Stupendous green energy and hydrogen projects set to transform Australia [GasTransitions]

On 11 November, mining giant Fortescue Metals, one of the largest iron ore producers in the world, based in Western Australia, announced plans to to build a stupendous 235 gigawatts (GW) of renewable capacity, mostly wind and solar. As Giles Parkinson writes in RenewEconomy, this represents “the single most aggressive push into renewables ever unveiled.” It would make Fortescue “a supplier of green energy and hydrogen that would rival the country’s biggest oil suppliers in terms of energy produced.”

“It is a time that has come. The world is never short and never will be short of renewable energy,” Chairman and Founder Andrew Forrest told shareholders at the annual general meeting. “After scientific and personal analysis of the renewable energy resources of our little planet I can assure you that there is more than enough renewable energy to sustainably and economically supply every person on this planet from this time forth. It is our job to respectfully use these readily available renewable resources and supply the world’s fuel and power at sufficient scale to satisfy the need for abundant, cheap, zero pollutant energy.”

The scale of the program is breath-taking, notes Parkinson. To put it into context, 235 GW of wind and solar is equivalent to nearly five times the current capacity of Australia’s main grid and more than the energy output of oil giants such as Chevron and Total.”

One caveat: Forrest did not outline specifics about where and when the scale of projects would be built. He did say that he would focus on products such as green hydrogen and ammonia, which would not just satisfy domestic energy and manufacturing needs, but also international markets in fuels, fertilisers and in green metals.

A “flywheel” plan illustrated in the presentation to shareholders indicates a focus initially on hydrogen and building the first 100 GW of wind and solar, and then using the cash flows and lower costs from that investment to further expand the amount of renewables and green hydrogen, notes Parkinson. Forrest said renewables and renewable hydrogen could be applied to fuel cells, ammonia, steel making, and industry heating. “Fortescue is building a major Renewable Energy/Green Industry business with global scale,” Forrest said.

The activities will be subsumed in a new company, Fortescue Future Industries, which has a team of about 40 executives working on the plan. Forrest revealed that the team had visited 23 countries, and would visit 24 more, to assess their government interest, green energy resources, and their potential to push into green industries.

Fortescue has already built a 60 MW solar farm, soon to be followed by a 150 MW solar farm plus big battery, in the Pilbara in Western Australia. It is also moving into green hydrogen in its iron ore operations, and plans to connect the solar production to Australia’s largest electrolyser in mid-2021 to generate green hydrogen for its hydrogen fuel cell bus fleet trial at Christmas Creek operations, and then move to trucks, trains and ships. The company is planning to reach zero net emissions for its own operations by 2040 at the latest. “The company would then move to a multi-gigawatt renewable hydrogen project to replace one billion litres of imported fuel. This revolution has to begin at home, it has to begin at Fortescue,” Forrest said.

The Chairman also revealed that the company had been working for the past five years to collect licences and patents to put the technology plan together. “This will place us up there with the major energy companies in the world if we fully develop them,” he said. “As each project tolls in we will consider them on their merits…and we will go ahead and finance those projects.” The company will be targeting the Asian, European and American markets in addition to Australia.

Massive projects

Elsewhere in Western Australia, two other massive green hydrogen projects are moving forward.

Hydrogen Renewables Australia announced on 16 November that it had agreed to partner with Denmark’s Copenhagen Infrastructure Partners (CIP) on a massive new renewable hydrogen production facility near Kalbarri in Western Australia, with up to 5 GW of combined solar and wind projects to supply it. The project, which will be built on the state’s mid-west coast, will use solar and wind resources along with desalinated sea water to produce renewable hydrogen for export to Asian markets, in particular Japan and Korea. The project is backed by the major German equipment provider Siemens.

“Our partnership with CIP will enable the Murchison Renewable Hydrogen Project to proceed with its planned development to assess the feasibility of producing competitive hydrogen exports for the Asian market,” said HRA executive chairman Terry Kallis in a statement. Kallis and CIP already cooperate on what looks likely to be Australia’s first ever offshore wind farm, the 2 GW Star of the South, being proposed off the coast of Victoria.

Another smaller but still sizable green hydrogen project moving forward in Western Australia is the A$350 million 750 MW Arrowsmith Hydrogen Project located north of Perth, undertaken by Infinite Blue Energy (IBE). IBE announced on 18 November that it will partner with Western Power to build a 330 KV power line to service the project, which will initially produce 25 tonnes of green hydrogen per day, to be expanded to a “global scale plant” later on. Arrowsmith will produce liquid hydrogen for export to the Asia-Pacific region, but will also supply wind and solar power to the local grid.

A third huge green hydrogen project being proposed in the Pilbara in Western Australia is a 15 GW wind and solar plant known as the Asian Renewable Energy Hub. This also aims at both the domestic and export markets. It is backed by CWP Renewables, Macquarie Group, and the world’s biggest wind turbine manufacturer Vestas. It had originally aimed for 9 GW, but with more studies it grew to 11 GW late last year and in July it went up to 15 GW.

That represents some $30 billion in investment and the potential to generate some 50 TWh of electricity a year, roughly equivalent to one fifth of the country’s annual electricity consumption, and about twice the current capacity of installed large-scale wind and solar.

Tipping point

In Queensland in North-Eastern Australia zinc refiner Sun Metals also came out with a major announcement on 22 November, saying that it will go 100% renewables, and will add further capacity to pursue “green hydrogen” opportunities in transport and export.

The decision by the South Korean owned Sun Metals refinery – the second biggest single energy user in Queensland, and one of the biggest in Australia – to reach 100% renewables by 2040 was described as a “tipping point” by Jon Dee, the Australian head of the RE100 initiative.

“This commitment by Sun Metals to go 100% renewable by 2040 is a real game changer,” Dee said in a statement. “If Sun Metals can go fully renewable by 2040, there’s no reason why every other Australian refinery and smelter can’t do the same.”

Sun Metals, owned by Korean Zinc Corp, already sources 22% of its electricity needs from its own solar plant. It now aims to reach 80% renewables by 2030, through the addition of wind energy – although it is not clear whether this will be through the purchase of wind farms themselves, or a contract for their output.

It will then seek other technologies such as batteries, biogas and hydrogen to fill the remaining gap, and also plans to invest in green (renewable) hydrogen to replace diesel on the site and as an export fuel in the future. It recently secured a $5 million grant from the Queensland government to develop one of north Queensland’s first renewable hydrogen production facilities.

“We have already started our renewables journey,” Sun Metals CEO Kiwon Park said. “As the first major energy user in Australia to build its own large scale solar farm, we’re already getting 22% of our electricity from solar and based upon our development pipeline we will easily achieve 100% renewable by 2040.”

In Townsville, Queensland, further north along the coast, Australian energy utility Origin Energy on 26 November announced a plan to build a 300 MW electrolyser which would be able to produce over 36,000 tonnes of green hydrogen a year for export markets.

Origin said it is working with Japan’s Kawasaki Heavy Industries on the project and has already completed a feasibility study. It expects engineering and design work to begin this financial year. It is also targeting a 500 MW green ammonia project in Tasmania for the domestic and export markets.

CEO Frank Calabria of Origin Energy said Australia “is a likely supplier of renewable fuels given its renewable energy potential and geographic proximity to growing Asian markets. He says demand will be customer led, but Japan looks strong from the mid-2020s and other markets in Asia will emerge in the 2030s.”

Origin is also considering building batteries at three of its biggest gas generator plants – up to 300 MW at Mortlake in Victoria, up to 200 MW at Uranquinty, and an unspecified size at Darling Downs in Queensland.

Key exporter

On 1 December, Queensland’s green hydrogen export prospects received “a further boost, with the government-owned Stanwell Corporation inking a deal with Japanese hydrogen giant Iwatani to partner in the development of a green hydrogen export terminal in Gladstone,” reported energy journalist Michael Mazengarb on Reneweconomy.

Iwatani, Japan’s largest domestic supplier of green hydrogen, will form a consortium with Stanwell to undertake a study into the production and liquefaction of green hydrogen in Queensland, with the ultimate aim of importing it into Japan.

Queensland premier Annastacia Palaszczuk said the deal was a landmark partnership for the emerging green hydrogen industry in Queensland. “If we can position Queensland as a key exporter of this resource, Queensland will be at the forefront of the renewable energy revolution,” Palaszczuk said. “To do that, we must partner with Japanese energy suppliers – and when it comes to hydrogen, they don’t come any larger than Iwatani. Hydrogen is the future. We’re investing in this sector because we know the great potential this industry has to drive Queensland’s economic recovery in years to come.”

Iwatani said that it was looking to develop plans for the production of green hydrogen, using supplies of wind and solar electricity, and was already examining ways to include the liquefication of hydrogen which would enable the zero-emissions fuel to be exported overseas.

Iwatani controls around 70% perof Japan’s domestic hydrogen market but said that it would need to look offshore to secure larger supplies of low-cost green hydrogen and sees Queensland as a viable location to establish a production base. Iwatani has already secured a number of partnerships with vehicle manufacturers, including Japan’s largest car manufacturer Toyota, to establish a network of hydrogen refuelling stations.

Mazengarb notes that “the deal is the latest in a series of major partnerships between Australia and Japan on green hydrogen, following Mitsubishi Heavy Industries securing a stake in the South Australian based green hydrogen and ammonia project developer, H2U.”

The Queensland labor government recently appointed Mick de Brenni as “minister for Energy, Renewables and Hydrogen”. It was the first appointment of an Australian minister dedicated to hydrogen, showing the important Queensland places on the export of hydrogen.

“The Premier has given me a mandate to do everything we can to grow this industry, and put Queensland workers front and centre in this,” de Brenni said. “We’ll continue to partner with the world’s leading energy companies, including our own, to develop this exciting new industry in Queensland.”

Hydrogen hubs

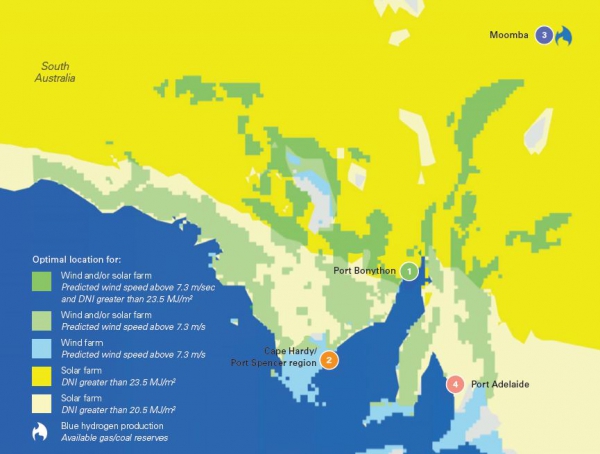

South Australia is also jumping on the green hydrogen bandwagon. In late October, the South Australian Liberal government named three “hydrogen hubs” that it expects will result in an “epic” growth in wind and solar capacity in the state, and enable it to become a major energy exporter to the rest of the country and the world. The hubs will be located at Port Bonython, Port Adelaide and Cape Hardy/Port Spencer.

“Hydrogen is shaping up as a game-changer in the fight against climate change and our aim is to get the cost down so that it’s a commercially attractive option for heavy transport, power generation and use by industry,” said South Australia energy minister Dan van Holst Pellekaan.

He issued a prospectus revealing that “South Australia can become a national and international exporter of clean power, while achieving the goal of net-100% renewable energy.” South Australia is already a world leader in the deployment of wind and solar, which produced more than 57% of state demand over the last 12 months, and on many occasions more than 100%.

The state, which has the country’s biggest electrolyser to date at Tonsley Park in Adelaide, has a target of reaching “net 100%” renewables before 2030, and become a net exporter of wind and solar. Van Holst Pellekaan said just one of the hydrogen hubs could at least double the current installed capacity of solar and wind in South Australia, which is just over 2 GW of large-scale wind and solar and over 3 GW including rooftop solar.

According to the plan, the envisioned hub at Port Bonython in the Upper Spencer Gulf could export industrial-scale green hydrogen around the huge wind and solar installations already built or planned for the region around Whyalla and Port Augusta. Both Port Bonython and Port Spencer could support green electrolysers of up to 2.5 GW, which in turn would support wind and solar additions of between 6 GW and 6.5 GW at each facility, which would take the state’s wind and solar capacity to around 300% of current state demand.

The Port Adelaide facility is described as “localised” green energy, supporting up to around 800 MW of contracted wind and solar, while Port Bonython is also earmarked for an additional “blue-green” hydrogen hub that would include some of the state’s gas resources.

The prospectus says that hydrogen will allow the world to rethink ways to generate and store energy, power transport fleets and heat homes. “There is no doubt that hydrogen production could be a transformative technology,” it says. “It will challenge industries to rethink their current processing, trigger close examinations of our gas pipelines and ports, and inspire a different mindset on how we fuel our transport sector.”

The announcement was welcomed by the Australian Hydrogen Council, which said hubs are vital to Australia’s hydrogen industry as they facilitate the large-scale demand that is needed to get the industry to scale. “The three hydrogen hubs detailed in the prospectus could put South Australia in a fantastic position to meet the growing domestic and export demand for hydrogen,” it said in a statement.

Apart from the Port Bonython project, which will include some “blue” hydrogen, it is clear that most of the new plans announced in Australia focus on renewable-based green hydrogen. The CEO of ARENA (Australian Renewable Energy Agency) has said that Australia can support up to 700 GW of large-scale wind and solar if the renewable hydrogen industry replaces the current LNG market in a de-carbonised economy.

On the other hand, the Australian Federal government led by Scott Morrison is still pushing the development of blue hydrogen based on coal and natural gas. Its Technology Investment Roadmap published in September backs production of hydrogen with carbon capture and storage technologies.

_f350x294_1607950686.JPG)