SDX Swings To Loss In H1

North Africa-focused SDX Energy swung to a $354,000 loss in the first half, versus a $971,000 profit in the same period last year, as a result of higher operating costs.

Net revenues were up 4% yr/yr in the six months ending June 30 at $24.4mn, but this gain was offset by a near 35% climb in operating expenses to $6.96mn, SDX said on August 22 Netbacks consequently slumped 4%, landing at $18.5mn.

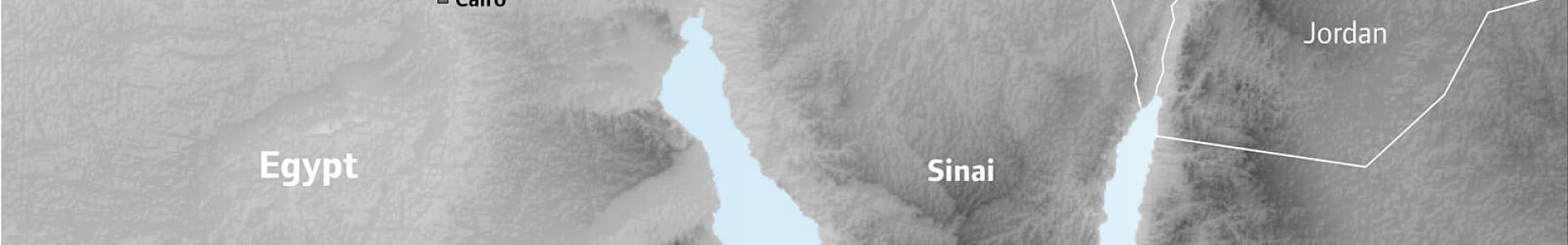

SDX blamed the spike in costs on increased workover activity in Egypt, where the company holds interests in the North West Gemsa, Meseda and South Disouq oil and gas fields. Netbacks were also affected by a 7% drop in realised oil prices in Egypt to $57.44/barrel.

These factors were partly mitigated by rising production at the Meseda oilfield as well as its gas fields in northern Morocco. The company netted an overall output of 3,539 boe/d from its assets in the six months, up from 3,234 boe/d a year earlier.

SDX’s mid-term growth plans are primarily gas-focused. It is set to begin a 12-well drilling campaign in Morocco in the fourth quarter of this year, targeting 15bn ft3 of gross unrisked prospective resources. It also plans to launch production at the South Disouq gas field in the fourth quarter, targeting a 50mn ft3/day plateau in early 2020. CEO Mark Reid said the project's launch would be “transformative” for SDX.