Shell’s energy security scenarios [Gas in Transition]

Shell published its Energy Security Scenarios report on March 21, reflecting the security mindset that has taken hold following the global upheaval caused by the invasion of Ukraine by Russia, as national interests and energy security take precedence in the drive to address immediate energy concerns. In one scenario, Archipelagos, Shell looks at how things could evolve if current trends continue and, in another, Sky 2050, Shell considers how the world must move to achieve net zero by 2050. Based on these scenarios the report discusses how the world could switch from where it appears to be headed, towards a lower-carbon future.

In a way, Archipelagos is a forecast based on where the world was in 2022 and where these known trends and policies could lead. Shell calls it an “explorative scenario,” which means “we do not assume the final outcome, rather we use plausible assumptions based on the data to determine what we believe will occur in the future.” In this, following the events of 2022, “global sentiment shifts away from managing emissions towards energy security.” In this:

- In the short-term nationalism pervades.

- The drive for energy security leads to significant use of low-carbon technologies.

- But competition between nations results in multiple low-carbon technology races.

- Rather than acting together to save the planet, groups of nations scramble to secure energy supplies and focus on building energy resilience to withstand future shocks.

- Global emissions stabilise in the 2020s and start falling from the mid-2030s, with net zero in sight, but still not achieved by 2100.

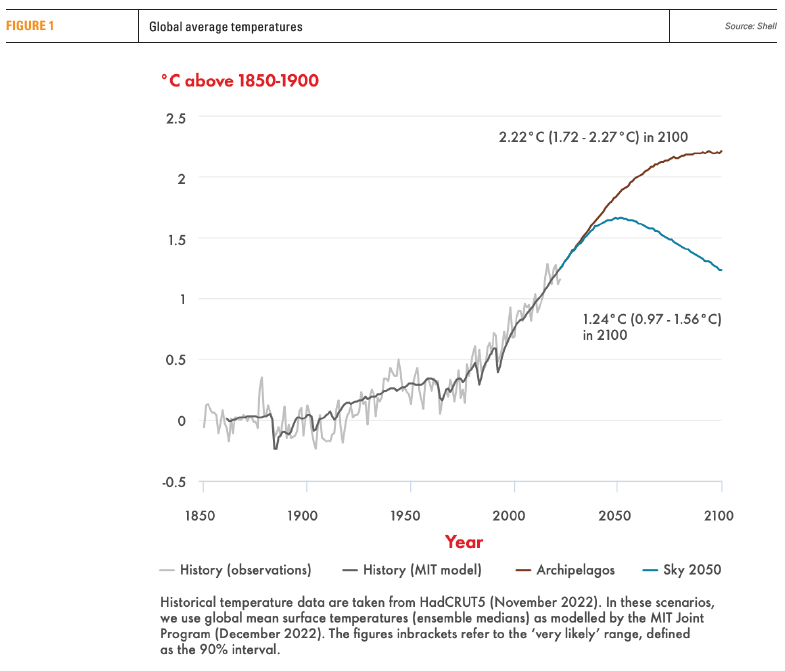

- Global average temperature carries on rising in 2100 but begins to stabilise shortly afterwards at around 2.2°C as emissions close in on net zero.

Sky 2050 starts with a desired outcome, net-zero emissions by 2050 and global warming limited to 1.5°C by 2100, and works backwards to the realities of 2022. It is a backcast, attempting to determine what needs to be done to achieve the end result. Shell calls it a “normative scenario, which means “we assume that society meets the most ambitious goal of the Paris agreement…and then we work back in presenting how this may occur.” As a result, Sky 2050 makes “many stretching assumptions,” but even then “global warming exceeds 1.5°C before it drops back down because of net removal of CO2 from the atmosphere.” Shell states that preventing that would need “action greater than the already substantial measures laid out in Sky 2050, which may not be technically feasible.” In this:

- A longer-term perspective on security emerges which includes the need to meet the threat of climate change.

- But then, momentum towards emissions reductions gathers pace as the need to deliver low-carbon energy infrastructure grows, driven largely by concerns over security and price.

- Emissions start to fall from 2025 and by 2040 the goal of net-zero emissions is clearly in sight.

- Despite a faltering start, eventually, under citizen and young people pressure, politicians adopt climate-friendly policies that become national priorities.

- This makes it possible for the world to reach net-zero emissions in 2050.

By 2100, despite overshooting 1.5°C earlier on, the rise in global average temperature returns to below 1.5°C in 2075 and falls back to around 1.2°C by 2100.

But neither Archipelagos nor Sky 2050 predict what may actually happen. The report discusses how the world could switch from where it appears to be headed, towards a lower-carbon future. Key points from this are:

- Fossil fuels lose market share. The energy system is decarbonising, the question is: how fast?

- There is no realistic path to an instant and steep drop in emissions.

- The average temperature rise is highly likely to breach 1.5°C.

- The future of energy is electricity, although hydrogen and bioenergy have significant roles to play.

- Bringing the temperature rise back down below 1.5°C will require large-scale carbon removal and storage.

Shell hastens to clarify that these are scenarios exploring how the world could possibly evolve under different sets of assumptions. They are not predictions or expectations of what will happen, or even what will probably happen or should happen. They are built from incomplete and uncertain information, using many assumptions, and even though they probably hold some truth, “all of them are likely to be wrong in one way or another.” They are intended as an aid to making better decisions.

Impact on primary energy demand

Globally, “primary energy use rises through the century, with only a modest and temporary levelling off in Sky 2050, as efficiency measures and early electrification take effect.”

But despite the fact that, for 60 years, the share of fossil fuels in primary energy has barely moved at around 80%, this changes in both scenarios.

Sky 2050 leads to rapid reductions to net-zero emissions, driven by concerns over climate security and by political demands by the younger generation. But doing so requires major interventions from policymakers in the energy system. Sky 2050 requires accelerated, even forced, retirement of fossil-fuel assets, high carbon prices, the rapid introduction of new low-carbon technologies and significant energy conservation through efficiency, economic austerity and behavioural change.

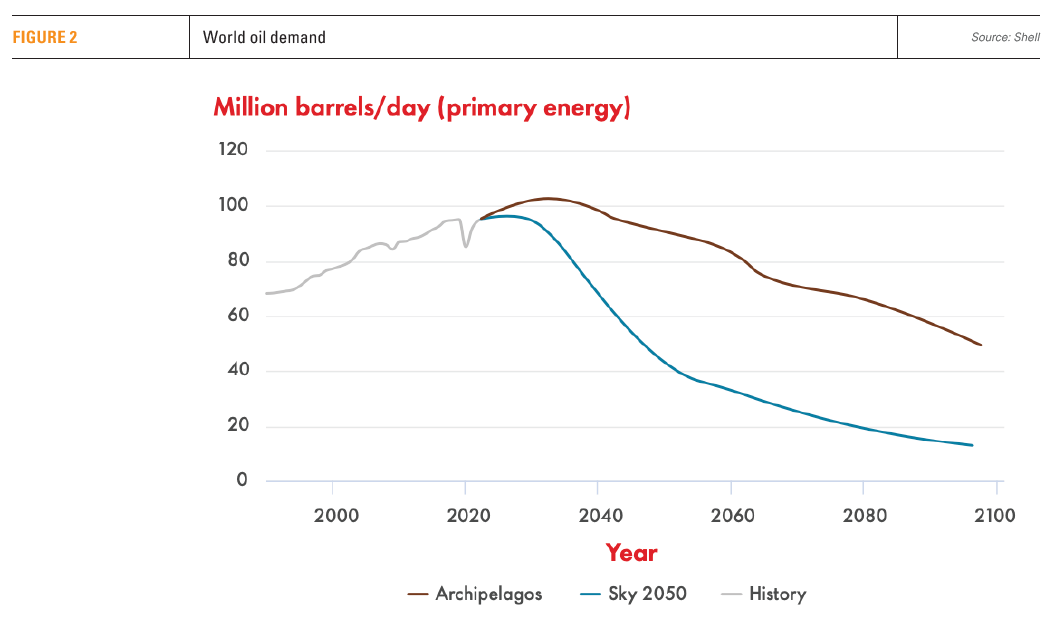

In Archipelagos fossil fuel demand continues to be high compared to Sky 2050, all the way to 2050. Ensuring this demand is met requires continuous investment. This is contrary to calls from the likes of IEA and IPCC. Given that at least in the foreseeable future world energy demand is likely to follow the Archipelagos trajectory, underinvestment in oil and gas could be a recipe for disaster – recurring energy crises and high prices. Even under Sky 2050, significant quantities of oil and gas will be needed until 2050.

Both scenarios bring out the importance of renewables. As energy transition moves forward, wind and solar quickly become dominant, with solar rising quite steeply. Shell states that from 2020, when they contributed around 10 exajoules (EJ) to the global energy system, the acceleration in both scenarios is dramatic. The amount of primary energy generated by wind and solar grows by a factor of 17 in Archipelagos by 2050, and by a factor of almost 30 in Sky 2050, contributing to the drive to reduce emissions.

Shell goes on to say “the rapid uptake of solar means both coal and natural gas stop growing as sources of electricity in the 2030s, with no further net addition of generation from these energy sources.”

But even though Sky 2050 achieves net-zero by 2050, Shell says that based on current trends the average global temperature will still increase by more than 1.5°C (see figure 1). In order to bring it down to this limit by 2100, it is essential to make a much more widespread use of carbon capture and storage (CCS), but also direct air capture with carbon storage (DACCS).

In Archipelagos, the global average temperature is still rising in 2100 but is levelling off at around 2.2°C as emissions close in on net zero – above the Paris Agreement 1.5 to 2.0°C range but not by much.

Oil and gas demand

Archipelagos sees oil demand (see figure 2) rising into the 2030s and dropping only slightly to 90mn bls/day by 2050. Even under Sky 2050 it plateaus and remains quite high into the 2030s, before it drops significantly to 40mn barrels/day by 2050. But it largely vanishes by 2100.

Oil’s use in the second half of the century is driven mainly by population growth rather than increasing individual needs.

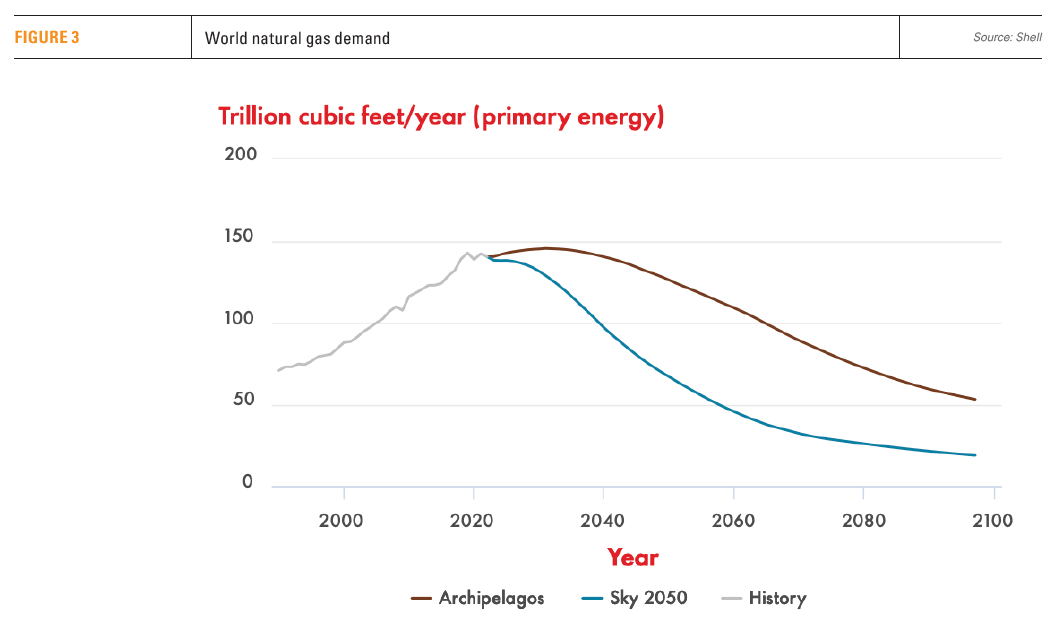

Natural gas plays an important role all the way to 2100 for both scenarios, even though its use declines. It continues to be used by industry, as a fuel for heat and to support power generation networks as intermittent renewables take an increasing share of the load. The trends for natural gas’ future use (see figure 3) are similar to oil.

LNG grows in the short-term. According to Sky 2050 “demand peaks in the 2030s and falls off from that point as the world rapidly moves away from using natural gas for electricity generation, residential cooking and heating.” On the other hand, Archipelagos shows LNG demand increasing all the way to 2040, even as global gas demand peaks in the 2030s.

Shell points out that “for both oil and gas demand, decline is hastened by the persistence of generally high and volatile prices. High prices incentivise demand reduction. “

Coal goes into permanent decline this decade and by 2060 it starts “its true exit from the energy system after nearly 300 years of use.”

Bridging the gap

The gap between the future the world may be headed for, as set out in the Archipelagos scenario, and a future that is consistent with net-zero emissions by 2050, as set out in Sky 2050, is significant. Shell suggests that to bridge this gap, it is critical society establishes a coherent policy framework.

Setting net-zero targets, and intermediate milestone targets, provides an important signal to business and broader society.

So does the introduction of carbon pricing. An explicit carbon price, whether through a carbon tax or an emissions trading scheme, such as EU-ETS, provides a more economically efficient and cost-effective method of driving low-carbon choices. A carbon price has been shown to drive improvements in energy efficiency and to lower emissions in end-use sectors like power, transport, buildings and industry. It has also been effective in driving fuel switching.

The risk though is that it can be seen by consumers and industry as an additional tax. Using the proceeds to invest in infrastructure to support the deployment and large-scale take-up of low-carbon options can be the answer.

Government policies can also help protect citizens from the impacts of climate change while enabling low-carbon choices. As Shell points out, the energy transition is a complex process – not just in terms of the required techno-economic change, but also in terms of the social process of change. No single policy can deliver a Paris-compliant energy transition. Instead, there must be a mutually reinforcing network of policies that all work to push society towards a low-carbon future.

The low-carbon technologies and fuels required for the energy transition are in various stages of commercialisation. Steps that can be taken to accelerate this include:

- Incentivise low-carbon supply.

- Create markets for low-carbon energy.

- Drive infrastructure investment.

Energy transition also involves social transformation. As a result, action must have broad-based support, and this means the energy transition needs to be fair. Fairness covers energy affordability, energy availability and making sure people are shielded from climate impacts.

Challenges

Both scenarios chart optimistic futures for technology rising to the challenge. Shell assumes that variable renewables will be able to meet up to 85% to 90% of final consumption eventually. But so far, while global energy demand carries on growing, renewables and green energy technology are not growing fast-enough to cover this growth, let alone replace fossil-fuels.

In addition, according to Bloomberg and the International Energy Agency (IEA), investments in clean energy must increase by a factor of 4 from current levels, and remain at that level every year if the world is to achieve net-zero by 2050. There is some way to go yet to achieve that.

Sky 2050 is based on the premise that “What might have taken decades to negotiate now takes much less time as individual nations, cities and companies ‘just-go-for-it’, with the world reaching net-zero emissions in 2050.” But as Shell points out, “no government today has such a comprehensive mandate [for such drastic action], and few, if any, appear willing to seek it at the polls”.

To date, wind and solar generation intermittency has been backed up by a combination that includes hydroelectricity, natural gas and interconnection between grids, and this has been enough to level out the variation in generation. But as solar and wind grow and dominate, additional technologies will be needed that include lithium-ion battery storage at a massive scale, chemical storage, flexible demand, local or cross-border interconnections. Technologies that still need to be developed and would need increasing quantities of critical, and rare, minerals. Risks associated with their scarcity and concentration in a handful of countries could threaten the future of renewable energy, as is scaling of their production to meet projected demand.

In the longer term, hydrogen is seen by many as a critical part of the global energy system. But according to the Sky 2050 scenario it will take time for green hydrogen to become an important part of the energy system. This is likely to happen in the 2030s and will make up 12% of final energy only by 2070. It will take even longer in Archipelagos, making up only 4% of final energy by 2070.

This demonstrates how difficult it will be for the EU to achieve its target to produce 20mn mt of green hydrogen by 2030, to replace the equivalent of about 63bn m3 of natural gas. Its target in RePowerEU to reduce gas consumption by 30% by 2030 depends on this. Moreover, this is what drives its policy to avoid long-term gas contracts. Does this mean more expensive spot LNG?

In order to limit the average global temperature increase to 1.5°C would require extensive deployment of carbon capture technologies. But relying on carbon capture technology, especially DACCS, comes with a warning. According to Shell, “It would take more energy than all the world’s houses will consume in 2100 to power the technology that captures enough carbon dioxide from the air to limit global heating at 1.5°C.” One hopes that substantially more efficient carbon capture technologies will become available to overcome such a challenge.

In order to limit the average global temperature increase to 1.5°C would require extensive deployment of carbon capture technologies. But relying on carbon capture technology, especially DACCS, comes with a warning. According to Shell, “It would take more energy than all the world’s houses will consume in 2100 to power the technology that captures enough carbon dioxide from the air to limit global heating at 1.5°C.” One hopes that substantially more efficient carbon capture technologies will become available to overcome such a challenge.

An additional warning came from a 2019 study published by Nature Communications. It highlighted the ‘clear risks’ of assuming that DACCS will be available at scale, with “global temperature goals being breached by up to 0.8°C if the technology then fails to deliver.” Carbon Brief says “the evidence suggests it would be risky to assume we will be able to deploy lots of direct capture at low cost.” It is best to cut emissions by “tackling energy demand as well as supply.”

The problem though is that demand is not waning. On the contrary, fossil fuel consumption is soaring with no signs of slowing down in the foreseeable future. Oil demand increased last year and will increase again this year. In the meanwhile, renewable uptake is increasing fast but not fast-enough to meet increasing energy demand, especially in populous nations like China and India. Renewables still contribute less than 10% of global energy. As a result, energy security requires growth in all energy sources – renewables, nuclear as well as fossil fuels – for some time to come.

Shell stated that its energy security scenarios “are intended as an aid to making better decisions.” And that’s exactly what the company is doing. Reflecting these, Shell CFO Sinead Gorman said that the spending level will remain steady in 2023: “Our philosophy has been a real pivot toward energy transition investments…But we will make sure that those investments go into the areas where we can see line of sight toward attractive returns to be able to reward our shareholders.”

Going further, Shell’s CEO Wael Sawan said that the company’s gas business “continues to grow in a world that is desperately in need of natural gas at the moment, and I think for a long time to come…gas has a critical role to play in the transition” to lower-carbon energy. Clearly Shell’s “big bet on natural gas” is now paying off “handsomely.”