Repsol Moves into Spanish Power, Retail

Spain’s Repsol said June 27 it has agreed to buy Viesgo’s low-emission power generation business and its gas/electricity retail arm for €750mn ($871mn) from investment funds Macquarie and Wren House.

It marks a decisive step by Repsol in the implementation of its new strategy of challenging former downstream partner Gas Natural (Naturgy) in Spain's power generation and energy retail markets. Four months ago Repsol decided to divest its 20.072% stake in that Spanish utility which it held for almost 20 years.

The agreement now includes the purchase of 2,350 MW of installed power generation capacity and almost 750,000 retail customers, strengthening Repsol’s position as a multi-energy supplier. Repsol said it thus becomes a “relevant player in the Spanish electricity generation market” with total installed capacity, once the deal is completed, of 2,950 MW.

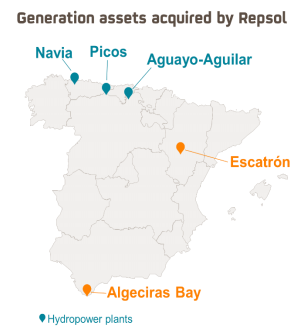

The Viesgo assets being acquired include two combined-cycle gas turbine (CCGT) plants at Escatron (near Zaragoza) and Algeciras totaling 1,650 MW capacity, plus 700 MW of hydroelectric plants in northern Spain. Viesgo’s coal-fired plants were excluded from the transaction.

The company’s Strategic Plan, announced June 6, set objectives to reach 2.5mn retail gas and electricity customers in 2025, as well as low-emissions generation capacity of about 4,500 MW. The 750,000 Viesgo customers will get it nearly halfway to its retail target, as they represent a 2% market share. Repsol meanwhile is not the only large gas group involved in an ‘energy transition’ deal.

BP also June 28 said it has agreed to purchase Chargemaster, the UK’s largest electric vehicle (EV) charging company with 6,500 charging points; the BBC reported the transaction price as £130mn ($171mn). “At BP we believe that fast and convenient charging is critical to support the successful adoption of electric vehicles,” said its downstream chief Tufan Erginbilgic.

Gas Natural too announced June 27 it has agreed to sell its 70% stake in South African coal-mining company Kangra Coal. The divestment of the asset, which originally belonged to Union Fenosa, to Luxembourg-based Menar Holding for $28mn is expected to complete by end-2018. It marks a further decarbonisation of GN's asset base and was bought originally to supply Fenosa power plants in Spain. The sale though remains subject to pre-emption rights held by the owner of the remaining 30% Kangra Coal shareholder, Izimbiwa Coal.

The CCGTs being acquired by Repsol are shown in orange (Credit: Repsol)