Sanctions Will Hit Russian Output: Ratings Agency

Russian ratings agency Acra has predicted that sanctions on Russia could lead to less oil and gas output in the 2020s. This contrasts with foreign companies' forecasts, which while differing as to degree, all see fast-growing gas production.

Analytical credit rating agency (Acra), owned by 27 major Russian companies and financial institutions, says the Western sanctions have affected 20–21% of Russian GDP. “Restrictions were imposed mainly against large state-owned banks (54% of banking sector assets), oil and gas companies (95% of the total revenues of the oil and gas industry) and almost the entire defence industry,” it said July 10.

The report added that over 400 Russian companies and banks are under sanctions, most of which are subsidiaries of large holdings. In 2017, the aggregate, consolidated revenue of these companies and banks amounted to rubles 30 trillion ($482bn at current rate), and their GDP share is estimated at 20–21%.

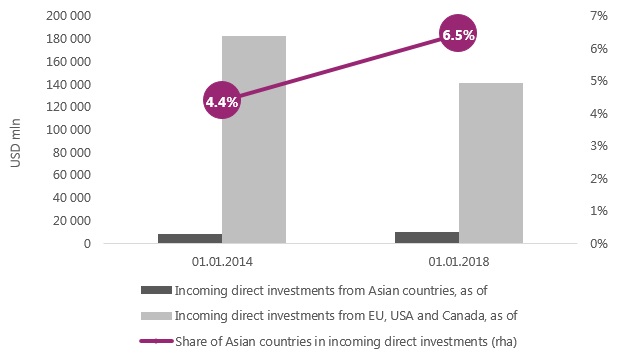

The sanctions also hit investments

Source: Acra

It says the main barriers to faster economic growth, which would have been possible but for sanctions, were cancelled joint technology-intensive projects, lower aluminium exports, and lower oil and gas production: “After the sanctions were introduced in 2014–2015, a number of long-term oil field development projects were cancelled, including nine large joint projects of Rosneft and ExxonMobil." These include the Kara Sea project. Rosneft declined to comment, but it has been looking for new partners and investors.

“The restrictions imposed against oil and gas companies will affect oil production rates in the 2020s. Those oilfields that were put into operation after 2013 should contribute to the increase in the total oil production in the period from 2019 to 2020, but in the 2020s, new technology and investment incentives will be needed for both brownfields and greenfields. This process will require significant expenses but will be restrained by sanctions,” it said.

Wood Mackenzie told NGW that: “We currently do not expect decline in Russian liquids production. If the Opec+ cut agreement is lifted, we expect Russian liquids production to grow to 11.8mn b/d in 2021 and stay above 11mn b/d at least until 2024. Further exploration and hard-to-recover developments could extend this plateau.

“In terms of gas, Russia has spare capacity and adjusts to demand in other markets. Generally speaking, production will keep growing until 2030 with Power of Siberia starting operations.”

The Power of Siberia pipeline will be put into operation in December 2019 to supply 1 trillion m3 Russian gas to China in a 30-year contractual period: the contract is for 38bn m³ but it will take a few years to reach plateau.

Cedigaz also told NGW that it sees 667.6bn m3 gas production for Russia in 2025, about 11.37% more than 2016, and expects 711.5bn m3/yr for 2040. The figure is far behind the Russian energy ministry’s own estimate in pre-sanction era in 2013, which projected 900bn m3/yr output by 2035.

Cedigaz’s Russian gas sector forecast (bn m3/yr)

|

Year |

Marketed Output |

Net LNG exports |

Net pipeline exports |

Implied demand |

|

2016 |

599.44 |

14.22 |

177.90 |

407.32 |

|

2025 |

677.60 |

35.00 |

228.60 |

414.00 |

|

2040 |

711.50 |

50.00 |

240.50 |

421.00 |

Last year, the International Energy Agency (IEA) predicted that Russia's annual gas production would rise by 11.5% to 718bn m3/yr by 2025 and continue to grow to 788bn m³/yr by 2040, but its oil output may decline by 7% in 2025 to 10.5mn b/d, then decrease to 8.6mn b/d by 2040.

BP’s April forecast also eyes 29% growth for Russian gas by 2040, standing at 72bn f3/d (744bn m3/yr).