Texas LNG CEO Slays LNG Canada Project

The CEO of a tiny 4mn mt/yr LNG project under development on the Gulf Coast of Texas said June 4 the 14mn mt/yr LNG Canada project in BC being developed by a consortium led by Anglo-Dutch major Shell could be as much as 40% over budget and may miss its mid-decade completion target by “many years.”

Vivek Chandra, CEO of Texas LNG – which has yet to take a final investment decision, despite being under development since before 2015 – responded to a question during a Flame webinar examining the health of the US LNG industry with the assertion that the corporate leadership of the LNG Canada project does not have a good track record of delivering major projects.

“I don’t want to name names but the companies that are doing these projects in Canada don’t have a great track record,” Chandra said. “All you have to see is the last four or five projects by this one particular company as operator to see what unmitigated disasters their project deliveries have been.”

Shell was a partner – but not as operator – in the Gorgon LNG project in Australia that came in late and well over budget, and had a 27.5% stake in – but was not the operator of – the Sakhalin-2 LNG project in Russia.

Based on Shell’s Gorgon experiences, Chandra said, the LNG Canada project – led by Shell with Malaysia’s Petronas, Petrochina, Japan’s Mitsubishi and Korea Gas as equity partners – is a risky proposition at best.

“Why should we feel today that that project – LNG Canada – is going to come on line and on budget,” he said. “More than likely, if their past record is anything to indicate by, it will be 30-40% over budget and it will be many years late.”

The LNG Canada project, Chandra said, faces many obstacles that make it riskier than many other greenfield projects. Among these, he suggested, is its remote location (on BC’s northern coast), “in a place where labour is expensive; in a place where you have to go through hundreds of streams and maybe five different major mountains” and “basically where there are no roads. You are basically asking for something to happen in terms of costs and pricing.”

American LNG projects on the US Gulf Coast, by contrast, have been completed “pretty much” on time and on budget – a reflection, Chandra said, of the entrepreneurial nature of project developers who “are not super-majors.”

“For the most part, if you look at the sheer number of tons coming out of the US and the fact that it was done with no drama in terms of cost and pricing, it gives you a lot of confidence that Americans can deliver projects,” he said.

Chandra said he “just doesn’t believe” that “other projects” – referring to those in Canada – can do the same.

“In today’s commodity market, where the price is the key, I think it’s a massive risk,” he said. “If you have to take locational risks, and build stick-built giant plants in the middle of nowhere, it’s a risky proposition in today’s market.”

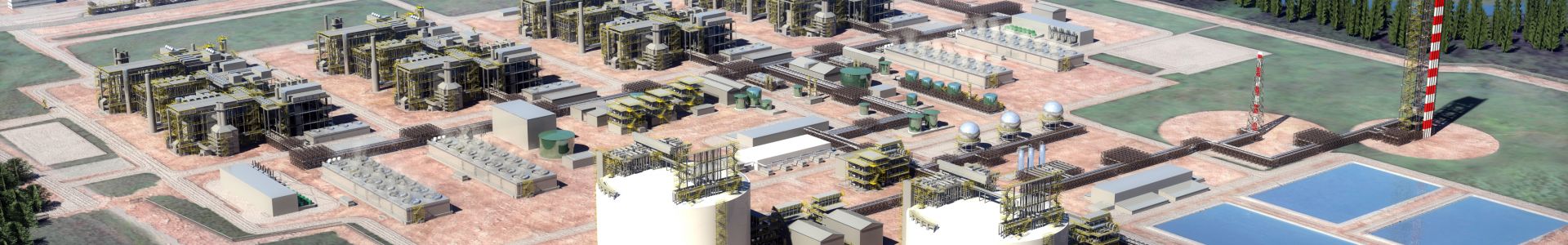

LNG Canada, however, is not a “stick-built” project. Like other major liquefaction projects under development, its components will be built in modules at fabrication yards in Asia then assembled on-site near Kitimat, which is easily-accessible to the Pacific Ocean.

An LNG Canada spokeswoman would not comment on Chandra’s assertions, but did tell NGW that “we remain as committed as ever to on time and on budget.”