Perspectives on the Future of Gas [Gas Transitions]

US consultancy McKinsey came out with a shocking report earlier this month which attracted very little attention in the international media. The famous firm has been giving out a semi-annual scorecard on Germany’s Energiewende since 2012. The latest edition of this Energiewende Index, published September 5, presents a devastating picture of the state of affairs in Europe's biggest economy.

Although German households are paying by far the highest electricity prices in Europe, to support renewable energy, Germany won’t come close to meeting its 2020 climate targets, reports McKinsey. German CO2 emissions were 866mn metric tons in 2018, which is 116mn mt – 15% –adrift of the 2020 target of 750mn mt. If the country continues as it has been doing the last decades, the 2020 target won’t be reached until 2046, by which time the target will be much lower.

But what is worse, the country is also headed straight for an energy shortage, warns McKinsey. “Energy security is no longer guaranteed after [the announced] coal and nuclear phaseout,” it says. “In the next ten years with the nuclear and coal phase-outs some 43% of power generation capacity [29 GW by 2030 and another 17 GW by 2038] will be taken off the grid.” McKinsey warns: “If no measures are taken, Germany’s energy supply security will be endangered.”

For the German government it’s an embarrassing predicament. With the German people clamoring for strong climate policies and tens of billions of euros to spend, the government is failing on all counts of the energy trilemma: affordability, sustainability and security.

According to McKinsey, to get back on course, Germany needs to step up its energy efficiency efforts, increase renewable power production and electrify its transport, heating and industry sectors. The Index notes that until now only the power sector in Germany has contributed materially to CO2 emission reductions.

However, McKinsey notes that Germany also clearly needs more power capacity: “New capacity of at least 17 GW will be necessary to compensate for the closures and to back up renewables and provide peak capacity. In addition to more renewables, new flexible power plants must be built or existing power plants must be kept in reserve.”

Let’s be honest: all this is pretty good news for the gas sector. And not just in Germany. The failure, if we may call it that, of the Energiewende, will send a clear message to policy-makers everywhere that they cannot base their climate policies on expansion of renewable energy alone. For one thing, they will need to ensure that there will be sufficient dispatchable power capacity in the system, be that of gas or nuclear power.

And this is all the more so if a country embarks on a massive electrification of its transport, heating and industrial sectors, as McKinsey recommends.

'Gas has a much brighter future than oil'

As I reported recently on NGW, the German government already seems to have come to the conclusion that it will need natural gas for some time to come to get out of the hole it has dug for itself.

That the prospects for gas are bright is confirmed by the latest edition of DNV GL’s annual Energy Transition Outlook (ETO), published September 11. DNV GL, headquartered in Norway, is a globally active provider of risk management and quality assurance services to the maritime, oil and gas, and power and renewables industries. It has published its ETO since 2017 – this is the third edition.

What I find refreshing about the ETO is that it dispenses with scenarios. It gives one single projection of future energy demand which it straightforwardly describes as “a forecast of the most likely path ahead”. This is based on a proprietary “integrated system dynamics simulation model” that ”reflects relationships between demand and supply in several interconnected modules” in 10 regions of the world. It seems a pretty thorough piece of work.

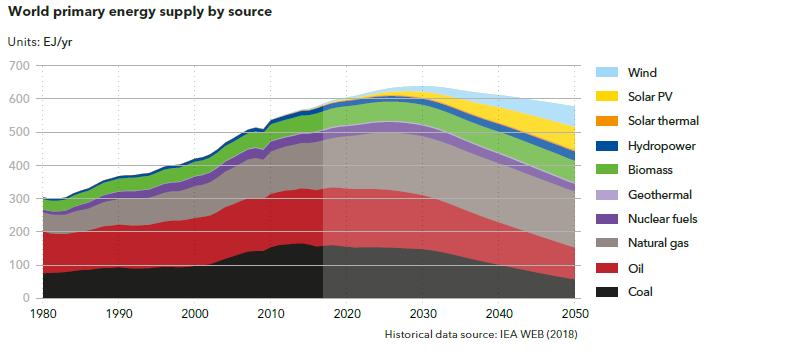

And it is bullish on gas. According to the ETO, “gas has a much brighter future than oil.” It will become the largest primary energy source in the world by 2026, when it will overtake oil, says the report.

Gas demand will keep rising until 2033, according to the ETO. It will then plateau at around 5.5 trillion m³, 19% higher than today, and “remain dominant until the end of our forecast period in 2050, when it will account for 29% of the world energy mix.” By 2050, global gas demand will be 5.17 trillion m³, still 13% higher than today.

Source: Energy Transition Outlook, DNV GL, September 2019

However, there are some important points to note about this forecast. For one, it is not in line with the IEA’s 2 degree scenario. If DNV GL’s outlook comes true, temperatures will have risen by 2.4° Celsius, based on current climate science. Thus, says the ETO, “Regulatory issues – such as carbon pricing, emission caps, and pollution regulation – could pose risks to the future share of gas in the global power generation mix.”

In addition, the gas supplied in 2050 will not all be natural gas: “The nature of the gas we consume will begin to change quite dramatically in the lead-up to mid-century, as the gas supply begins to be decarbonised through the introduction of new forms of gas such as biogas, hydrogen and syngas.”

Hydrogen demand in particular “has increased in our forecast compared with the results of our 2018 modelling,” says the report, although it will still only provide “less than 2% of global final energy in 2050.” This “is largely due to the lack of current policy to support the large-scale rollout of hydrogen as an energy carrier.”

The ETO adds: “There is clear evidence of the benefits of hydrogen as a low-carbon fuel for heating, industrial decarbonisation and transport, and several ground-breaking projects are developing its applications. However, our model reflects a lack of clear support for carbon capture and storage, which is a necessary engineering solution to allow ‘blue’ hydrogen (produced from fossil fuels) to be developed at scale, as opposed to ‘green’ hydrogen produced via electrolysis.”

Another point to note: while gas demand will continue to increase in India, China and southeast Asia, it will peak in Europe at 615bn m³ in 2021 and in North America at 1270bn m³ in the same year.

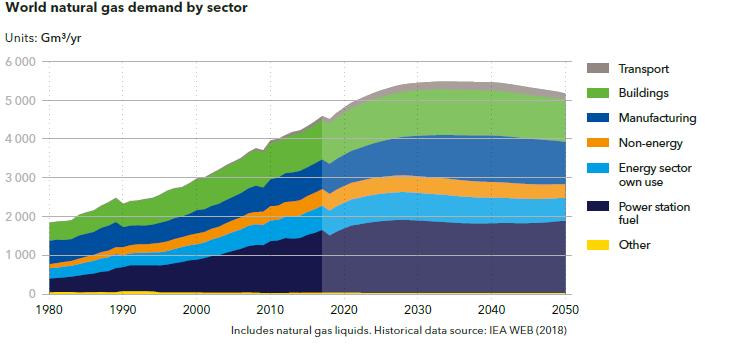

The ETO sees the brightest prospects for gas in the manufacturing sector, which will become “the most demand-intensive sector for gas beyond 2035”:

Source: Energy Transition Outlook, DNV GL, September 2019

These developments will have important implications for gas infrastructure. According to the ETO, “gas trade forecasts and other results from our model support the requirement for new pipelines including those for cross-border transmission; and, significantly increased demand for liquefied natural gas (LNG) terminals of varying scale (liquefaction and regasification terminals, fixed and floating assets). We predict seaborne natural gas trade (LNG and liquefied petroleum gas combined) to more than quadruple, from 383mn mt/year in 2017 to 1,604mn mt/yr in 2050.”

“Gas is critical to keeping household energy bills at reasonable levels and ensuring industrial competitiveness"

The report adds that “we expect increased expenditure on, and activity associated with, older pipeline systems in several regions, including Europe, Middle East and North Africa, North America, and northeast Eurasia. In several countries, pipeline systems and compressor networks will continue to be repurposed and undergo changes of service due to shifts in where gas is produced and consumed. This will be driven by new gases (e.g. hydrogen and biogases) entering gas networks at local distribution level, and by a growing share of LNG imports over traditional, piped gas from offshore locations.”

Gas has several significant advantages over electricity, says DNV GL. “In many countries, gas networks transport more energy at lower cost than electricity networks, and can be particularly important for meeting peaks in demand. During peak winter demand periods in colder climates, gas networks can provide several times more energy than the electricity grid network, and they have a significant role to play in energy storage and peak shaving.”

In the UK, for example, “gas demand peaks at around 2.5 TWh/day in winter. This is compared with an electricity demand peak of around 1 TWh/d. Including exports, storage, power stations, industry and local uses, overall gas demand in the UK peaks at around 4 TWh/d, around four times that of electricity.”

In addition, “Gas is critical to keeping household energy bills at reasonable levels and ensuring industrial competitiveness,” says the ETO. A crucial point.

Looking specifically at Europe, the report notes that “for domestic customers, the average price of gas across the EU is 4.9 eurocent/kWh, or 6.7 eurocent/kWh including taxes and levies. For electricity, the average price is 13.3 eurocent/kWh, or 21.1 eurocent/kWh including taxes and levies. Per unit, electricity is around three times the price of gas, and the ratio is similar for industrial consumers. It is critically important therefore to consider direct decarbonisation of the gas system alongside greater electrification.”

As we saw above, when discussing the costs of the Energiewende, energy costs are (or should be) a key consideration for policymakers. According to the ETO, “The EU’s energy transition requires about 2.8% of GDP (EUR 520bn–575bn) investment annually to achieve a net-zero greenhouse gas economy in 2050, according to the European Commission. Using existing infrastructure such as a gas grids can help to keep down cost increases for consumers, thus making the energy transition more socially affordable and acceptable.”

No great surprise

Needless to say, not everyone is as positive about the future of natural gas as DNV GL. Another recent research report, The Future of Gas in Europe, written by Mihnea Catuti , Christian Egenhofer and Milan Elkerbout of the Brussels-based Centre for European Policy Studies (CEPS), which came out in August 2019, is somewhat less optimistic.

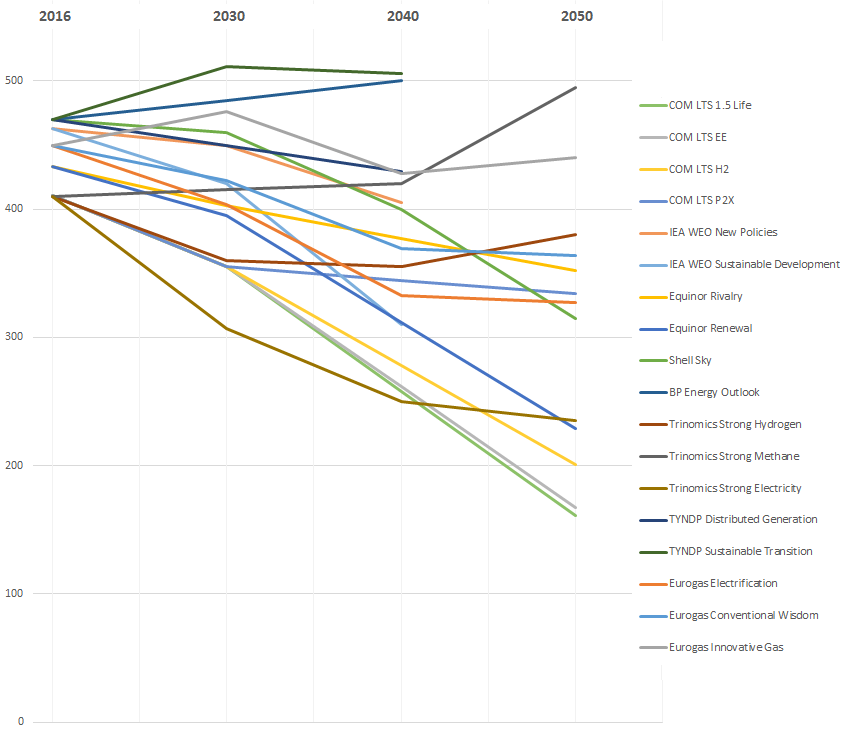

The CEPS study, which deals only with Europe, is useful because it provides an overview and analysis of all the most recent major studies on the future of the European gas market up to 2030 and 2050. In other words, it is a review of the literature.

Its main conclusions will not come as a great surprise. “Up until 2030, the demand for natural gas is projected to remain stable or to decrease slightly”, is how the CEPS study sums up the findings of the other reports. “Switching to natural gas-fired power plants can represent a short and medium-term solution for countries going through a coal phase-out. Gas can also contribute to the flexibility in the power sector necessitated by the increasing share of variable renewables such as wind and solar.”

CEPS notes that “the EU has one of the highest potentials in the world for switching from coal to gas-fired power generation, which can provide rapid emissions reductions. However, the window of opportunity for such a choice is limited.”

For the period after 2030, “natural gas investments are increasingly facing the risk of stranded assets, given the long lifetime of gas infrastructure projects”, write the researchers.

Most projections indicate a decline in demand for gas by 2040 and 2050: “There may be increases in demand in individual sectors, but overall, the future consumption of gas is generally predicted to fall. Europe’s choice of promoting energy efficiency measures and the electrification of end-users will create further pressures on gas demand.”

Projected gas demand in Europe according to a number of recent studies. Source: CEPS, August 2019

Projected gas demand in Europe according to a number of recent studies. Source: CEPS, August 2019

The reason for the expected long-term decline is clear: climate policy. The authors observe that “studies generally show a long-term correlation between the assumed greenhouse gas emission reduction target and the expected demand for gas (especially natural gas). In scenarios with greenhouse gas emission reductions of less than 80%, demand for gas is projected to be constant or to slightly increase … These projections generally represent business-usual scenarios that reflect current policies and market trends. … Scenarios targeting at least -80% greenhouse gas emissions generally project a decline in gas consumption …, but only scenarios consistent with a 95-100% reduction in greenhouse gas emissions project the nearly complete phase-out of natural gas.”

"It should not be assumed that gas is ‘safe’ in the energy transition"

Naturally, the expected decline in gas consumption will have a strong impact on infrastructure investment. Some studies, say the CEPS authors, “do not recommend any large-scale natural gas infrastructure investments (with the exception of a few LNG terminals), as all future consumption needs can be served using the existing infrastructure.” Nevertheless, “new projects may be able to improve security of supply and improve the functioning of the internal market, but investments would need to be made based on careful evaluation.”

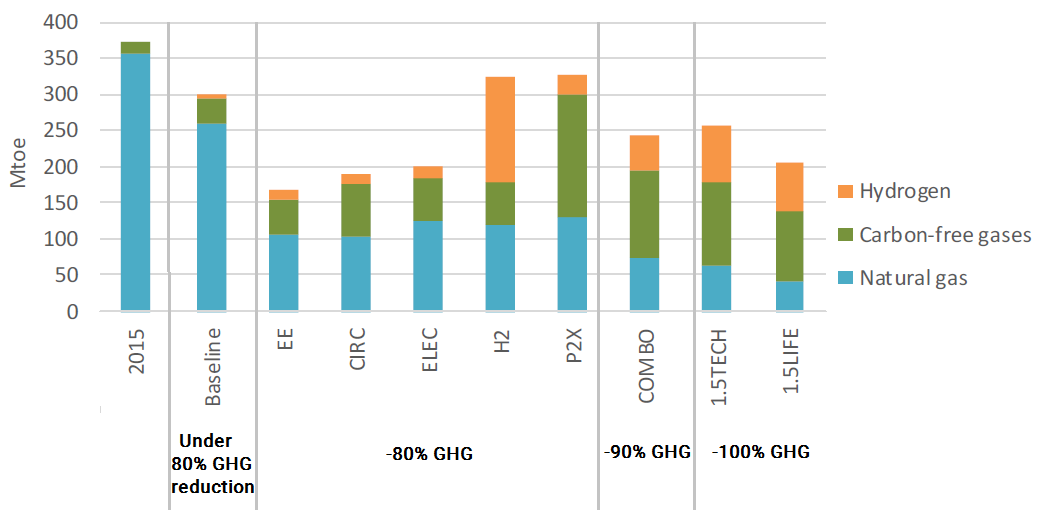

When it comes to the demand for “gaseous fuels”, i.e. including biogas, biomethane and hydrogen, “the picture is far more complex”, says the CEPS report.

A lot depends on the assumptions that went into the studies, notes CEPS: some scenarios with 100% greenhouse gas emission reductions have higher use of gaseous fuels than others with only 80% reduction, because of different assumptions on the extent of electrification of the energy system.

The differences are visible in this chart:

Projected demand gaseous fuels in Europe according to different scenarios. Source: CEPS, August 2019

CEPS observes that “biogas and biomethane are currently the most commercially ready alternatives to natural gas and require no major infrastructural upgrades. However, their production will be limited by the availability of feedstock and regional contexts.”

As to hydrogen, “delivering high volumes and developing a fully-fledged hydrogen infrastructure is improbable without blue hydrogen, produced from natural gas and using carbon capture and storage (CCS),” according to the authors. “Blue hydrogen would help in ramping up the production of hydrogen in initial phases, yet its production is not a carbon-neutral process – even with the use of CCS technology. Green hydrogen is produced from renewable sources and therefore requires high volumes of affordable renewable electricity and the further development and cost reduction of electrolyser technology.”

Nevertheless, one study, carried out by Frontier Economics, “estimates that even at a lower cost of €80/kWh, long-term and seasonal storage volume in batteries would be more than 100 times more expensive than in large gas facilities.” This makes hydrogen particularly suitable as an energy storage carrier, for use “in hydrogen gas turbines to generate electricity at peak times." Likewise, “biogas and biomethane-fired combined cycle gas turbines can also be used to provide peak capacity.”

A dim view

For the least positive outlook on gas we turn to Carbon Tracker – the London-based environmentalist think tank which invented the idea of the “carbon bubble.”

On September 5, the same day that McKinsey came out with its withering analysis of the Energiewende, Carbon Tracker published an update of its earlier reports which aim to show which oil and gas assets will become “stranded” if the world is to limit global warming to “well below 2 degrees.”

"We are now at a tipping point in the relative costs of clean energy portfolios and gas-fired power plants”

The new report, called Breaking the Habit, takes a dim view of the future of gas. It lays out two scenarios, called P1 and P2, which are both based on the IPCC’s Special Report published in October 2018, and which both assume that measures are taken to limit warming to 1.5° C.

The differences between P1 and P2 are not important for our purposes: both project a steep decline in gas demand. Carbon Tracker notes that they present a very different picture than the IEA’s Sustainable Development Scenario, which assumes 2° C warming, as can be seen in this chart (which includes projected oil supply):

![]()

Source: Carbon Tracker, Breaking the Habit, September 2019

“In scenarios with no or limited CCS, gas demand has to fall sharply”, writes Carbon Tracker: “-4.5% compound annual growth rate(CAGR) in P1 and -3.2% CAGR in P2. The addition of CCS in P2 makes relatively more space for oil than it does gas.”

The reasons that the IEA gives gas “some space to increase in the medium term” is that it allows a higher temperature outcome as well as significant CCS use. However, Carbon Tracker adds, “the limits are still clear: in the IEA’s SDS, the average carbon intensity of electricity generation falls from 484 grammes of CO2/kWh (g CO2/kWh) in 2017 to 69 g CO2/kWh in 2040-47. This compares to the carbon intensity of a new combined cycle gas turbine of 350 g CO2/kWh in 2048.”

Carbon Tracker concludes that “it should not be assumed that gas is ‘safe’ in the energy transition. There is considerable uncertainty regarding future demand in a decarbonising globe, and plenty of opportunity to invest in supply options that would destroy value.”

Tipping point

Allow me to conclude with some personal remarks. I believe the problems of the Energiewende show that no industrial country can run largely on renewable energy. That’s the good news for gas.

Nevertheless, it should not be forgotten that German energy policy has its idiosyncrasies. The German government’s decision to phase out its nuclear power stations was not very smart from a climate perspective.

In addition, Germany is failing to build the transmission grids that its energy transition needs. As McKinsey reports, just 1,087 km of the planned 3,600 km of power lines have been completed. Other countries may be more successful in turning their energy systems around. If temperatures keep breaking records, the pressure to “decarbonise” will become ever stronger.

As a sign on the wall, the US-based Rocky Mountain Institute (RMI), a respected clean energy think tank, just published two new reports which aim to show that “the rapidly falling prices and improving capabilities of technologies that can combine to form clean energy portfolios (CEPs) – optimised combinations of wind, solar, battery storage, and demand-side management that can provide the same grid services as a gas plant – call into question the cost-effectiveness of investment in new gas infrastructure.”

RMI notes that “in just the past year, leading utilities’ investment proposals have pivoted heavily to CEPs, with announced projects in Colorado, Michigan, Indiana, California, North Carolina, Oregon, and other states that underline the emerging cost advantage that CEPs now enjoy over new gas-fired generation.”

According to RMI, we are now at a “tipping point in the relative costs of CEPs and gas-fired power plants”, such that “over 90% of proposed combined-cycle gas plants, if built, would be uneconomic to run compared with the cost of building a new clean energy portfolio.”

If renewable energy could really manage to combine climate, cost and security of supply advantages, the world would start to look very different.

How will the gas industry evolve in the low-carbon world of the future? Will natural gas be a bridge or a destination? Could it become the foundation of a global hydrogen economy, in combination with CCS? How big will “green” hydrogen and biogas become? What will be the role of LNG and bio-LNG in transport?

From his home country The Netherlands, a long-time gas exporting country that has recently embarked on an unprecedented transition away from gas, independent energy journalist, analyst and moderator Karel Beckman reports on the climate and technological challenges facing the gas industry.

As former editor-in-chief and founder of two international energy websites (Energy Post and European Energy Review) and former journalist at the premier Dutch financial newspaper Financieele Dagblad, Karel has earned a great reputation as being amongst the first to focus on energy transition trends and the connections between markets, policies and technologies. For NGW he will be reporting on the Dutch and wider international gas transition on a weekly basis.

Send your comments to karel.beckman@naturalgasworld.com