The energy transition needs greater urgency [Gas in Transition]

Since 1952 the Statistical Review of World Energy has been providing timely, comprehensive and objective data and analysis of world energy markets from the year before. Its reputation is second to none. It is considered to be the standard reference on the subject. Until last year, the review was prepared and published by BP. But this year responsibility has been passed to the UK Energy Institute (EI). BP continues to publish the companion annual Energy Outlook report that delves into the future and the factors, trends and uncertainties shaping global energy transition.

So why the change, especially at a time of escalating energy, environmental and geopolitical crises? The answer may be linked to BP’s change of direction. In February BP announced that it will be slowing its planned cuts in oil and gas, while at the same time it will be scaling back planned renewables spending. In line with other majors, BP plans to produce more oil and gas for longer. With this change in direction, handing the review to EI will ensure the publication’s future independence and its reputation as a source of factual and unbiased energy data.

BP will continue to support the new review in the near-term, to ensure continuity, while accounting firm KPMG and consultancy Kearney have become EI’s partners and will also help to fund the publication. Data compilation will be undertaken by the Centre for Energy Economics Research and Policy at Heriot-Watt University. A powerful team to ensure that the review continues to provide an authoritative, comprehensive and objective annual benchmark of world energy statistics.

As EI CEO Nick Wayth said: "the report plays into our role as a trusted and neutral player helping the world navigate the energy transition.” KPMG added “the EI Statistical Review is essential reading for policymakers around the world trying to balance the energy trilemma.”

The energy crisis that started in 2021 and the war in Ukraine, and the upheavals they caused in global energy supplies and prices, catapulted energy security concerns to the top of the global energy agenda in 2022, ahead of climate change. The turmoil caused by these upheavals is reflected in the key findings of the review:

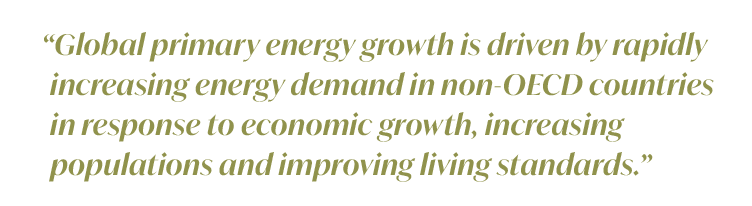

- Global primary energy consumption carried on increasing, up 1.1% in 2022 and 2.8% in 2019. It increased by an average of 1.4%/yr during the last ten years (see figure 1) and this trend looks set to continue.

- Fossil fuel consumption’s contribution to primary energy remained steady, at 82%. In fact, the use of fossil fuels has remained steady over the past 50 years, at over 80%, despite the increasing investment in and growth of renewables. In effect, surging primary energy demand has been offsetting the growth in renewables.

- The share of renewables to primary energy increased to 7.5%, excluding hydroelectricity, up 1% on 2021, with renewable power growing by 14%.

- CO2 emissions from energy use continued to increase, by 0.9%.

- Oil consumption increased by 2.9mn b/d to 97.3mn b/d, but still 0.7% below 2019 levels. But had Chinese demand recovered in line with the rest of the world, oil demand would have been at least 1mn b/d higher.

- Global natural gas consumption dropped by 3%, impacted by the very high prices in Europe and Asia, contributing 24% to global primary energy, from 25% in 2021.

- LNG supply grew by 5% to 542bn m3, the highest ever, reflecting the change in gas trading flows since the start of the war in Ukraine, particularly the switch from pipeline gas to LNG in Europe.

- Russian gas supplies to Europe dropped to 15% of Europe’s gas use in 2022, down from about 40% in 2021.

- Coal consumption continued to increase, up by 0.6%, largely driven by China and India, while consumption in North America declined by 6.8% and in Europe by 3.1%. Global coal consumption is now at its highest level since 2014. Coal production increased by 7%, mostly in China. China, India and Indonesia accounted for about 95% of overall coal demand growth in 2022.

- Global electricity generation increased by 2.3%, with coal remaining the dominant fuel, with a share of 35.4%.

Oil demand is back in growth mode. In the June edition of its Oil Market Report, the International Energy Agency (IEA) expects global oil demand to reach a record high of 102.1mn b/d in 2023, about 2mn b/d more than in 2019. Evidently, reports that oil demand has peaked were premature.

.png) Since the drop caused by the COVID-19 lockdowns in 2020, global primary energy demand has returned back to growth mode, and pre-Covid-19 trends, in response to the growth in global GDP. As Nick Wayth said during the presentation of the review, “the notion of new-normal post-COVID with energy growth disconnecting from the long-term trends does not seem to be playing out.” In fact, the 1.1% growth experienced in 2022 was just under the 1.4%/yr average growth during the past ten years, with forecasts expecting this to grow by 1.3% in 2023.

Since the drop caused by the COVID-19 lockdowns in 2020, global primary energy demand has returned back to growth mode, and pre-Covid-19 trends, in response to the growth in global GDP. As Nick Wayth said during the presentation of the review, “the notion of new-normal post-COVID with energy growth disconnecting from the long-term trends does not seem to be playing out.” In fact, the 1.1% growth experienced in 2022 was just under the 1.4%/yr average growth during the past ten years, with forecasts expecting this to grow by 1.3% in 2023.

But these figures mask real trends. This growth is driven by rapidly increasing energy demand in non-OECD countries in response to economic growth, increasing populations and improving living standards. OECD energy demand peaked in 2007, with OECD countries now accounting for less than 39% of global primary energy consumption.

With OECD energy demand remaining flat over the last ten years, and non-OECD energy demand increasing linearly during the same period at a rate just under 8 EJ/yr – with no sign of slowing down - the world is far from reaching an energy demand peak in the foreseeable future.

During the last two years renewable energy, excluding hydroelectricity, grew by about 5 EJ/yr, well below the primary energy growth rate. Hence the need for growth in all sources of energy, not just renewables, to provide the energy the world needs.

Since 2012, global renewable energy consumption appears to be growing at a more or less steady rate of about 12.5% per year. If this rate and the rate of growth of primary energy consumption are maintained, by early 2030s the increase in renewable energy should match the increase in primary energy demand. After that, renewables could start making inroads into the contribution of coal to primary energy and even replace it by the 2040s.

Russia’s invasion of Ukraine caused massive upheaval in world energy markets. It exacerbated the energy price crisis that started in 2021, impacting the cost of living and the global economy. Established global energy trading has been upended. US and EU sanctions on Russian gas, oil, oil products and coal have led to massive realignments in global energy trading flows that are still unravelling.

These crises and energy security concerns reinforced the enduring resilience of oil and gas, even as solar and wind power carried on increasing exponentially.

Natural gas

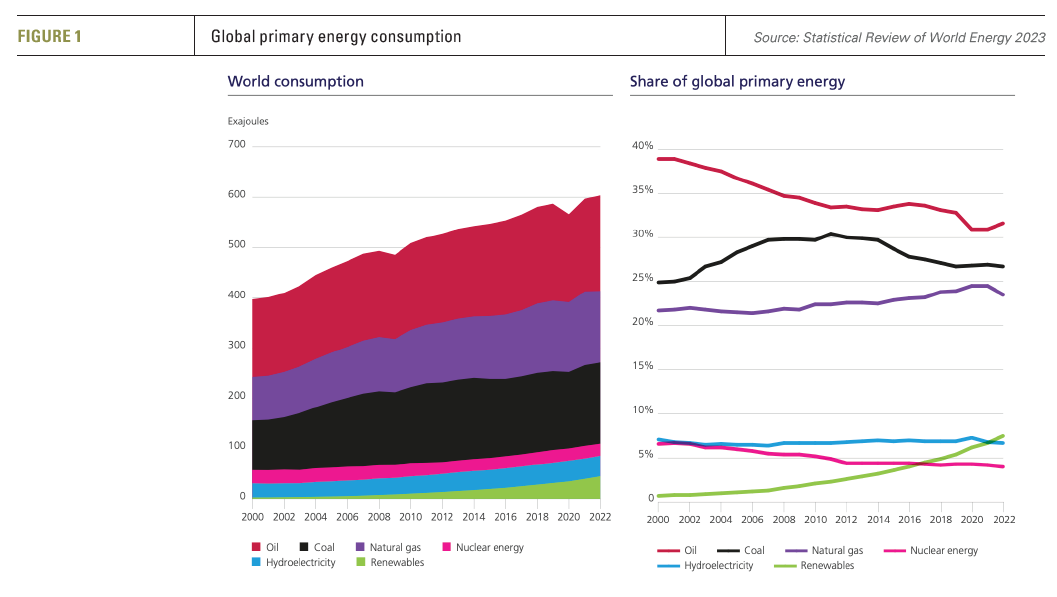

Global natural gas consumption dropped by 3% in 2022, to just under the 4 trillion m3 peak achieved in 2021. But the trend over the last ten years has been one of growth, at an average rate of 1.7%. In fact, gas consumption has been increasing steadily since 1965 (see figure 3) and, given global energy developments, following the energy crisis and the war in Ukraine, it looks set to continue for a long-time to come.

The IEA says gas consumption needs to fall dramatically by the end of the decade, and carry on falling, in order to remain on track to achieve net-zero by 2050. Based on current trends this does not look likely.

Not surprisingly, LNG exports increased to an all-time high in 2022, to 542bn m3. The Middle East was the largest exporter of LNG and, together with Australia and the US, represented 65% of total LNG exports. Japan was the largest importer of LNG, at 98bn m3.

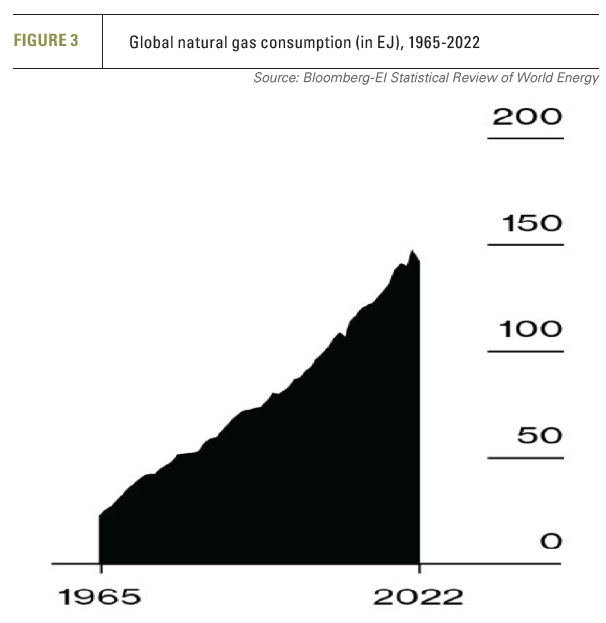

In 2022, international trade of natural gas as LNG represented 56% of all inter-regional traded gas, with pipeline gas declining to 44%, reversing the norm that existed ten years ago (see figure 4). Given the demise of Russian gas to Europe by pipeline, this is a trend that is expected to continue in future.

The review states that “unlike LNG trade that grew in 2022, international trade of natural gas via pipelines declined by around 15%, falling 78bn m3 compared to 2021. Over the past 10 years Russia has, on average, been responsible for around 43% of total global gas exports via pipelines. In 2022, its share of total global pipeline exports fell to 29%, a drop of around 76bn m3. Despite this, it still ranked highest at 25% of total global exports, followed by Norway at 23%.”

The review states that “unlike LNG trade that grew in 2022, international trade of natural gas via pipelines declined by around 15%, falling 78bn m3 compared to 2021. Over the past 10 years Russia has, on average, been responsible for around 43% of total global gas exports via pipelines. In 2022, its share of total global pipeline exports fell to 29%, a drop of around 76bn m3. Despite this, it still ranked highest at 25% of total global exports, followed by Norway at 23%.”

Not surprisingly, net gas imports to Europe dropped by a massive 35% with almost all of it due to the cutoff of pipeline exports from Russia.

This was largely replaced by imports of LNG, with Europe accounting for much of the global LNG demand growth, increasing its imports by 57%, while countries in the Asia-Pacific region and South and Central America reduced their purchases due to prolonged COVID-19 lockdowns.

With China still in lockdown, Japan replaced it as the world's largest LNG importer in 2022.

Demand for long-term LNG contracts is still increasing as a result of supply security concerns, with 45.25mn mt/year clinched so far this year.

A positive development in 2022, was that, even as global CO2 emissions from energy use continued to increase, by 0.9%, carbon emissions from natural gas flaring dropped by 3.8%.

Renewables

Solar and wind recorded a record increase of 266 GW in 2022, with solar accounting for 72% of the capacity additions. But despite this growth, renewables did not dent the dominance of fossil fuels that still provide 82% of global primary energy demand.

Nevertheless, 2022 saw the largest ever increase in wind and solar new-build capacity, with solar up 25% and wind up 13.5 %. Together they reached a record 12% share of power generation. In addition, renewables, excluding hydro, met 84% of net electricity demand growth in 2022.

But there is a huge geographic disparity in the adoption of renewables. In Europe renewables, excluding hydro, provided 30.8% of electricity consumption in 2022, while the rest of the world managed only 13.8%, even after including North America and China.

Having gone too far on its own, Europe is now pushing China, India and the US to cut emissions faster and share the burden as European consumers and industry begin to baulk at the costs of the green shift in Europe’s energy system. The FT warns that the backlash against the green transition is likely to grow as “EU industry is squeezed by US competitors with lower energy costs and subsidies under the Inflation Reduction Act, and China’s dominance of the supply chain for green technologies.”

But with energy consumption per capita in non-OECD countries being less than one-third of that in OECD countries, but growing as living standards improve, responding to Europe’s call may not be their top priority.

China added the most solar and wind power in 2022, accounting for about 37% and 41% of global capacity additions respectively. But that is not enough to cover the 3% annual increase in China’s primary energy demand, hence the need for growth in all energy sources. This also applies to India. These are the reasons why global emissions are still growing.

As EI president Juliet Davenport said: “despite further strong growth in wind and solar in the power sector, overall global energy-related greenhouse gas emissions increased again. We are still heading in the opposite direction to that required by the Paris Agreement.”

That, of course, is also because renewables provide only a small fraction of global primary energy, at 7.5%, to make a significant impact – despite the fast growth. This is “well behind most projections for clean energy levels needed to meet the Paris Agreement climate targets.”

Implications

2022 was a particularly complex year for global energy. It started in the aftermath of the energy crisis and high prices during the second half of 2021, followed by recovery from Covid-19, only to experience the shock of Russia’s invasion of Ukraine and its global consequences on energy flows and prices, to be followed by China’s renewed lockdowns, maintaining the turmoil throughout the year. These events are vividly captured in the gyrations experienced by the price of natural gas at the Dutch TTF gas trading hub.

These crises led to the rise of energy security to the top of global energy concerns, exacerbated by the realignment in global energy flows. At the same time, despite robust growth, renewables were unable to dent the share of fossil fuels in the growing global primary energy consumption.

During the EI presentation of the Review there was no acknowledgement of the problem of renewables intermittency and its impact on the reliability of energy supplies.

During the EI presentation of the Review there was no acknowledgement of the problem of renewables intermittency and its impact on the reliability of energy supplies.

With wind and solar providing an increasingly higher share of total power capacity, the need for more back-up power capacity increases. As Prof. Dieter Helm points out, for a system where intermittent renewables sometimes can produce most of the energy demand and sometimes very little, adequate firm power capacity needs to remain in place. And that has to be paid for by someone. A good example of the impact of climatic change and long-term intermittency for which there is no effective solution yet is Europe’s troubled hydropower, but also nuclear due to water cooling problems, that are currently underperforming. In 2021 it was wind power due to low wind speeds. The problem will remain until new technologies become available to deal with the intermittency problem, especially long-term intermittency, reliably.

Simply setting up targets, such as net-zero by 2050, and working backwards, i.e. back-casting, to determine how energy supply needs to evolve to deliver such targets, other than telling us what needs to be done, is no indication of reality.

While intermittency remains unsolved and energy security remains a concern, the world cannot plan on the basis of hope that when needed technologies will become available to ensure reliable energy supplies. What is needed is certainty and at present, and in the foreseeable future, as the Review shows, that means continued dependence on fossil fuels.

Electricity comprises 17.4% of global primary energy, only marginally up on the 2021 contribution of 17.2%. In fact, growth during the last ten years has been steady but slow, averaging about 2.5% per year. It is not growing as fast as hoped and it will take time before it can dent fossil fuels. IEA’s Net-zero by 2050 scenario requires electricity to provide a 50% share of total energy demand by then – impossible to achieve without a massive change in current trends.

As a result, in addition to requiring a massive growth in renewables – that in turn requires an effective solution to intermittency – achieving net-zero by 2050 also requires a massive growth in electricity infrastructure. The IEA warns that as solar and wind capacity grow, the share of curtailed renewable generation is also rising, making timely planning and investment in grids critical.

As Nick Wayth observed: “Is the energy transition happening? The answer is probably a bit of yes and a bit of no. Yes, in terms of the renewable growth, but a clear no in terms of the reduction in demand for fossil fuels…Are emissions moving in the right direction? Clearly not.”

However, what the review brings out is a clear message that the world must “inject more urgency into the energy transition,” and develop the low-carbon technologies needed to bring emissions down. The good news is that the US and China are back in talking terms, ready to resume cooperation on tackling the climate and emission challenges facing both countries and the world.