South Asia’s shifting NGV opportunities [LNG Condensed]

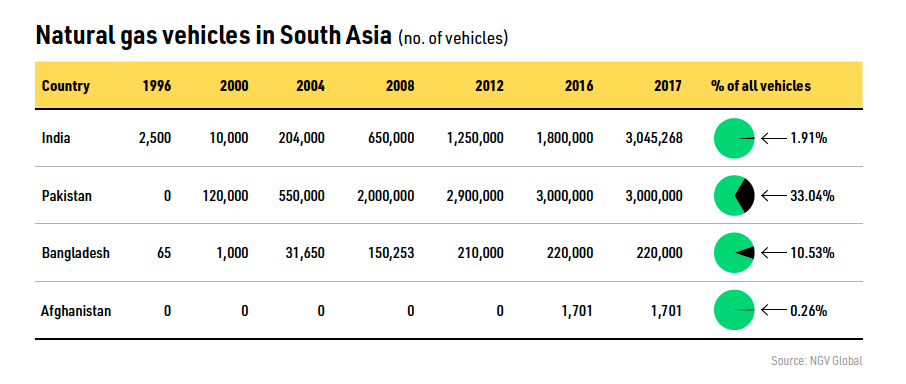

NGVs were promoted in Pakistan from the 1990s to replace imported gasoline and diesel with indigenous gas for security of supply and balance of payments reasons. Based on the cost advantage of CNG, tax breaks and other incentives, NGV numbers soared from 120,000 in 2000 to 3.1 million in 2011, when Pakistan hosted the second-largest number of NGVs globally.

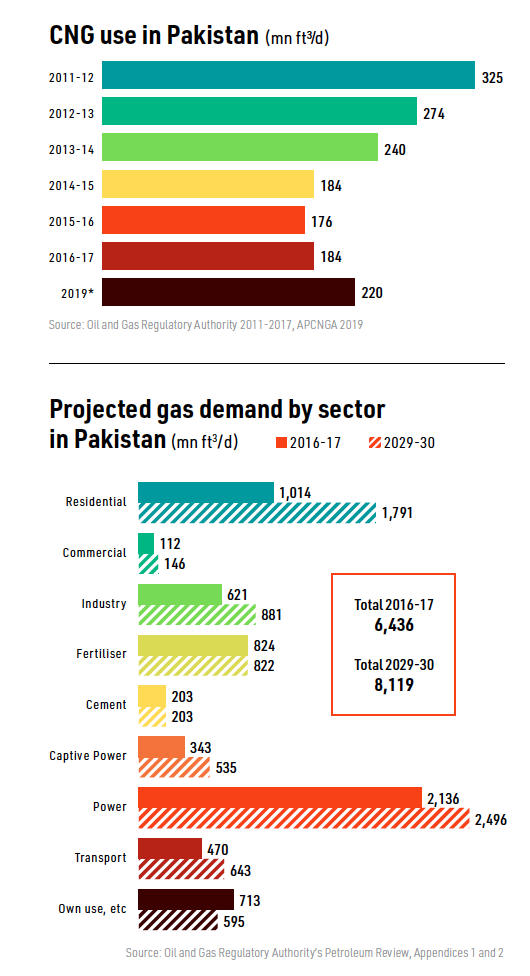

CNG use reached 0.325bn ft3/d in the financial year ending June 2012. But problems had already emerged in the 2000s when domestic gas production began to falter. By the 2010s, CNG faced intense competition for gas from generators, industrials and residential users.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

Constrained gas supplies were compounded by safety concerns, with the government attempting to stop new conversions, ration CNG and close refuelling stations. By FY2015-16 CNG use had fallen to 0.176bn ft3/d.

Even so, industry group NGV Global estimates Pakistan had 3 million NGVs in 2017, much the same as in 2011. By January 2019, the figure was 3.7 million, according to the All Pakistan CNG Association (APCNGA).

That jump followed a government rethink favouring NGVs as oil prices rose and pollution worsened. It also came in anticipation of a gas import bonanza.

LNG imports began in 2015 through Elengy’s 0.6bn ft3/d floating storage and regasification unit (FSRU) at Port Qasim. The 0.75bn ft3/d Pakistan GasPort Terminal subsequently entered operation, with more LNG projects planned.

Piped Turkmen and Iranian imports of 1.325bn ft3/d and 0.75bn ft3/d, respectively, are also planned, although these are both long-term pipeline projects that will take years to build, if they are completed at all. The prospect of pipeline imports from Iran, in particular, is unlikely to progress while US sanctions on the country are in place.

Winter setback

However, CNG use suffered a setback in late 2018. Gas supply problems led to the prolonged closure of many CNG stations as other consumers were given priority. The problems were caused by strong gas demand growth combined with low supplies resulting from declining domestic production and constrained LNG imports.

The Oil and Gas Regulatory Authority (Ogra) projects domestic gas output will fall from 3.69bn ft3/d in FY2016-17 to 1.41bn ft3/d in FY2029-30, so the onus will fall on imports to meet gas demand projected in the latter year at 8.12bn ft3/d, of which 0.643bn ft3/d is expected to be for transport sector use.

The latter projection may be on the low side. In March 2019, APCNGA said gas supplies allocated to CNG should rise immediately from 0.22bn ft3/d to 0.5bn ft3/d to satisfy suppressed demand and reduce the oil import bill by $670mn/yr.

But there is supply-constrained demand in other sectors too. With strong competition for supplies, falling output and uncertainty over the timing and stability of piped imports, increased transport gas use will require a greater share of a greater volume of LNG imports.

APCNGA has said this could be achieved by letting private importers use spare capacity at LNG terminals, operating on a tolling basis.

The government says it is open to this, although its feasibility is subject to conditions including the harmonisation of tax on LNG imported by state and private enterprises. Bottlenecks in the distribution network must also be resolved, while private importers serving the transport sector would have to compete with those serving other consumers.

The future direction of Pakistan’s LNG sector is itself uncertain under Prime Minister Imran Khan’s administration.

Threats in late 2018 to renegotiate LNG contracts and Khan’s visit to Qatar in early 2019 to seek price and payment changes with its main LNG supplier mean an LNG market that grew 45% year on year in 2018 is being closely watched by international investors.

What they see will determine the prospects for both LNG imports and NGVs. In a scenario of unconstrained imports, and with a supportive regulatory environment, CNG use should rise strongly, leading to further growth in NGV numbers. Costs and levels of consumer acceptance are positive. It would also have a beneficial impact on the country’s balance of payments.

However, in a scenario of constrained supply, CNG use has typically found itself low down the list of government priorities when it comes to allocating scarce gas supplies.

Bangladesh

Bangladesh’s NGV market faces similar problems to Pakistan. Faltering domestic gas output and burgeoning demand has resulted in increasing competition for the fuel from other, more influential sectors.

Although it grew rapidly in the 2000s, Bangladesh’s NGV fleet stalled in the mid-2010s at 220,000. By June 2018, it had increased to 269,500, according to Rupantarita Prakritik Gas, a subsidiary of state energy company Petrobangla. Meanwhile, the number of CNG stations has expanded to 599.

However, prospects for further growth appear limited. Although CNG producers pay more for gas, industrials and generators have priority for supplies that will come increasingly from three operational or firmly-planned LNG terminals.

The problem was highlighted in late 2018 when a reduction in gas supplies was borne by CNG stations, rather than other users.

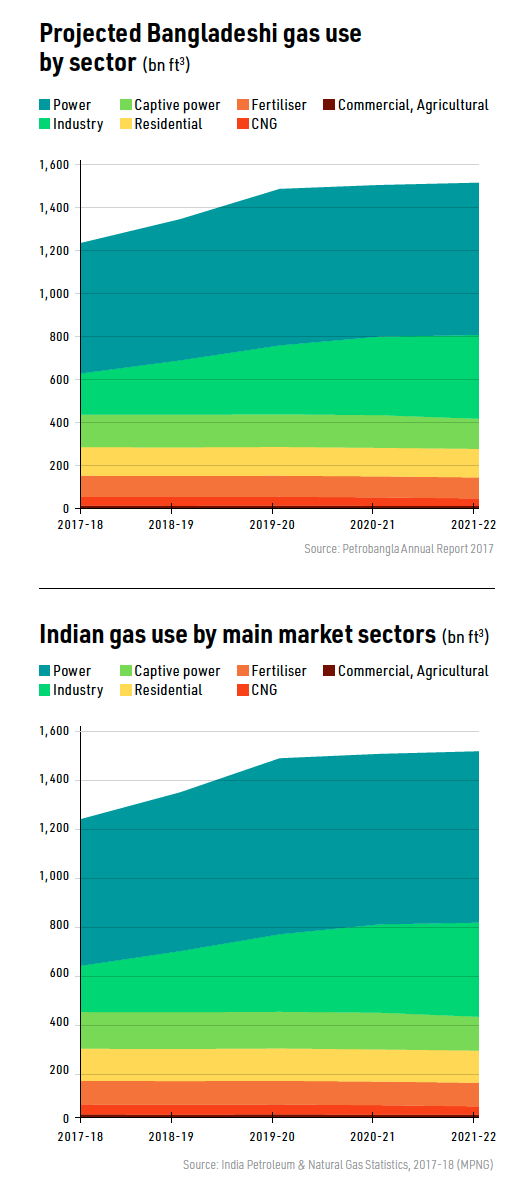

CNG accounted for 46.9bn ft3, or 4.8% of total gas use in the financial year ending June 2017. But Petrobangla’s latest annual report forecasts a fall in CNG use to 34bn ft3 in FY2021-22, when it is expected to account for only 2.2% of gas consumption. As in Pakistan, latent demand is expected to go unmet as a result of competition from other sectors, a situation which a more open import and distribution environment would resolve.

India

Indian NGV development was limited in the 1990s and 2000s, given the size and potential of the market. CNG was not a priority market for limited Indian gas supplies.

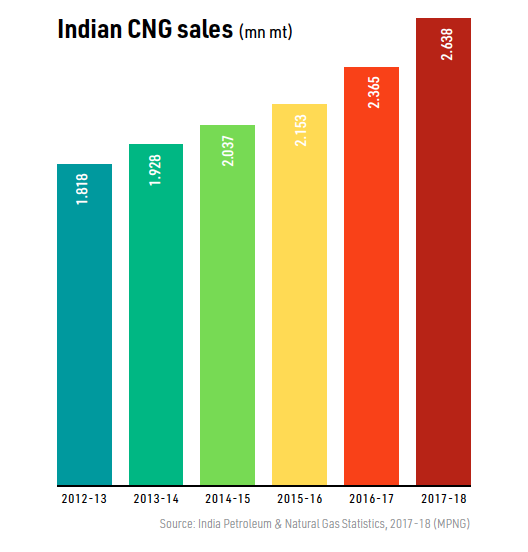

However, environmental concerns became increasingly important in the 2010s. The rising oil import bill and bullish forecasts of higher gas output in the 2020s added to the momentum. The NGV fleet jumped from 1.25 million in 2012 to 3.045 million in 2017, and was officially estimated at 3.3 million in early 2019.

The potential for further growth is considerable. NGVs represent less than 2% of the vehicle fleet, which Japan’s Nomura Research Institute (NRI) projects will grow by 8%/yr to 2030.

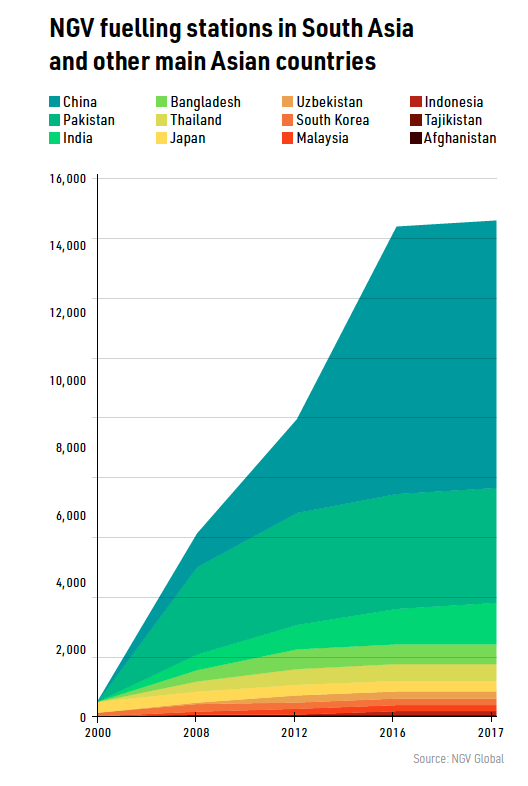

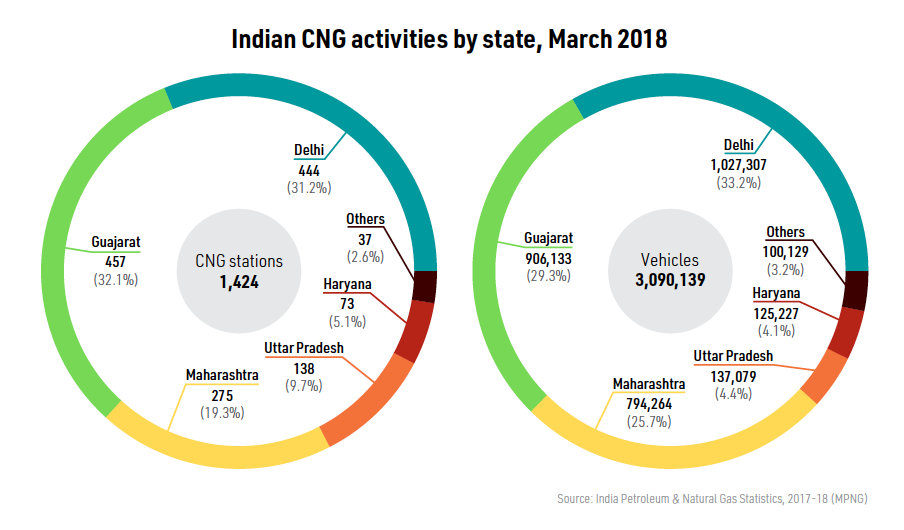

The main constraint to date has been refuelling capacity. CNG stations were added more slowly than NGVs in the mid-2010s, rising from 724 in 2012 to 1,233 in 2017.

The main constraint to date has been refuelling capacity. CNG stations were added more slowly than NGVs in the mid-2010s, rising from 724 in 2012 to 1,233 in 2017.

This reflects the patchy coverage of gas distribution networks. More than 80% of CNG stations are in Delhi, Maharashtra and Gujarat, according to Petroleum and Natural Gas Minister Dharmendra Pradhan.

That is set to change following two tenders to develop distribution networks. On completion of the projects 70% of India’s population and 53% of its area -- 402 districts in 27 states and territories – should have access to gas. The policy is integral to the government’s goal of more than doubling gas’ share of primary energy to 15% by 2030.

In July 2018, the Petroleum and Natural Gas Regulatory Board awarded 86 areas covering 174 districts in 22 states. In March 2019, it awarded concessions for a further 50 areas covering 124 districts in 14 states. Existing networks cover 240 million people in 91 areas.

NRI projects there could be 10 million more NGVs by 2025 in India, if CNG stations increase by 5,000, with NGVs potentially accounting for half Indian vehicle sales by 2030. Pradhan has said CNG station numbers will increase to 10,000 by the late 2020s. This implies 23 million or more NGVs could operate by 2030.

Where infrastructure exists, NGV penetration is high. For example, in Delhi a third of vehicles (just over one million) are NGVs, while nearly a third of refuelling stations are CNG, according to NGV Global.

Growing interest

There is no lack of consumer interest in NGVs given their cost advantage. In March 2019, the Indian government said CNG was 60% and 45% cheaper than gasoline and diesel, respectively. The overall cost of CNG vehicles is about 20% lower than either.

Vehicle manufacturers are enthusiastic, given the stringent environmental standards squeezing the market for diesel vehicles. India’s largest car maker Maruti Suzuki produced 74,000 CNG vehicles in 2017 and plans to sell 200,000 in 2022. Other car makers are exploring the market, with Volkswagen expressing interest in January 2019.

Apart from CNG-based NGVs, there is also interest in LNG as an alternative to diesel-fuelled heavy commercial vehicles. For example, Petronet LNG plans to install 20 LNG stations on a 4,000 kilometre route from Delhi to Thiruvananthapuram.

An uptick in NGV activity is already occurring. Pradhan said in February that the number of CNG stations now exceeds 1,500, while Maruti Suzuki’s CNG vehicle sales rose 50% year on year in the first half of the financial year ending March 2019.

But building the new gas distribution networks will take time. The concessions allow eight years to complete them and associated CNG stations.

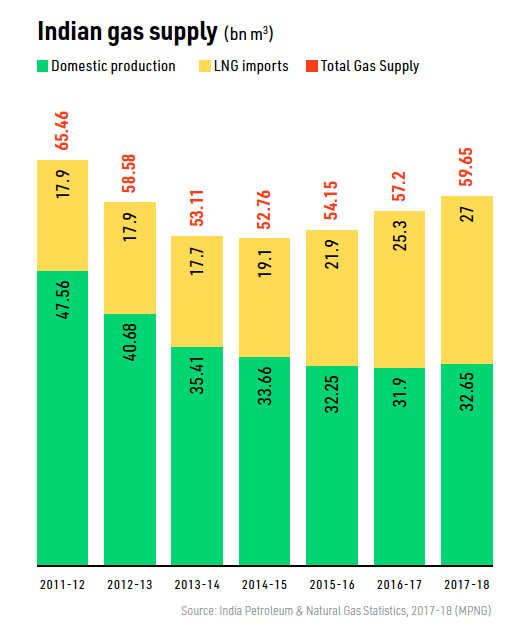

Securing sufficient gas supplies may also prove difficult, given India’s past difficulties in meeting output targets. Domestic gas production fell from 1,679bn ft3 in FY2011-12 to 1,153bn ft3 in FY2017-18. The latest figures show production for the ten months to January 2019 up 0.4% year on year, but 7.4% below target.

City gas use did increase by over 50% between FY2011-12 and FY 2017-18, while 14% of gas is earmarked for distribution networks – of which about three-quarters goes to CNG. But there are competing demands from other users.

Nor are NGVs necessarily regarded as a long-term option. Some players, including officials at Maruti Suzuki, see electric vehicles (EVs) as the real prize with NGVs an interim measure. If the roll out of India’s distribution networks is too slow, domestic gas output struggles, and EVs achieve early take off, NGVs could thus miss out as coal by wire is supplanted by coal by tyre.

Market potential

The scale of South Asian energy demand, alongside the environmental and diversification imperatives to use gas, and underlying gas production issues, mean South Asia will be a substantial growth market for LNG regardless of which sectors take the fuel.

The NGV share will to a great extent depend on how fast national gas distribution grids are rolled out. In the absence of realistic price signals, it will also depend on political decisions regarding gas allocations as demand in other sectors is pushed artificially higher by subsidies.

But as (or perhaps if) national markets and prices are liberalised, CNG will be better placed to prosper than more subsidised sectors such as fertiliser production. At that stage CNG and wider transport sector gas use could grow more rapidly than suggested here – assuming EVs have not overtaken them.

But as (or perhaps if) national markets and prices are liberalised, CNG will be better placed to prosper than more subsidised sectors such as fertiliser production. At that stage CNG and wider transport sector gas use could grow more rapidly than suggested here – assuming EVs have not overtaken them.

CNG’s cost advantage versus gasoline and diesel make it resilient to competition from EVs. In addition, the domination of India’s power sector by coal-fired generation brings into question the environmental gains of electric mobility versus CNG.

For the full Magazine sign up FREE below and download the March 2019 edition of LNG Condensed.

NOW AVAILABLE: Volume 1, Issue 3 - March 2019

LNG Condensed brings you independent analysis of the LNG world's rapidly evolving markets.

LNG Condensed brings you independent analysis of the LNG world's rapidly evolving markets.

Covering the length of the LNG value chain and the breadth of this global industry, it will inform, provoke and enrich your decision making. Published monthly, LNG Condensed provides original content on industry developments by the leading editorial team from Natural Gas World.

LNG Condensed is your magazine for the fuel of the future.

Volume 1, Issue 3 - March 2019

Canada - The Sleeping Giant

> Editorial: Pressure Testing the European gas Market

> Feature: South Asia’s Shifting NGV Opportunities

> Feature: Small-Scale LNG Opens Up Markets

> Country focus: Philippines: Major Potential for Small-Scale LNG

> Project spotlight: Arctic LNG 2

and more!

Sign up now to receive LNG Condensed monthly FREE (after filling out the form you will be redirected to LNG Condensed's archive where you can find every issue already published available for download):