Cold 1Q Boosts Statoil's Profit

Norwegian producer Statoil reported higher 1Q profits April 25, as production along with oil and gas prices rose year on year. Net income increased year on year by 21% to $1.285bn in 1Q2018.

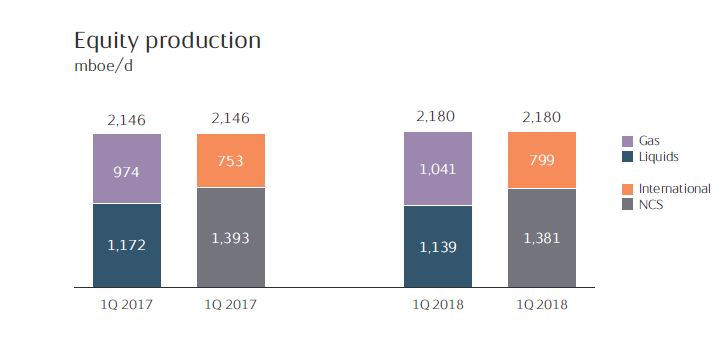

Statoil’s first quarter equity production of 2.18mn barrels of oil equivalent per day - made up of 1.139mn boe/d liquids and 1.041mn boe/d gas - was 2% higher year on year, on the back of new fields and wells. It also reported record high production outside Norway (see graphic below), and higher gas deliveries into strong markets.

Natural gas sales volume in 1Q2018 was flat year on year at 15.5bn m3, but entitlement increased to 13.8bn m3 (from 13.1bn m3 in 1Q2017).

Moreover, average invoiced European natural gas sales price was 26% higher year on year to $6.90/mn Btu in 1Q2018, due to the higher demand as a result of sustained periods of cold weather on the continent and in the UK. Average invoiced North American piped gas sales price was also 5% higher at $3.48/mn Btu, also due to higher demand as a result of prolonged cold weather.

CEO Eldar Saetre said that Statoil reduced its net debt ratio to 25.1%, after paying its costs on the Martin Linge gas and oil field development, and that cashflow in 1Q2018 exceeded $7bn.

Statoil’s outlook for full year 2018 is for $11bn organic capital expenditure, of which $1.5bn on exploration, with production rising by 1% to 2% versus 2017 and rising by an average compound growth rate of 3%-4% during the 2017-20 period. Last month the company said that a May 15 shareholders’ meeting will decide on the board’s recommendation to change Statoil’s name to Equinor.