Northwest European prices surge [NGW Magazine]

After an early summer lull, the rally in UK and European gas and power prices seen earlier this year has accelerated, with levels at the time of writing (early September) almost double those of two years ago, and the highest for the time of year since 2013, when oil prices were over $100/barrel. Despite this, strong Chinese gas demand is keeping LNG out of Europe by pushing up Asian LNG prices, leaving the continent increasingly dependent on gas pipeline imports as domestic output declines. The question being asked is whether this will be the year that US LNG makes it into northwest Europe, in big volumes.

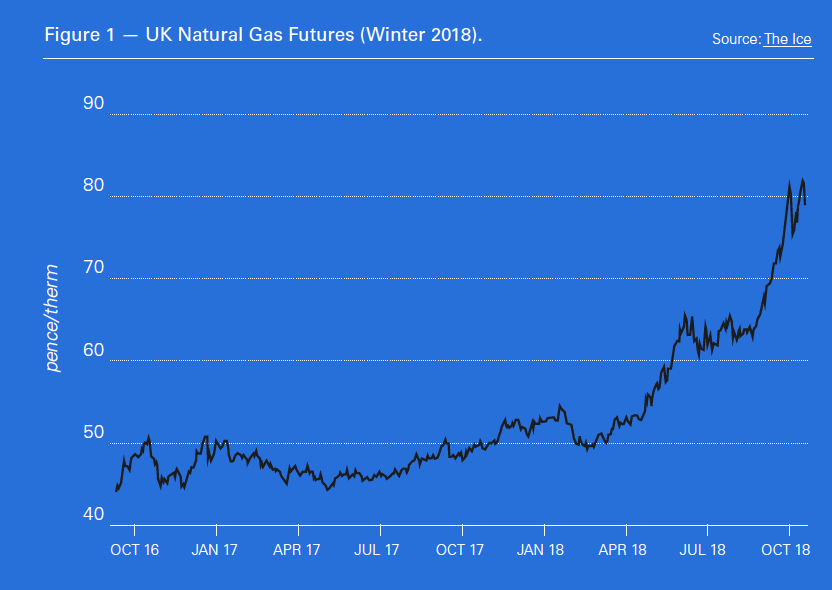

As buyers move to secure remaining annual supplies for the year or winter ahead from October, gas and power prices have been rising sharply in northwest Europe, fuelled by an anticipated continuation of a switch away from coal as generators seek lower carbon alternatives – helped along by a dramatic rise in carbon prices. Stronger than expected LNG demand from China and elsewhere is also supporting the market by limiting LNG arrivals. NBP winter 2018 stood at 79.5 p/th on September 20, up from 59.35 p/th on 30 April and 49.8 p/th a year ago. As can be seen from the ICE futures market, the rise has been significant and dramatic.

Asian LNG prices have also shown an unexpected summer upturn on the strong Chinese demand, reaching $11.50/mn Btu at the end of August – bucking the normal seasonal pattern of weaker prices in the summer when heating demand is lower. The end-August price is the same level reached at the peak of last winter in mid-January, suggesting prices may rise further given the bulk of this winter’s demand is still to materialise.

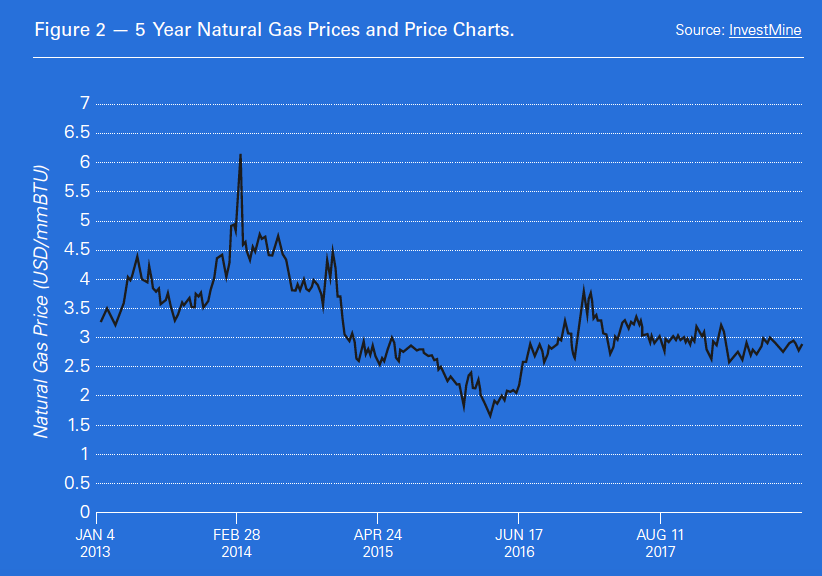

US Henry Hub (HH) prices, on the other hand, have shown little change through the year, apart from some fluctuations.

This will improve the economics of sales from the US to both Europe and Asia, raising the chance of progress at the various US export projects being planned around the coast, although securing long term sales still remains the key to progress (see below). The relative price moves have certainly improved the administration’s goal of increasing US energy exports – and go some way to offsetting China’s proposed import tax.

Tight fundamentals

Much of the market strength is down to tighter fundamentals, with European gas demand remaining elevated after rising for the third year running in 2017, following declines earlier in the decade. High late winter heating demand was followed by record-breaking temperatures in July and August, driving up air-conditioning demand and forcing French nuclear plants to shut as water cooling failed. Low river water levels prevented coal barges from reaching some German power stations, curbing output there. In the UK, calm weather cut wind output, and in the North Sea lengthy maintenance on gas pipelines and facilities restricted supply.

“The UK gas system is just plainly short, short and thrice short; outages persist whilst demand will also inevitably start to pick up at some point,” said a trader following sharp rises September 10, adding that there was a lot of activity in the volatile markets as buyers sought to cover or renew annual contracts from October.

The bullish sentiment was further strengthened by sharp rises in Calendar 2018 ETS carbon prices, which breached €25 ($29.4)/metric ton CO2 September 10 – a rise of over 500% since early last summer. The prices did not last, and were at €21.8/mt September 20, suggesting profit-taking; but nevertheless, some are concerned that prices could go much higher if there is a structural shortage of allowances, with one German bank forecasting as high as €100/mt CO2 by 2020, although most projections are much lower.

The high prices and summer demand have also disrupted Europe’s seasonal storage refill this summer. So, after ending last winter at record low levels, they remain at near their lowest for the time of year at the start of autumn and the 2018/9 winter heating season. Thompson Reuters (Point Carbon) is forecasting that the October gas storage inventory in northwest Europe will be 398 TWh, which would equal the record low seen in 2013 and below the 415TWh seen in early October last year.

Chinese demand has so far kept LNG from augmenting European supply. China imported about 32.2mn mt in the first eight months of this year, according to shipping data – up 46.4% from the same period last year. This demand growth has led to a watering down of forecasts of global over-supply for the next couple of years. For example Wood Mackenzie said in a recent interview that very strong demand and high coal prices mean the anticipated LNG oversupply is unlikely to materialise apart from a slight summer surplus, for the next couple years, which could put pressure on European prices. It said an oil-linked LNG deal at 12% free on board for mid-term Papua New Guinea deliveries indicated “relative price strength compared with longer term deals as the impact of additional Chinese demand filters through.”

Market signal

The price rises do act as a market signal and should stimulate supply to Europe, including by making LNG import projects like Ireland’s Shannon or Germany’s proposed LNG terminals more likely, as well as improving the likelihood of further upstream LNG final investment decisions, of which there are many.

Germany, which used to rely on imports from Groningen in The Netherlands for a quarter of its imports, is particularly in need of an LNG import terminal or other alternatives to Russian supplies – especially given rising demand, fracking bans and falling domestic output. Uniper put its backing behind a facility at Wilhelmshaven, a deepwater port close to pipelines – one of three possible LNG import locations so far suggested in Germany. RWE is focusing on Brunsbuettel, for which FID is reportedly planned by the end of 2019. Qatar Petroleum also said last week that it was in talks with both RWE and Uniper about co-operating on a LNG terminal, although RWE said this was limited to potential gas deliveries to Germany.

The terminals will get an added push from German and EU policymakers that favour LNG as a way of reducing Europe’s dependence on gas from Russia. Wood Mackenzie forecasts that European gas imports will rise from 50% now to 70% by 2025 and 80% by 2035, given a likely continued rise in demand as coal is replaced with gas, and domestic production falls. Other than Russia, traditional pipeline suppliers like Algeria are not able to increase supplies, leaving LNG imports as the main alternative. The improved economics of sales from US markets could increase the flow substantially.

“We expect US LNG to account for half European LNG imports by mid-20s. The trouble is it has to be between private companies and will European utilities be prepared to sign long term deals with US project developers? It comes down to whether European buyers have the appetite to take on the HH-NBP/TTF price risk,” said WoodMac.

A long-term deal of this sort with Taiwan’s CPC looks set to be the basis for the go-ahead of Cheniere’s 2mn mt/yr Sabine Pass train 6. The deal has a HH-link, and with oil prices – as well as LNG and NWE gas prices – higher, more buyers may seek greater HH exposure, improving buyer interest at other proposed US export plants.