Petchems and the need for gas [NGW Magazine]

Petrochemicals are becoming an important part of oil and gas future demand growth, but they constitute a global energy system ‘blind spot’, not receiving the attention they deserve. This was the conclusion of a report released in October by the International Energy Agency (IEA) on the ‘Future of Petrochemicals – Towards more sustainable plastics and fertilisers.’

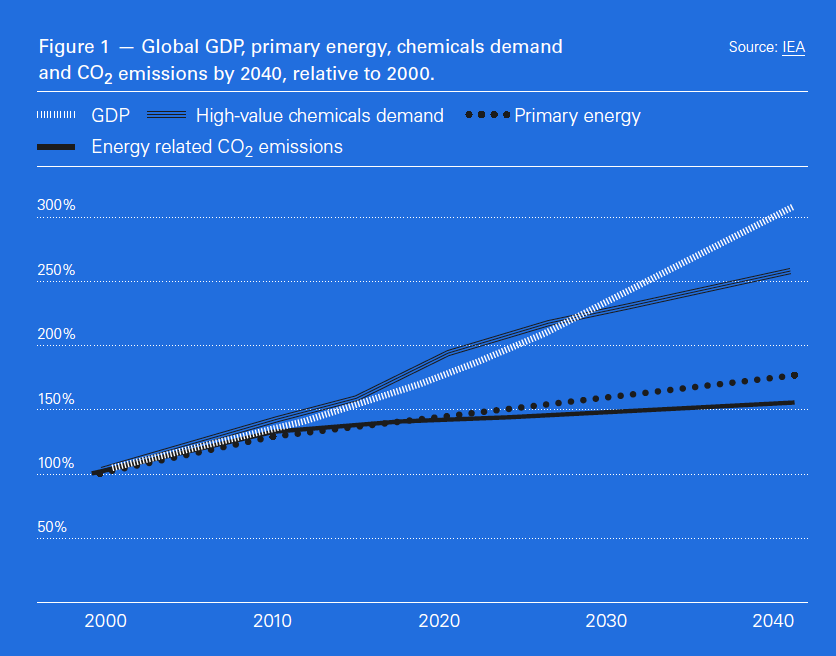

Despite environmental concerns, the petrochemical industry has been growing steadily and will continue doing so, in line with global GDP growth (Figure 1). Chemicals demand is expected to increase by over 250% in comparison to 2000.

The IEA says the petrochemical industry is expected to become the major driver in the growth of oil demand in the future. But its use of natural gas is also increasing. At present it accounts for about 8% of global gas consumption, about 300bn m³/yr, expected to grow by another 56bn m³/yr by 2030.

Among bulk materials worldwide, plastics are growing much faster than steel, aluminium or cement. The use of synthetic nitrogen fertilisers is now widespread, contributing to the production of almost half the world’s food.

Advanced economies, US and Europe, use twenty times the amount of plastic used by developing countries and about ten times as much fertiliser on a per-capita basis. Evidently there is massive scope for further growth.

As expectations grow that oil demand, but also gas demand, may peak over the next 10 to 20 years, the oil and gas industry is pushing development of petrochemical business as a way to sell more of their products.

.png) Surging demand

Surging demand

Petrochemicals are an integral part of modern living, used in everyday products such as textiles, transport, packaging, construction, electrical and electronic equipment, consumer products, fertilisers, and even in producing renewable energy (Figure 2). Packaging consumes 36% of plastics globally, by far the biggest end-user sector.

Demand for petrochemical products is increasing rapidly, as the global economy grows, with no economically viable alternatives. It is hard to see this abating. MarketWatch estimates that by 2023 the global petrochemicals market will reach $1075bn.

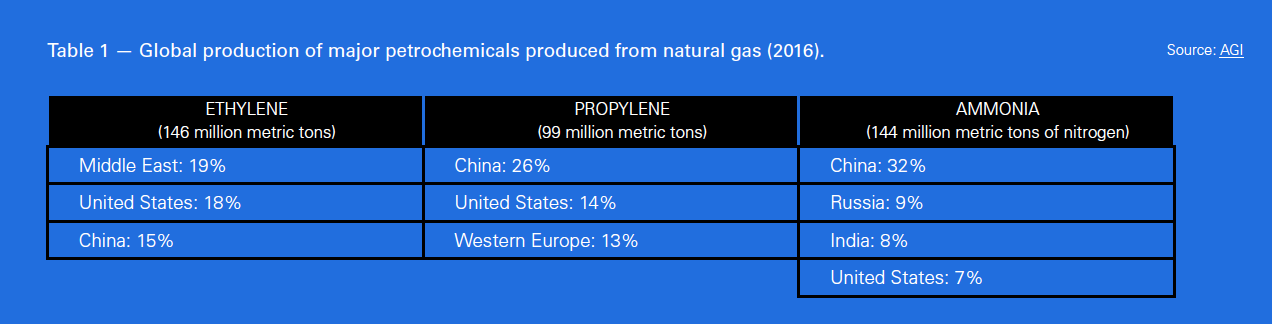

Petrochemicals produced from oil and gas make up around 90% of all feedstocks. The global production of major petrochemicals produced from natural gas, ethylene, propylene and ammonia, is summarized in Table 1.

But as IEA points out: “Petrochemicals are one of the key blind spots in the global energy debate. The diversity and complexity of this sector means that petrochemicals receive less attention than other sectors, despite their rising importance.”

Global petrochemical installed production capacity was 610mn metric tons (mt) in 2017. Of this, 90mn mt, or 15%, is in North America. With shale gas in abundance, over the next decade North America is expected to construct about a quarter of the additional capacity that is needed worldwide.

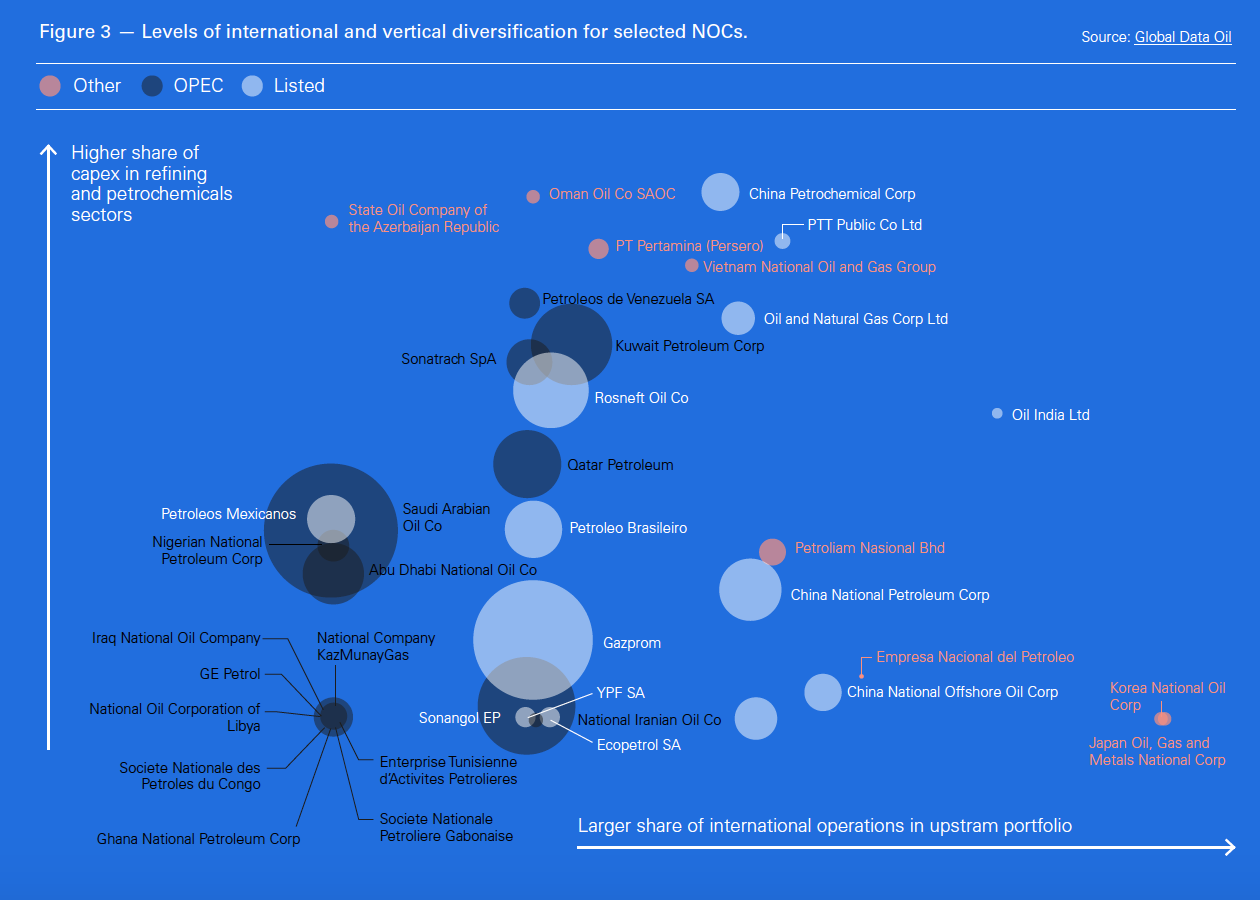

In a recently released report, GlobalData forecasts that national oil companies (NOCs), led by Saudi Aramco, are planning to spend $116bn in new petrochemicals projects. This is part of their diversification beyond upstream oil and gas exploration and production (Figure 3), as the world transitions away from fossil fuels into cleaner energy.

Through these investments NOCs hope that demand for high-value hydrocarbon-derived products will continue to grow strongly during energy transition, countering reduced consumption, lost to renewables in other sectors.

The IEA says that China and the US will see the largest near-term capacity additions, with longer-term growth led by Asia and the Middle East: “By 2050, India, southeast Asia and the Middle East together will account for about 30% of global ammonia production.”

An essential ingredient of the petrochemicals industry is the availability of easily accessible, and very importantly, cheap feedstock. The US, the Middle East and China are well placed in this respect. India’s petrochemicals demand is growing fast but it is comparatively lower, facing challenges.

But Europe will struggle to compete. Europe is one of the most expensive places in the world to make petrochemicals, and cannot compete with the US, the Middle East and China. Energy, in the form of gas, in Europe is three times higher than in the US today. There are no cheap feedstocks in Europe. The US and Middle East feedstock costs are much lower. On top of this, demand growth is low and regulatory compliance costs are high. The future of Europe’s petrochemicals industry is challenging.

Petrochemicals in the US

Until about early 2000s, petrochemical plants in the US were closing down. But since then they have been experiencing a major resurgence, benefiting from increasing volumes of low-cost shale gas and gas liquids. The Energy Information Administration (EIA) forecasts that US natural gas production will carry on increasing, expected to grow by 59% between 2017 and 2050, reaching about 1.22 trillion m³/yr. Benefiting from this, the US has now increased ethane-based petrochemical production, accounting for about 40% of global capacity.

More specifically, the US Gulf Coast is experiencing a rapid pace of petrochemical growth, even outpacing the Middle East (Figure 3). In fact even Middle East companies such as Sabic and Saudi Aramco are in the process of expanding their chemical operations in the US, benefiting from the availability of low-cost feedstock.

Sabic is partnering ExxonMobil to build the world's largest ethane cracker, to process ethane into ethylene, a basic component of most plastics, as part of a massive $10bn petrochemical complex near Corpus Christi. Shell, Total and other major international companies are also investing in US petrochemical industry.

While ethane faces challenges in Saudi Arabia as there is little gas available, cheap supplies have been growing rapidly in the US, where production is projected to increase by about 60% to 2mn bls/day by 2021, up from 1.26mn bls/day in 2016, according to IHS Markit.

The very low feedstock cost has created a substantial difference in the cost of plastics made in the US, where companies now enjoy a rare advantage. This is also offering opportunities to fertiliser producers, who are investing in building plants.

This low cost also makes it possible to export ethane and propane from the US to China, India or Europe at low prices.

As a result, the US Gulf coast is capitalizing on its access to cheap ethane and other natural gas feedstocks, attracting investment into expansion of existing plants and building of new ones. In addition, the Ohio-Pennsylvania-West Virginia ‘crescent’, with huge resources of equally or even cheaper shale gas, is challenging the Gulf Coast region in building new profitable petrochemical plants. This is helping US petrochemicals gain a leading position in the global market. Canada, with its plentiful cheap natural gas, is hoping to replicate this.

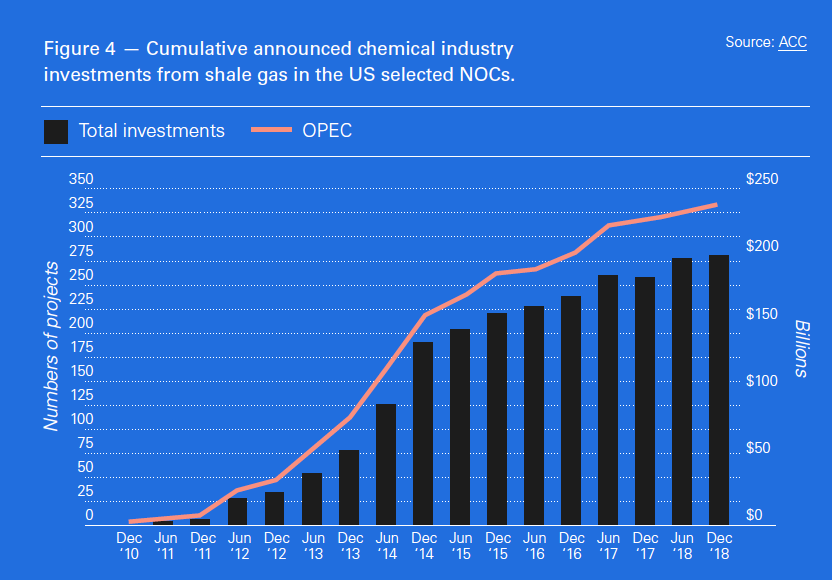

According to an American Chemistry Council (ACC) announcement in September, since 2010 this investment has surpassed $200bn (Figure 4).

The key messages from ACC are:

- Since 2010, 333 chemical industry projects have reached a total value of $202bn.

- 53% of these projects have been completed or are under construction, while 43% are still in the planning phase.

- These projects could lead to $292bn in chemical and plastics output, supporting 786,000 jobs nationwide by 2025.

- About 68% of the $202bn is foreign direct investment or includes a foreign partner.

This prompted ACC’s president and CEO, Cal Dooley to say: “This is an exciting milestone for American chemistry and further evidence that shale gas is a powerful engine of manufacturing growth…The US remains the most attractive place in the world to invest in chemical manufacturing. We look forward to continuing to transform energy into a stronger economy and new jobs.”

Petrochemicals in the Middle East

The Middle East is blessed with low-cost locally available feedstocks. Led by Saudi Arabia and Iran, it remains the lowest‑cost centre globally for many key petrochemicals, with many new projects being announced in Saudi Arabia, Kuwait, Qatar, Egypt and other countries in the region.

The recent, controversial, investment conference in Saudi Arabia led to the signing of deals worth more than $50bn in sectors which included petrochemicals. Notable among these was an agreement to build an integrated petrochemical complex and downstream park in the second phase of the Satorp refinery, jointly held by Saudi Aramco and Total.

Egypt announced in June its intention to establish the largest petrochemicals complex in the Middle East. It is about to sign a contract with Carbon Holdings, the local company that would build the complex. The Tahrir petrochemical project is expected to cost about $10.9 bn and will be built in the Suez Canal economic zone. Financial close is expected at the end of this year. Construction is expected to take about four years and will eventually double Egypt’s petrochemical exports. This comes on the back of Egypt attaining gas self-sufficiency this year, with production expected to exceed domestic consumption as Zohr ramps-up in 2019.

Not to be left behind, Qatar Petroleum (QP) is proceeding with the development of a new world-scale Petrochemicals Complex at Ras Laffan Industrial City, to start operations in 2025, using ethane as feedstock.

The Middle East still leads the world in terms of total petrochemicals capacity, reaching 150mn mt in 2016. However, in terms of gas, apart from QP and now Egypt, lack of new ethane supplies is forcing other producers in the Middle East to switch to higher cost feedstocks derived from crude oil, eating away their competitiveness in global markets, especially when it comes to competing with the US. It also makes it more difficult to attract new investors.

Not surprisingly, substantial effort is being placed in research to develop new processes for the efficient conversion of crude oil into fuels and petrochemicals. It is hoped that through more advanced process technologies, the downstream sector can adjust to changing feedstock availability while maintaining its competitiveness.

At the annual Gulf Petrochemicals and Chemicals Association (GPCA) forum in November 2017, its chairman, Yousef Al-Banyan, CEO Sabic, said that GPCA’s members will have “to transform themselves and increase productivity, move from basic products to specialty products and embrace sustainability, digitisation and partnerships in order to raise global competitiveness.” This holds true, even more so, today.

Petrochemicals in China

China is the world's top chemicals consumer, accounting for a third of global demand. It is in the process of building another 15 ethylene complexes between now and 2023, with a total, additional, capacity close to 15mn mt/yr. This will constitute the biggest wave of petrochemical expansions ever. In doing so, it is allowing access of global companies and Chinese independents into this vast industry.

China is using oil and cheap coal and methanol as the main sources of feedstock of its rapidly growing chemicals and petrochemicals sector. Coal is plentiful, cheap and indigenous, and can be converted into methane, not having to rely on expensive imports of oil and gas, which have also proved to be vulnerable to security of supply risks. The IEA states that “Coal-based methanol-to-olefins capacity in China will nearly double between 2017 and 2025, providing the material inputs for its large domestic manufacturing base.”

However, this makes environmental impact from China’s petrochemicals sector quite substantial, accounting for about 18% of the industrial carbon emissions globally.

Nevertheless, China is likely to generate half of all global growth in petrochemical production between now and 2025. This relies on its huge potential for domestic demand to continue growing, while exports are still expanding.

This is what has attracted ExxonMobil to sign deals in September with the Guangdong provincial government to proceed with a multibillion-dollar petrochemical project, expected in start in 2023, despite the trade war between China and the US. Shell, Total and BASF are also active in China’s petrochemical industry. Saudi Aramco and Sabic are following suit.

However, despite impressive growth, China’s chemicals industry remains unbalanced, needing to rely on imports of some key products, such as ethylene. But despite that, petrochemical plant development does not show any signs of slowing down.

Petrochemicals in India

Even though experiencing healthy growth, over 10% per year, the penetration of petrochemicals in India is far lower than the global annual average, estimated to be about 10 kg per capita compared to the global average of about 30 kg per capita. This indicates a significant potential for future growth to satisfy increasing domestic demand.

Total installed capacity of major petrochemicals is about 18mn mt, which is less than 3% of the world total.

India’s petrochemicals sector faces several challenges, key among which are limited access to competitive feedstock and regulatory and policy limitations. India needs to overcome these challenges if its domestic industry is to reach its full potential.

In fact, with limited natural gas reserves, India is becoming increasingly reliant on imports of shale gas-derived ethane from the US, benefiting from its low cost. The country is also importing 90% of its methanol requirement mostly from Iran and Saudi Arabia.

There is a drive by the government to promote cheaper materials in industries such as farming and food packaging, and India’s oil refiners are trying to respond. At present the country is importing about half of its petrochemicals consumption.

A number of Indian state-owned energy companies are committing to major investments to boost their petrochemical activities and are expected to become significant players in the sector. Capacity expansions by several other manufacturers are moving ahead and gradually filling the gap between domestic demand and supply. But it remains to be seen how successful they will be.

Reliance Petrochemicals, India’s largest, but also the world’s largest integrated producer of polyesters, polymers, elastomers, chemicals and textiles, is leading this expansion.

Concerns

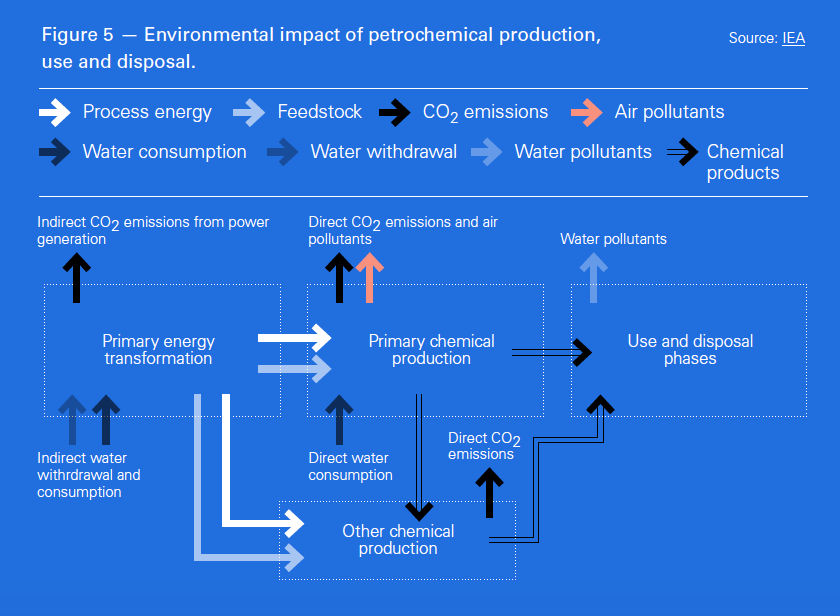

Introducing the IEA’s report, Fatih Birol, Executive Director, said “As the global economy develops, the future of the petrochemicals industry is of major significance for both global energy security and the environment.” Even though petrochemical products provide substantial benefits to society, their production, use and disposal present a variety of climate, air quality and water pollution challenges that need to be addressed (Figure 5).

It is environmental concern over plastics pollution that is increasingly attracting attention, leading to a public outcry in Europe over the last few months, forcing measures to tackle plastics waste, estimated at 10mn mt/yr.

Recycling measures are still evolving, and certainly have a long way to go in the developing world where the most potential for growth in the use of plastic products is. For example, for each metric ton of polyethylene being recycled, about the same amount of ethylene can be saved, or least 1.5 mt of oil.

Another environmental concern is that chemical plants are associated with emissions of hazardous air pollutants. It is essential for existing and new plants to demonstrate that they are abiding by air quality standards and are using the best methods available for pollution control to within permissible limits.

Policy to address environmental concerns is still evolving, as the world starts to understand the ramifications of the increasing use of plastics and their impact on pollution and waste, especially in the world’s oceans. Policy to encourage recycling of at least some of the waste can go some way in alleviating part of the problem, as demonstrated in some parts of Europe. Discovering ways to break down plastics, making disposal easier, could have an even stronger effect.

Despite these concerns, the difficulty in developing competitive clean alternatives is a key factor underpinning the robust overall demand growth for petrochemical products.

In order to address the challenges, the IEA report describes a ‘Clean Technology Scenario’ (CTS) in line with UN’s Sustainable Development Goals, providing an ambitious but challenging pathway to reduce the environmental impacts of petrochemicals by 2050. This includes waste management improvements to achieve rapid increase in recycling, with the aim to more than halve cumulative, ocean-bound, plastic waste by 2050.

The future

Despite these concerns, the future for petrochemicals is bright, with no sign of growth being reversed over the next 15 to 20 years. This is driven by demand in developing economies growing at rates which exceed GDP growth. Demand growth will also carry on increasing in developed economies, but at slower rates (Figure 1). A future without petrochemical products seems unlikely.

New processes

New processes and technological improvements increase efficiency, bring costs down and lead to the development of new products. An example is the development by Siluria and Linde Engineering of a new, one-step, gas-to-chemicals process to produce ethylene based on oxidative coupling of methane.

Methane is a plentiful and cheap feedstock, from abundant conventional and unconventional gas resources, that cannot be converted to ethylene through conventional steam cracking. It is the discovery of novel processes like this that has the potential to increase use of gas in the production of petrochemicals beyond historical growth rates.

The holy grail of converting CO2 into chemicals, instead of releasing it into the atmosphere, could be a major breakthrough in the drive to decarbonise fossil fuels. But, despite considerable research effort, with some degree of success, doing this commercially at large scale is still some way off.

Better data management and more digitalisation also enables considerable savings in operating costs, increased margins, optimisation and technology and product innovation.

Regulatory frameworks that encourage development of new technologies and their commercialisation, especially development of biodegradable plastics and improved plastic recycling technologies, could only be beneficial for the industry as well as the environment.

On the other hand, policy measures could also help reduce future petrochemical consumption and waste. These include more efficient packaging; banning single-use plastics; improvements in waste collection and increase in recycling rates; and biofuels as feedstock.

Demand for plastics and fertilisers will continue growing, in line with increasing global populations, economic development, technological advances and the expectation of better living standards. Given the strong link between petrochemicals and fossil fuels, a world dependent on petrochemicals offers the fossil fuel industries future growth opportunities outside the traditional sectors of power generation, heat and transportation, which are being challenged by renewables.