Shale Gas: Market Opportunities and Challenges in the EU and Ukraine

The EU Ukraine Business Council together with Konrad Szymanski MEP held a round table meeting in the European Parliament on 7 December to discuss the opportunities and challenges for Shale Gas in the EU and Ukraine.

Distinguished panellists included Konrad Szymnaski MEP, Pawel Kowal MEP, Pawel Zalewski MEP, Olaf Kopczynski of the Polish Permanent Representation, Boleslaw Rey of PGNiG, Oleksii Leschenko of the Gorshenin Institute and Olav Aamlid Syversen of Statoil.

In my short report I would like to focus on some critical issues, connected with opportunities and challenges that any investor will face in the sphere of Ukrainian shale gas production.

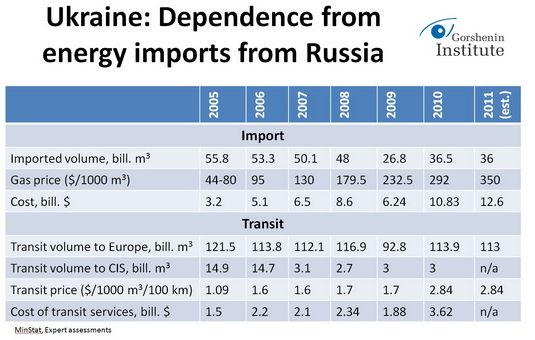

Ukrainian Natural Gas balance – strong dependence on energy imports from Russia. We import 60% of gas, mainly for the needs of our metallurgical and chemical industry and for heat generation. Most of the gas for communal heat generating companies is subsidized by Naftogas (Ukrainian gas monopoly), and this fact causes huge budget deficit of state enterprise in the amount of $2 bill. a year. The Ukrainian export potential, its competitive advantage strongly depends on imported gas price. Objectively Russia, as monopoly supplier has very effective leverage to promote its geopolitical interests in Ukraine. We even have such a term as gas-fleet relations, as Ukrainian gas debt, that has been accumulating for years is always connected by our Russian partners with prolongation of Black sea fleet dislocation in Sebastopol sea base.

Some experts also note the interdependence of Russia and Ukraine in gas relations, as Ukraine consumes about 20% of all gas exported by Gazprom to Europe.

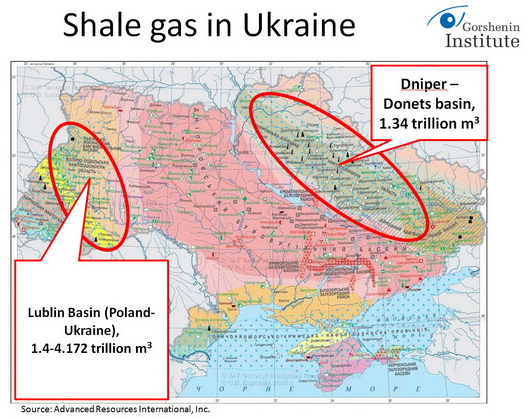

2. According to the assessments of international research organizations, two large shale gas basins are located on the territory of Ukraine. One of them is in the Dniper-Donets region, the second one is shared with Poland, the Lublin basin. By the way, Dniper-Donets region accounts for 80% of Ukrainian domestic gas production.

The geological similarities and geographic proximity to Poland allows EuroGas to believe that the Lublin Basin, which lies under Poland and Ukraine, could be 10-15 times as large as the Barnett formation in the US, and have a pay zone close to 4000 ft compared to 200-300 ft for Barnett.

Ukraine is more suitable for horizontal drilling than the more densely populated parts of Europe because of the large area required to drill, the use of large amounts of water, and the chemicals used for shale gas drilling. The use of chemicals, although not proven to be an environmental hazard, has come under extra scrutiny in heavily populated areas.

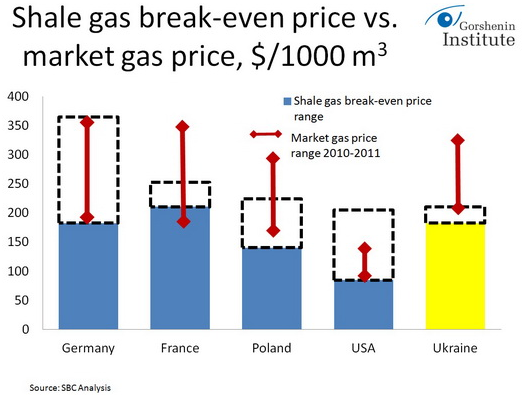

Not all experts are convinced that shale gas will be a long-term alternative to conventional gas. Some experts believe that most shale gas wells are uneconomic and always will be unless operator costs come down, gas prices rise sharply, and high average prices are sustained. Analysis of wells in the Barnet formation reveal that 15% of wells drilled in 2003, had a lifespan of less than 5 years, compared with the average lifespan of gas wells in the U.S. of 30-40 years.

According to Gazprom the industry production of shale gas in Europe (GB, Poland, Ukraine) will be launched not earlier than 2015. But it is supposed that volumes of production by 2030 will not be so substantial – maximum 30-40 billion cubic meters.

According to researches even in Europe cost production of shale gas at the level of $270-340/1000 square meters will be profitable. For Ukraine this figure will be about $200/1000 square meters, which is substantially lower than Russian import gas price that tends to increase in the nearest future. More than that, exploration of shale gas fields in Ukraine will create thousands of new work places and provide for big contracts for pipes and equipment for domestic producers.

Ukrainian government is very interested in shale gas exploration, and regularly shows their interest to the foreign investors. But, as it is expected, foreign companies before starting to work on Ukrainian market, require changing the rules of the game.

Experts state that Ukraine has huge political risks which remain the main greatest impediment to gas investments in Ukraine. The Ukraine bureaucracy is not easy to navigate, whereas in Poland registering a concession and getting an exploration license is done through the Energy Ministry and takes approximately three months; it can take a year or more in Ukraine and it is a convoluted process involving several ministries and departments.

Foreign start-ups have complained about official pressure on their companies, ranging from price ceilings on gas sales to their licenses being challenged in court. Even larger players, such as Houston-based Marathon, the fourth largest U.S. integrated oil & gas company, exited the country in 2008.

In addition the new administration in Kyiv is perceived as being closer to Russia than the previous one and it is currently negotiating a new pricing model for Russian gas, which may reduce the price Ukraine pays for gas, create a domestic price ceiling for independent producers and increase the political and economic influence of Gazprom and Russia in the Ukrainian gas industry. Ukrainian Prime Minister Mykola Azarov recently said “The issue of the gas price is vitally important for us. If we fail to agree with Russia we will face very serious difficulties,”

Shell asks the Ukrainian Fuel and Energy Ministry to change legislation regarding shale gas production. Shell intended to invest in the segment if bigger areas are offered for production and license periods are lengthened and tax breaks introduced. Ukrainian government officials have said they are prepared to initiate these changes.

The problem of shale gas can only be solved in the context of energy sector reforms and reforming Naftogaz.

Among other challenges, that investors will face in Ukrainian shale gas industry, are the following:

- Technological issues. Water supply in suitable volumes sometimes will be an issue. We also know that Americans bought Ukrainian scientific research institute from Kharkov, that dealt with shale gas researches from the soviet times. It shows, that technology issues will be critical in the production of shale gas in Ukraine.

- Ecological issues. The Lublin basin area is not densely populated, but producers in Dniper-Donets basin area will encounter issues connected with ecological problems, that production may cause for local communities.

- Access to infrastructure

In long term shale gas production is a very prospective area in Ukraine.

Oleksii Leshchenko, Gorshenin Institute, Kiev, Ukraine

Source: Gorshenin Institute