Santos swoops on weakened Oil Search [Gas in Transition]

Australian producer Santos is hoping to secure control of compatriot Oil Search in September, after filing an improved bid in early August.

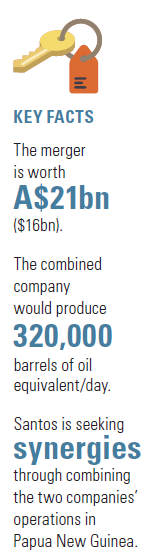

The A$21bn ($16bn) merger creates a gas-heavy regional champion with an output of 320,000 barrels of oil equivalent/day from its “high quality, long-life, low-cost assets” with “significant growth optionality,” Santos said. These include about 5bn barrels of 2P, 2C reserves, and it will have over US$5.5bn of liquidity to develop them.

For Santos, the main attraction is the operational synergies to be gained from merging the two companies’ operations in Papua New Guinea. (PNG). There are also possibly greater financial savings to be made from general administrative costs at home as well.

Oil Search has had little success upstream outside PNG, but there it operates all the currently producing oil and gas fields. Both are partners in the operational LNG terminal, ExxonMobil’s PNG LNG, but only Oil Search is a partner, with ExxonMobil, in TotalEnergies’ planned Papua LNG project.

Santos and Oil Search have undertaken to make the deal official within four weeks of the August 2 agreement. Santos upped its bid from a 12.3% to a 16.8% premium to the July 19 closing price and Oil Search, whose share price had been wobbling, partly owing to the abrupt departure of its CEO Keiran Wulff July 19, commended it to its shareholders. The CFO Peter Fredricson is now also the acting CEO.

The CEO of consultancy EnergyQuest Graeme Bethune told NGW: “Santos has always been gas dominated and Oil Search has been on its radar screen for years. Now the planets are aligned with a low Oil Search share price and leadership turmoil.”

Although not likely to trigger any regulatory alarm-bells owing to the new company’s size, there is a question mark over Oil Search’s Alaska oilfield. Bought while Wulff was at the helm it does not fit naturally with the new business.

Oil Search will end up with 38.5% of the new company – it had been 37% in the first bid – and Santos the rest, subject to the approval of the PNG government and no better bid coming from elsewhere. This might come from the existing international oil companies present in PNG: ExxonMobil and TotalEnergies. Three years ago, ExxonMobil trumped Oil Search with its successful bid for InterOil, and since then has also found more low-cost gas for development.

Woodside, which made an unsuccessful bid some years ago, was also in the frame. But as of August 17 it had launched an all-share, friendly bid for BHP's upstream assets which would leave it little headroom for another.

PNG might be slow to give its approval though. “Buying Oil Search is a bit like trying to take over a national oil company,” Bethune said. The PNG government did have a significant stake in Oil Search.

The LNG plant in Papua where both are involved is the big draw. Santos has a 24% interest in the licence that includes the Hides gas field, which resulted in Santos becoming a foundation partner in the ExxonMobil-operated two-train PNG LNG project. The field supplies 90% of the feed gas.

The contracts all have just over a decade to run so there is no off-take risk, Bethune said. There is also a lot of upside this year from the spot market. “It’s a new plant which has run very well. In 2020 we estimate the plant produced 8.5mn metric tons. The long term contracts add up to 6.5mn metric tons, implying 2mn mt of spot sales,” he said.

According to its website, Santos is positioned to grow its presence in PNG through PNG LNG backfill and the development of the 4 trillion-ft³ P’nyang field, as well as standalone opportunities. The company’s exploration and appraisal position includes exploration permits in the Hides to P’nyang geological trend and the Eastern Carbonate trend, in the Gulf Province.

Taxing times

The P’nyang field development, and hence PNG LNG plant expansion, has been held up by a dispute between ExxonMobil and the government over the size of the tax take. ExxonMobil is not alone in this: Twinza has also had a long struggle over revised fiscal terms with the government.

Twinza said that the new rate would make its development of its wholly-owned Pasca A gas and condensate project uneconomic. There are also 14 gas fields nearby that would be ripe for aggregation.

But Twinza and the government were reportedly near an agreement as of early August. ExxonMobil has many other projects to develop in the meantime, notably off Brazil and Suriname, and the PNG government relies heavily on revenues from the hydrocarbons industry which is also a major employer.

There are also growth prospects in another licence, PRL 15. It contains the onshore Elk and Antelope onshore fields, which TotalEnergies is pursuing as a two-train, 5.4mn mt/yr LNG project that will be integrated into the PNG LNG facilities.

Following a PNG government visit to Paris in May, CEO Patrick Pouyanne said the project was high on the company’s list of projects "given its proximity to growing Asian LNG markets.” The company expects a final investment decision in 2023 following front-end engineering and design work next year.

The French producer has had to be more enthusiastic about its plans for PNG which had been long in abeyance, since a raging insurgency forced the evacuation of workers from its major Asia-facing Mozambique LNG project in the spring. The fate of that project is still unknown, and the company has a growing Asian demand portfolio, notably India and China.

The project owners of Papua LNG are TotalEnergies (40.1%), ExxonMobil (36.5%), Oil Search (22.8%) and minority parties (0.6%). State-owned Kumul Petroleum has an entitlement to acquire up to 22.5%.

TotalEnergies is the largest shareholder of the PRL15 permit with a 31.1% interest, alongside partners ExxonMobil (28.7%) and Oil Search (17.7%), with the state taking 22.5%.

Santos’ proposed deal follows the purchase of some of ConocoPhillips’ Australian assets, including stakes in Bayu Undan which it shares with Timor Leste; and the related Darwin LNG project. Santos took an FID on another Darwin LNG back-fill field Barossa in March this year and has since sold down its stakes in Bayu Undan and the terminal. The US major has already sold its stake in the stalled Greater Sunrise project to Timor Leste.

Oil Search to make a difference soon

"The impact of Oil Search's portfolio becomes more pronounced by the middle of the decade when it would contribute over half of growth to the combined production output,” said Wood Mackenzie when the terms of the deal were announced.

"At current commodity prices, the combined entity will generate significant free cash flow through 2021 and 2022. A stronger balance sheet will then provide a solid platform from which to invest in new development projects in Australia and PNG.

"Capital reallocation within a larger portfolio, or strategic divestments would be likely to smooth out future outflows. The merged company will be able to proceed with existing farm-down processes at Dorado and Alaska from a position of strength.

"For Australia's E&P landscape, this might not be the last transformative deal we see this year, with BHP's petroleum business and Woodside strongly rumoured to be in discussion on a similar match-up.