Domestic Shale Gas is Needed to Achieve a Fully Functioning European Gas Market

Relying only on hubs for price discovery makes sense in the US where numerous producers are in competition. This is not the case in Europe where the main external sources of supply in 2011 were Russia (24%), Norway (19%), Algeria (9%) and Qatar (7%), giving those four countries and their state-owned company c.50% of the market. So, with European gas supply on the verge of being mostly spot-indexed, after implementation of the third energy package, the EU Commission should foster domestic shale production as a diversification to boost not only security of supply but also to finally achieve a fully functioning gas market.

European gas supply: on the verge of being mostly spot-indexed

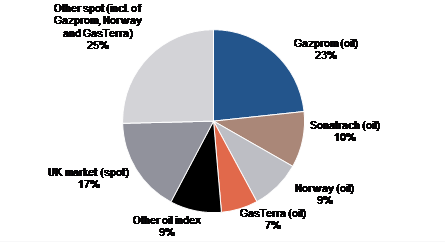

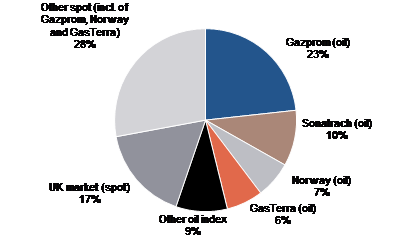

European gas supply: 58% oil-linked in 2011

According to our estimates, in 2011, 58% of the gas sold in Europe was under an oil-linked formula. Since the 2008 crisis, this ratio has remained unchanged at 58%: on the one hand successful renegotiations of long-term contracts introduced some spot indexation but on the other, due to demand destruction, buyers had to reduce their spot purchases and there was an increase in oil-linked Qatar LNG volumes in Continental Europe during this period. But contract renegotiations and arbitration cases could reduce oil indexation to less than 50% of the total by 2014. We believe this could be a tipping point.

In February 2012, GDF SUEZ confirmed that almost all its long-term gas contracts had been reviewed to increase market price indexation to above 25%, to lower oil-indexed prices and to shorten price review cycles. We therefore estimate that an additional 1 bcm of Russian gas has moved from oil indexation to spot indexation as the GDF SUEZ-Gazprom contract was formerly with 15% spot indexed.

In March 2012, ENI and Gazprom reached an agreement on gas supply contracts. ENI/ Gazprom revised prices and flexibility but didn't disclose details on the agreement reached. We estimate that they agreed a total c.13% discount (taking into account renegotiations since 2009) but have maintained a full oil-indexed formula. With this discount, Gazprom gas is now more competitive than Statoil gas, which faces further renegotiations in 2012e.

In March 2012, E.ON and Statoil agreed a "structural" solution on long-term gas prices. This is a long-term fix that allows E.ON not to find itself in the loss-making position of paying higher prices for its gas purchases than that obtained on resale. As neither of the companies gave details of the terms of the deal, if we assume that (i) Statoil/E.ON long-term contract is for 15 bcm/y and (ii) 25% has already been spot-indexed since the 2009 crisis, then the "structural" fix means that it is now 100% spot-indexed. Our assumptions imply the deal has moved (since January 2012) an additional 11 bcm from oil indexation to spot indexation.

Thanks to these recent deals, European gas supply could be 55% oil-indexed and 45% spot-indexed in 2012e.

The closer we get to 50%, the more unstable the system is going to be. So oil indexation is facing major challenges. The old system where oil-linked long-term contracts were signed to ensure both security of demand and security of supply and hub spot trading provided additional volumes is facing a step change. By 2014e, oil indexation pricing should represent the minority stake in European gas supply. In Europe, the rationale for oil indexation disappeared many years ago, so hub pricing makes more sense today.

In April 2012, a French court annulled a gas supply contract between ENI and a French gas-fired production plant in an attempt to prevent the latter's bankruptcy. This decision followed the implementation of a safeguard procedure that allows French courts to implement measures to improve the economic situation of a company. This decision could strengthen the buyers' case before an arbitration tribunal…

RWE and PGNiG have taken Gazprom to arbitration in an attempt to index more of their contracted volumes to spot prices. The outcome of the arbitration process is difficult to predict and there may still be concessions on prices thanks to ongoing negotiations to avoid arbitration. One possibility is that the arbitrators may decide that the long-term contracts that used to be oil-indexed in the 60s, this being the only price mechanism available at the time, should now be spot-based, since this is the way the majority of gas should be sold in Europe from 2014e. Such a decision could help the establishment of a single EU gas market and could possibly boost long-term gas demand…

How long can producers manage this market?

Thanks to maintenance and production issues, gas producers have managed to keep prices fairly high. A back-of-the-envelope calculation shows that the total European gas demand for 2012e (485 bcm) at 460 $/1,000cm for the oil-linked and 315 $/1,000cm for the spot gives an average price in Europe of 400 $/1,000cm, compared with 80$/1,000cm for the US. For Europe, the "overprice" in terms of the bill is therefore 325$/1,000cm or $155bn for 2012e (0.9% of European GDP)!

The drawback is that gas is a fuel that is losing market share in power generation, as seen in the UK, Germany and Spain. On top of the renewables expansion backed by the EU member states, cheap coal is further displacing gas out of the European energy mix at a time when demand is low. High gas prices (mainly oil-indexed in Germany and spot in UK) make gas-fired power plants uncompetitive vs. coal fired power plants as demonstrated by market clean spark spreads that have been lower (and even negative in some instances) than clean dark spreads for over a year.

This is also the case in Spain, where a domestic coal support law went into effect in February 2011. Coal-fired plants are displacing combined-cycle gas plants as domestic coal generation is forced into the system. In 2011, Spanish gas demand for electricity was reduced by 19%, and this trend is continuing in 2012.

During 2009-2011, the big gas producers resisted major formula changes. They preferred to reduce their production levels while still enjoying the high rents enabled by high oil-linked gas prices. Now, with gas demand further down, the big gas producers are compelled to move, by agreeing to alternative pricing. Even Gazprom has recognised that the long-term contract formula needs to be addressed to enhance the competitiveness of Russian gas in Europe.

More spot means better market places are needed

The US is the first gas market with 22% of the worldwide gas consumption. Thanks to a very liquid and transparent market, Henry Hub gas is a recognized commodity asset that is widely used by the financial community. With 14% of the worldwide gas consumption, the EU is the second gas market. So far, poor hub liquidity and poor transparency have limited access of the financial markets except in the UK.

Relying only on hubs for price discovery makes sense in the US where numerous producers are in competition. This is not the case in Europe where the main external sources of supply in 2011 were Russia (24%), Norway (19%), Algeria (9%) and Qatar (7%), giving those four countries and their state-owned company c.50% of the market. So, long/medium term contracts should remain an important tool to ensure risk is shared fairly between buyers and producers. But they will not be the same as previously (30 years, oil-linked). Instead, they could be for 10 years and spot-indexed, with a floor and a ceiling to mitigate spot price volatility (in Northern Europe), or with an increased discount to oil (for Southern Europe) and with little volume flexibility, to suit both buyers' and sellers' new requirements.

But moving to a majority gas spot pricing in Europe could further shift the power in the hands of major producers at time of high demand, if we don't, at the same time, manage to increase domestic production, increased import infrastructure and / or build new storage (to have ability and options to store gas when spot prices are low and withdraw it when spot prices are high).

Europe gas proven reserve, which have decline 4.4% on a CAGR in 2000-2010, can only grow if we decide to go for shale gas. And the European gas market will still not be able to function properly unless there is enough domestic production to counterbalance the power of Gazprom, Statoil, Sonatrach and Qatar Petroleum. After implementation of the third energy package, the EU Commission should foster domestic shale production as a diversification to boost not only security of supply but also to finally achieve a fully functioning gas market.

Dr Thierry Bros is the author of the recently published book "After the US shale Gas Revolution", Editions TECHNIP (www.editionstechnip.com). To see the full summary of the book and Dr Thierry Bros' biography and contact, please click here

Thierry Bros is, since 2010, Senior European Gas and LNG analyst for Société Générale. He was, from 2002 to 2007, Senior Oil & Gas expert at the FrenchMinistry of Economics, Finance and Industry, where he represented France on oil markets and emergency questions at the International Energy Agency (Paris) and the European Commission (Brussels). As a gas specialist, he negotiated the European directive concerning measures to safeguard security of natural gas supplied for France and reviewed the regulations governing the opening up and liberalization of the French gas market. Dr. Bros is also a visiting faculty professor at several universities and a speaker at international conferences on gas-related subjects. He can be reached at bros.thierry@gmail.com.