Shell Exec Insists Canadian LNG Not Dead

Although two major Canadian LNG export projects have been cancelled in the last few months, LNG Canada CEO Andy Calitz has insisted that the Canadian province of British Columbia (BC) still has a future in LNG.

“I actually believe that BC will have an LNG industry, that there is societal support for an LNG industry from BC and…I believe specifically the LNG project can and will happen in BC,” Calitz told Glacier Media’s Business in Vancouver following an address to the Greater Vancouver Board of Trade (GVBOT) on September 22.

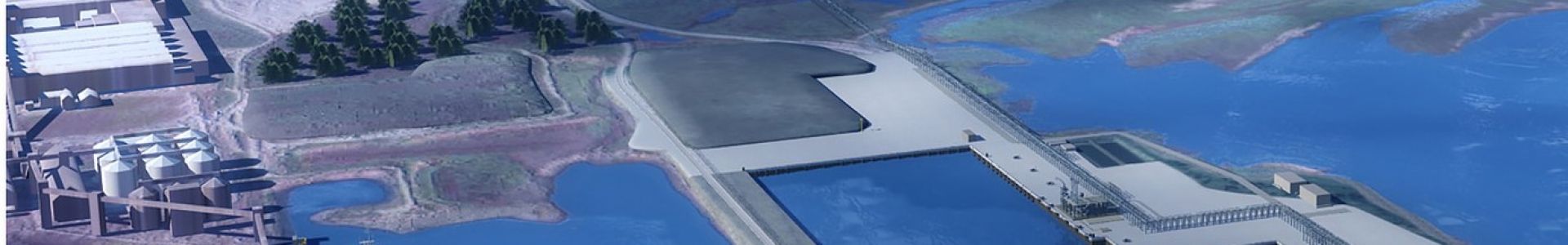

LNG Canada – a joint venture of Royal Dutch Shell, PetroChina, Korea Gas Corporation (Kogas) and Japan's Mitsubishi – entered the BC LNG fray in 2012 with a C$35.2bn proposal to develop a 12mn metric tons/year terminal at Kitimat on the BC central coast; later that year it enlisted TransCanada to build and operate the C$4.8bn Coastal GasLink pipeline to supply the terminal, bringing the total project cost to around C$40bn.

In 2015, the project received federal and provincial environmental approvals, and in early 2016, the BC Oil and Gas Commission issued a facility permit.

Later in 2016, however, the joint venture delayed indefinitely a final investment decision (FID), citing “global industry challenges” and “capital constraints”. Earlier this year, Shell divested some of its BC natural gas assets, raising questions about whether the joint venture would have enough upstream supply for the first two trains of the project. It also shelved the Prince Rupert LNG project that it acquired in 2016 from BG Group.

This July, shortly after Petronas cancelled its Pacific NorthWest LNG project, Shell CEO Ben Van Beurden reiterated that he thinks LNG Canada “is the best project in Canada” but cautioned that the partnership needs two things to happen to move the project forward: first, a break-even price that is resilient during down cycles, and second, the right timing.

“On the first point, the process LNG Canada is in to achieve a competitive price for its EPC contract is fundamental to success as well as mitigations to avoid future cost increases both during construction (eg labour costs) and operations (eg taxes),” Susannah Pierce, LNG Canada’s director, external relations, wrote in a LinkedIn post. “On timing, Ben suggests that an investment decision in the next 18 months could enable the project to start producing ‘right at the moment when the market, spot market, short-term market, is getting very tight, again.’”

In his address to the GVBOT, Calitz said that the overall fiscal competitiveness – including taxes and royalties – needs to be considered before LNG Canada can move ahead with an FID, which it hopes to do in 2018.

“We need the government of British Columbia specifically, but also the [Canadian] federal government, to take a last look at the fiscal tax competitiveness of Canada for an LNG project,” he said. “This is an important but also a sensitive matter. We do not seek any form of subsidy at all. We pay our full tax burden. One of the conditions of the new government is that there should be a fair return and benefit for British Columbians. We will do that. We need them to look at the full complexity of federal, provincial, local and other taxes that we pay to say, ‘Does this still make sense? Is this still competitive?' ”

In cancelling a feasibility study into its Aurora LNG project earlier this month, CNOOC subsidiary Nexen Energy cited "the current macro-economic environment" for its decision, but did not comment on the fiscal environment in which the project would operate.

Dale Lunan