Project Spotlight: LNG Canada [LNG Condensed]

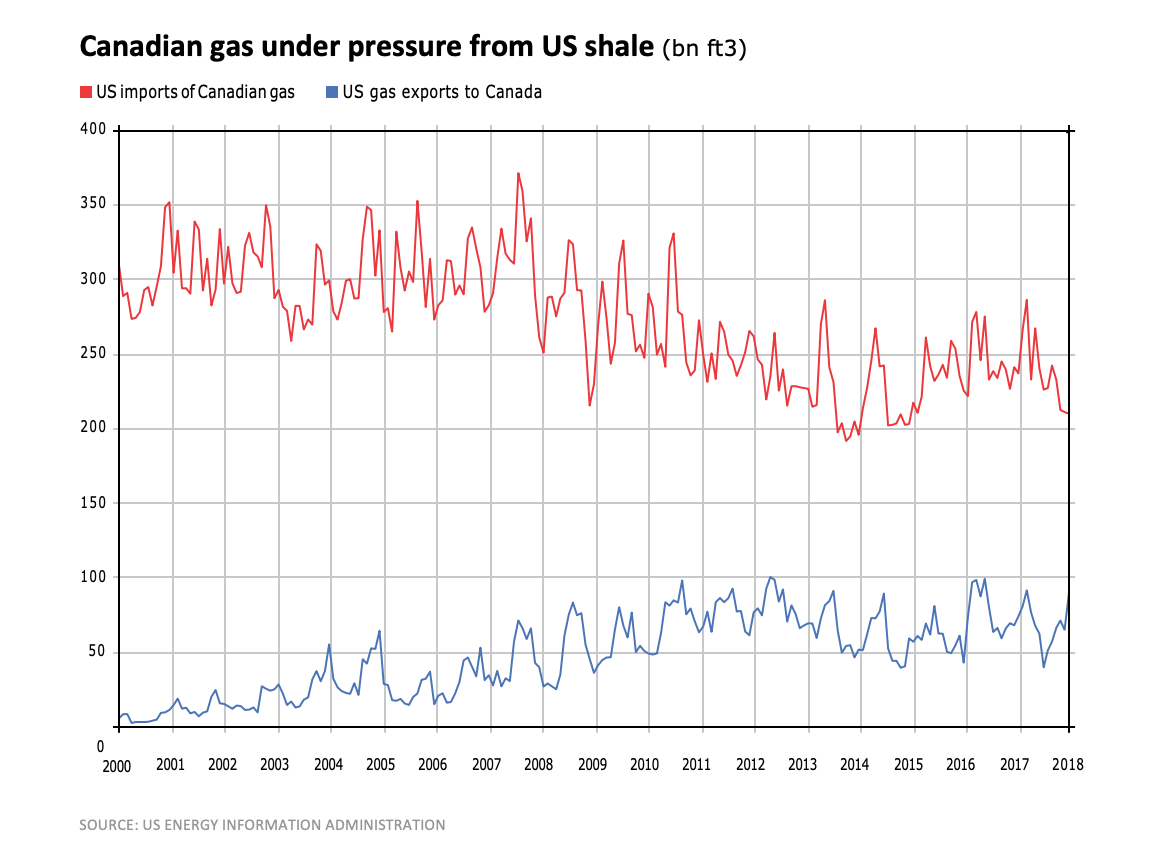

Canada has long benefited from the presence of the world’s largest economy on its southern border. While US energy imports were rising, it made sense to take the shortest route possible to market rather than look further abroad.

Canada has long benefited from the presence of the world’s largest economy on its southern border. While US energy imports were rising, it made sense to take the shortest route possible to market rather than look further abroad.

But the US shale boom changed all that, making Canadian dependence on the US market a vulnerability, depressing Canadian crude prices and resulting in a grad- ual decline in natural gas exports to the US. In November 2018, these stood at 7bn ft3/day, down from 10.3bn ft3/d in November 2002.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

The industry has long seen the answer in LNG as a means of taking its gas to markets internationally, but Canada has been slow to develop liquefaction plants, with the lack of export capacity hindering upstream expansion of its gas resources.

The US, by contrast, has been faster off the block, admittedly taking advantage of earlier errors. The availability of redundant terminals built to import LNG meant much of the infrastructure was already in place for the conversion of brown- field sites to liquefaction plants. For its part, Canada faced much greater challenges in the development of green field sites, which required major new pipe- lines, for which permitting proved difficult.

However, while projects and consortia have come and gone, Canada now looks set to enter the LNG age via the LNG Canada project, providing it with alternative markets to its gas-soaked southern neighbour. In October last year final investment decisions were taken to proceed with LNG Canada and the Coastal GasLink pipeline, which still faces opposition from some members of the Wet’suwet’en First Nation.

BIG BACKERS

It has taken a powerful combination of forces to get LNG Canada up and running. The companies behind the venture on the production side are Anglo-Dutch major Shell (40%) and Malaysia’s Petronas (25%). Co-operation between the companies is long-standing. The Bintulu Gas-to- Liquids plant completed in 1993 and the MLNG Tiga liquefaction plant completed in 2003 are just two examples.

On the demand side are companies representing both upstream interests and the world’s three largest LNG markets: Japan’s Mitsubishi (15%), China’s PetroChina (15%) and South Korea’s Kogas (5%), the world’s single largest LNG importing company. Two off-take agreements with Japanese companies Tokyo Gas and Toho Gas have been signed by Mitsubishi, marking the first ever sale of Canadian gas in Asia.

The project will be a major investment for British Columbia coming with a price tag of $40bn, of which $18bn will be spent on the two-train plant, albeit not all in Canada. Nonetheless, LNG Canada has already awarded local contracts worth $937mn. At peak construction, the project will employ an estimated average of 4,500 workers with an additional 2,000-2,500 likely to be em- ployed on the Coastal GasLink project.

PROJECT SPECS

The plant will be powered by a combination of gas-fired turbines and electricity generated by BC Hydro, the use of renewable electricity reducing the plant’s carbon footprint.

The plant will be located at Kitimat at the head of the Douglas Channel about 650 km northwest of Vancouver. Each of the two trains will have capacity of at least 6.5mn metric tons/year, with an option to expand to four trains in a second phase.

The plant will be located at Kitimat at the head of the Douglas Channel about 650 km northwest of Vancouver. Each of the two trains will have capacity of at least 6.5mn metric tons/year, with an option to expand to four trains in a second phase.

Construction of the first two trains is expected to take about five years, bringing the plant online in 2023/24. Storage capacity at full build out with be 450,000 m3.

The storage tanks will hold the LNG until it is piped via two cryogenic transfer lines to the wharf and LNG carrier. An existing wharf will be redesigned to berth two LNG carriers at a time, each with capacity between 140,000-265,000 m3. The carriers will be brought into the wharf at low speeds by up to three tugboats.

A rail yard will also be constructed and connected to the Canadian rail system. This will be used to load condensate, a petroleum liquid by-product of the liquefaction process. The plant will draw water from the Kitimat River, which will used be in a closed-loop system and treated at a water treatment facility before any residual water is returned.

Two flare stacks, one 60 metres and the other 124 metres, will be constructed as safety devices should venting prove necessary.

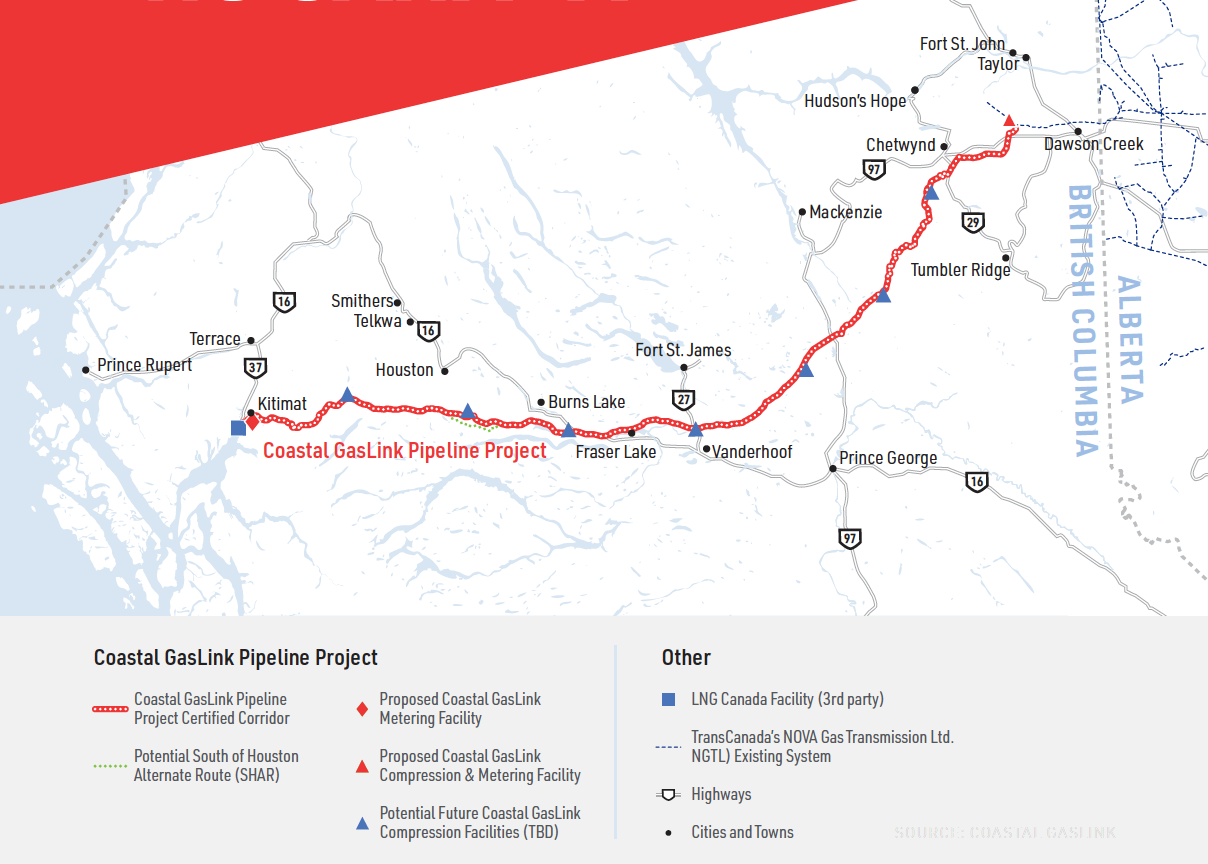

The Coastal GasLink pipeline will run 670 km from the Dawson Creek/Montney area to Kitimat.

The pipeline will be built, owned and operated by TransCanada. The pipeline is expected to cost $6.2bn with initial capacity of 1.7bn ft3/d (48mn m3/d). Shell, Petronas, Mitsubishi and Cnooc are all expected to develop existing upstream resources to feed the LNG plant, suggesting little impact on depressed Canadian gas prices unless the second phase of the project is implemented.

In October last year, a joint venture between Fluor Corp and JGC Corp was awarded the engineering, procurement, fabrication and construction contract, worth $8.4bn and $5.6bn respectively. Oil services company Baker Hughes will install four GE LMS100-PB natural gas turbines and eight centrifugal compressors for the LNG export project. The turbines are rated at 105 MW and 45% efficiency at ISO conditions.

Download this article and many others by subscribing to LNG Condensed ↓

_f193x247_1552386214.jpg) LNG Condensed brings you independent analysis of the LNG world's rapidly evolving markets.

LNG Condensed brings you independent analysis of the LNG world's rapidly evolving markets.

Covering the length of the LNG value chain and the breadth of this global industry, it will inform, provoke and enrich your decision making. Published monthly, LNG Condensed provides original content on industry developments by the leading editorial team from Natural Gas World.

LNG Condensed is your magazine for the fuel of the future. Sign Up Free below:

Volume 1, Issue 2 - February 2019

> Japan: future uncertainty, but potential upside

> Which ship engine should a new ship owner shoot for?

> Argentina to join LNG production club

> Poland’s 2040 energy plan provides key role for LNG

> LNG Canada — a game changer for Canada’s gas industry

> Conference Report: EGC Vienna

and more!

Sign up now to receive LNG Condensed monthly FREE