Majors Face Downgrades over Renewables Rise

S&P Global Ratings may downgrade 13 oil and gas producers within weeks because of risks relating to the energy transition, including the rise of renewable energy, it said on January 26.

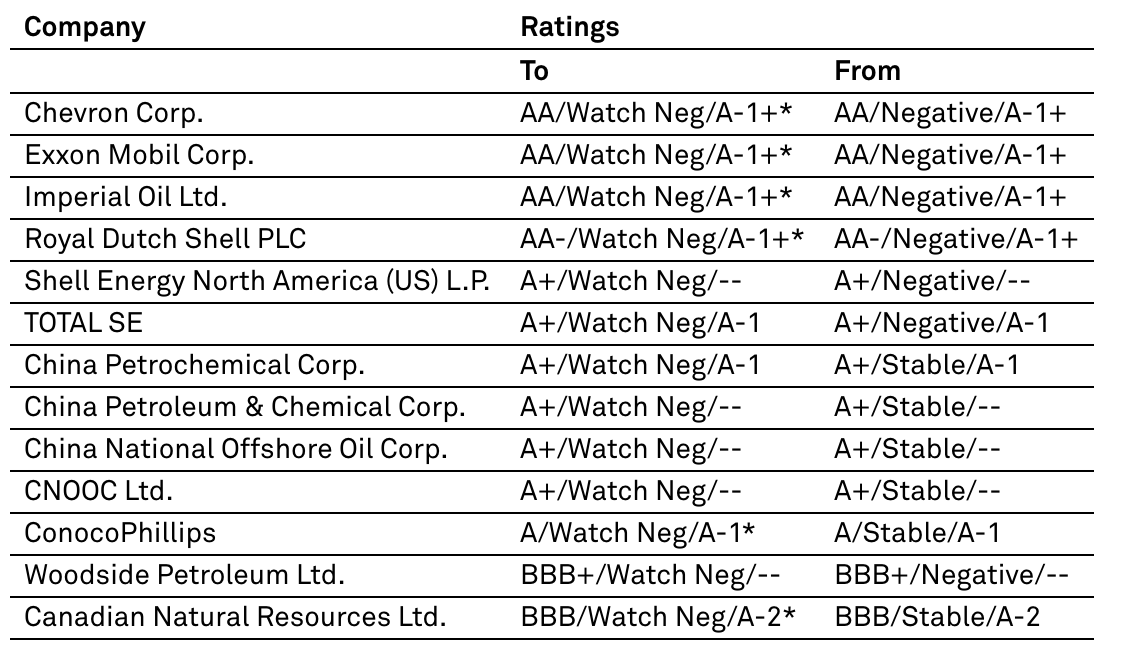

Majors Chevron, ConocoPhillips, ExxonMobil, Royal Dutch Shell and Total were among those placed on notice, as were Shell Energy North America, ExxonMobil unit Imperial Oil, Canadian Natural Resources and Australia's Woodside Petroleum. Also on the list were China Petrochemical Corp, China Petroleum & Chemical Corp, China National Offshore Oil Corp and Cnooc Ltd.

Justifying the move, S&P cited "significant challenges and uncertainties engendered by the energy transition, including market declines due to growth of renewables." It also noted "pressures on profitability, specifically return on capital, as a result of high dollar capital investment levels over 2005-2015 and lower average oil and gas prices since 2014."

Recent and potential oil and gas price volatility was also a factor.

Source: S&P Global Ratings

"In most cases, at this point we do not anticipate downgrades of more than one notch solely as a result of the industry risk review," S&P said. "This said, we cannot exclude a combination of the industry risk revision and other material factors leading to a two-notch downgrade, especially given the potential for negative surprises after the Covid-19 impacts in 2020."

In addition, S&P said it had revised its credit outlooks for BP and Suncor Energy to negative from stable.

The IEA and many others have slashed their long-term forecasts for oil and gas prices, in light of the Covid-19 pandemic and the energy transition gaining momentum. This has raised the risk that many upstream assets once thought as promising may end up stranded.

Banks and other long-term investors such as BlackRock are also shying away. Its CEO Larry Fink said that the pandemic has accelerated investments in other, cleaner energy, although the majors are also investing in that direction too.