[NGW Magazine] Iran fails to hit targets

Just over two years since its nuclear deal, Iran has only managed to attract $1.3bn in foreign investment – mostly from China – in upstream oil and gas projects, or 4% of what it has projected.

Iran is lagging behind on the plans to develop its upstream oil and gas business. It had hoped for about 32bn m³ to date from abroad, assuming 16bn m³/yr. And on the domestic front, almost nothing has come from local companies so far.

Iran was counting on $20bn/yr being poured into its oil and gas projects in 2016-21, of which $16bn/yr should have come from abroad. Oil minister Bijan Namdar Zanganeh told parliament that the total investments in up/downstream oil and gas projects from domestic and foreign entities stood at $1.5bn in the first nine months of this fiscal year which started March 21, 2017.

A National Iranian Oil Company spokesman Mohammad Naseri told NGW that since the nuclear deal was implemented in January 2016, Iran has signed only two major agreements with foreign entities: a $5bn deal with a consortium led by French major Total for South Pars phase 11 (SP 11); and a $630mn deal with Spanish Tubacex to produce 600 km of corrosion-resistant alloy (CRA) pipes to be used in South Pars gas field’s new phases. The sulphur content of the field is 5,000 parts per million.

Iran also signed a 10-year contract with Russian Zarubezhneft March 14 to develop the Aban and West Paydar oil fields, which produce 37,000 barrels/day together now. Zarubezhneft has 80% and local Dana Energy 20% of these projects which will cost an estimated $741mn to develop.

NGW learned that Total has spent $50mn since sealing the deal with NIOC, mostly on preparation and studying the project. It presented Iranian officials and local companies with details of four tenders it has issued to select subcontractors for SP 11. Iran said March 6 that Total has selected the winning subcontractors and will notify them soon that they can start developing the project, although the French company is still reluctant to start works owing to the threat of US sanctions.

Iran says that if Total were to leave the contract, another shareholder, China National Petroleum Corporation (CNPC), which now has a 30% stake, could take Total’s 50.1% share but so far CNPC has not confirmed its intention to do so. Total is expected to spend $3bn (including $0.5bn taxation) on the project and make a profit of $6bn in 20 years. Naseri said that Iran has defined up to $110-bn worth upstream projects in five years, mainly in the oil sector, but domestic companies do not have enough funds and technology to become themselves involved in these projects on their own accounts. “They have to establish a joint venture with foreigners,” he said.

In the SP 11 deal, Total has established a joint venture with Petropars (19% share); and Tubacex has formed a joint venture with Mobarakeh Steel (50%). Although the Spanish company is obliged to build a CRA production unit and transfer the technology to Iran, it still has a few years to do so as the contact was only signed in mid-2017 and that allowed three years. It will be built on Geshm Island in the Persian Gulf.

“Iran has allocated $5bn from its national development fund to maintain oil production and renew the equipment in oil and gas industry, but when it comes to the future of new upstream projects, it depends on foreign investment. We have signed above 30 memoranda of understanding with foreigners and hope to finalise several oil contracts next year,” Naseri said, adding that only one local company, Ghadir, has a $2.5bn upstream contract with NIOC. It is not clear how much they have spent as of now. Ghadir announced in 2016 that 85% of the cost is expected to be met by overseas firms.

Recently Iran said that the negotiations with Russian companies to develop three oil fields have neared conclusion and in total, two contracts are planned to be signed in spring. Ghadir has a $7bn memorandum of understanding with Russian state-owned Zarubezhneft and Turkey’s Unit International to develop several oil and gas fields.

Midstream projects in better condition

Despite the problems of the up/downstream projects, the midstream gas projects are in a better state, Saeed Momeni, the national Iranian gas company’s (NIGC) director for gas supply told NGW, adding that $1.4bn have already been invested in the grid this fiscal year. “Currently 26mn households are connected to the grid. 98% of urban and 70% of rural houses are supplied with natural gas,” he said.

Iran’s gross gas production was a little more than 293bn m³ (802.73mn m³/dayay) this fiscal year (including flaring and re-injection), about 3% more than last year when it grew 9.6% on the year before.

South Pars accounts for 70% of the country’s total gas production, producing 560mn m³/day gross gas. Iran plans to bring the volume to 616mn m³/day next year and when all 28 standard phases are operational, which is expected to be the case from 2021, it will produce 780mn m³/day.

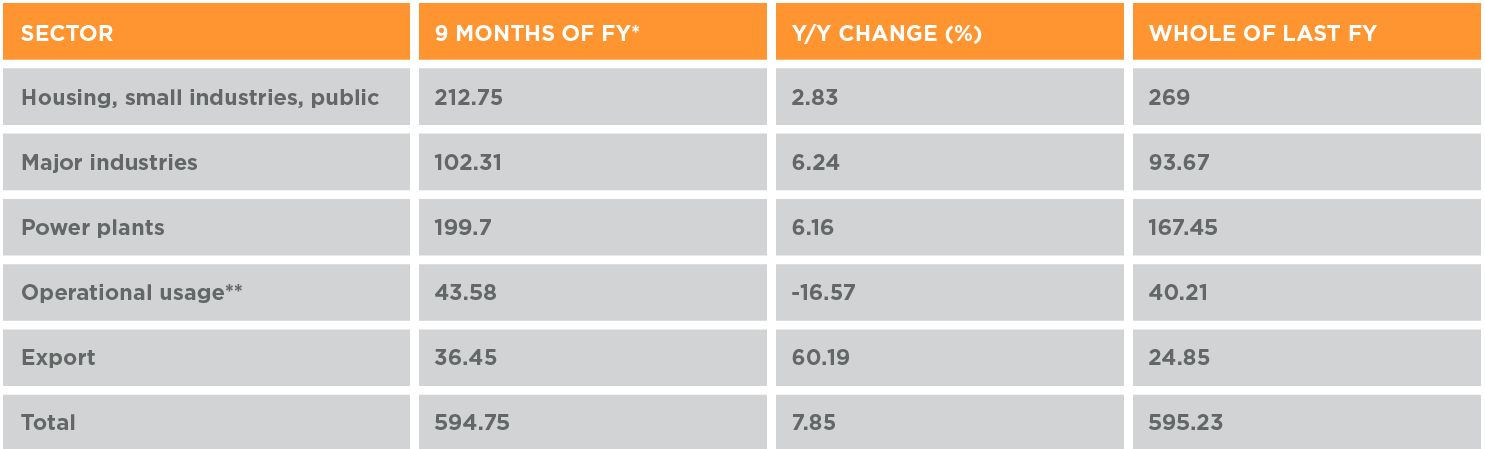

Gas deliveries to major sectors

Source: NIGC, mn m³ * FY: Fiscal year. ** Operational use includes NIGC’s own gas in processing and transport fuel.

The country also lost 11bn m³ from grid leaks and 16.5bn m³ were flared, but the amount flared is coming down, with a reduction of 0.8bn m³ last year at the fields on Geshm island. Iran needs $5bn to curb flaring altogether.

With refined gas demand of about 207bn m³/yr and oil demand of 1.7mn barrels/day but home to less than 1% of world population and just 0.54% of global GDP, Iran has a very high energy intensity. According to documents obtained by NGW, Iran needs 0.9mn mt oil equivalent to create $1000-worth of GDP: nine times more than Japan and Germany and double the global average. Iran had a $200-bn plan to halve energy intensity and slow the emission growth by 2030.

Developing cross-country major pipelines

Iran also has almost completed the Iran gas trunk-line 6 (Igat 6) this year, aimed to transit 110mn m³/day of gas from South Pars to its western regions. Almost half of that will go to Baghdad and Basra in neighbouring Iraq, based on two contracts each for 25mn m³/day.

NIGC told NGW that $10bn contracts for Igat 9 & 11 have also been signed with local companies after negotiations with foreign entities, including South Korean Kogas, failed. The projects have not started yet.

Both pipelines will be able to carry 110mn m³/day from South Pars, with Igat 9 going northwest and Igat 11 going northeast. Potentially the two lines can supply gas to Turkey, EU and Afghanistan, although the latter now is expecting gas from Turkmenistan, having broken the ground on the long-awaited and much doubted 33bn m³/yr line that will also go to Pakistan and India (Tapi). NIGC told NGW that Iran plans to define further midstream projects totalling $8bn in the next four years. Momeni also said that connecting remote industries to the grid, saving 2.7bn litres/yr on liquid fuel, would cost $1.7bn.

During the first nine months of the year, some 16.5mn m³/day were supplied to refineries, 46mn m³/day to petrochemical plants, 25mn m³/day to steel plants, 6.5mn m³/day to cement plants and 1.8mn m³/day to aluminum and copper plants, he said. Iran used 53.36bn litres of LPG, gasoline, diesel and fuel oil in total during the same period, of which almost exactly half – 49.4% – was diesel and fuel oil.

Gas demand

Momeni says the gas shortage in the housing sector is nearly over, but in winter the supply to other sectors is still declining, mostly because of the historic 570mn m³/day demand record in the housing sector this year.

Iran plans to increase gross gas production capacity from 800mn m³/day today to 1.2bn m³/day in 2021. Growth is expected to come mostly from South Pars, the same reservoir known as North Field in Qatar.

However, South Pars is expected to face a fall in pressure of 30 bars by 2023 and to lose 40% of its output. Iran needs to spend $20-25bn on new platforms that weigh 20,000 mt, each carrying several giant compressors to maintain production.

Momeni said that Total will build the first such platform for SP 11 (at a cost of $2.5bn) and will transfer the necessary technology so that Iran can make more. Iran has spent $95bn and launched 27 of the total planned 41 ordinary platforms at the South Pars gas field, with some of them – 17-20 – below capacity.

The Iranian section of the reservoir contains 14 trillion m³ gas, or a third of the reserves, and needs a further $10bn to complete (excluding the cost of the giant platforms), Pars Oil and Gas company (POGC) told NGW.

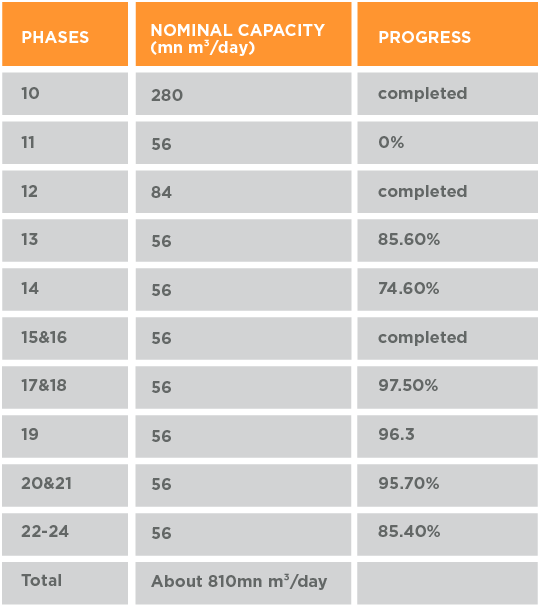

Latest developments in South Pars as of 3Q 2017

Qatar also plans to increase production from this field by 10% in the coming years. The two countries produce almost the same volume of gas from the field.

Other fields

Iran has other fields such as Kish, Farzad and North Pars to offset the fall in output from South Pars, but there is no chance of bringing them onstream in the near term without involving foreign companies.

Alongside South Pars, POGC is also responsible for development of North Pars, Golshan, Ferdoosi, Balal and Farzad B – these last four holding collectively perhaps 1.6 trillion m³ – and the oil layer of South Pars. Although South Pars/North Field straddles the border, Iran's North Pars field, which has 1.67 trillion m³ reserves, lies wholly within Iranian waters.

Coming to costs and revenues of South Pars, POGC says developing two standard phases (with 56mn m³/day capacity) will cost about $5bn and the revenues will recoup the investment in just 2-2.5 years. Iran estimates there will be a $42bn profit from each standard phase over 20 years. Iran has introduced newly designed contract model, called Iran Petroleum contract (IPC) to put development of 49 oil and gas fields on tender, expecting $20bn/yr investment, of which 80% would come from abroad.

But so far Iran has not signed any contracts with foreign entities, despite delaying the tenders several times. NIOC told NGW that apart from the threat of US sanctions, foreign companies have not completed their studies on some of the fields.

“The first tender on Azadegan oil field may be issued after March 2018,” he said. The Iranian government should have issued tenders in 2016, but domestic critics and rival hardliners led to several amendments of the contract.

Then the US presidential victory of Donald Trump and his tough position against Iran cast a shadow on its upstream – one that lengthened with the dismissal of his Secretary of State Rex Tillerson on March 12..

Dalga Khatinoglu, Rashel Aramyan