Replacing natural gas will be hard [Gas in Transition]

Every international meeting, be it the G7, G20, BRICS, produces more pledges on climate and global warming and yet the world is as far from meeting Paris Agreement goals as ever.

A good example is the G20 Declaration issued on September 10. It emphasised the need to “accelerate clean, sustainable, just, affordable and inclusive energy transitions,” but then also the need for food and energy security. It emphasised “the importance of maintaining uninterrupted flows of energy from various sources, suppliers and routes, exploring paths of enhanced energy security and market stability, including through inclusive investments to meet the growing energy demand, in line with our sustainable development and climate goals, while promoting open, competitive, non-discriminatory and free international energy markets.”

The Declaration avoided setting goals for curbing use of fossil fuels, but it made a pledge to triple renewables capacity by 2030 and reiterated support for phasing down unabated coal-fired generation. Energy security loomed high, concerned that “the potential for high levels of volatility in…energy markets remains, given the uncertainties in the global economy.”

And all for a good reason. Despite the progress made by renewables, natural gas and oil are still indispensable to global energy needs and will be for a long time to come.

In the meanwhile, we have the annual ritual by the International Energy Agency (IEA), declaring that the end of fossil fuels is ‘nigh.’ But this presupposes that energy transition could be accelerated through “stronger climate policies,” something that so far has been a challenge. It is subject to many assumptions, uncertainties and ‘ifs,’ with plenty of reasons for scepticism. Backlashes to climate policies in the world’s largest economies – including Germany and the UK – driven by inflation and its impact on the economy and cost of living, mean oil and gas demand may not peak so soon.

IEA executive director Fatih Birol warned that “Oil and gas companies may not only be misjudging public opinion…they may well be misjudging the market if they expect further growth of oil and gas demand across this decade.”

But are they? In Europe there are increasing concerns about voters’ tolerance for rapid change. As The FT points out, Roberta Metsola, the head of the European parliament, warned this month that European Commission (EC) climate policies risk driving voters towards populist parties, as is already happening in Germany. In the UK, the government has backed new oil and gas drilling, driven by energy security concerns.

So far penetration of renewables in energy sectors other than electricity has been minimal and is increasing only very slowly.

Energy resilience

In a future energy system increasingly dependent on electricity, resilience – the ability to continue operations without impact from any short or long term disruptions to power supply – becomes very important. Michael Liebreich, senior contributor, BloombergNEF, pointed out that while getting to 90% clean power could be affordable, the last 10% could cost as much again as the first 90%. Ensuring energy resilience of the last 10% will be expensive. In today’s interconnected and interdependent systems, reliance on uninterrupted energy supplies is essential.

According to JP Morgan, the full cost of electricity (FCoE) to consumers of high renewable grid penetration must also include: (a) investment in transmission upgrades to create larger renewable coverage areas, (b) backup thermal power generation required for times when renewable generation is low, and (c) capital costs and maintenance of utility-scale battery storage. FCOE explains why wind and solar are not necessarily cheaper than conventional fuels and in fact become more expensive the higher their penetration in the energy system.

According to JP Morgan, the full cost of electricity (FCoE) to consumers of high renewable grid penetration must also include: (a) investment in transmission upgrades to create larger renewable coverage areas, (b) backup thermal power generation required for times when renewable generation is low, and (c) capital costs and maintenance of utility-scale battery storage. FCOE explains why wind and solar are not necessarily cheaper than conventional fuels and in fact become more expensive the higher their penetration in the energy system.

Long-term intermittency – when wind and solar are unavailable or under-performing for long periods – cannot be compensated by battery storage alone. According to Liebreich what would be needed in such situations – in terms of staying with clean energy – is “a combination of renewable overcapacity, multiple long-distance interconnectors, much more bio-energy, nuclear power and pumped-hydro storage, and long-duration storage of either hydrogen or its derivatives.” A workable and dependable combination of these technologies does not exist today. And despite the hype, it will take a long time before green hydrogen is in a position to displace natural gas. As a result, back-up generation can be provided only by fossil fuels, and preferably natural gas.

At present electricity comprises just over 17% of global primary energy. Over the last ten years it has been growing slowly, by an average of 2.3% per year. At this rate, it will take a very long time before electricity dominates global energy supply. But with much of transport going electric, over time electrification is bound to increase more rapidly than now. Nevertheless, EC’s estimate that by 2050 about 80% of overall energy demand will be provided by electricity and green hydrogen, sounds like a daydream. And then there is the remaining 83% of primary energy where renewables penetration is minimal – dominated by fossil fuels.

The green hydrogen bubble

“Europe’s time spent sleepwalking to the tune of hydrogen lobbyists – draining funds and political capital for far too long – appears to be coming to an end.” At least that is what a recent article published in Euractiv claims.

The EC estimates that to produce and transport 10mn t of green hydrogen domestically and another 10mn t as imports, will require investments close to €1 trillion between now and 2030. And that’s just the EC estimate. Real costs are likely to be higher. As much as two-thirds of this will have to be invested in new renewable power generation.

But producing green hydrogen in Europe is very expensive when compared with fossil fuels. Subsidised renewable generation will require even larger subsidies and even more land. As The Guardian points out, “it remains an open question whether European consumers would be prepared to foot the very significant price rises needed to go green in this way.”

With the targeted 10mn t of green hydrogen imports expected to come mainly from the Middle East and North Africa (MENA) regions, a recent report by the German Heinrich Böll Foundation points out that this could have serious negative impacts on scarce water resources and the energy needs of these countries. The green energy required to produce green hydrogen “should be used locally to address immediate needs rather than being directed to produce hydrogen for use in Europe.”

MENA is currently targeting to increase its solar power capacity almost eightfold, to about 57 GW by 2030. According to Recharge, in order to produce 10mn t of green hydrogen would require 320 GW installed solar power capacity. The enormity of the challenge is obvious.

With all these challenges, the IEA warned in its Global Hydrogen Review 2022 that the EU is unlikely to meet its target of 20mn t of green hydrogen by 2030. Evidently, plans to accelerate phasing out consumption of natural gas on the assumption that it will be replaced by green hydrogen are premature.

The original expectation was that green hydrogen would be used widely in all sectors, including transport and heating. But it now looks more likely that most of it will be used in the industrial sector for heat and as feedstock. But even there, with current economic developments and the high cost of energy, industrial demand for green hydrogen by 2030 is projected to be far below EU’s targets.

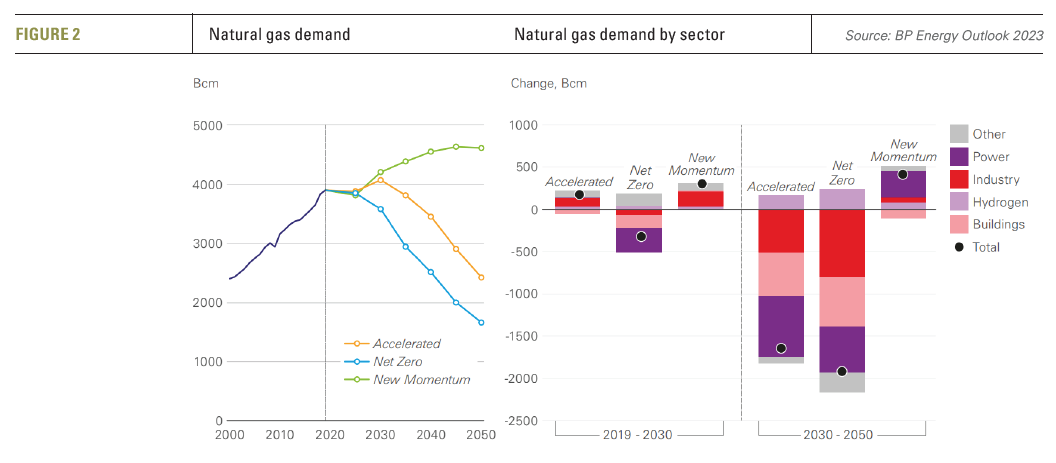

BP’s New Momentum scenario shows green hydrogen providing only about 2.5% of global final energy consumption even by 2050.

It is no wonder then that the EC is now changing its tune, focusing on electricity. There is a realisation that counting on green hydrogen will not deliver EU’s targets – it will not replace natural gas. Earlier this month, energy commissioner Kadri Simson shifted emphasis to expanding the EU's electricity grid. She said in an article in The FT that there is no green future for Europe without an upgraded power grid.”

Clearly green hydrogen is unlikely to replace natural gas in substantial volumes any time soon.

Natural gas

Natural gas is a cheap source of high-density heat for industrial use. According to Leibreich, to displace such gas, green hydrogen costs will have to drop by a factor of more than ten in the US, or carbon prices to reach $200 per t of CO2.

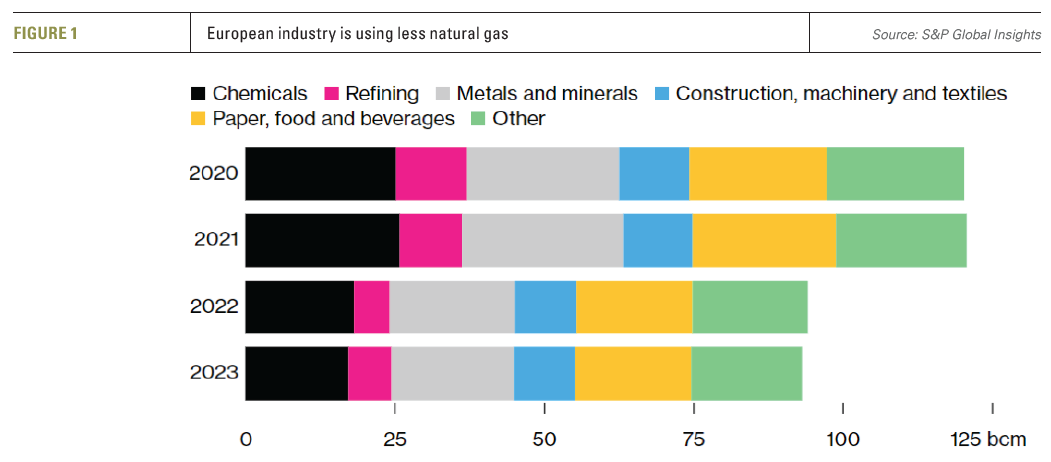

Although natural gas consumption in the developed world is projected to continue to fall due to high prices and falling industrial activity (see figure 1), the opposite is true in the rest of the world where energy and gas consumption are projected to keep rising (see figure 2).

The future demand for natural gas depends on the speed of the energy transition. In BP’s Energy Outlook 2023 demand under the New Momentum scenario – based on current trends and known policies - is rising all the way to 2050, by about 20% above 2019 levels.

With future gas demand in Europe and the US projected to decline by 2050, this is driven almost entirely by rising demand in Asia and the rest of the world.

Evidently, as JP Morgan points out, reducing investment in and production of natural gas and oil, under the assumption that renewables can quickly replace them in all energy sectors, is prone to substantial economic and geopolitical risks. Instead, during energy transition, more effort should be made to reduce emissions and make fossil fuel use as efficient as possible. Replacing coal with natural gas and eliminating methane emissions must be a priority.

The bottom line is that natural gas is hard to replace and will have a key role to play in global energy consumption all the way to 2050 and likely beyond.