Nigeria Produces More Gas, But Less for Its Own Needs

Nigeria grappled with a decline in gas supplies to power plants, despite an overall increase in gas production in the months up to November 2016.

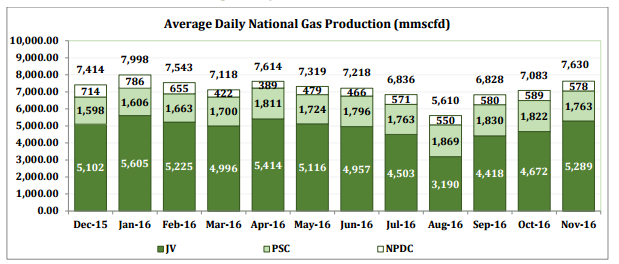

Gas production rose steadily during the three months to November 2016, according to data published last month by Nigerian National Petroleum Corporation (NNPC). Despite the impact of attacks on pipelines by the Niger Delta Avengers and other militant groups, gas production reached 204.9bn ft³ in September, 219.6bn ft³ in October and 229bn ft³ in November last year; the latter corresponds to 7.63bn ft³/d.

Only 56% of November's production, so 127.43bn ft3 (or 4.25bn ft3/d), was commercialised: one-fifth in the domestic market, and four-fifths for export (mostly as LNG). The remainder can include gas that is reinjected to oilfields, gas used to run field facilities, and some flaring and venting.

NNPC added that, in October 2016, there was a 56% decline in the number of vandalised pipeline points from 179 in September to 101 in October. This was also much less than the 204 points vandalised in November 2015. However, significantly, gas supplied to power plants continued to decline, as onshore associated gas production proved trickier to maintain than large-volume offshore gas [and oil] production.

Nigerian total gas production, monthly to November 2016, showing joint-venture, production sharing contract, and NPDC-only shares (Graphic credit: NNPC)

NNPC said that gas supplied to power plants declined to only 528mn ft3/d in November 2016, equivalent to power generation of 2,344 MW – far lower than the corresponding November 2015 figure of 3,102MW.

That 528mn ft3/d represented a mere 7% of Nigeria’s overall 7.63bn ft3/d gas production in November. NNPC though was quick to defend itself when asked about the gap between gas production and supplies to power generators.

On January 12, NNPC upstream subsidiary, Nigerian Petroleum Development Company (NPDC) managing director Yusuf Matashi said that destruction of the 48-inch Forcados trunk line by militants in 2016 gravely impacted gas production by NPDC and its joint venture partners.

Matashi said the attack primarily led to a loss of about 70% of NPDC’s crude oil production capability but also had a significant impact on gas production: “Unfortunately gas production in the region where we operate is associated with crude oil that we produce, so when we shut in oil wells, we also shut in most of the gas. That is why we now see the … gas supply shortage for power generation.”

Appearing before the House Committee on Local Content of Nigeria’s parliament, Matashi promised that NPDC would increase its gas production by as much as 50% when the Forcados line comes back onstream.

Shell, as operator of the Forcados terminal, has maintained a force majeure (FM) notice on crude oil and gas supplies since February last year – signalling its inability to produce normal volumes. In contrast, last week it was reported that Eni lifted its FM on supplies from its Brass River crude oil terminal, leaving Forcados the only major crude still under FM.

Omono Okonkwo