The Importance of Natural Gas to Turkey’s Energy and Economic Future [GGP]

Turkey has historically been one of the most important transit corridors between the East and the West and provides the only marine passage from the Black Sea to the Aegean Sea. Its control of the Bosphorus has dictated much of the geopolitical history of the region. Turkey’s geography makes it an important transit route from parts of the hydrocarbon-rich Middle East and the Caspian Sea to Europe.

With the introduction of Trans-Anatolian Natural Gas Pipeline (TANAP) from Azerbaijan, increased natural gas supplies will be available to Turkey and, via the Trans Adriatic Pipeline (TAP), to South Eastern, Eastern, Central, and Western Europe. TurkStream will also provide additional Russian gas to Turkey and, through the proposed Tesla pipeline, bring Russian gas to South Eastern and central Europe. These additional major pipelines, as well as other recent investments in natural gas distribution and LNG infrastructure could enhance Turkey’s position as an energy bridge from hydrocarbon-rich states to Europe. The pipelines will also help relieve congestion that Turkey’s gas distribution system has experienced in recent years.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

In this context, Turkey has expressed an interest in becoming a natural gas “hub,” raising several questions: What steps and investments are needed to become a natural gas hub? Will Turkey’s status as a transit country enable it to become a natural gas hub? Can this help improve energy security for Turkey and for European consumers?

To help answer these questions, it is first worth looking at the key features of a gas hub. Henry Hub, the world’s most robust natural gas hub, is located in southern Louisiana. Its associated infrastructure – nine interstate and four intrastate pipelines and ample storage facilities in the region – provides physical access to most major gas markets in the US. It is the official delivery point for futures contracts on the New York Mercantile Exchange (NYMEX) and establishes the benchmark price for North American gas markets. Because of its large volume of contracts (an average of 500,000 gas contracts per day in the first quarter of 2018), liquidity and transparency, Henry Hub enables gas-on-gas pricing as opposed to the fragmented, oil-linked pricing that prevails in regional gas markets in other parts of the world.

It is also important to understand the value of a hub. The Dutch Government, in considering investing in the development of a gas hub in the Netherlands, described the benefits as follows:

“The primary aim of the gas hub strategy is ‘to secure the country’s gas supply and promote the continuity of European gas supplies’... By creating a gas hub, the government wishes to guarantee the country’s access to energy sources in the long-term…The secondary aim the government is seeking to achieve is economic growth and boosting the country’s earning potential.”

A Turkish natural gas exchange would take advantage of its gas hub as the reference location for future contracts that are physically satisfied and establish natural gas as a competitive commodity in its region. A competitive Turkish pricing point and liquid supply source could also provide many advantages to Turkey, contributing to its national economy and enhancing its energy security. In addition, it would give Turkey a larger stake in improving regional stability, increasing production, and promoting low cost infrastructures.

Current Domestic Policies Supporting the Role of Natural Gas in Turkey

Turkey is growing its natural gas infrastructure and importing natural gas from more diversified sources of supply, actions that enhance the role of natural gas in Turkey and the region. Many regulatory and market changes are already in line with Turkey’s goals to privatize its electricity and natural gas markets, although much work remains to be done. Progress towards a Turkish natural gas hub would depend on continued implementation of these reforms, as well as the unbundling of contracts held by Turkey’s state-owned gas transmission system operator.

Diversification of Turkey’s Natural Gas Supplies

Diversification of sources of gas supply has been a key feature of Turkey’s energy policy. For instance, TANAP now provides access to the Azerbaijan Shah Deniz field. Due to the field’s scalable features and the potential for additional production in shipping volumes from Shah Deniz that could be doubled with a modest investment, this would increase the share of imported Caspian gas relative to Russian and Iranian gas. This would likely create opportunities for additional contract/price flexibility.

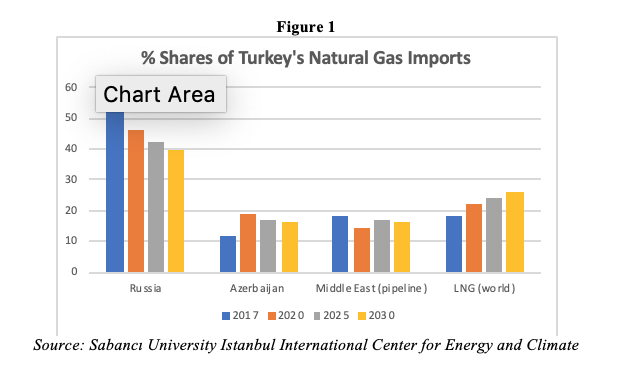

TurkStream will provide new import capacity from Gazprom but there will be decreased imports from Gazprom’s Westline, making the net addition of TurkStream significantly lower than its 15.75 BCM/yr. capacity (the capacity of the TurkStream line terminating in Turkey, not including the capacity of the line that would transit through Turkey into Europe). Figure 1 shows a recent projection of how Turkey’s natural gas suppliers will become more diversified.

This figure demonstrates the importance of Azerbaijan relative to Russian imports but also the importance of LNG where Qatar is being added as a supplier to the current LNG-contract suppliers, Nigeria and Algeria. Floating regasification terminals (FSRUs) are also being added. These terminals will have sufficient excess regasification capacity to take advantage of spot LNG supplies. Emergency and surplus regasification capacity – coupled with the flexibility of FSRUs – would contribute to the gas supply liquidity.

Market Reforms

Privatization will require major reforms in Botaş along with supportive policies. Turkey’s current policies represent a good start in a long process; they will help generate capital, increase market transparency for energy buyers and sellers, and help promote wholesale and retail price competition – the realization of which is important for Turkey’s energy and economic future. The advantages of these changes are manifold. Competitive markets typically produce cost-effective capital formation and a lower cost of retail energy services. Under state control, energy prices do not necessarily reflect costs but, in the long run, costs are more important since subsidized energy prices are costly to sustain and can lead to reduced economic growth.

Market liberalization would mean the end of existing policies to cross-subsidize natural gas prices differently among power generators, industry, and retail customers. In general, depending on the trend line of marginal energy costs, retail energy prices could rise or fall after market liberalization. However, with Turkey’s recent low costs and current low prices, retail prices may initially rise as subsidies are reduced or removed. Nonetheless, cost-reflective energy pricing is the best way to increase national economic performance and also promote energy efficiency. With cost-reflective prices, other ways can be devised to support needy consumers while achieving national economic benefits and environmental improvement.

Policies towards market liberalization in Turkey are affecting both the power and natural gas sectors. As noted, the Turkish natural gas market is dominated by Botaş, which holds most of Turkey’s long-term natural gas import contracts and controls its pipeline transmission system. Botaş had monopoly rights on importing natural gas until 2001 but it was not until 2007 when Royal Dutch Shell, Bosphorus Gaz, and Tur Enerji initiated non-Botaş gas sales to the market. Nonetheless, Botaş’ dominant market position is enshrined by the contractual obligations it has that cannot realistically be transferred to private parties in a short period of time.

Botaş also owns and operates Turkey’s natural gas distribution system. It has, over the years, made progress in expanding natural gas availability throughout Turkey; almost every Turkish province is now connected to the natural gas grid. Botaş has also made investments and secured contracts to eliminate bottlenecks in Turkey’s dispatch capacity, enabling it to better serve large population centers. TANAP and TurkStream, for example, provide three new entry points, doubling Turkey’s send out capacity and reducing the likelihood of gas shortages during peak demand. While it has temporarily lowered the utilization rate to 63 percent (2016), this action is likely a transitory problem that could be resolved as the Turkish gas market develops.

Botaş effectively controls gas prices and subsidizes merchant power generators, industrial customers, and retail customers while charging higher prices to merchant plants with power supply contracts to TETAŞ, and EÜAŞ power plants (a government-founded company). The recent decline in the USD-Turkish lira exchange rate increases the cost of the subsidies as the imported gas is priced in USD. Brent oil prices also significantly increased in the last year, effectively increasing the rolling average price of the pipeline contracts. Lastly, because of the expiring merchant power plant contracts with TETAŞ, the base of gas supply that is cross-subsidizing the other customers will be declining. All of these factors will likely cause Botaş to move to cost-reflective pricing, as seen in its August 6 announcement of price increases although residential and industrial tariffs remained 20 percent to 35 percent below Botaş’ weighted average cost of natural gas (underscoring the need for additional and significant reforms).

Benefits to Turkey from Investing in a Natural Gas Hub

The establishment of a natural gas hub in Turkey can unlock significant benefits that would support the country's economic, environmental, and security goals.

Price Stability

Market changes and investments could be the most effective way to reduce natural gas pricing uncertainty and volatility, increase the desirability of natural gas as a key energy source for Turkey, and potentially lead to the eventual establishment of a hub. The creation of a natural gas hub would effectively de-link natural gas prices from oil prices, removing a significant source of gas price volatility that has little to do with the fundamentals of natural gas markets.

Economic Benefits

While a hub would not bring foreign exchange earnings to Turkey from exports of its indigenous gas production, it would enable such earnings for associated financial and physical services, providing foreign exchange revenues for Turkish investors and traders. A hub would also help facilitate investments in domestic gas production in Turkey, especially in shale gas production, where the period from investment to payoff tends to be much briefer than for conventional production.

Energy Security

A Turkish natural gas hub would enhance Turkey’s energy security by reducing the vulnerabilities associated with current gas imports through increased gas storage capacity, greater supply diversity, and the capacity to import large volumes of spot LNG as needed. In addition, the Turkish hub effectively makes Turkey a natural gas exporter regardless of its production levels, enabling it to directly respond to demand from connected European purchasers, and to add to overall global supplies. This may result in better trade agreements and increased investment in the Turkish economy.

Global Importance of Natural Gas

The global importance of natural gas is expected to grow as a result of increased supplies of unconventional natural gas. The International Energy Agency (IEA) anticipates that the shale gas revolution will continue to expand gas production. By 2040, the IEA projects that annual natural gas production from unconventional resources will increase by 1,061 billion cubic meters while conventional sources will increase only by 622 billion cubic meters. Overall annual natural gas production is expected to increase from 3,536 billion cubic meters to 5,219 billion cubic meters. It is in Turkey’s economic interest to remain tied into this important world energy resource and not to discount the possibility that Turkey may itself develop its domestic shale gas resources and offshore gas supplies.

Allocation of Energy Resources and Reducing Greenhouse Gas Emissions

Natural gas as a component of Turkey’s energy mix could help firm variable renewable generation (i.e. a non-dispatchable renewable energy source like wind or solar) and offer a relatively low capital-cost alternative to retiring coal plants that cannot be affordably retrofitted with carbon capture, storage and utilization technologies. Natural gas can also play an important role in reducing Turkey’s power sector greenhouse gas emissions, especially if competitive markets allocate power sector investments.

Towards a Turkish Hub

Establishing a robust Turkish natural gas hub would require significant infrastructure investments such as changes to the current Turkish natural gas market; support for additional production from different sources in the region to add volume and liquidity; resolution of underlying geopolitical tensions that discourage investors; development of additional sources of supply; and potential customers and suppliers. In addition to cost-reflective pricing and supply diversity noted above, there would have to be gas-on-gas competition and new transparent market mechanisms.

Destination Clauses

In a robust gas trading hub, Botaş would no longer dominate the gas market and gas pricing. A diversity of private parties would have to assume the take-or-pay contracts with major pipeline suppliers. In addition, a trading hub requires a large volume of spot gas. Much of this gas could come from private parties that have long-term take-or-pay contracts with foreign suppliers as long as their contracts do not include destination clauses.

As a precondition for future diversification, Botaş should aim to eliminate destination clauses in its renegotiated contracts; without such actions, destination clauses for large suppliers such as Russia and Iran will restrict needed supply liquidity. Eliminating such clauses serves Turkey’s short and mid-term interests. Botaş could secure contracts sufficient to meet Turkey’s domestic gas requirements, while also establishing Turkey as a natural gas exporter. Botaş could then take advantage of changes in the spot gas markets, supporting its domestic pricing strategies with new revenues.

The prospects for eliminating destination clauses are better than in the past for a number of reasons. LNG contracts offer an example of disappearing destination clauses, where contracts without them are now widely available. Also, the European Commission recently imposed antitrust obligations on Gazprom to remove destination clauses from its contracts to “enable the free flow of gas at competitive prices in Central and Eastern European gas markets.” Most importantly, 2020 is likely to be a buyers’ market since the worldwide market is well-supplied and the prospects for new gas supplies appear to exceed expected demand growth in the mid-term.

Given Turkey’s declining domestic natural gas consumption, the flexibility to resell natural gas during favorable market conditions is likely to be a high priority for Botaş. Of course, Gazprom will not welcome Turkish competition to its TurkStream line that is destined to supply gas to Europe. Nonetheless, their markets are likely to be different and, if Turkey became a free-market natural gas trading center, Gazprom could benefit from the likelihood of higher export volumes.

Storage and Interconnections

A physical gas hub must have enough storage to provide supply liquidity and common carrier pipelines to facilitate physical sales and purchases of its gas. Turkey’s existing gas storage facilities include:

• TPAQ Silivri: 2.8 BCM underground; maximum injection 16 MCM/day and maximum withdrawal 20 MCM/day; additional 1.8 BCM by 2023

• Botaş Tuz Gölü: 1.2 BCM underground; maximum withdrawal 44 MCM/day: additional 4.2 BCM by 2023

• Çalık Tuz Gölü; 1 BCM

• Toren Tarsus: 500 MCM

• Botaş Marmara Ereğlisi: 255 KCM LNG; maximum regasification 8.2 BCM/year and maximum withdrawal 22 MCM/day

• EgeGaz Aliağa: 280 KCM LNG; maximum regasification 6.0 BCM/year and maximum withdrawal 16.4 MCM/day

Turkey’s plans for additional storage, equivalent to 20% of its gas consumption, could help underpin an effective and valuable regional storage hub that serves both Turkish and foreign customers. The Turkish gas market must also be sufficiently deregulated to set by supply and demand and not fiat. In addition, interconnections are important to the free movement of gas from major pipelines and LNG regasification plants to storage and/or distribution to international customers.

Divestiture of Botaş Contracts to the Private Sector

Eliminating the means by which a single player, e.g. the government, can determine prices is an essential step for a Turkish natural gas hub and exchange, without which commercial and non-commercial traders would simply not participate. A commodity market that relies only on physical sellers and physical purchasers would have too few exchanges with which to discover prices and would also have high price volatility. Non-commercial traders are essential for any commodity market to have enough liquidity to function properly; they substantially increase the volume of trades necessary to have a relatively stable market and also provide information and signals to the market that may not be the purview of commercial traders.

In 2005, Botaş began the process of divestiture of its pipeline contracts but immediately ran into difficulties since suppliers (Russia, Iran, Nigeria, and Algeria) were unwilling to begin negotiating with multiple private companies. By 2007-2012, negotiations with Gazprom resulted in new private contracts with seven Turkish companies and a corresponding decrease of gas imports by Botaş from Westline. Turkey’s Energy Market Regulatory Authority (EMRA) approved these contracts after determining that there was sufficient domestic natural gas demand; it continues to consider gas import licenses based on domestic requirements for gas.

As noted, Botaş controls wholesale prices for different categories of gas customers. This restricts the pricing opportunities of businesses that hold natural gas import licenses and contracts. Continued diversification of Botaş’ gas contracts not only involves ongoing transfers of contracts to private companies but also supports the movement to cost-reflective pricing. This will enable private importers to operate at a profit and eventually result in the transfer of assets to private entities sufficient to establish a true market pricing of Turkey’s gas resources. These are difficult decisions to make, in difficult times. In the end, however, there could be substantial benefits to Turkish consumers, the country’s economy, and the environment. It is possible that a divestiture timetable could be engineered to maximize the benefits of market liberalization at a time when gas prices are falling, not rising.

Conclusions

Turkey has made progress in laying the groundwork for turning a state-controlled natural gas and power sector into a private competitive market—but much work needs to be done. As the government evolves its role in Turkey’s natural gas markets, it will still have an important responsibility to encourage the development of domestic natural gas supplies. This could contribute to the eventual establishment of a competitive trading hub that will have value to Turkey as well as gas consumers in the region.

The Turkish government has made direct investments to provide electrical and natural gas services to more consumers throughout the country, as well as the significant expansion of gas distribution infrastructures. For the gas sector, supply contracts have been secured from more diversified sources of foreign supply. These investments and take-or-pay contracts were needed to meet Turkey’s growing energy needs, especially to supply modern energy services to the entire country. Also, tenders have been provided to increase Turkey’s renewable power industry. During the next round of pipeline negotiations, perhaps the most important action Turkey could take to advance the establishment of a natural gas hub is the elimination of destination clauses in gas contracts. An added benefit of this would be the increased progress towards cost-reflective pricing, a benefit for both Turkish energy consumers and Turkey.

Competitive markets are a desirable goal for the future. Measured, purposeful, and thoughtful actions that are objectively analyzed and transparently developed are the right path. Turkey should continue to build on its current laws and policies that lay the groundwork for the privatization of its energy markets. It should divest natural gas contracts to private parties while continuing to ensure investment in critical infrastructures such as natural gas storage and regasification terminals. Actions to resolve long-standing issues in the Eastern Mediterranean would also be attractive to investors and to potential customers in Europe who may be concerned about a range of actions, some recent and some decades-old, that work against the stability, flexibility, and liquidity that would support a robust hub.

Melanie Kenderdine

Melanie Kenderdine is a nonresident Senior Fellow at the Atlantic Council’s Global Energy Center and a Principal at the Energy Futures Initiative, a Washington-based think tank. Previously, Kenderdine served at the US Department of Energy as the energy counselor to the Secretary and the Director of the Office of Energy Policy and Systems Analysis

This article was originally published in the Fall 2018 issue of Turkish Policy Quarterly (TPQ), published in collaboration with Atlantic Council IN TURKEY.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.