Norwegian outages highlight European vulnerability to gas supply shocks [Gas in Transition]

The unquestionable importance that Norwegian natural gas supply now has for European energy security became strikingly obviously on June 13 after outages occurred at three major facilities, at Ormen Lange, Nyhamna and Aasta Hansteen. By June 15, the TTF front-month gas price had jumped to over €40/MWh ($472/’000 m3) from a low of about €24/MWh at the beginning of the month. As of July 24 it was trading back under €30/MWh.

This shows how sensitive the European gas market remains to supply disruptions, but also how strong its reliance on Norwegian gas has become. With Russia’s gas exports to Europe tumbling down, following its invasion of Ukraine in 2022, Norway has become Europe’s largest supplier of natural gas.

This shows how sensitive the European gas market remains to supply disruptions, but also how strong its reliance on Norwegian gas has become. With Russia’s gas exports to Europe tumbling down, following its invasion of Ukraine in 2022, Norway has become Europe’s largest supplier of natural gas.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

Norway responded to EU’s scramble to secure alternative gas supplies by increasing its gas exports to 122bn m3 in 2022, from 113bn m3 in 2021, becoming Europe’s top gas supplier. The Norwegian Ministry of Petroleum and Energy confirmed earlier this year that that the country plans to maintain exports at this level for the next five years.

Norway exports gas primarily through pipelines to the UK, Germany, France, Belgium and from September 2022 to Poland through the Baltic gas pipeline. It also exports LNG from its Arctic Hammerfest liquefaction plant, that restarted operations in May 2022.

The country earned record oil and gas revenues in 2022, mostly benefiting from the very high gas prices in Europe. According to Statistics Norway, it earned €131bn – about three times higher than the €45bn it earned in 2021, when oil and gas exports accounted for about half of Norway’s export revenues and more than 20% of the country’s GDP.

But it is not just gas. Norway also exports the bulk of its oil production to Europe. This amounted to 1.4mn barrels/day in 2022, out of about 2mn b/d of total production.

This increased and sustained demand prompted Norway to announce earlier in the year that it would offer oil and gas companies a record number of exploration blocks in the Arctic, to prolong output so that it can continue supporting Europe’s energy security.

Norway’s oil and gas production and reserves

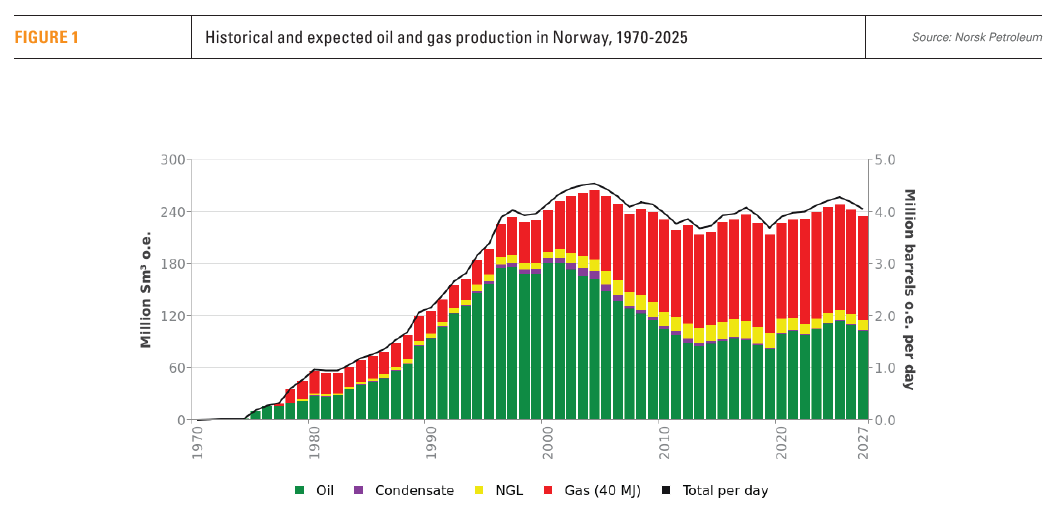

In 2022 Norway’s oil and gas production totaled 3.85mn boe/d (see figure 1), with natural gas accounting for 53%. These correspond to about 2% of global crude oil production and 3% of global natural gas production. Output is expected to peak during 2025 at just over 4.1mn boe/d, and then drop back 3.85mn boe/d by 2027.

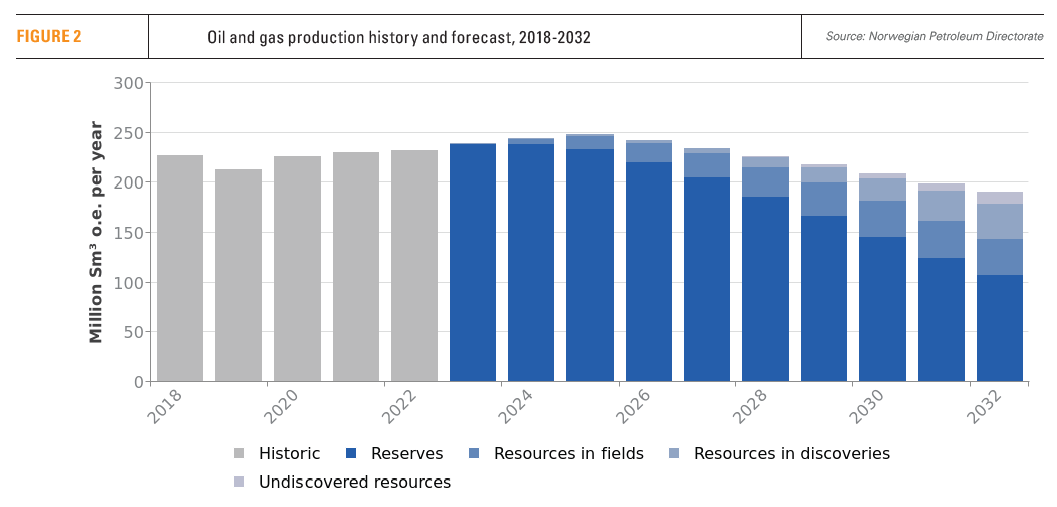

According to the Norwegian Petroleum Directorate (NPD), this decline in oil and gas production will continue thereafter, even after allowing for resources in existing fields, resources in new discoveries and undiscovered resources. (see figure 2).

Clearly, without further investments and new discoveries, Norwegian oil and gas production will decline even more rapidly.

Clearly, without further investments and new discoveries, Norwegian oil and gas production will decline even more rapidly.

Norway’s total proved gas reserves, including contingent resources in existing fields and discoveries, reached about 2 trillion m3 in 2022. NPD estimates that there is another 1725bn m3 gas in undiscovered resources.

Over the same period, oil reserves, including condensates and NGLs and contingent resources, totaled 11bn barrels. NPD estimates that there is another 13bn barrels of oil and condensate in undiscovered resources. More than 60% of these are located in the Barents Sea. Hence the emphasis in the new licensing round, announced in May and focused on this Arctic region.

Norway changes tack on oil and gas expansion

In 2019, a growing number of politicians and environmental groups were calling for a faster end to oil and gas production in Norway, in reaction to the country’s failure to cut its emissions, despite the fact that Norwegian standards for producing and processing oil and gas are some of the cleanest in the world. Environmentalists even took the fight to courts, attempting to prevent the government from opening up the Arctic and other sensitive regions for drilling.

However, in December 2020 Norway's supreme court upheld government plans for Arctic oil exploration, dismissing a lawsuit by campaigners that oil licensing breached Norway's constitution, paving the way for more drilling.

Pressure on Norway to curb oil and gas production is not likely to go away, though. Environmentalists have gone back to the courts and are determined to pursue the fight until they succeed.

Norway’s $1.4tn sovereign wealth fund (SWF) – the world’s biggest and largely generated from the country’s oil and gas exports – said earlier in the year that it is “prepared to start dropping companies for mismanaging climate risk from next year.” It actually voted for resolutions at their AGMs to force Chevron and ExxonMobil to align their climate targets with the Paris Agreement and commit to absolute carbon emission cuts by 2030. But despite repeated threats that it will divest oil and gas company stocks, SWF still holds about 6% of its total equity investments in integrated oil and gas companies.

Many find this dichotomy paradoxical. On the one hand SWF threatens to drop its oil and gas investments, and on the other the Norwegian government is doing everything it can to maintain and even increase oil and gas production and exports.

The clash with environmentalists came to a head at Equinor’s annual general meeting (AGM) in May. Environmental campaigners put forward a motion urging Equinor to set targets and implement measures to reduce greenhouse gas emissions in line with the Paris Agreement. But with the Norwegian government – which owns 67% of Equinor –- voting against it, the motion failed.

In effect, Norway is ploughing ahead with new oil and gas exploration and developments. Equinor’s position is that “oil and gas will be needed in the decades ahead. As long as there is a need for oil and gas, we think it is important that we continue to invest in fields that can contribute to energy security with a low carbon footprint, while creating jobs and value for society.”

The global energy crisis has highlighted how critical energy security and affordability are, and this appears to have given rise to a political consensus in Norway that it should continue and maintain its oil and gas production, at least over the foreseeable future – or for as long as Europe wants it. Other than the Green Party, Norway’s biggest political parties remain supporters of this view.

The message from Norway’s petroleum and energy ministry to oil and gas companies is “to explore all economic oil and gas resources within the available areas, including in the Barents Sea.” It is estimated that as much as two-thirds of Norway’s undiscovered oil and gas resources lie in the country’s Arctic regions.

Oil and gas companies are responding, but they are also seeking to cut emissions. They are investing in offshore wind farms and are powering their offshore operations with electricity instead of using fossil fuels.

New exploration and development

The Norwegian government gave approval at the end of June for oil companies to develop 19 oil and gas fields with investments exceeding $18.5bn, stating this would be “essential to Europe’s energy security” for decades to come. This includes Aker BP’s Yggdrasil development, in an area estimated to contain about 650mn boe. Production is due to start in 2027, and it will be one of the biggest development projects on the NCS over the last few years.

Another factor driving this flurry of activity is a rush by oil and gas companies to take advantage of temporary tax incentives introduced by the Norwegian parliament in 2020 to encourage investment during the COVID-19 lull in activity.

Environmentalists reacted immediately by taking the decision on three of the 19 fields to court – chosen because, they claim, “their impact assessments are either non-existent or inadequate.” claiming

“They violate Norway’s constitution and international human rights commitments,” they said. But the government is undeterred and is sticking to its plans.

In addition to approving development of the 19 oil and gas fields, Norway launched its 2023 offshore oil and gas exploration round in May, offering 92 blocks: 78 blocks in the Barents Sea and 14 blocks in the Norwegian Sea. Bids are expected by August 23 and awards should be made during the first quarter of 2024. This is quite a jump on the 28 blocks offered in 2022 and the 84 offered in 2021, demonstrating the government’s resolve to extend oil and gas production, with an emphasis on developing largely untapped Arctic regions.