Russian Gas Exports to Europe Surge in January

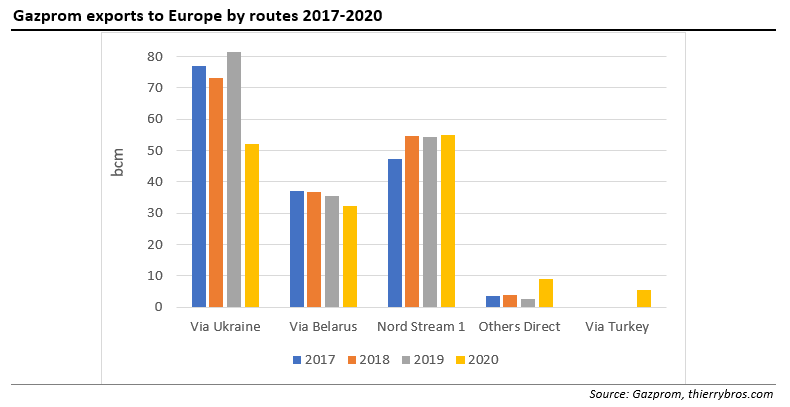

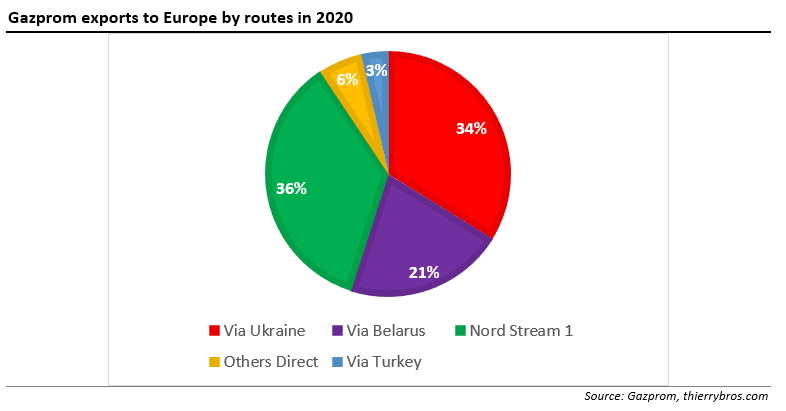

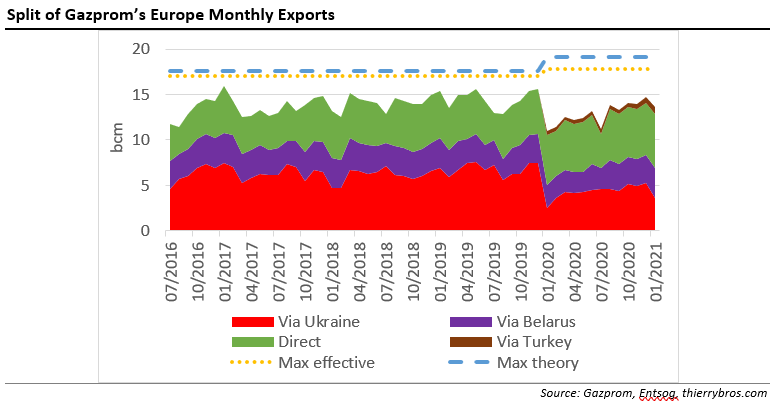

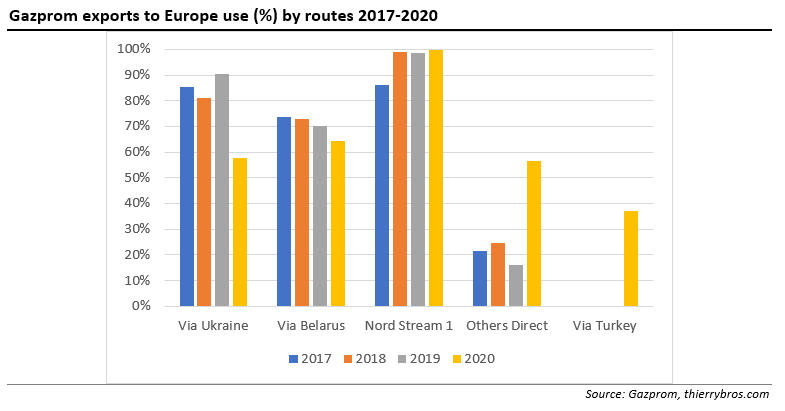

In 2020, Gazprom transported 59.2bn m³ through the nominal 55bn m³/yr Nord Stream 1 pipeline[1]. This is the most in one year since the start of operations in 2011. This latest data allows us also to fine-tune by routes the split of the 154 bn m³ that Gazprom exported via pipe to Europe.

The transit deal signed on the December 29, 2019 between Gazprom and Naftogaz provides for 40bn m³ transit volumes for 2021. As the 40bn m³ is measured on a uniform flow of 110mn m³/d or 3.4bn m³/month, lower flow in one month cannot be freely offset by a higher flow later. Gazprom has to book additional capacity with the operator Gas Transmission System Operator of Ukraine (GTSOU). In January, Ukraine transited 3.6bn m³. If Gazprom manages to keep the same monthly use of the transit in Ukraine it will transit 42bn m³, for which it would pay less than $0.1bn m³. This tends to prove that, when signing the 2019 contract, Gazprom was not so sure of Nord Stream 2 being in operation even in 2021.

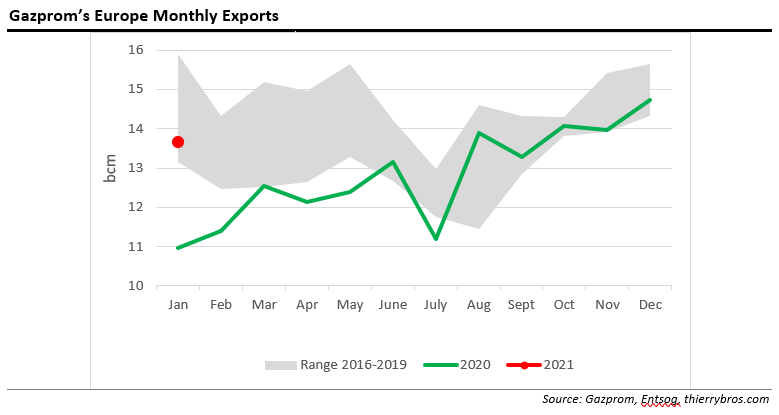

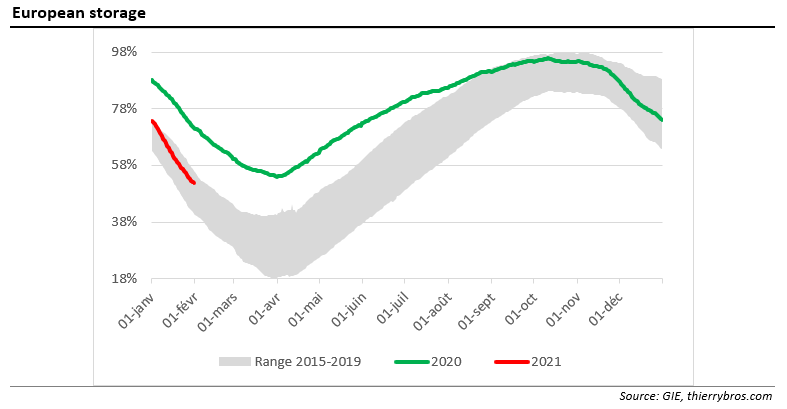

Storage reached its peak October 11 with 95.7% full, slightly lower than the record high reached in 2019 (97.8%). Storage has been back in the historical 2015-2019 range since mid-October.

Covid-19 will continue to restrain EU demand and hence imports. But as we have long been writing, Gazprom is not the only producer to swing supply any longer. All producers are sharing the burden of reducing volumes to Europe.

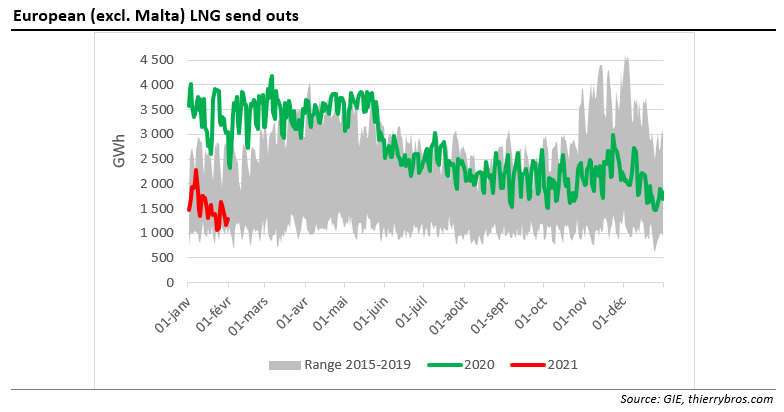

In January, European LNG send outs were down by 55% on 2020 and back inside the historical 2015-2019 range. This can be explained by record high prices in Asia diverting all possible spot trade away from Europe.

Thierry Bros

February 1, 2021

Advisory Board Member, Natural Gas World

[1] "The Nord Stream Pipeline Transported a Volume of 59.2 Billion Cubic Metres of Natural Gas in 2020" - Press Releases - Nord Stream AG (nord-stream.com)

[2] The low load factor for TurkStream can be explained by the ramp up period, while in Ukraine it is the legacy of the historical Soviet grid. The 2020-2024 transit contract provides some visibility to decommission unneeded capacity to make the system more efficient.