Opportunity knocks: Maintenance market for renewables and low-carbon set to approach $250bn by 2030

The maintenance, modification and operations (MMO) market for the renewable and low-carbon energy industries is set to soar by the end of the decade and approach $250 billion, presenting ample opportunities for operators to reap rewards from the energy transition. The oil and gas industry has dominated the MMO sector, but that is set to change as green energy sources increasingly account for a greater percentage of the world’s energy mix.

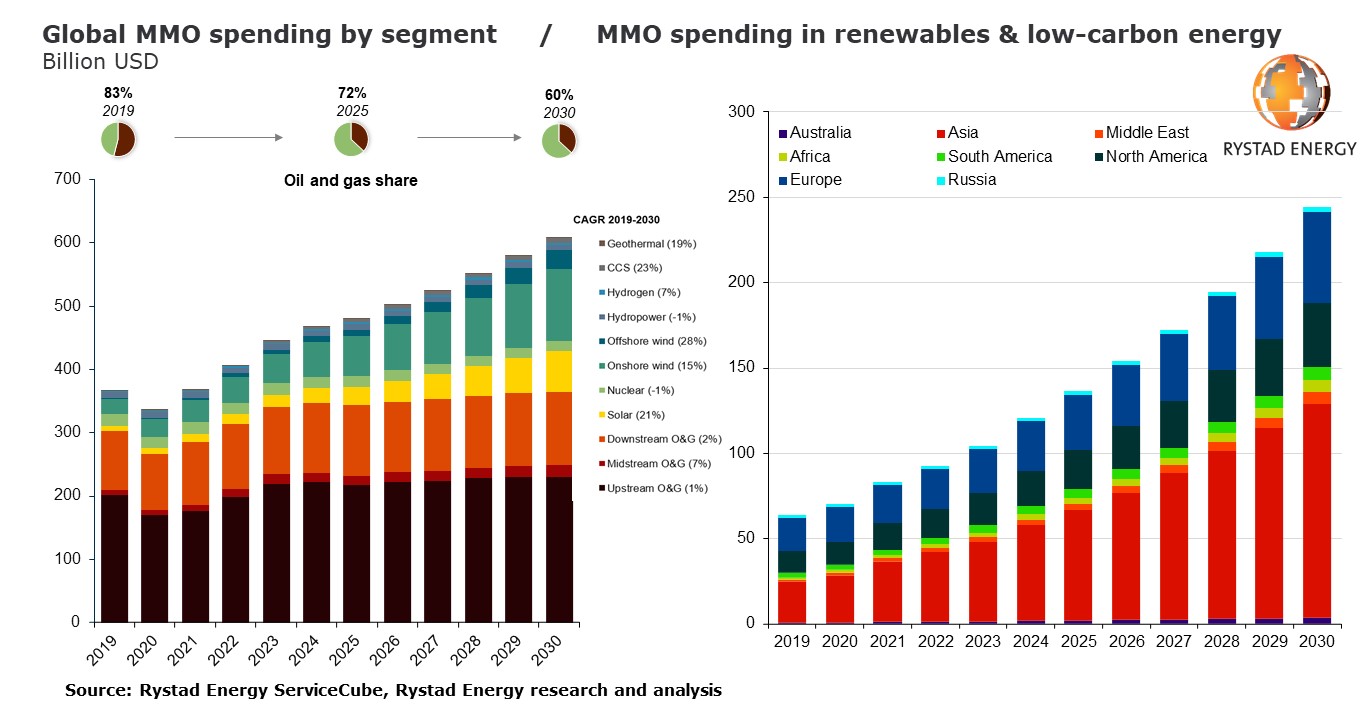

Rystad Energy research shows that annual MMO spending, including in oil and gas, will surpass $600 billion in 2030, up from $367 billion in 2019, before the Covid-19 pandemic disrupted the industry. Out of that spending, the MMO market for renewables and low-carbon energy is set to almost quadruple from $63 billion in 2019 to $244 billion in 2030.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

In 2019, global MMO spending was dominated by the fossil fuel industries, with 82% of total expenditure originating from the oil and gas industry. By 2030, that total will drop to only 60% as renewables and low-carbon energy sources pick up steam and take an increasingly large slice of the pie.

“With the rapid adoption of renewable and low-carbon energy infrastructure expected by the end of the decade, there will be ample opportunities for MMO players to take advantage. The suppliers who can adapt quickly and service the maintenance needs of these growing industries will be in pole position to seize a significant portion of this expenditure towards 2030,” says Ulrik Eriksen, energy services analyst with Rystad Energy.

The MMO sector comprises many activities and operations, including inspection of facilities and equipment, surface treatment, pipe maintenance, and transport and logistics. In their attempts to adapt to the energy transition, there are synergies from which MMO suppliers can benefit greatly, such as similarities in required activities across energy sectors and a low degree of specificity for the activities within the MMO sector. For instance, drones are already used for offshore oil and gas inspections, which can easily be adapted and used for offshore wind facilities. Similarly, suppliers that offer various access solutions within offshore oil and gas can also use similar solutions for offshore wind. Companies conducting pipe maintenance can utilize these capabilities also for process equipment within the renewables and low-carbon sectors.

MMO players are among the best positioned to thrive in the energy transition due to a high level of adaptability and a low degree of specificity. However, their exposure to renewable energy is somewhat limited to date, as oil and gas still dominate the market. Increasing capital expenditure investments, as seen in the engineering, procurement, construction and installation (EPCI) market, will increase demand for MMO players as more renewable and low-carbon assets come online and operational spending follows capital investments.

Follow the money

Breaking down the expected spending by 2030, growth is widespread, but certain areas are expected to soar. Upstream, midstream and downstream spending in the oil and gas industry is expected to rise. Combined MMO expenditure in the oil and gas industry is forecast to jump from $303 billion in 2019 to $364 billion in 2030. However, the most remarkable growth will be visible in other areas.

As mentioned above, total non-fossil fuel MMO expenditure is projected to surge by 2030, driven primarily by growth in solar, wind, geothermal and carbon capture and storage (CCS). The maintenance market in the solar industry is expected to be worth $64 billion in 2030, up from only $12 billion in 2021. The onshore and offshore wind markets are also projected to spend an increasing amount on MMO, with combined spending hitting $143 billion by the end of the decade – a considerable jump from the 2021 total of about $39 billion.

CCS and geothermal, two technologies expected to gain significant momentum in the coming years, will also provide opportunities for maintenance operators. The CCS industry is expected to spend close to $7 billion on MMO in 2030, up from $1 billion in 2021, while the comparatively small geothermal sector will reach $1.6 billion in maintenance expenditure by the turn of the decade.

Regionally, the main driver of global growth will be Asia, including China. MMO spending in the region is expected to grow rapidly from $35 billion in 2021 to $125 billion in 2030, more than half the global market value. North America and Europe will also attract significant spending but, even combined, the two will fall far short of Asia’s total. Expenditure in North America in 2030 is projected to be $37 billion, while the European market will top $53 billion.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.