Russia, the EU, China, the energy price cap and the end of a“long century” of US global dominance [GGP]

Most of the problems that we have been facing today in the energy sphere in Europe, including regarding gas, from this author’s view, relate, first and most, with the beginning of the end of the “long century” (term of G.Arrighi) of US dominance in the global economy, and secondly, to the hand-made internal gas market structure that EU legislators and regulators have been developing through the series of EU Energy Packages (1998, 2003, 2009) and the subsequent Network Codes (2010-2016).

The hand-made structure of the internal EU gas market, which puts in the centre of its price-setting the developments at the paper gas market, has just triggered and multiplied negative effects of the current energy crisis in the EU, which began in the bloc in mid-2021. The deficit of renewable electricity for air conditioning in the hot summer of 2021 pushed upward demand – and the prices – for reserve fuels for renewables, which means gas and coal. So this happened long before February-2022 events.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

Blaming Russia for not supplying additional gas volumes towards the end of 2021 above its contractual obligations (the latter were fulfilled in full) when the prices went up means not to see the difference between “to have the right” and “to have the obligation”. Especially when the Nord Stream 2 pipeline was technically available to deliver 55bn m3/year of incremental gas to the EU but was prevented from doing so under illegal (since beyond the UN Mandate) US sanctions acting in sovereign Germany. See the very illustrative discussion on these issues between Fatih Birol, IEA, Jonathan Stern, OIES, and Alan Riley, Atlantic Council, in Financial Times on pages 12, 17 and 24 January 2022 [1-3].

“Long century” of US global dominance comes to an end

Let us refer in more detail to the first element of the reasoning – to the consequences of the coming (and even ongoing) end of the “long century” of US dominance in the global economy. The latter has been based on US dominance in the Anglo-Saxon global financial system and the US dollar as the global reserve currency.

The Anglo-Saxon global financial system has been developed and dominated by the US since the establishment of the US Federal Reserve System (Fed) in 1913. It enabled the US dollar, through the turbulent developments of the 20th century, to become the world reserve currency. The creation of the Fed was initiated at the “duck hunting” meeting at Jekyll Island in 1910. This is where and when, from this author’s view, the “long century” of US global dominance was conceived. Development of US dollar as the global reserve currency was first based on Bretton-Woods system of 1944, when the US dollar with fixed gold parity substituted gold as the universal hard currency standard, and then later in 1971-1976, when the Jamaika monetary system established floating exchange rates with six reserve currencies (now five, after introduction of the Euro, which substituted the German mark and French franc). But the US dollar stays until now as the dominant one.

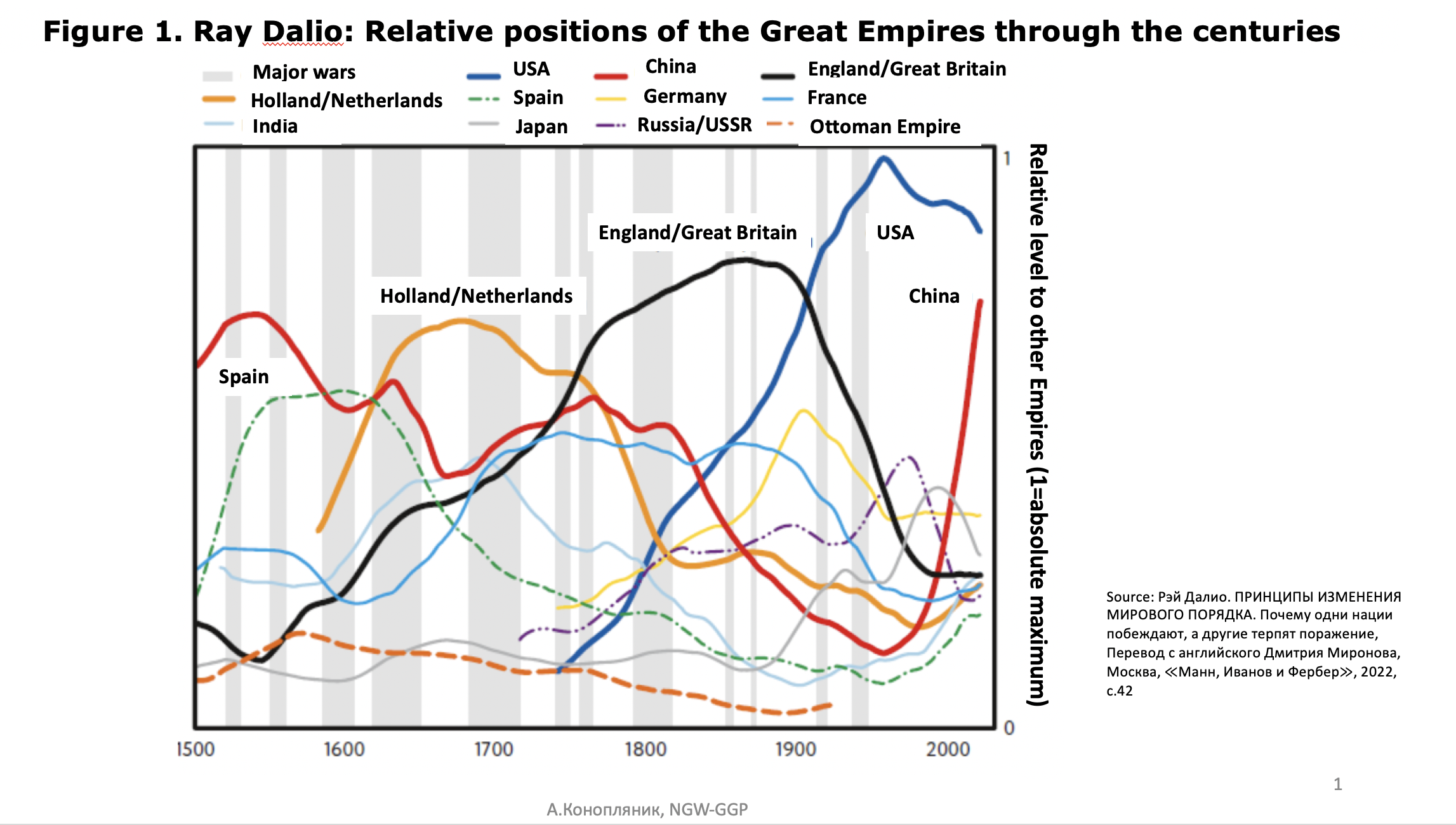

From this author’s view, the key element of the current world developments is not the Russia-Ukraine war conflict, and not even the NATO-Russia conflict in Ukraine, and not even EU energy crisis (while Russia is falsely blamed to be the origin of it) – all those developments are just the reflections of the more fundamental changes: the ongoing departure of US as the global dominant power (great power on the fall of its cycle) and the ongoing raise of China as the upcoming world dominant power (great power on the rise of its cycle) (see figure 1). The rise and fall of empires and/or dominant states is a universal global trend through the history of civilizations as was well proven by Paul Kennedy [4], Giovanny Arrighi [5], Ray Dalio [6], Alexander Mirtchev [7], etc. The “long century” of the US has been drawing to its close as in the past the previous “long centuries” of Britain, Holland, Venice, etc came to their end. This is why the Eurasian “long century” is on the rise – whether, more probable, in the combination of key Eurasian economies, including China, India, Russia, Saudi Arabia and Iran, or, less probable, just a Chinese one – and this will predetermine a totally different world order compared to the one based on Anglo-Saxon financial markets and US dollar as the reserve currency.

The area of competitions of key global powers has been broadening – few others are now challenging the relative US dominance. This is why, according to A.Mirtchev, the current “universally securitized world worsens Hobbesian trap, according to which the choice in favour of advanced antagonistic actions is the most rational”. In such a world “it might be beneficial for one state to act against another state within an increasing number of circumstances. … So they more often use the instruments which change the rules and institutions to influence expected results and prevent supposed threats” [7].

The US has been trying to prolong its “long century” as world dominant power, thus to use all instruments for this, trying to diminish the competitive powers of its competitors, including by changing international rules and institutions.

Triad of competitive aims of the US in Europe

There are three competitive aims for the US “on elimination”: Russia, the EU, China. The US has been undertaking against this triad a long-term economic action aimed to defend its deprived dominant position in the global economy. At that, US action at the “European front” has been working simultaneously against each element of the triad.

Russia: By pulling Russia into military conflict with Ukraine (such long-term strategy is evidenced by, say, Zbigniew Brzezinski [8] and or George Friedman [9], see below) and by continued NATO extension to the east, the US thus forcing Russia to divert its human, capital, natural resources to the military sphere, thus slowing down and playing for time Russia’s potential technological breakthroughs in non-military industries and its potential competitive strengthening in the latter in the global markets.

The US has been creating obstacles for Russia’s energy resources in Europe, both directly, through its own sanctions, like CAATSA of 02.08.2017 [10], or indirectly, through an anti-Russian sanctions agenda and sanctions packages of the EU and its member states. Now eight such EU packages are in force, and the ninth is in preparation, as they say.

Thus the US clears the way for its own LNG to flow to Europe to substitute Russian pipeline gas, though US LNG is more costly (if the cut-off price of both in the EU is considered) and by two factors more climate-dirty than Russian pipeline gas. Firstly, any LNG is dirtier than pipeline gas since there are three elements to consider regarding emissions (due to leakages and evaporation) present in the LNG value chain which are absent in the pipeline gas value chain: liquefaction, shipping, and regasification. Secondly, US LNG is a shale-gas based LNG and shale gas production (which is the basis for US LNG export to Europe) produces much more emissions compared to traditional gas production (which is the basis for Russian gas pipeline export to Europe).

Thus the US has been creating the market for profitable marketing of its LNG in Europe, which under non-distorted market competition will lose there to Russian gas. Especially after new modern pipelines, bypassing Ukraine, are in place – the Nord Stream-2 is (was) the most technologically advanced of all, thus further diminishing transportation costs for Russian gas to the EU and its cut-off price in the bloc. And it would have further increased the gap in GHG emissions between gas exports originating from Russia and the US in favour of the first.

Europe: Europe is one of the global competitors of the US and seems to be now the weakest one. The US is weakening Europe thrice – and earning on this also thrice. First, by substituting cheaper Russian gas in the EU with more expensive US LNG. Second, by thus making EU industry more costly (through more expensive energy costs) and less competitive, The US conduces EU industry to out-migrate to the US. The recent Biden’s Inflation Reduction Act (IRA) of 16.08.2022 [11] stimulates such inflow of foreign capital and industries into the US. Thus de facto the US deindustrialises Europe, at least in the short-term, based on the current energy and technological background. And third, by not allowing EU companies to receive subsidies, etc. introduced by the IRA to develop a new “green economy” – the economy of the next technological background. Only companies working in the US will be supported. This will increase the competitive gap between the US and the EU, who are political allies but economic rivals, in favour of the first.

According to Politico, France and Germany want to negotiate with Washington about such “unfair competition” [12]. It was on purpose that French president Emanuel Macron has criticised the US, stating that “the North American economy is making choices for the sake of attractiveness, which I respect, but they create a double standard” with lower energy prices domestically while selling natural gas to Europe at record prices. And French finance minister Bruno Le Maire criticised the US for selling LNG to European companies at “four times the prices at which it sells it” domestically. [13]

By such actions the EU is being disposed of as a US competitor in the global economy. Nothing personal. Only business.

China: China became the key trade partner for the EU, while Chinese exports to the bloc are almost twice as high as EU exports to China. The shrinking of the EU market as a result of the purposeful refusal of cheaper Russian energies and their substitution by more expensive alternatives (primarily US LNG) means the downgrade of EU demand for Chinese goods, thus slowing down Chinese economic growth. While China is considered by the US as its key global economic rival.

And US-friendly Europe became in such global competition the weakest link which is sacrificed in favour of solving a very pragmatic internal US task, which is the primary one for every US president – “America First!”.

US: to tear Russia from Europe by reincarnated Intermarium

Two US upgrades in the 20th century were mostly stipulated by two World Wars which took place in Europe and Asia, but most importantly – beyond the US territory, and the two following post-war reconstruction periods. For the new US revival (to prevent decline in its dominance) it, first, needs new global war beyond the US territory. Recently Alejandro Mayorkas, the US secretary of homeland security, has stated in writing that a nuclear explosion, if it happens in Europe, will not have negative consequences for Americans [14-15]. Second, the US needs to break ties between Europe (firstly Germany as the EU locomotive) and Russia to prohibit the unification of their resources. An effective instrument for this is the pre-planned (pre-scripted), according to Zbigniew Brzezinski in 1987 [8], conflict between Ukraine and Russia.

In a very direct and straightforwardly articulated manner, the thesis of the necessity for the US to separate Europe from Russia was expressed, for instance, by George Friedman, president of private US intelligence company “Stratfor” (which is usually called “a shadow CIA”). At the conference of “The Chicago Council on Global Affairs” on February 4, 2015, he stated (and I fully share the validity of his logic since it has been confirmed by the US actions) that: “…the final aim of the US consists in the creation of “Intermarium” – territory between Baltic and Black Seas, the concept of which was developed as far back as by Pilsudski. The first aim for the US is not to allow German capital and German technologies to be united with Russian natural resources and labour resources in an invincible combination. … the US has been working on this for the whole century. The trump card of the US which prevents such a combination – a dividing line between Baltic states and Black Sea… Russia and Germany, acting together, became the only power which presents a fundamental threat for the US.” [9]

The current reincarnation of the Pilsudski’s “Intermarium” was initiated by the US Atlantic Council in 2014 [16], and formalised in 2016 as the interstate initiative by the two European presidents (of Poland and Croatia), the so-called “The Three Seas Initiative”. It now unites 12 EU states and stipulates the creation of “vertical” infrastructure corridors in the east of the EU.

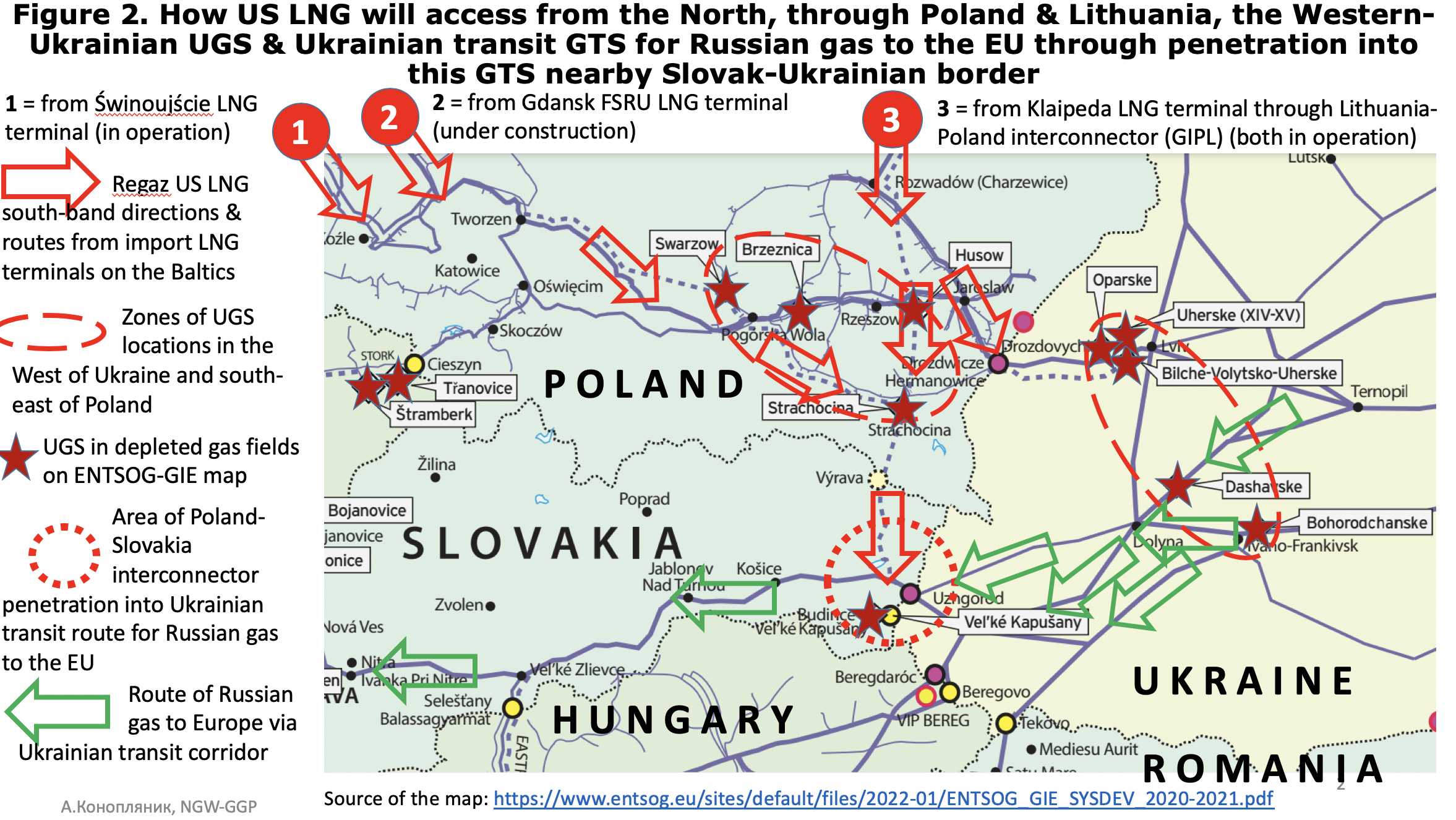

This includes, in particular, the vertical gas transportation North-South corridor (see GGP, 14.09.2022), which aims to connect import regasification LNG terminals in the north (in the Baltic Sea) and in the South (in the Aegean, Marmara and Adriatic seas) to bring regasified US LNG, enriched by clean “molecules of freedom”, from the north and south to the east European states to substitute “non-democratic” Russian pipeline gas, spoiled by dirty “molecules of dictatorship and autocracy.”

The “North-South” gas corridor was signed to penetrate and disrupt the horizontal East-West Ukrainian transit gas corridor for Russian gas at the geographical point to the West from the Ukrainian border and close to the Western-Ukrainian underground gas storage (UGS) facilities. US LNG can therefore be transported further to the west, deep into the EU, from the east of the EU, through the working gas transportation system (GTS), which was created for supplies of Russian (then Soviet) gas to the EU. Regulatory provisions of the Third EU Gas Package, such as mandatory third parties access to infrastructure (MTPA) and the “use-it-or-loose-it” (UIOLI) principle will support this.

Such penetration has already occurred on August 26 when the construction of the Poland-Slovakia interconnector was finished by connecting it with the Slovak GTS, which means with the extension of Ukrainian transit corridor, at the Velke Kapushany dispatch point (see figure 2).

Since 2017 the Ukrainian UGS has operated under a customs warehouse basis, with free access for international traders for temporary storage for 1095 days (three years). Access to the Western-Ukrainian UGS (with approximately 25bn m3 of working capacity) is badly needed, first, to flatten the discrete character of LNG supplies (contrary to steady flow of pipe gas). Second, to provide the possibility to influence the price on the trade hub in Baumgarten (Central European Trade Hub). It is the key pricing centre for central and east Europe and the distribution centre for the flows of Russian gas going through the Ukrainian gas corridor. Part of the gas goes from Baumgarten to the south, via Austria, to Italy, and another part further to the west, via the Czech Republic, to Germany and France.

Energy price cap as an end to state sovereignty over natural resources

In the course of strategic US operation on preserving its global dominance, we have been facing its gradual refusal from all those “rules of the game” (see A.Mirtchev [7]) that were steadily developed through the previous stages of international economic development within the post-Yalta-1945 world order and under growing globalisation. This took place till the new strong players entered the global competitive market and they began to narrow the gap with the US or create difficulties for its further economic expansion.

One of the most evident examples of such refusal, from my view, is the US-initiated proposal to introduce the price cap for energy exports originated from Russia. It seems to be very “technical”, from the first glance. But I see a much more deep underlying sense in this proposal. It is not so much about the quantitative level of the proposed restrictions - whether the cap will be established at, say, $40 or 60/barrel for Russian oil and/or €50/MWh for Russian gas. And it is not about returning to the “cost-plus” pricing system – to provide by such proposed restrictions cost-coverage for Russian companies of their production and transportations costs to their export markets. This will allow them to stay “in the money,” but will not give the Russian state any tax profits from energy trade in oil and gas.

US actions aimed at establishing price cap (since it were the US that initiated this discussion), are aimed, from my view, at undermining the fundamental principles of international law (see A.Mirtchev [7]) and the demolition of the post-Yalta-1945 world order based on such principles. The proposal to establish a price cap on energy exports by the third states (for oil, gas or any other natural resource) means for me the de facto proposed dismissal of state sovereignty over natural resources.

The key ideologist and initiator of such a proposal seems to be the current (since 2021) USsecretary of the treasury, Janett Yellen. She is a well-known economist. She has a reputable economic background and academic practice, as well as professional experience of practical economic activities in the White House Council of Economic Advisors, the Federal Reserve, and the Treasury Department. So this was her conscious proposal.

According to “Washington Post”, the first time the proposal for establishing an energy price cap was voiced “on the night of April 21, when she gathered some of the world’s most powerful financial/economic leaders together for a private dinner in Washington”. She definitely well understood the economic consequences of her proposal. “If it succeeds… and you manage to eat at Russia’s revenue — that’s a huge deal,” said Daniel Fried [17], the key ideologist and coordinator of the anti-Russian sanctions under the Obama and Trump administrations.

The Western instrumental decision will enter into place on oil on December 5. It will act through corresponding insurance restrictions on Russian oil which is to be sold above price cap level (yet to be defined). Although Russia has already said it will not sell its oil to the states that will implement such an oil price cap policy. There is no agreement on a price cap on gas. But the very fact of introducing such restrictive measures is much more important.

The decision on the establishment of energy price caps means for me a conscious dismissal of such a fundamental international law principle as the permanent state sovereignty over natural resources. This principle is fixed in the UN GA Resolution #1803 as of December 16, 1962. It was further reproduced in many following international legal and political documents.

Three price levels and pricing mechanisms

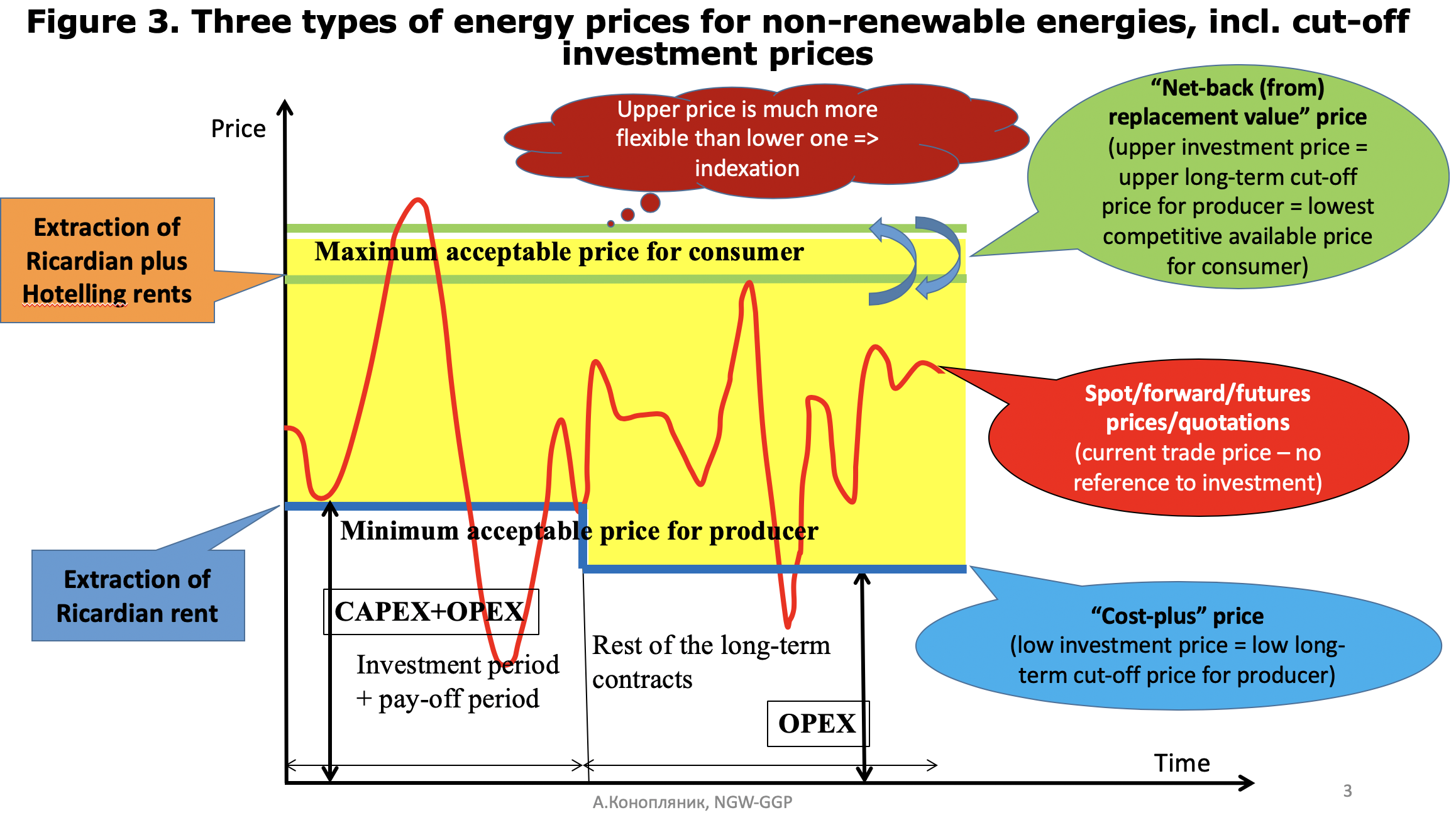

There are three pricing mechanisms and three corresponding pricing levels in natural resources at the physical markets (see figure 3). The first two – for the term contracts, they reflect upper and lower “investment” prices.

The lower investment price – is the cut-off pay-back price which covers all costs for energy production and transportation to the buyer (capital and operating costs, including cost of debt financing) plus reasonable rate of return considering all the appropriate risks. This is a “cost-plus” price. It provides for the extraction of the Ricardian rent which is the difference between the production and transportation costs of the given energy from the fields located in different natural environments and at different distances from the market. This is the minimum acceptable price for the producer-exporter.

The upper investment price is linked to the replacement value of the given energy. This is why the so-called “oil indexation” in the term contracts means binding the price of the given energy with the price of its substitute in the end-use (at the burner tip). The principle is based on the theory of Harold Hotelling (1931). It provides for extraction of both the Ricardian rent (differential rent between the given energies from different locations) and Hotelling rent (the rent between production and delivery cost at the end-user or at the delivery point of the given energy and its alternative/substitute). In sum total the two establish a natural resource rent.

This pricing is called “replacement value based pricing” if the contractual delivery point is located at the end-user’s burner tip, or “net-back replacement value” (NBRV) pricing if the contractual delivery point is located in between the producer and the end-user.

In European gas this pricing method has been historically linked to a basket of petroleum products, in Asia – to crude oil. In European gas it was first introduced in 1962 by The Netherlands in the so-called “Groningen pricing formula” of the long-term delivery contract. Prior to this NBRV pricing was used in European oil in the 1950s/1960s by the International Oil Cartel (IOC) during the post-WWII reconstruction period in Europe based on the US “Marshall Plan”. The IOC actively promoted motorization of Europe based on cheap oil from their concessions in the Middle East. In order to monetise residual fuel oil (RFO) produced from this oil at their European refineries, the IOC linked the price of RFO with the discount to the price of replacement fuel in electricity generation which was then the coal from Western Germany. This is how European coal was substituted in European electricity by RFO from oil mostly produced by US companies (five of the seven IOC companies were US ones) under the programme of US support of European post-war reconstruction.

The third one is the “trade” price, which refers to the spot and/or futures deals with both deliverable and non-deliverable contracts. It is based on risk-expectations of the traders on the physical energy market and speculators on the paper energy market. Those market players do not face investment risks referred to production and delivery.

While based on expectations/perceptions, these prices can fluctuate in a broad range. They can go above the upper investment price and thus provide for traders/speculators an incremental “price” rent above the sum of Ricardian plus Hotelling rents. But they can also fall below lower investment price, even below zero level. If the “trade price” dominates at the given market (say, if dominant pricing method is established at the marketplaces – trading hubs) and is incorporated into term contracts, it will provide incremental positive or negative price rents (depending on the state of the market in the given moment) both for traders who do not face investment risks and producers who do face such risks.

Who owns the Hotelling rent?

UN GA Resolution #1803 was adopted in 1962 when on the petroleum market only two investment pricing methods and two types of investment prices were present. Spot market began to develop only a decade later. And the futures trades – two decades later.

Based on provisions of the permanent state sovereignty on natural resources, the Hotelling rent belongs to the host state – the owner of natural resources in place within its sovereignty (except US), and not to the third states. This means the US-initiated EU and/or G7 proposal to establish a price cap at the level of the “cost-plus” price means the conscious intention to withdraw Hotelling rent from the host states into the disposal of the third parties to whom natural resources which are the origin of this Hotelling rent do not belong.

Today the US proposes to retire the state sovereignty principle over natural resources with regards to Russia’s energy resources (this country possesses a huge amount of them) which are the backbone of Russian economic development and are an integral part of the current – today’s and tomorrow’s – development of the global energy economy. Tomorrow such an aim might become China’s, as it owns or controls huge amounts of “green metals” and/or rare-earth materials, which might become an important element for global energy a day after tomorrow.

This is how this author sees the long-term US strategy to preserve its shrinking competitive niche in the global economy at the cost of Russia, Europe, China.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.

Andrey A.Konoplyanik, Dr. of Sc. (International energy), Professor

Adviser to Director General, Gazprom export LLC,

Professor (at the Chair of World Economy) of Diplomatic Academy, Russian Ministry of Foreign Relations,

Member of Scientific Council on System Research in Energy, Russian Academy of Sciences

Bibliography:

[1] IEA chief accuses Russia of worsening Europe’s gas crisis. Financial Rimes, January 12, 2022. (https://www.ft.com/content/668a846e-d589-4810-a390-6d7ff281054a)

[2] Letter: Europe’s energy crisis should not be blamed on Gazprom. Financial Times, January 17, 2022 (https://www.ft.com/content/e447ae74-7e93-4b5c-9952-0e570507d671)

[3] Letter: Putin uses gas supplies as leverage on Nord Stream. Financial Times, January 24, 2022 (https://www.ft.com/content/65fa1e2e-e22e-431b-b1d2-ca90187bc247)

[4] Paul Kennedy. The Rise and Fall of the Great Powers. Economic Change and Military Conflict from 1500 to 2000. Vintage Books, 1989

[5] Giovanni Arrighi. “The Long Twentieth Century: Money, Power, and the Origins of Our Times”. London: Verso, 1994/2010

[6] Ray Dalio. Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail. Avid Reader Press / Simon & Schuster, 2021

[7] Alexander Mirtchev. The Prologue: The Alternative Energy Megatrend in the Age of Great Power Competition. Post Hill Press, 2021

[8] Zbigniew Brzezinski. The Grand Chessboard: American Primacy and Its Geostrategic Imperatives. Basic books, 1997

[9] Presentation of George Friedman, Founder and President of private intelligence agency “Stratfor” at the conference of “The Chicago Council on Global Affairs”, 04.02.2015, https://www.thechicagocouncil.org/event/europe-destinedconflict; https://www.youtube.com/watch?v=iOY1dDqa7F0; https://www.youtube.com/watch?v=xewzbMYmC_I;

[10] Countering America’s Adversaries Through Sanctions Act (CAATSA). Public Law 115–44, 115th Congress, Aug. 2, 2017 (https://www.govinfo.gov/content/pkg/PLAW-115publ44/pdf/PLAW-115publ44.pdf)

[11] H.R.5376 - Inflation Reduction Act of 2022117th Congress (2021-2022), Public Law No: 117-169 (08/16/2022) (https://www.congress.gov/bill/117th-congress/house-bill/5376/text)

[12] H.V.D.BUTCHARDT, C.CAULCUTT. Scholz and Macron threaten trade retaliation against Biden. // Politico, 27.10.2022 (https://www.politico.eu/article/france-and-germany-find-ground-on-a-common-concern-u-s-protectionism/)

[13] Ania Nussbaum. Macron Accuses US of Trade ‘Double Standard’ Amid Energy Crunch. Bloomberg – Europe Edition - Politics, 21.10.2022 (https://www.bloomberg.com/news/articles/2022-10-21/macron-accuses-us-of-trade-double-standard-amid-energy-crunch)

[14] В США министр отметил, что атомный взрыв в Европе не отразится на жизни американцев (In the US the Minister has stated that atomic explosion in Europe will not reflect on the lives of the Americans). // ИноСМИ (Foreign Media), 15.11.2022 (https://inosmi.ru/20221115/atomnyy-257869594.html)

[15] В США считают, что ядерный взрыв в Европе не навредит американцам (In the US they consider that nuclear explosion in Europe will not harm Americans). // РИА Новости (Russian Information Agency “The News”), 15.11.2022 (https://ria.ru/20221115/vzryv-1831770650.html?in=t)

[16] Completing Europe: From the North-South Corridor to Energy, Transportation, and Telecommunications Union. // Atlantic Council & Central Europe Energy Partners, November 2014, 90 pp. (https://www.ceep.be/www/wp-content/uploads/2014/11/Completing-Europe_Report.pdf)

[17] Jeff Stein. Janet Yellen’s global campaign to defund Russia’s war machine. // “The Washington Post”, July 14, 2022 (https://www.washingtonpost.com/us-policy/2022/07/14/yellen-putin-oil-price-russia/)