Norwegian Gas Output Stable in 1H

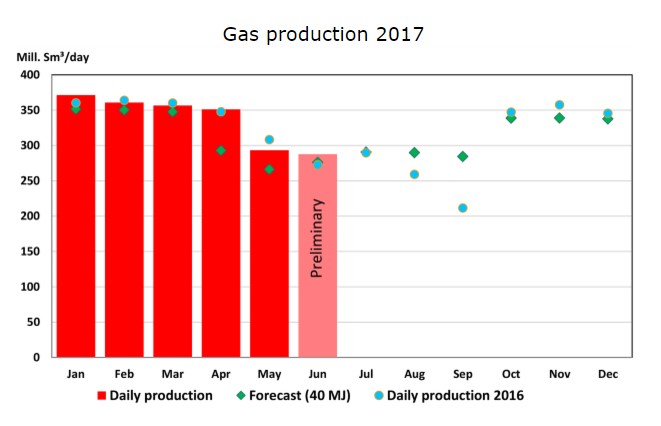

Norway produced broadly the same amount of sales gas in the first six months of 2017 as in 1H2016, according to preliminary data from offshore regulator Norwegian Petroleum Directorate (NPD) released July 11.

Sales gas production in 1H2017 were 60.9mn m3 oil equivalent (oe), compared with its year-ago six-month figure of 61.1mn m3 oe.

NPD said that Norway's total petroleum production in 1H2017 was 119.6mn m3 oil equivalent -- of which 47.5mn was oil, 11.2mn condensates and NGLs (natural gas liquids) and 60.9mn sales gas -- which, all told, was 1.1mn m3 oe higher than the total petroleum produced in 1H2016.

The preliminary figure for sales gas production in June 2017 was 8.6bn m3 gas, a decrease of 0.5bn m3 from the previous month (May 2017), but in line with what NPD expected for June. For liquids, production was 1.884mn b/d of oil, condensate and NGL -- a decrease of 116,000 b/d compared to May.

Norway covered 20% of Europe's gas needs in 2016 and remains the second largest gas supplier to Europe, after Russia.

However UK consultancy Timera Energy noted July 10 that Norwegian upstream investment has been in decline, partly because of the lower oil and gas price environment. It also noted that the shutdown of the UK’s Rough storage facility to new gas injections had impacted Norwegian flows to the UK - describing these are becoming more seasonal in order to ‘backfill’ lost UK storage deliverability across winter. As UK production has increased this year, that had priority into the UK market during the summer as it no longer has access to Rough.

In its July 10 blogpost, Timera argues that Norway, whilst remaining a key supplier to Europe for decades to come, will increasingly yield market share as the battle between Russian and LNG imports into Europe heats up, with Norwegian gas acting as "a price taker from the sideline."

Mark Smedley