Is Russia Dumping Gas?

By Mikhail Korchemkin

In a recent analytical paper Russia's Natural Gas Dilemma (full text with links is available here), Stratfor claims that Gazprom is losing money on its domestic sales. This statement is a way outdated. According to the financial reports of Gazprom, the domestic sales are profitable from 2004. The important swing from loss to profit was also mentioned in the company's 2003 annual report (see page 64).

After two profitable years, Gazprom's top management has decided that all gas produced at the highest cost goes to Russian consumers and this simple accounting trick has created a loss in 2007. As explained to the shareholders, "stripped gas bought from our daughter companies is much more expensive than natural gas and the stripped gas is being delivered exclusively to Russian consumers". It is worth noting, that in an arbitration trial in 2002, Gazprom has proved that all stripped gas goes for export sales (at that time exports of this product were free of customs duties). In 2008-2011, Gazprom reported profits from the domestic sales. Gazprom sells gas at the state-regulated wholesale price that is above the delivery cost in all regions of West Siberia and European Russia. The article wrongly assumes that Gazprom sells gas to the end-users. There are no dumping prices of gas in Russia.

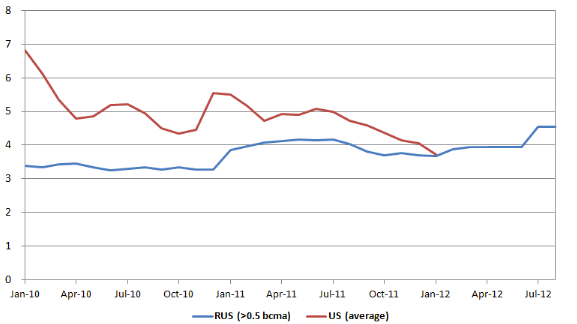

As a matter of fact, the low end-use price of natural gas in Russia is a myth. In January 2012, the average price of natural gas used by the US power plants has reached parity with the price paid by major power plants in Russia that consume over 0.5 bcm/year or over 50 mmcf/day (see the chart below). Moreover, the average price of gas in Ohio ($3.00/MMBtu) and Pennsylvania ($3.49/MMBtu) is much lower than the price paid by power plants in Central European Russia. Note that power sector represents 30% of the total domestic sales of the Russian gas giant.

Figure 1. End-use price of natural gas in the power sector of the US and Russia, USD/MMBtu

Sources: EIA; RF Federal Tariff Service

On July 1, 2012, the price for non-residential consumers will be raised by 15%. The Russian price for May-August 2012 is our forecast based on the current exchange rate of the Russian ruble.

It is worth noting that Gazprom is the least taxed company in the Russian oil-and-gas sector. In 2011, Russia produced more natural gas than oil in terms of oil equivalent. However, the total gas production tax collection ($4.6 Bn) was just a fraction of that of oil production tax ($62.9 Bn). In the period of growing export prices, the Russian government was steadily reducing the share of export duties in the export revenue of Gazprom.

According to the Russian government, the end-use price of gas for non-residential consumers should be at least twice higher than now. If the price goes that high, Russia is very likely to start importing fertilizers, cement and other natural gas-intensive products from the USA. The real dilemma is about that.

Mikhail Korchemkin is managing director of Eastern Europe Gas Analysis (EEGAS).