The Next Prize: Geopolitical Stakes In The Clean Hydrogen Race

Yergin could not have picked a better title for the book—not just because he was awarded a Pulitzer for it, but because he masterfully exposed how oil was a game of huge risks and monumental rewards. Today, judging by all the excitement, hydrogen seems well positioned to become the next great prize, a zero-carbon version of oil.

Hardly a week goes by without a government or a company announcing a new hydrogen plan or project. The enthusiasm for hydrogen is understandable: whether it is used in a fuel cell to produce electricity or burned in an engine to produce heat, the only ‘exhaust’ it creates is water vapor. As more and more governments commit to net-zero-emission targets by mid-century, hydrogen becomes an appealing energy carrier to decarbonize hard-to-electrify sectors, such as heavy industry and long-haul transport.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

For all the hype, though, hydrogen will not become the new oil. It is unlikely to ever eclipse oil’s market share in the world’s energy mix (currently more than 30 per cent of primary energy), let alone match the ubiquity, liquidity, and geostrategic significance of oil, which has long been and still is an indispensable fuel for the movement of goods and people and to power the machines of war. Since hydrogen is a conversion business rather than an extraction business, rents will likely be smaller than those for oil. If anything, hydrogen bears more resemblance to natural gas, and is more likely to lead to regional or even distributed markets.

That said, the global stakes surrounding hydrogen are huge. Even as a locally or regionally traded commodity, hydrogen is one of those technologies that can reshuffle the geopolitical cards in the 21st century, alongside other technologies such as artificial intelligence, machine learning, electric vehicles, and smart grids. Countries and companies are jockeying to gain mastery over what is set to become a multi-billion-dollar international commodity market in a decade or two. The size and scope of that market is still uncertain, but the clean hydrogen race is clearly on, and is deeply affected by geopolitical motives and consequences.

Hydrogen’s promise

For decades, the geopolitics of energy has revolved around fossil fuels, and oil in particular. As new energy sources, particularly solar and wind, have achieved spectacular cost reductions, the contours of a new energy order begin to emerge. For large chunks of our energy demand, renewable-powered electrification will be the most efficient way to abate emissions. The decarbonization of other sectors, however, will require different solutions, based on molecules rather than electrons. This is where hydrogen comes into the spotlight, either in pure form or as a compound (for example, ammonia).

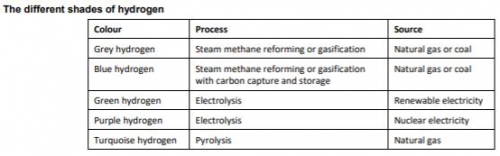

Hydrogen is not an energy source, however, but an energy carrier. It can be produced in different ways, from a range of sources, each with a different impact on climate change. Various colours are used to describe these different production pathways.

While the bulk of hydrogen is still made from unabated fossil fuels (‘grey’ hydrogen), the falling costs of renewables and electrolysers improve the prospects of ‘green’ hydrogen becoming competitive sooner rather than later—within less than a decade according to IRENA. ‘Blue’ hydrogen will be its biggest contender as a decarbonization fuel, though it still has 5– 15 per cent of the carbon footprint of the natural gas or coal that it was made from.

The outlook for hydrogen has further improved in the wake of the COVID-19 pandemic, as some governments have allocated large funds to hydrogen as a way to foster both economic recovery and climate action. In Europe alone in the last six months, governments have announced more than $30 billion of hydrogen investments by 2030. In sum, the prospects for hydrogen to finally live up to its promise of becoming a key part of the clean-energy puzzle have, it seems, never been better.

For policymakers, the lure of hydrogen is that it can provide a secure and reliable supply of energy and heat at all times, night or day, winter or summer, at a cost that is bound to come down and without emitting carbon dioxide (in the cases of green, purple For policymakers, the lure of hydrogen is that it can provide a secure and reliable supply of energy and heat at all times, night or day, winter or summer, at a cost that is bound to come down and without emitting carbon dioxide (in the cases of green, purple.

The race for technological leadership

The anticipated boom in hydrogen could create large new markets. McKinsey and the Hydrogen Council estimate that a global hydrogen market could meet 18 per cent of final energy demand by 2050. By that time, sales of hydrogen as a commodity and related equipment (such as electrolysers, hydrogen refuelling stations, and fuel cells) could be worth $2.5 trillion per year and generate 30 million jobs. Bloomberg New Energy Finance (BNEF) believes hydrogen could even meet up to 24 per cent of final energy demand by 2050, which would open up $11 trillion of investment opportunity over the next 30 years (BNEF, 2020).

As such, hydrogen is just another battleground for technological and economic supremacy between the established and rising powers of this world. Just as the US ascent to global supremacy in the 20th century was inseparable from oil, countries are now vying to control the key energy technologies of the future: not just hydrogen, but also solar, batteries, digital networks, electric vehicles, and so on. Countries have a strategic interest in being technology makers, not technology takers in these critical areas.

This geo-economic calculus is already influencing hydrogen policies. Germany’s massive green-hydrogen push, for example, is a clear bid to outcompete China, mindful of the painful experience of losing its solar photovoltaic (PV) manufacturing industry to China a few years ago (Amelang, 2020). While China has done a lot to drive down the unit costs of PV and wind, it has also acquired dominant positions in the value chains of these and other energy technologies, like electric vehicles and rare earths.

Electrolysers have the same kind of modularity as PV solar panels or batteries, and could thus experience the same kind of price deflation that we have seen for those technologies. BNEF estimates that, as of 2019, electrolysers were already 83 per cent cheaper to produce in China than in Western countries, (BNEF, 2020). Admittedly, Chinese manufacturers focus on the more standard alkaline electrolysers, which are less flexible than the solid oxide and proton exchange membrane technologies that European firms have focused on. But in many respects, it looks like the race has already been run. It will be hard for European manufacturers to beat China on costs.

Trade opportunities and risks

While some major powers may head towards hydrogen self-sufficiency (the United States, China, India, and Brazil, for instance), hydrogen looks set to become an internationally traded commodity. The largest single component of green hydrogen production is the cost of renewable electricity, so producers need cheap electricity to be competitive, not just cheap electrolysers (IRENA, 2020). This creates an opportunity to produce hydrogen at locations with optimal renewable sources and export it from there.

Some countries, like Japan, Korea, and Germany, are gearing up to become large-scale importers of hydrogen, while others, like Australia, Chile, and Morocco, aim to become significant exporters of hydrogen. That creates the basis for new bilateral energy-trading relationships—for example Chile with Japan, Morocco with Germany, and Oman with Belgium—which could add up to a completely new geography of energy trade (Van de Graaf et al., 2020).

Several oil- and gas-rich countries in the Middle East are banking on hydrogen to maintain their position as key energy suppliers to the world. While the desert kingdoms of the Gulf have ample solar potential, underground storage space, and experience in molecule trade, their ambitions might be constrained by lack of sufficient water and, more importantly, competition from their own (cheaper) oil and gas exports.

Japan, which is currently importing all of its oil and gas, strongly supports hydrogen. In 2017, it announced its ambition to become a full-fledged ‘hydrogen society’, envisaging widespread use of hydrogen across virtually all sectors. It has marshalled its diplomatic apparatus both to catapult hydrogen to the top of the international agenda (e.g. by convening a ministerial meeting on hydrogen in 2019 as G20 host), and to scavenge for potential suppliers of imported hydrogen. In June 2020, Japan received its first cargo of liquid organic hydrogen carrier from Brunei and is set to begin with trial shipments from Australia soon.

Europe is serious, too, about hydrogen imports. A European industry alliance has developed a plan to develop 2x40 GW of electrolysers by 2030, 40 GW in Europe and 40 GW in neighbouring regions, for export of hydrogen to the EU (Van Wijk and Chatzimarkakis, 2020). Germany’s national hydrogen strategy foresaw not only €7 billion earmarked for domestic production of green hydrogen but also €2 billion for overseas production. Germany is currently exploring imports from countries as diverse as Morocco, the Democratic Republic of the Congo, and even remote Australia. Some of these schemes smack of ‘green colonialism’, as they see developing countries solely as the providers of raw materials to power the industrial centres of the rich world (Van de Graaf et al., 2020).

Hydrogen valleys and corridors

A key bottleneck in all this will be transportation costs. Hydrogen could be moved across borders in ships or pipelines. One way to ship hydrogen is to liquefy it, but for that it needs to be cooled to −252°C, which uses a lot of energy (for comparison, LNG requires cooling to −160°C). It’s more practical to use a vector like ammonia or toluene (a liquid organic hydrogen carrier) for hydrogen transport, but those conversions are expensive. In September 2020, Saudi Arabia sent its first shipment of ‘blue ammonia’ (made from natural gas with carbon capture and storage) to Japan, where it will be used to produce electric power.

Pipelines may make more sense, especially if existing pipelines can be repurposed for hydrogen transport, such as in Europe, which already has good connections to Norway, Ukraine, and North Africa. The gas transmission industry is confident that such retrofitting is technically feasible and affordable (Enagás et al.,2020). The expected decline of gas demand in Europe opens opportunities for the conversion of gas transmission infrastructure. The upshot is that, akin to natural gas, hydrogen could be traded more on regional markets than on global markets. All in all, transporting hydrogen is an order of magnitude more expensive than transporting natural gas, which is itself more expensive than shipping oil.

Of course, the initial steps will be more modest. At present, around 85 per cent of all hydrogen is still produced and consumed on site (e.g. at refineries). Scaling up both supply and demand infrastructure for hydrogen could be achieved through industrial clusters, especially in different coastal areas. Europe’s hydrogen strategy is geared towards establishing such ‘hydrogen valleys’ or hubs (e.g. ports or cities). From there, ‘hydrogen corridors’ could be developed that connect regions with high renewable potential to demand centres.

Over time, then, the hydrogen market could come to mimic the natural gas market: North America largely self-sufficient, Europe importing some piped hydrogen from neighbouring countries, and Japan relying on seaborne shipments of hydrogen. A key difference with natural gas, however, is that all major countries (including importers like Europe, Korea, and Japan) will be prosumers. Another difference is that climate-conscious importers will want to have certificates or guarantees of origin to make sure that the hydrogen they get is of the right ‘colour’, as well as technical standards for safety and quality of handling equipment.

A reality check

Based on the growing drumbeat of the media, one could easily think that cost-effective green hydrogen is just around the corner and will be traded on global markets that eclipse those for oil and gas before 2050. In truth, though, there remain significant hurdles and pitfalls in scaling up hydrogen markets. Green hydrogen is still nowhere near competitive with blue or grey hydrogen, let alone with fossil fuels. There is a risk that blue hydrogen will continue to dominate the supply picture, which would be incompatible with mid-century net-zero targets.

In order to create demand, there is a risk that countries will support policies that lead to carbon lock-in (for instance, when hydrogen-blending mandates prolong the lifetime of natural gas and limit the spread of residential heat pumps) or that are simply inefficient, such as promoting hydrogen cars instead of electric vehicles. As the CEO of Volkswagen recently put it: ‘to drive the same 100 km [with a hydrogen car] you need three times the wind farms than you do with electric cars’, (Quoted in: Todts, 2020).

For some advocates, indeed, hydrogen is the answer to every energy question. Its real value, however, will be as one focused part of a suite of energy solutions.

Conclusion

Interest in hydrogen has waxed and waned, yet this time might be different. Technologies like wind, solar, and electrolysers are on learning curves, which will make the value proposition of carbon-free hydrogen ever more attractive, especially as a growing number of governments set carbon- or climate-neutrality goals. Some countries, like Germany, want to leapfrog to green hydrogen straight away, skipping the blue hydrogen phase, but this will be very difficult to achieve given the current cost advantage that blue hydrogen enjoys. Yet sustaining or expanding the value chain of blue hydrogen creates a clear risk of carbon lock-in.

Green hydrogen has to travel an even longer and more winding road to become competitive with fossil fuels. The current fervour with which new hydrogen value chains are created offers cause for optimism. Numerous players are placing different bets. From Airbus announcing concept designs for hydrogen airplanes, to a Swedish joint venture launching a pilot plant to make carbonfree steel, to Saudi Arabia planning to build a 4 GW green hydrogen plant on the shores of the Red Sea, it is clear that hydrogen is gradually moving from niche to mainstream.

Just as in Yergin’s grand story of oil, hydrogen is a game of huge risks and geopolitical significance. Whether it will yield the same monumental rewards remains to be seen.

Originally publishes by the Oxford Institute For Energy Studies.