Nigerian projects slow with Covid-19 [NGW Magazine]

The first Covid-19 case recorded in Nigeria in February 2020 came as a surprise: many Nigerians thought the country’s tropical climate would be too much for it. But current figures for Africa’s largest gas resource holder have proved this belief wrong and a number of projects are sliding back in consequence.

As of May 21, Nigeria had recorded 6,677 confirmed cases, 1,840 discharged patients and 200 deaths. The Covid-19 pandemic has caused a strain on Nigeria’s gas sub-sector, to the extent of delaying gas projects from the Nigerian National Petroleum Corporation (NNPC) as well as Anglo-Dutch Shell and local company Seplat that were supposed to come onstream in 2020.

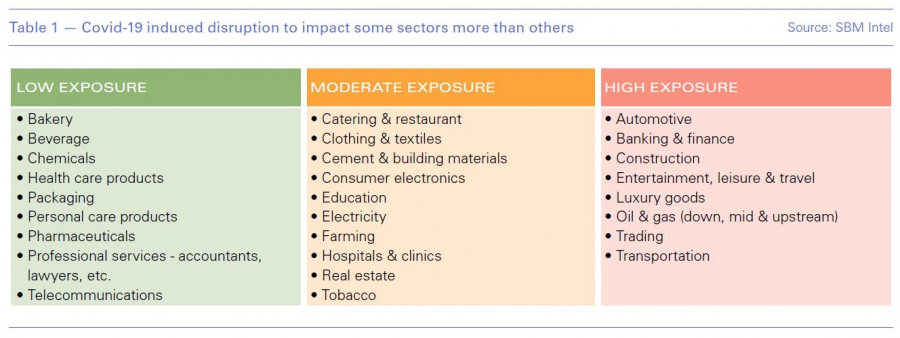

SBM Intelligence, a Nigerian research company, said in April 2020, that the Covid-19 virus would hit oil and gas hard.

Among the projects to be delayed is the 614-km Ajaokuta-Kaduna-Kano (AKK) gas pipeline, which brings gas to power generators. It will cross three states – Kogi (Ajaokuta), Kaduna and Kano – and supply 2bn ft³/d (56mn m³/d) of gas to its customers.

Also under the AKK project are gas-fired plants to be built in Abuja, Kaduna and Kano, which are expected to deliver 3.6 GW of power.

The AKK pipeline project was due to kick off in the first quarter of 2020 but according to the NNPC group managing director, Mele Kyari, the project will not now launch until the second quarter of 2020, as Nigeria gradually eases the lockdown.

In March 2020, Nigeria’s Federal Executive Council fast-tracked the issue of a sovereign guarantee to support debt servicing. China Export and Credit Insurance Corporation Sinosure had agreed to underwrite up to a maximum of 85% of the cost of the AKK project. Following a new project financing design by the NNPC, stipulating that the balance of 15% of the financing will be taken up by the Nigerian Gas Company, a subsidiary of the Nigerian National Petroleum Corporation (NNPC), the cost has fallen to $2.6bn.

The earlier contract, approved by the administration for the AKK was $2.9bn based on 100% contractor financing model.

The petroleum ministry’s technical adviser on Gas Business and Policy Implementation and also the programme manager for the Nigerian Gas Flare Commercialization Programme (NGFCP Justice Derefaka cited this case as an example of the importance of gas to the national government.

He told a conference in April that the fact that the government was providing sovereign guarantees for the external financiers of the AKK gas pipeline showed the strategic importance of the project and proved that the government wanted Nigeria to take her place as a gas nation in the world once Covid-19 was in retreat.

UK-listed producer Seplat has also said that the pandemic and the resultant volatility of global oil prices had delayed several of its projects. But completion of the $700mn Assa-North-Ohaji-South (ANOH) gas project, which it owns jointly with Shell Petroleum Development Company, remains a top priority.

Seplat set up the ANOH Gas Processing Company and aimed to raise $420mn of equity to de-risk the project, with nine Nigerian banks and five international banks on the debt side.

The $700m ANOH project involves the development of the Ohaji South gas and condensate field in licence block OML 53 and the Assa North field in block OML 21.

The ANOH project covers 719.84 km²of the south-eastern region of Imo state and is about 25 km from Owerri, the Imo state capital and 75 km from the south-south region of Port Harcourt, the Rivers state capital. The two fields are together expected to produce 600mn ft³/day, which is enough to generate 2.4 GW of electricity.

NNPC, in collaboration with Oilserv, is also developing Lot B of the Obiafu-Obrikom-Oben (OB3) Gas Transmission Pipeline System, a 67-km, 48-inch line that runs through the south-south regions of the Delta and Edo states.

The primary objective of the $2.8mn project is to meet the country’s gas demand for power generation and industrialisation. It is the largest transmission pipeline system to be built in the country and is government-funded.

Lot B is at the commissioning stage according to Oilserv, which is the executor of the project. Nestoil is the executor of the nearly-completed precursor Lot A, which is about the same length. Work has been completed on Lot B but there is still work to be done on Lot A.

During the Nigerian Gas Association (NGA) Business Forum in May 2020, Derefaka told attendees that although the Covid-19 pandemic had a significant impact on industries globally, it had not affected demand for gas in Nigeria.

Modele Idiahi, the managing director at Eleva Group, a regional energy consortium, believes that businesses in manufacturing, logistics, power generation, and food processing will have to continue operating and will need energy. The lockdown is gradually being eased to revive the economy, as government has put safety measures in place to protect those who have to work are still being set up as a result of the oil price crash and they all need power for their businesses.

During an April 2020 conference organised by the Women in Energy Network (WiEN) on Gas Development following Covid-19, Derefaka told attendees that the government is committed to opening up Nigeria’s gas sector, citing the case of the AKK project.

He said that in line with Nigeria’s natural gas policy of 2017, gas will be the focus of the country’s efforts to diversify the economy, working in close relationship with renewables. He said NNPC is running with different gas projects as well as JV partners to open the sector up.

During the WiEN conference, Derefaka told attendees that the government was considering incentives and taxes to encourage the fertilizer, agriculture and petrochemical industries to operate profitably despite the virus.

He said that while Covid-19 has slowed down projects that the government had intended to prioritise, there will be a long-term recovery package for them.

Nigerian Gas Commercialization Project (NGFCP)

The Nigerian Gas Flare Commercialization Project is an offshoot of the national gas plan for power supply and compressed natural gas. The project is strictly market-driven. To put the need for this in context, Nigeria uses about 750mn ft³/day for power generation, but it flares 888mn ft³/d, even though it is still grappling with poor power supply.

All third-party investors/qualified applicants who submitted their bids May 4 are looking to use the flared gas to market other products such as fertilizers, liquid petroleum gas and petrochemicals.

Although the identities of the bidders are not being disclosed by the Department of Petroleum Resources (DPR), the department did say it had selected 200 firms to capture flared gas under the NGFCP. The gas price is geography-sensitive. Derefaka said the onshore non-flared gas will be sold at 25 cents/’000 ft³ onshore; it will fetch 15 cents/’000 ft³ if it is in swamps; and 10 cents/’000 ft³ for gas otherwise flared offshore.

Gas Network Code to benefit LNG

In February 2020, the natural gas network code came into effect. The code is a set of rules that governs the use of the gas transportation system in Nigeria by suppliers, transporters, shippers and agents. The aim is to ensure non-discriminatory access for the benefit of consumers.

The code provides open and competitive access to gas transportation infrastructure and development of the gas sector, in line with the government's policy to reinforce and expand gas supply and stimulate demand through the National Gas Expansion Programme.

According to Nigeria LNG, the natural gas network code gives it too the chance to unleash its hidden potential of starting domestic supply of LNG, delivering it by tanker as it does LPG from Bonny Island in Rivers State to the sea port in Lagos State. From there it can be distributed to other parts of the country. NLNG is exploring this option to give itself the optionality if export market prices are too low as a result of Covid-19.

The president of the Nigerian Gas Association Audrey Joe-Ezigbo has also said that the implementation of the network code will attract more entities to invest in Nigeria’s gas pipeline infrastructure.