Qatar LNG shuns Europe [Gas in Transition]

The energy crisis and the war in Ukraine have made energy security a priority, ahead of climate change concerns. That, and Europe’s goal to rapidly reduce dependence on Russian gas, have given a new lease of life to the global LNG market.

Energy security and sky-high energy prices last year are changing LNG contract preferences in favour of long-term deals. This also applies to Qatar LNG.

Even though in the aftermath of the invasion of Ukraine by Russia Qatar was quite willing to contribute to Europe’s drive to diversify away from Russian gas, the priority now is buyers that are willing to buy for the long-term.

Qatar considers this necessary to provide supply security and stability well into the future, irrespective of how the global markets develop, but also to secure its own financial future.

Qatar LNG

In 2022 Qatar was the largest LNG exporter in the world with 80mn metric tons, followed closely by Australia with 79mn mt and the US with 78mn mt. The US is on track to regain first position this year.

QatarEnergy (QE), which operates all oil and gas facilities in Qatar, is in the process of expanding LNG production nameplate capacity from 77mn mt/year now, to 110mn mt/yr by 2025 and 126mn mt/yr by 2027, a total increase of 64%.

QE is committed to the “greening” of its LNG. As part of that process, which involves reducing routine flaring, its North Field expansion project incorporates a CCS facility.

With a reputed breakeven price of $4/mn Btu, Qatar LNG is the cheapest in the world. Qatar’s North Field gas field (also known as North Dome) is the largest in the world, with an estimated 36tn m3 recoverable gas, in 65 m of water, making it easy and cheap to produce. In addition, with such a vast resource, there is no risk that Qatar will ever run out of gas supply.

QE CEO, Saad Sherida Al-Kaabi believes the energy crisis has generated massive interest in LNG and its potential role in addressing supply concerns, especially in dealing with intermittency during energy transition. And with transition being a long-term process, gas will be needed for decades to come. In effect, when it comes to LNG supplies to the world QE will be “the last man standing.”

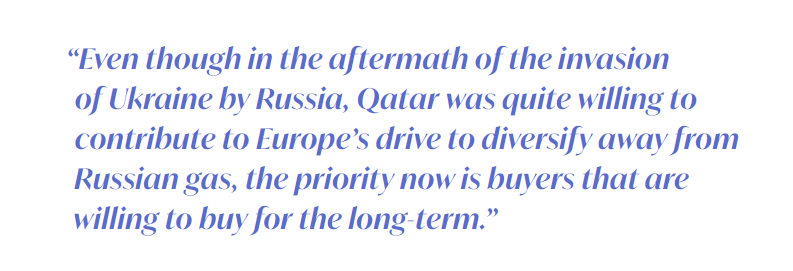

At present, about 70% of existing Qatar LNG contracts are with Asian buyers (see figure 1). Traditionally Asia has been Qatar’s biggest regional market, not Europe. Many of these will expire towards the end of the decade and beyond. Over 50% of existing European contacts will also require renewal by then.

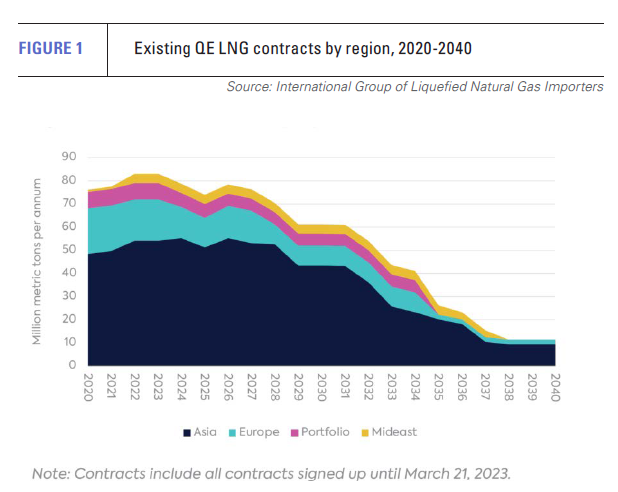

Including its US investments, by 2028 close to 140mn mt/yr of LNG will be under the control of QE and by the end of the decade more than half of it will be unsigned (see figure 2), making QE’s influence on the global LNG market even stronger.

QE’s stated policy is to prioritise long-term, oil-indexed, contracts, limiting LNG it makes available to the spot market to between 5-10% of volumes sold. QE is leveraging its advantageous position to lock-in customers, giving preference to those prepared to enter into long-term deals.

With European gas policies discouraging long-term contacts, unless changed, Qatar LNG will be shunning Europe, opting for Asian clients who are more willing to enter into such contracts.

Europe’s gas policies

EU’s Green Deal and REPowerEU policies aim to accelerate transition away from fossil fuels to clean energy. In support of this, the EU has adopted very ambitious climate change targets to 2030, aiming to achieve net-zero emissions by 2050. A recommendation by the European Scientific Advisory Board on Climate Change mid-June is urging the EU to accelerate this further by setting a target to cut emissions by 90-95% by 2040. Achieving this will require a faster transition and further and faster reductions in oil and gas consumption.

In fact, so far, the EU managed to reduce natural gas consumption by about 18% in the period August 2022 to March 2023, in comparison with the average gas consumption over the same period between 2017 and 2022.

In addition, in 2021 the European Commission introduced a directive for the Internal Markets in Renewable and Natural Gases and in Hydrogen that states: “No long-term contracts for the supply of unabated fossil gas shall be concluded with a duration beyond the end of the year 2049.”

These policies create huge uncertainty about the longer-term use of gas and LNG in Europe and deter European utilities and LNG traders from entering into long-term purchase contacts.

They are also very risky. Even if Europe succeeds in reducing gas demand, BP’s New Momentum scenario in its Energy Outlook 2023 shows this remaining high, at 55% of today’s level by 2050. And if renewable intermittency remains unsolved, it could even be higher. Shunning long-term gas contracts is likely to lead to future crises.

Even though European LNG buyers need to secure gas supplies now, this uncertainty, combined with Europe’s determination to accelerate the pace of energy transition, deters them from entering into long term deals.

This is exacerbated by the fact that most LNG purchasing in Europe is through the private sector, unwilling to take the risk of long-term contracts as long as current EU gas policies persist.

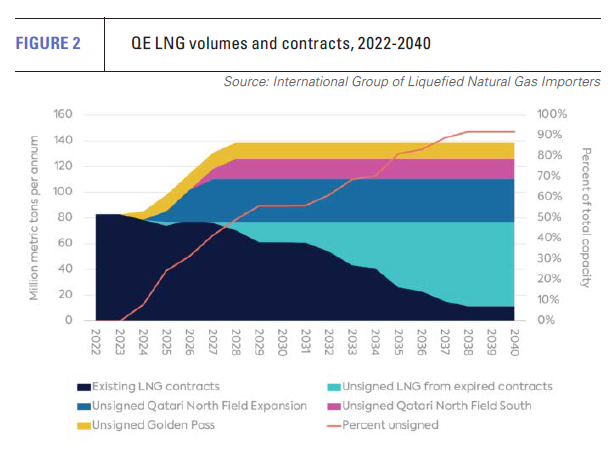

As a result, LNG producers, including QE, are exploring other markets for their LNG, mainly in Asia, where most outlooks project continued growth in gas and LNG demand all the way to 2050 (see figure 3).

According to BP’s New Momentum scenario – based on current trends and known policies and “designed to capture the broad trajectory along which the global energy system is currently travelling” - by 2040 the LNG market is expected to nearly double its 2019 level, with demand dominated by Asia.

Shunning Europe

In response to this growing demand, QE is expanding LNG production, but will not divert exports to Europe, unless European buyers are prepared to enter into long-term contracts. Most of QE's LNG export capacity remains tied up in long-term LNG export deals with Asian customers.

QE CEO, al-Kaabi, said at the end of 2022, "Qatar is absolutely committed to the sanctity of contracts … so, when we sign with an Asian buyer or European buyers, we stick to that agreement." These contracts include an option to divert as much as 15% of the LNG to destinations with better prices. Following the invasion of Ukraine, al-Kaabi declared that Qatar would stand in “solidarity with Europe” and not divert gas supplies to other customers even for financial gain. QE fulfilled this pledge and delivered contracted LNG volumes to Europe to the full.

But, with ample gas supply and gas prices in Europe tumbling down, al-Kaabi confirmed on June 1 that Qatar’s self-imposed ban on diverting LNG away from Europe had now ended.

So far in 2023 less than 18% of Qatar’s LNG output has sailed to Europe, down from 25% in 2022. Short-termism and low gas prices have reduced Europe’s attractiveness as an LNG destination.

Al-Kaabi believes that Europe made “a mistake in pushing to switch to renewable energy too quickly while remaining dependent on gas supplies for baseload power.” In June he warned that Europe could still face a shortfall if economic growth rebounded.

He said that "whether it's in the US and EU, in the Americas and Europe and Asia, gas is absolutely going to be needed for a very long time" and “until then we'll be serving their markets.".png)

By the end of 2022 China emerged as the largest offtaker of Qatari LNG with an increase of almost 70%. Exports to India also increased by around 10%.

In November QE signed a contract to sell 4mn mt/yr of LNG to China’s Sinopec – the longest LNG supply contract ever signed, lasting 27 years. Sinopec also took a 5% stake in one of North Field’s East expansion LNG trains.

On June 20, China National Petroleum Corporation (CNPC) and QE signed a similar deal, involving a 5% equity transfer in one of the North Field expansion project trains. These deals confirm the view that China will play a central role in Qatar's future LNG export strategy. They have also moved Qatar closer to China politically.

According to recent reports, buyers in China, India, Taiwan and Pakistan are currently in talks with Qatar for more supply.

This contrasts with QE’s agreement in November to supply 2mn mt/yr of LNG to Germany under a 15-year deal starting 2026. However, al-Kaabi told the FT in June that he expects to sign long-term supply agreements with “several European countries” that include France, Italy and the UK, before the end of the year. That would be a major departure from EU’s reluctance to support long-term LNG supply contracts due to concerns about balancing short-term energy security with commitments to reduce emissions by 55% by 2030 and achieve net-zero by 2050.

Even though outlook scenarios designed to deliver net-zero by 2050 question the longer-term role of natural gas in energy transition, Qatar remains committed to its LNG plans. It believes LNG will be needed for a long time to come and has the scale and low production cost base that enable QE to outcompete all other competitors.