Sterling Resources Provides Current Resources Estimates for Offshore Romania

Sterling Resources Ltd. has provided current resources estimates for its properties offshore Romania.

The current estimates prepared by independent reserves evaluator RPS Energy (1) comprise individual and aggregated resources estimates for the fields and prospects in Block 13 Pelican and Block 15 Midia (Sterling 65 percent), Block 25 Luceafarul (Sterling 50 percent) and Block 27 Muridava (Sterling 40 percent). The Prospective Resources estimates do not include those relating to the Anca and Maria prospects in Block 15 Midia, which are planned to be sold to ExxonMobil Exploration and Production Romania and OMV Petrom pursuant to the transaction announced earlier.

-

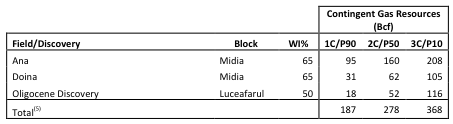

Company Share 2C Contingent Resources(2)(4)(5) offshore Romania are now 278 billion cubic feet (Bcf) of gas. This represents a 24 percent increase from the figure reported as at the end of 2011 in the Company’s Annual Information Form, which did not include the contribution from the gas discovery in the Luceafarul Block.

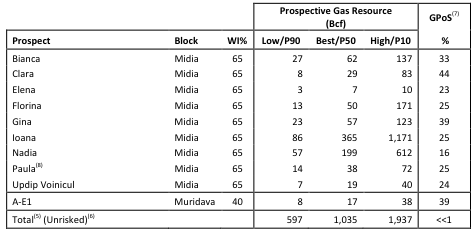

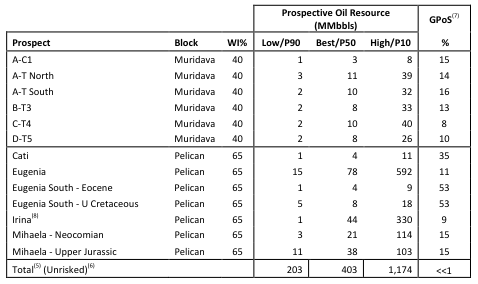

- Company Share Unrisked (6) Prospective Resources (P50)(3)(4)(5) offshore Romania now stand at 403 million barrels (MMbbls) of oil and 1,035 Bcf of gas, excluding the Anca and Maria prospects in the Midia Block. This represents a 100 percent increase and a 40 percent increase respectively in the equivalent figures reported as at the end of 2011 in the Company’s Annual Information Form, which did not include the contribution from prospects in the Luceafarul and Muridava Blocks.

Company Share Resources Estimates for offshore Romania

.png)

The updated estimates incorporate some small downward revisions to the Contingent Resources of the Doina discovery and to the Prospective Resources of certain gas prospects in Block 15 Midia, as a result of a software error in the commercially available software used by RPS Energy. The 1C, 2C and 3C Contingent Resources and P90, P50 and P10 Prospective Resources for individual fields and prospects are provided in the following tables.

Company Share Contingent Gas Resources (2)(4)(5)

Company Share Prospective Gas Resources (3)(4)(5)

Company Share Prospective Oil Resources (3)(4)(5)

“Sterling has long recognized the hydrocarbon potential in our extensive Black Sea acreage,” commented Mike Azancot, Sterling’s Chief Executive Officer. “With our recent addition of interests in the Block 27 Muridava and Block 25 Luceafarul earlier in 2012, and further assessment of prospects in both the Midia and Pelican Blocks, we can now report a significant uplift to our prospect portfolio.”

Notes on Resources Estimates:

(1) RPS Energy, Resources Evaluation of the Luceafarul (25), Muridava (27), Midia (15) and Pelican (13) Blocks Offshore Romania effective September 30, 2012 and dated October 17, 2012.

(2) Contingent Resources are those quantities of petroleum estimated as of a given date to be potentially recoverable from known accumulations using established technology or technology under development, but which are not currently considered to be commercially recoverable due to one or more contingencies. Contingencies may include factors such as economic, legal, environmental, political and regulatory matters, or lack of markets. It is also appropriate to classify as Contingent Resources the estimated discovered recoverable quantities associated with a project in the early evaluation stage. Specific contingencies preventing the classification of the resources as reserves are further definition of resource volumes through further appraisal drilling, regulatory approvals and sanction, and selection of a specific field development concept, including the most viable crude offtake delivery routing and oil sales contracts. There is no certainty that it will be commercially viable to produce any portion of the Contingent Resources.

(3) Prospective Resources are those quantities of petroleum estimated as of a given date to be potentially recoverable from undiscovered accumulations by application of future development projects. There is no certainty that any portion of the Prospective Resources will be discovered or, if discovered, that it will be commercially viable to produce any portion of the Resources. These Prospective Resources are in areas of the field or geological horizons, in which the presence of hydrocarbons require confirmation by drilling.

(4) The P(50) or 2C is considered to be the best estimate of the quantity that will actually be recovered. If probabilistic methods are used there is at least a 50 percent probability P(50) that the quantities actually recovered will equal or exceed the estimate. Similarly, the 1C or P(90) and 3C or P(10) represent the low and high estimates respectively.

(5) Company Resources totals shown by Resources category are statistical aggregates of Unrisked Resources at the company level. For Contingent Resources these statistical aggregates assume no dependencies between discoveries and for Prospective Resources these statistical aggregates assume no dependencies between prospects.

(6) Unrisked stochastically summed volumes assume that all prospects are successful. The likelihood of this is deemed to have a probability of much less than 1 percent.

(7) Geological Probability of Success (GPoS) is defined as the chance that resource volumes of the prospect will exist as described in the technical evaluation. GPoS is derived by a combination of the Regional Play Chance, (a combination of the chances of having hydrocarbon source, reservoir and seal) and Prospect Specific Chance (a combination of the chances of having a trap, seal, reservoir and hydrocarbon charge). All reported GPoS are evaluated by RPS Energy (reference note 1).

(8) On block Prospective Resources.

As with all oil and gas fields at this early stage of appraisal, there are significant positive and negative factors, which may impact the resource volumes for Romania. There is a significant range of uncertainty associated with the resource volumes due to variations in geological properties, reservoir petrophysical properties and potential well flow rates in the undrilled portions of the reservoir structure.