US Shale Firms Devon, WPX Agree Merger

US shale companies Devon Energy and WPX Energy have agreed to an all-stock merger, the companies said on September 28, estimating that the move will improve annual cash flow by $575mn by the end of 2021.

Under the deal, WPX shareholders will receive 0.5165 shares of Devon for each of their own. Devon shareholders will control around 57% of the combined company, which will also be named Devon Energy. It will have an enterprise value of about $12bn, the firms said. WPX CEO Rick Muncrief will serve in the same role at the merged company, while current Devon CEO Dave Hager will become its board chairman.

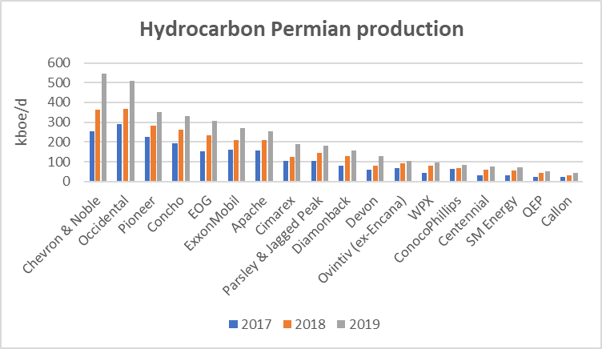

The tie-up will create one of the largest unconventional producers in the US: by output it will be the eighth largest (see graph). Devon, which works in the Delaware, Powder River, Eagle Ford and Anadarko basins, produced 325,000 barrels of oil equivalent/day of hydrocarbons in the second quarter, of which just under a third was gas. WPX operates in the Delaware and Williston basins and lifted 207,000 boe/d in the same period, with gas accounting of almost a quarter of this supply.

Source: Thierry Bros

"This merger is a transformational event for Devon and WPX as we unite our complementary assets, operating capabilities and proven management teams to maximise our business in today’s environment, while positioning our combined company to create value for years to come," Hager said. "Bringing together our asset bases will drive immediate synergies and enable the combined company to accelerate free cash flow growth and return of capital to shareholders. In addition to highly complementary assets, Devon and WPX have similar values, and a disciplined returns-oriented focus, reinforcing our belief that this is an ideal business combination."

Muncrief added that the "merger-of-equals" would reward WPX shareholders with "disciplined management of ... assets and an unwavering focus on profitable, per-share growth."

Devon and WPX expect to make the $575mn in annual cash flow savings through operational efficiencies, cuts to general and administrative expenses and reduced financial costs.

The combined producer will benefit from improved margins, higher free cash flow and the ability to reward shareholders with higher dividends, the companies said. Free cash flow will take priority over production growth, with management committing to limiting reinvestment rates to 70-80% of operating cash flow. Output growth will be limited to no more than 5% annually, even in more bullish market conditions.

Free funds will be used for clearing debts, share repurchases and supporting a fixed dividend that will be paid quarterly at a rate of $0.11/share, as well as a variable dividend. The deal is expected to close in the first quarter of 2021. Funds managed by EnCap Investments, which own 27% of WPX shares, support the transaction.