Thai LNG imports set for another record year [Gas in Transition]

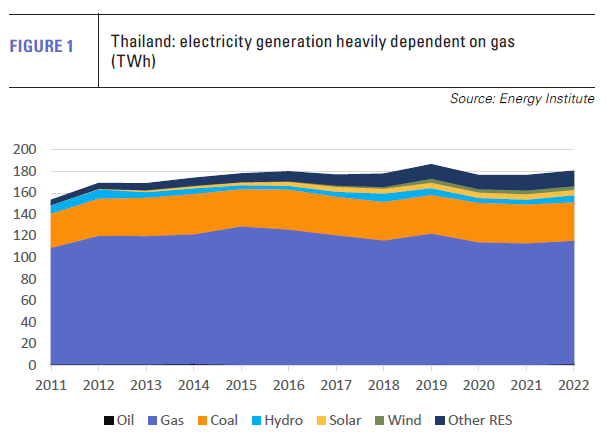

Thailand was one of the few Asian countries to increase its LNG imports last year as other importers curbed their appetites in the face of high spot market prices. Thailand depends on gas for almost two-thirds of its electricity generation (see figure 1) and has a large petrochemical sector based on gas feedstock. Demand therefore has relatively little elasticity.

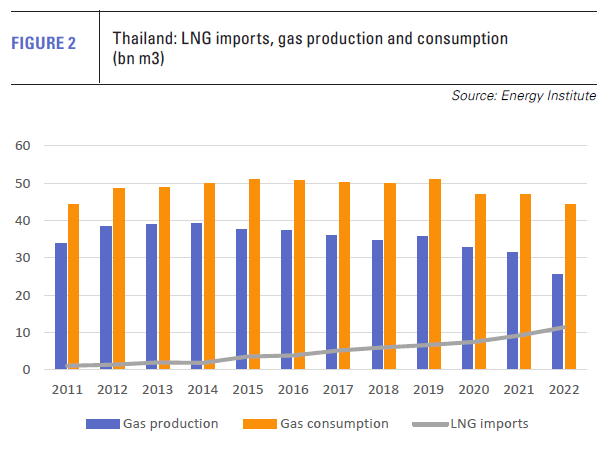

Thai gas consumption dropped in 2020 to 46.9bn m3, down 4bn m3, owing to the impact of the Covid-19 pandemic, which hit the country’s large tourism sector hard. After staying steady in 2021, last year overall gas consumption fell again to 44.3bn m3, reflecting the high cost of imported LNG, but imports of LNG still rose.

The primary problem for Thailand is the fall in domestic gas production in combination with the relative inflexibility of its demand (see figure 2). Meanwhile, it cannot look to its gas imports from neighbouring Myanmar for a boost as capable investors have been exiting the country’s gas patch since the re-imposition of military rule in 2021.

As a result, such is the upward trajectory in LNG demand, that officials from the state-run energy company PTT have forecast that the country’s regasification capacity will nearly double by the end of the decade to about 30mn t/yr, up from the current level of 19mn t/yr.

Last year, Thailand imported 11.4bn m3 of LNG (8.4mn tons), up 24.3% on 2021. In June this year, customs data showed monthly imports of 1.41mn tons, almost three times the level of June 2022. April also saw record imports, suggesting the country could exceed even last year’s import levels.

Domestic production nosedives

Thailand’s domestic gas production peaked at 39.1bn m3 in 2014 and has declined every year since, with the exception of 2019. Last year, the fall was particularly large. Output dropped 18.7% from 31.5bn m3 to 25.6bn m3, forcing the country into the LNG spot market.

Thailand produces gas from a number of mature gas fields and has so far not been successful in reversing their decline. Gas output from the Malaysia-Thailand Joint Development Area and other small fields has continued to fall this year, although some increase has been reported for the Bongkot field. Ratings agency Fitch in August noted an 8.8% decline in total gas production in the first five months of 2023 and forecast domestic gas output this year at less than 25bn m3.

Thailand’s state oil and gas company PTT plans to raise output from the Erawan field. PTT took over control last year, following the expiry of US major Chevron’s lease. Although the field produced 12.4bn m3 of gas in 2019, production had fallen to about a quarter of its 2019 level after the change of ownership.

Production was put at 5.7mn m3/d in early 2023 with PTT hoping to restore output to 11.4mn m3/d by the middle of this year and 22.8mn m3/d in 2024 (8.3bn m3/yr, 6.1mn t/yr).

Problems with Erawan and the age of the country’s other fields suggest gas output will continue to decline. New exploration may reverse this, but not soon. Three new exploration licences were awarded in May by the Department of Mineral Fuels, two to PTT and one to Chevron, opening an additional 35,000 km2 to exploration in the Gulf of Thailand.

Myanmar gas in the doldrums

Thailand receives about 15% of its gas supply from Myanmar, where investment has stalled following the country’s return to military rule in February 2021. PTT, which operates two fields in Myanmar, has postponed development of its M3 block project, and, at the end of last year, PTT’s Oil and Retail Business suspended its fuel storage operations in the country.

Both France’s TotalEnergies and Chevron have sold or abandoned their stakes in the Yadana offshore gas project. Of Myanmar’s two largest fields, Yadana, which accounts for 40% of the country’s exports, has reserves of less than 10% of the original 181bn m3, according to an estimate made by Japan’s JOGMEC. Yetagun field output is reported to be in sharp decline and Malaysia’s Petronas, PTT and Japanese investors all exited the development last year.

The Shwe field, which started up in 2013 and is operated by South Korea’s Posco, supplies most of its gas to China. With the exception of the Shwe field partners, this leaves PTT and Posco as the only major foreign investors active in the country.

As a result, it is unlikely that Thailand will be able to increase the amount of gas sourced from Myanmar and quite possible that it will instead decline in coming years. Pipeline imports from the country last year were 6.6bn m3, down slightly from 6.7bn m3 in 2021.

Meanwhile, on the demand side of the equation, gas consumption is recovering in Thailand. Tourism is steadily recovering and the country’s GDP is forecast to grow by about 3% this year and next.

PTT will also be a driver of gas demand as it expands its gas processing plant capacity to provide feedstock for the petrochemicals sector. Although one new processing plant will replace an older one, capacity is expected to expand in the period 2025-2028 and with it demand for gas feedstock.

Thai energy transition slow off the blocks

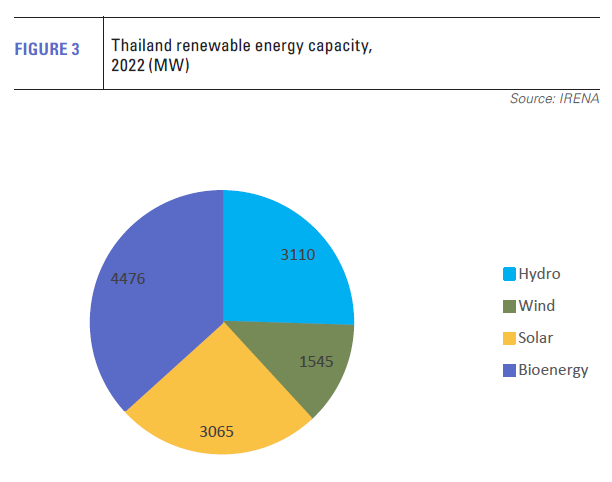

The main user of gas in the country is the electricity sector, with industry, including gas separation plants, coming second. Gas-fired generation accounted for 63.4% of the country’s power in 2022. A further 19.7% was provided by coal and lignite, with the remainder made up by renewables, the largest source of which is bioenergy (see figure 3).

Thailand has not been amongst the quickest to adopt ambitious climate change targets and its performance in terms of installed renewable energy capacity is modest. However, there are signs that climate change policies are becoming a more central part of government thinking.

Thailand has not been amongst the quickest to adopt ambitious climate change targets and its performance in terms of installed renewable energy capacity is modest. However, there are signs that climate change policies are becoming a more central part of government thinking.

In April, the country’s excise department announced that it was planning a carbon tax which would be imposed on three sectors of the economy, energy, transport and industry. Although details of the proposal are still being prepared, reports suggested a start date of May 31, 2026 for the reporting of annual carbon dioxide emissions by entities covered by the proposed tax.

This summer the Department of Climate Change and Environment was established within the Ministry of Natural Resources and Environment. The new department will supervise the country’s climate change activities and coordinate private and public agencies.

In November last year, the government submitted an updated Nationally Determined Contribution to the UNFCCC, which raised its emissions reductions ambitions. The aim under the updated NDC is to reduce greenhouse gas (GHG) emissions by 30% versus a business-as-usual scenario by 2030. With adequate technical and financial support this level of ambition could be increased to 40%.

Even so, this is not a particularly ambitious climate policy agenda by international standards.

Perhaps reflecting the absence of a supportive policy environment, there appears to be little momentum in the country’s renewable energy sector. Total renewable energy capacity has only edged up in the last three years, rising from 11.8 GW to 12.2 GW at the end of 2022, according to data from the International Renewable Energy Agency..

Wind capacity recorded no growth between 2020 and 2022 and solar capacity saw an increase of just 98 MW between 2018 and 2022.

Instead, Thailand has turned to electricity imports as a means of limiting its gas consumption and reducing the carbon intensity of its electricity generation. The country currently imports more than 10% of its total electricity consumption, much but not all of which is generated by hydro plants.

The Electricity Generating Authority of Thailand (EGAT) has an agreement in place to import electricity from 10,500 MW of capacity in Laos. Laos has and continues to construct large amounts of new hydro capacity in the Mekong river basin, creating a power surplus for sale to neighbouring countries. The country could have as much as 28 GW of capacity by 2030.

The large-scale development of hydro has drawn criticism from environmental groups, owing to its impact on the Mekong river basin ecosystem.

EGAT also has plans to build a series of floating solar farms over the next 15 years, which will have a total capacity of 2,750 MW. The first farm, with 45 MW capacity, started operation in 2021 at Sirindhorn Dam in the country’s northeast.

There is every likelihood that the renewable energy sector will start to grow more strongly and the government is creating a more supportive regulatory environment.

EGAT has estimated that Thailand could host a potential 13 GW of offshore wind. The country’s first offshore wind farms are expected to start construction next year and the government has a target of 3 GW by 2037. EGAT is providing Power Purchasing Agreements for the first projects.

Renewables are therefore set to take a larger share of the electricity market, but progress so far has been limited and the country still needs to address at some point its continued use of coal and lignite. This accounted for nearly 20% of power generation last year. As a result, gas demand is likely to remain firm over the remainder of the decade both from the power sector and industry, which, with domestic gas production and pipeline imports in dire straits, suggests more LNG will be needed.