Russian LNG Heads for UK Amid Cold Snap (Update)

(Updates with comments from Gas Connect Austria, Ineos and Centrica Storage)

The first LNG spot sale from the Yamal LNG facility, northern Russia, is expected in the UK Isle of Grain import terminal some time next week, delivered by Malaysian Petronas.

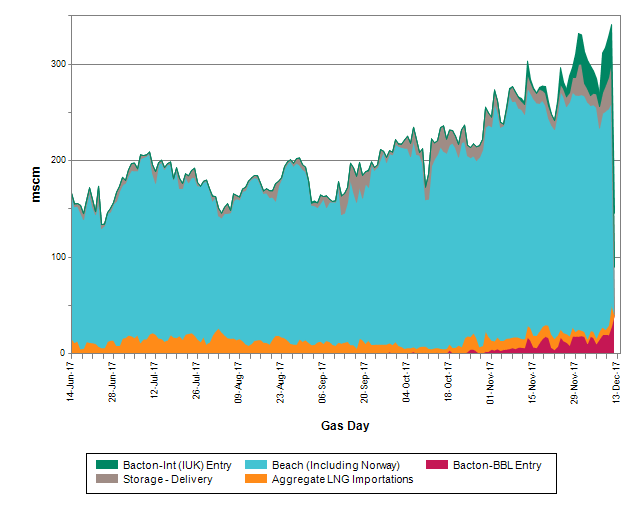

The cargo was loaded up at the weekend aboard the LNG carrier Christophe de Margerie (pictured above) and will bring about 170,000 m³ of LNG, or about 102mn m³, compared with present seasonally high UK demand this week of around 330-389mn m³/d. Isle of Grain is operated by National Grid and can regasify 58mn m³/day.

Prices in the mid-60s p/th this week work out at $8/mn Btu, which is lower than the delivered price in Asia of around $9/mn Btu. But the journey time is shorter, saving on fuel and day-rates. It would be the first time that physical Russian gas supplies has competed with Russian gas, although the volume is very small, and the UK is not among Gazprom's largest markets for physical Russian piped gas deliveries.

Yamal LNG cargoes will be sold by the shareholders once the commissioning period ends in April. The project is privately-owned, the majority shareholder being Russian Novatek.

The UK, and Europe in general, have been affected by a number of problems this week, notably the fatal explosion at the Austrian gas hub Baumgarten, which triggered a brief shut-down in Russian flows to Italy leading to a state of emergency.

But also chemicals giant Ineos discovered a hairline crack on the UK Forties pipeline system last week, and the line's closure has taken about 25mn m³/day out of the market until it is fixed, which could take another month; and problems offshore Norway included the giant Troll field, where there was an outage in the platform's power supply on December 12, hitting deliveries through pipelines to Germany (at Emden) and the UK (Langeled line).

And the giant UK North Sea offshore storage unit Rough, which would normally have stepped up, has been operating as a medium-sized field as it winds down, delivering about 8mn m³/day this winter instead of its usual 45mn m³/d. As Rough's pressure drops, so its output could decline further. Centrica Storage (CSL) is applying for permission from the offshore regulator, Oil & Gas Authority, to produce gas, once the current permit has expired. It has already been cleared by the Competition & Markets Authority to close the site down.

CSL has been able to produce 30bn ft³ (about 850mn m³) in line with the consent it received from the upstream regulator Oil & Gas Authority in September this year, and has been selling that ever since. It is now seeking the relevant consents to produce the recoverable gas from Rough, which is in the order of a 150bn ft³. It will inform the market when it receives the consent, it told NGW December 14.

Mid-range storage is also being worked hard, industry sources said.

The Interconnector UK has been flowing into the UK, but at just over 60mn m³/day it has headroom, able to ship at about 80mn m³/d depending on demand. That too has been affected briefly: high gas pressure at the Bacton terminal forced National Grid to curtail interruptible capacity on December 12 for some hours.

As the immediate tightness on December 12 eased, closing day-ahead NBP prices eased from 67.35p/th ($8.99/mn Btu) that day, to 60.975p/th December 13. Over the 24-hr period, closing prices for Europe's largest hub, the Dutch TTF, eased from €22.25/MWh ($7.67/mn Btu) to €21.50/MWh.