Russia, Norway Trim Q1 Gas Exports

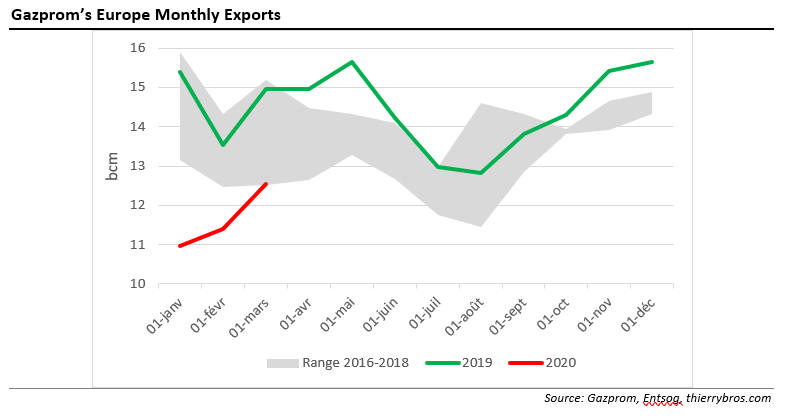

The December 29, 2019 deal between Russia's Gazprom and Ukrainian Naftogaz provides for 65bn m³ this year. As the 65bn m³ is on a flat rate of 178mn m³/d[1] or 5.5bn m³/month, there is no carry-over of shortfalls from month to month. With lower contracted transit flows in Q1 20, this means that the maximum contracted volume via Ukraine can now only be 59bn m³ for 2020. The coronavirus-impacted-demand will continue to restrain EU imports needs and prices at hubs are at historic lows.

The Nord Stream 2 saga is still unfolding with, in March, PGNiG[2] included in the German Nord Stream 2 derogation procedure. The decision on whether to grant the derogation will be made by the German regulatory authority Bundesnetzagentur before 24 May 2020…

Following TurkStream start-up, flows from Europe to Turkey at the Strandzha-Malkoclar border into Bulgaria are now in reverse mode with Russian gas entering Europe via Turkey. We have updated the below graph to reflect this change.

.png)

Europe's lockdown is reducing demand hugely and hence the storage withdrawal period is now ending with a record inventory of 596 TWh (54% full vs 40% full last year). As Nord Stream 2 is still not fully constructed and as the transit volumes contracted via Ukraine are down for 2021 (40bn m³ vs 65bn m³ in 2020), we should expect the market to restore up to the maximum level this summer. Like in 2019, this would be the mitigation strategy. But this time, we would need 15bn m³ less for re-storing… And this without taking account of the Covid-19 demand destruction.

.png)

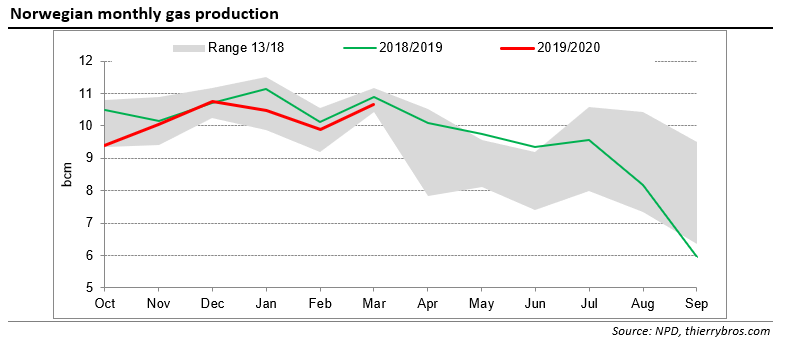

As we have been writing since early this year and contrary to consensus, Gazprom is not the only producer to swing supply. After having already reduced production by 6.4bn m³ in 2019 vs 2018, Norway Q1 exports were down 1.1bn m³ vs Q1 2019. We could see spare capacity in 2020e very similar to 2016 in volumes but completely different in who takes the burden. For the first time ever, Gazprom could only hold half of the global spare capacity.

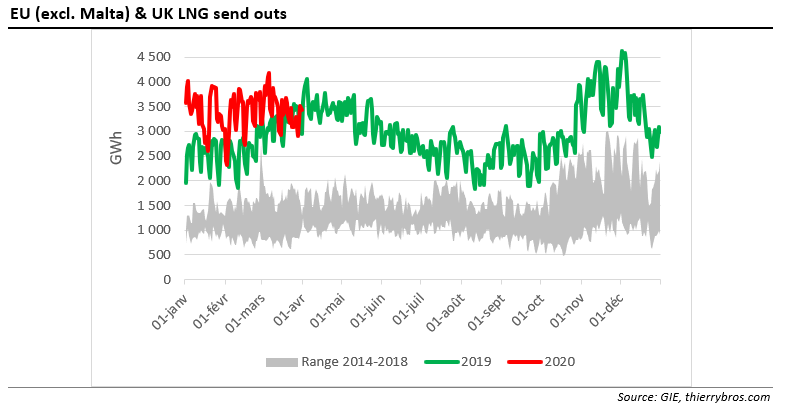

Year to date regasified LNG send-out was up 25% (+6.1bn m³). But recent regas flows are now slightly below 2019 level, showing that all producers are sharing the burden of reducing volumes to the EU to avoid a price free fall.

.MHT)