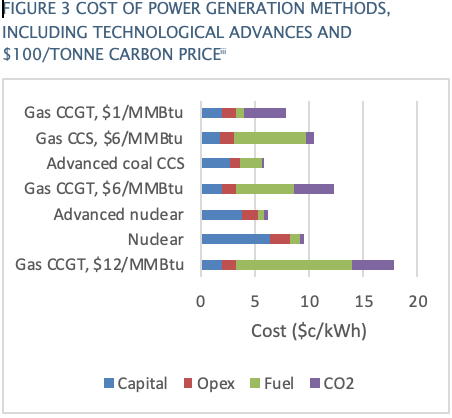

Cost is, of course, a vital metric to compare generation methods (FIGURE 3). Gas-fired power is very sensitive to the gas price assumption. Other key parameters include the discount rate (cost of capital), coal quality, and location-specific factors (altitude, temperature, humidity, access to a coal port or rail-line, cooling water, land price, public acceptability, permitting costs, labour costs, pollution legislation, access to the transmission grid). The figures in the chart are, therefore, only indicative. The options for advanced nuclear and advanced CCS require significant technological development and deployment experience, and may not be achieved. This chart also does not consider the various types of renewable energy.

With these caveats in mind, it can be seen that conventional nuclear can be competitive with moderately-priced gas power if there is a high carbon price. Advanced coal CCS and advanced nuclear could also be attractive, but remain quite speculative. Without a carbon price, moderately-priced gas power is the most attractive option today.

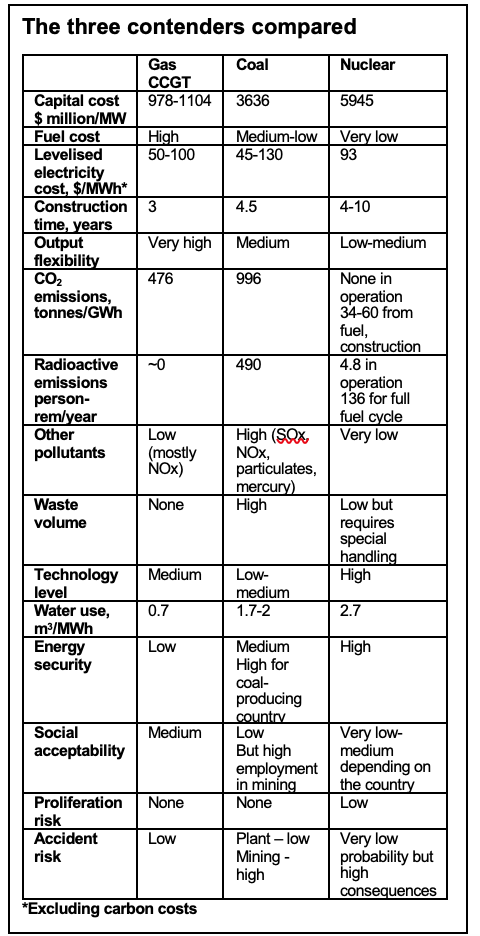

However, energy sources cannot simply be compared on a single criterion such as cost or pollution. Table 1 compares gas, coal and nuclear power on a variety of metrics. Many of these will vary by country or location: for instance, proximity to coal mines or ports, opposition to pollution, the strength of a nuclear safety culture or technological sophistication, or the availability of low-cost gas.

For this reason, there will be a role for all three generation methods globally, but one may dominate in particular geographies. Some areas, such as Australia, are strongly anti-nuclear while others, such as most of Africa, lack the market size or technological and regulatory sophistication. Areas without coal resources are less likely to develop new coal plants today. Therefore the question of competitiveness of gas versus coal or nuclear may not be relevant in some areas. In countries such as Russia, China, India, South Korea and Japan, however, it is very significant.

The coal and nuclear outlook depends heavily on geography

Gas power is expected to show solid growth in many regions. In contrast, coal faces severe economic and pollution challenges in North America and Europe, with countries such as the UK exiting coal power entirely.

Coal remains important in countries with large domestic resources, such as China, India, South Africa and Australia, where it is a cheap, secure resource that provides employment. The worst of air pollution can be tackled by installing scrubbers and moving heating and small-scale industries to gas. If there is little concern about carbon dioxide emissions, these countries will continue to use coal extensively.

Coal is also being adopted, somewhat surprisingly, in countries with no resource of their own, such as Egypt and the UAE. This is because of the relatively high cost of LNG imports and concerns over supply security.

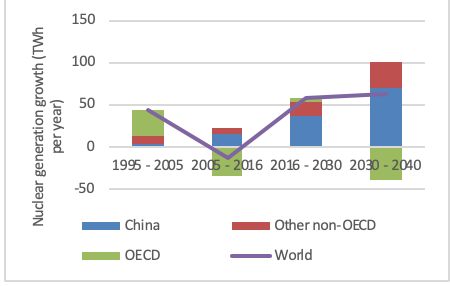

Nuclear power is set to shrink in the OECD, as ageing plants are shut down and countries such as Germany, Japan, South Korea and France pursue plans to exit nuclear entirely or to reduce its share.

In the US, coal and nuclear have both come under strong pressure from low-cost natural gas since 2007. Nuclear provides 20% of US electricity, but only two new reactors are under construction, while 11 plants are due to close by 2025.

Conversely, in regions dependent on importing LNG or relatively costly pipeline gas, nuclear becomes more attractive on a security-of-supply and cost basis.

Thus China ends up leading nuclear growth, with other non-OECD contributing. By 2030, Chinese nuclear generation will overtake the US and EU. The Middle East is another area of growth, with 5.6 GW under construction in the UAE and another 10.2 GW by 2030 possible in Egypt, Jordan and Saudi Arabia, though all of these plans face challenges.

Nuclear power has more strategic implications than coal and gas

Nuclear power also has important strategic aspects. Some countries have seen it as a stepping stone to a nuclear weapons programme, or at least the way to give them an option to nuclearize in the future if a strategic situation demanded it. Nuclear power is a sophisticated technology that has historically been a symbol of modernity and a way to build national skills.

Nuclear power offers more energy security than gas, in particular, for countries without domestic resources. Uranium has a small volume and can be easily stockpiled. It is available from a range of suppliers who are different from traditional Middle Eastern oil and gas suppliers, such as Kazakhstan, Russia, Australia, Canada, Namibia and Niger.

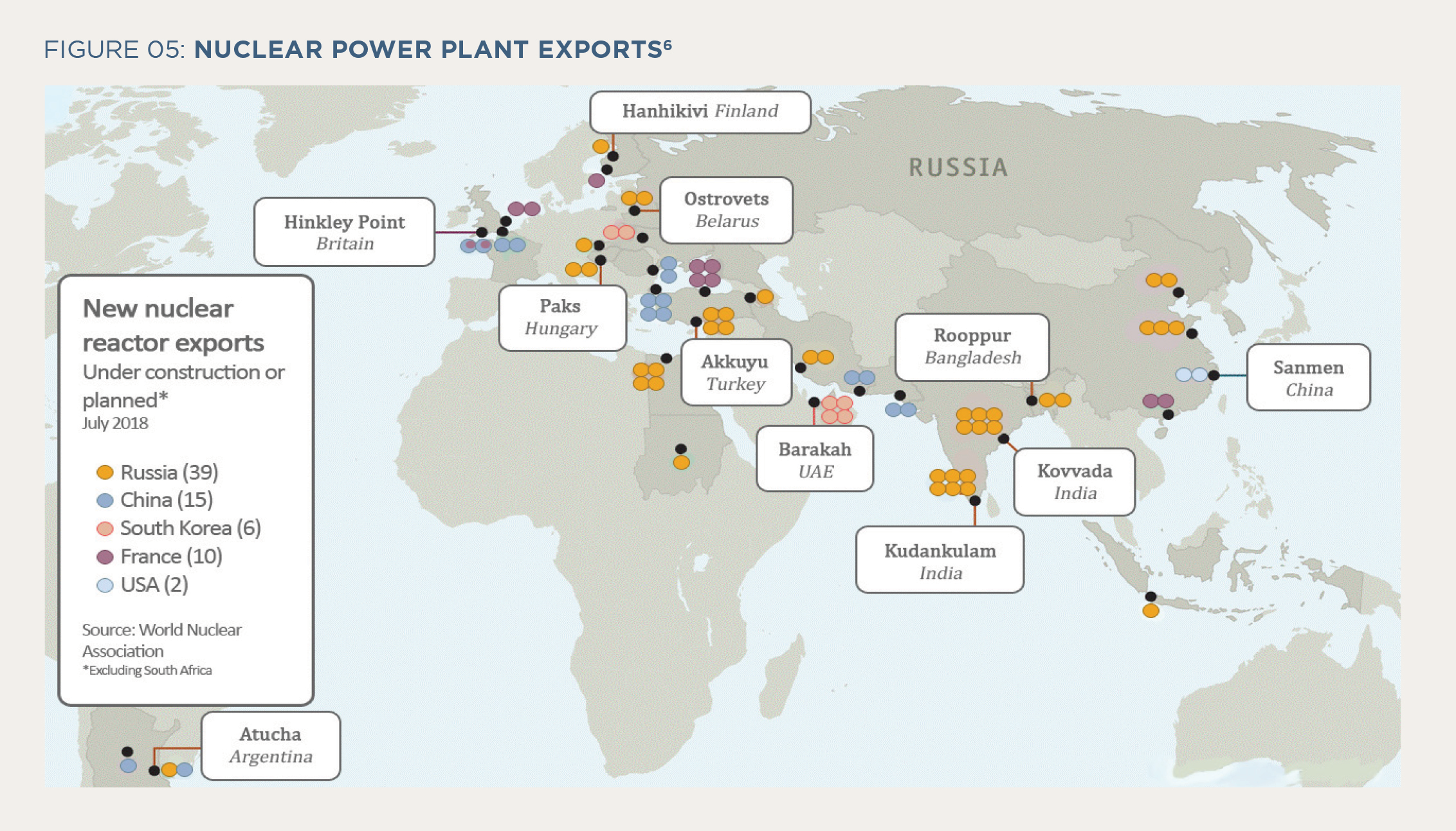

The export of nuclear power technology has long been a staple of international economic diplomacy, and recently competition has heated up. Russia’s state-owned Rosatom has been active in offering competitively-priced reactors to countries such as India, Iran, Turkey, Egypt, Jordan and Saudi Arabia. The US has been hampered in its response by the poor state of its domestic nuclear business, the bankruptcy of Westinghouse, and by political requirements to enforce anti-proliferation safeguards. China has also been active, as have South Korea and France, who have sought international sales, often entwined with diplomatic incentives such as conventional arms sales, soft loans and plant insurance.

This competition allows some countries to secure reactors that they would not be able to afford on a fully commercial basis. But the spectre of great-power competition and the strings attached to such deals may raise public opposition.

Technology offers a boost to all three generation methods

The continued attractiveness of coal and gas depends on technologies that boost their efficiency and reduce or eliminate carbon dioxide emissions and other pollution. In contrast, the future for nuclear requires reducing the capital cost and build time.

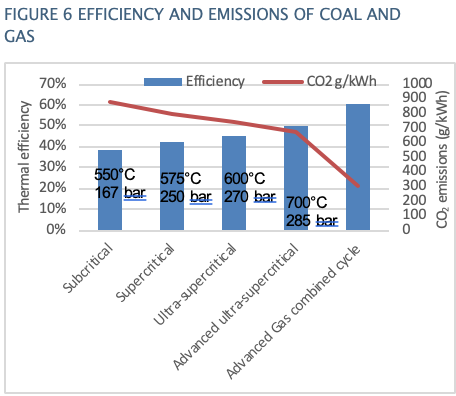

As FIGURE 6 shows, operating coal plants at higher pressures and temperatures, using advanced materials, reduces coal use and emissions, though at higher capital costs. Other air pollutants can be reduced by scrubbers and burning low-sulphur coal. Still, coal does not approach the low emissions, flexibility, low capital cost and high efficiency of an advanced gas combined cycle plant.

Long-term environmental sustainability for coal will require the deployment of low-cost CCS. So far a small number of units are in operation, for instance, the Boundary Dam plant in Saskachewan, Canada, and the Petronova plant in Texas.

However, they raise the cost and fuel consumption of plants that are already economically challenged by low-priced gas and the falling cost of renewables. CCS may be more effectively applied to gas-fired power, and to industry.

Bringing down the cost of deploying additional nuclear reactors of broadly traditional types would require a sustained commitment to build several to a standard design, and rebuild the nuclear supply chain and engineering expertise. Outside China, this does not seem likely to happen. In most countries, there is too much public opposition, economics are unfavourable, and/or the market is too small or growing too slowly to require several new reactors.

Research and development of new types of nuclear reactors might change this. Features of new designs include passive safety (eliminating the need for active cooling, which failed in the Fukushima accident). Analysis of advanced designs suggests possible levelised costs, after deployment of several units, of 3.6-9 USc per kWh. The average cost of 6 USc per kWh would be highly competitive with other forms of near-zero carbon generation.

Small modular reactors (SMRs) of 300 MW or less could be factory-constructed to bring down costs , and some designs can be placed underground for safety and security. Very small designs of around 15 MW could be used with remote communities that rely today on diesel generators. Some can provide space/water heating, industrial process heat or desalination. Canada, the US, UK and China are all providing support for SMR development. NuScale’s 60 MW demonstration is set to be completed at the Idaho National Laboratory by 2024, which will be an important test case.

The developments in advanced nuclear power are interesting. But they do not appear, at the moment, likely to lead to a dramatic expansion in the future role of nuclear.

Conclusions: Implications for leading oil and gas producers

Overall, the “conventional wisdom” outlook for coal and nuclear is quite favourable for gas. Major gas exporters can gain market share as old coal and nuclear plants in North America and Europe are closed down. At the same time, coal is set to stagnate in the main emerging Asian economies, and nuclear to grow, but not dramatically.

Developments in coal and nuclear do not make much difference to the oil market outlook. Oil’s role in power generation is small and set to fall further. Electrification of transport depends on advances in batteries rather than changes in electricity generation.

This line of development does rely on gas being perceived as a secure, relatively affordable and accessible fuel. If gas is priced expensively, China, India and other major Asian states will rely on coal more heavily, and likely deploy more nuclear power.

If low-cost CCS is rolled out on a big scale, it would probably still favour gas more than coal. However it would boost both over nuclear. A major expansion of nuclear power is not impossible but probably unlikely. It would require rapid progress on commercialising new, competitively priced reactors, probably the small modular types.

To avoid major surprises, leading gas exporters should monitor the technological, regulatory and public opinion landscape for advanced nuclear and coal CCS in the key markets: North America, Europe, China, Russia and India.

Al-Attiyah Foundation

Research Series Issue 28: December 2018

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.