[NGW Magazine] Mexico's gas imports held back

Mexico bought more LNG from the US and fuel oil than expected, thanks to slow approvals for gas pipelines. The country is working to cut gas imports however, and sees a future in exports.

Delays in commissioning key natural gas pipelines, designed to boost exports of shale gas from Texas to Mexico, have led to the continued use of fuel oil and more LNG imports than originally planned for the power sector. This has led the state-owned utility to import far more LNG than was expected two or three years ago.

Total US gas exports to Mexico have risen to a record 4.3bn ft³/day, up just 6% from last year, as key natural gas pipeline projects have been delayed by opposition from local landowners and other issues.

A senior energy analyst with Denver-based S&P Global, Ross Wyeno, a past bull on gas exports into Mexico, said that although exports have reached an all-time high, delays in the commissioning of pipelines has led to the continued use of large volumes of fuel oil for power generation by utility Comision Federal de Electricidad (CFE), along with more LNG imports than were expected.

“Land rights issues and other factors have led to delays in construction of the pipelines,” Wyeno told NGW. “That’s having an impact on LNG imports and electricity power prices. The lack of export growth can largely be traced back to pipeline construction delays in Mexico.”

As a result, Mexican LNG imports have risen to an average of over 600mn ft³/day this year, up by 15% from last year.

Mexico’s Altamira LNG terminal took delivery of 10 LNG cargoes between June and late August, triple the number of deliveries in the same period last year. It is likely that further cargoes have been received over the last few months.

The US has emerged as the primary supplier of LNG to Mexico, having delivered over 107bn ft³ to the country, representing about 76% of total LNG imports.

Meanwhile, CFE has shifted to the use of more fuel oil, according to government data. Its fuel oil demand was up 58% in the first quarter of the year, even though it wants to eliminate the use of fuel oil to generate power, responsible for about 50% of its power production.

That has also led to power prices being about 42% higher than last year, Wyeno said.

The key pipeline that has been delayed at this point is the 1bn ft³/day Villa de Reyes-Aguascalientes-Guadalajara link, which was already supposed to be carrying gas by now to western Mexico and Guadalajara, Mexico’s second largest city. “We expect it to go into operation by mid-year in 2018,” Wyeno said.

In addition, he said the Sur de Texas-Tuxpan natural gas pipeline, an 800km, $2.1bn, 2.6bn ft3/day link from Brownsville, Texas to Tuxpan, in the state of Veracruz, will likely be delayed until late next year. Calgary-based TransCanada, the 60% majority owner of the 2.6bn ft³/day pipeline project, hasn’t discussed delays in the commissioning of the project.

There are other smaller inter-country pipeline projects that have been delayed.

Mexico now consumes a little over 8bn ft³/day of gas and the country’s energy secretariat, Sener, has said that will grow to 11.6bn ft³/day by 2027, as CFE shifts to more gas use and as the country’s manufacturing sector’s gas use grows.

James Brick, principal gas analyst for North America for Wood Mackenzie, is even more bullish on future gas use in the country, predicting gas demand will grow by more than 74% over the next 15 years, with US imports growing by 200% in that time.

While Wyeno remains bullish on the country’s long-term gas use, with seven new or expanded pipelines built between the US and Mexico in the last three years, he also believes continued LNG imports will be needed, especially to meet seasonal demand.

Most of the growth in consumption will come from CFE’s shift away from fuel oil to gas and from industrial growth.

Previously, large industrial consumers, such as auto plants, were unable to develop their own cogeneration or other power facilities. However, the monopoly of CFE, like its oil and gas counterpart, Petroleos Mexicanos (Pemex), is set to gradually end and now large gas and power users have other options.Industrial demand now accounts for about a quarter of total gas use, while the power sector accounts for about half of total gas use. Pemex itself accounts for most of the balance of demand, as it utilizes gas within its own operations.

It has been estimated that Mexico will need $164bn in investments in electricity generation, transmission and distribution over the next 20 years.

Mexican officials have said they would like to see domestic gas production grow in the future, which they have said is a major goal as the energy reform process advances and more private sector players become involved in the country’s energy industry.

Wyeno said it’s difficult to get a handle on the progress of pipeline projects on the country.

“Unlike Ferc (the US-based Federal Energy Regulatory Commission) sanctioned projects in the US, which are required to publish construction status reports, the current status of these Mexican gas pipelines is largely unknown,” he said. “The timely completion of these projects will be instrumental in both limiting constraint pricing in Mexico, as well as alleviating oversupply in areas such as the Permian Basin.”

Third round attracts Asian E&P

Asian upstream companies are registering their interest in Mexico’s upstream as the north American country plans its third round next March, said the president of the hydrocarbons regulator CNH Juan Carlos Zepeda Molina. In that round, 35 production sharing contracts will be offered for three regions offshore in the Gulf of Mexico.

In an interview in London December 4, Molina said Malaysian state-owned Petronas and Thai PTT E&P were among the new companies to pre-qualify, and added that oil exporters had to look at the countries that were the largest importers of hydrocarbons. “We have noticed growing interest from Asia,” he said, with Chinese and Indian companies also on the list. “With the US self-sufficient, Asia is the most important market for oil exporters.”

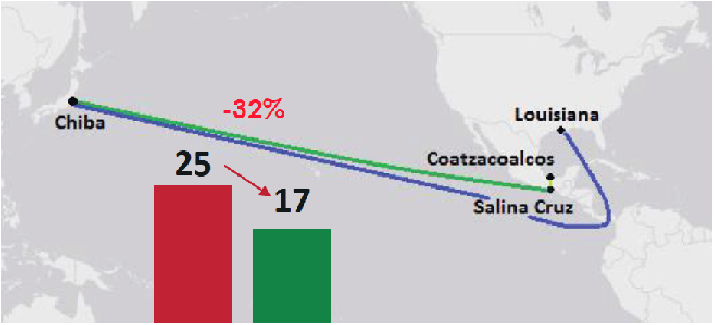

Comparison of hydrocarbons transportation time (days)

Credit: Mexican National Hydrocarbons Commission

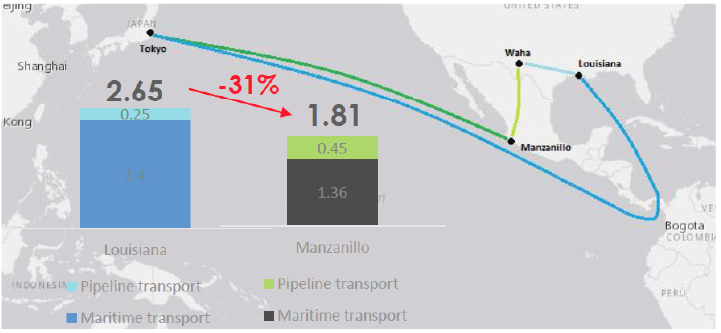

Comparison of gas transportation costs (USD/mmBTU)

Credit: Mexican National Hydrocarbons Commission

At its narrowest point, Mexico is just 200 km across, so bringing oil and gas across from the country’s Atlantic to the Pacific coast and onward to Asia is a short journey and there are no Panama Canal fees to pay. The recovery in oil prices could stimulate further interest, as Mexico’s existing finding and development costs average $35/barrel in deepwater and $20 in shallow water, he said. “Companies are comfortable with that level, the fields are profitable,” said Zepeda Molina.

Mexico’s oil production has been falling, with Pemex planning to produce about 1.9mn b/d for the next few years, although output should rise from about 2022. It imports about 84% of its gas, nearly all of which comes from the US either by pipeline or as LNG. Two subsea pipelines are being built from the US that could bring another 2bn ft³/day, debottlenecking supplies, he said. “Gas is the most important fossil fuel for the coming decades, to meet the twin demands of growing electrification and lower carbon dioxide emissions.”

Most of Mexico’s gas production comes from conventional reserves onshore, in the hands of local companies. No shale gas rounds have been launched so far, although he said the technical regulations for that, including a national water commission, are in place. The energy ministry has the authority to launch bidding, and this is expected next year.

So far there have been 72 licences issued in 11 sub-rounds or farm-ins and 106 exploration wells drilled, leading to “a couple of good discoveries,” he said, “but it will take time to get results.”

Assuming a 30% success rate from those licences, he said the state could expect to receive about $60bn over their lives, most of it coming in the first decade of the field’s life. No commitment wells are necessary in the first licence phase, just seismic: so he is pleased to see so many have been drilled.

Rounds 1 and 2 each had four sub-rounds and Pemex sought partners for three discoveries, a process that CNH also handled on the state’s behalf. Big oil and gas finds include Trion, in the Gulf of Mexico.

Predating the opening up of the upstream in 2015, the field lies on the Mexican side of the Perdido area, and BHP Billiton farmed into it with 60%. More recent is the Zama find, made by Houston-based Talos (as operator), UK Premier and local Sierra, which Talos won in 2016.

Bidders identify the blocks, the work commitment, the extra royalty they are prepared to pay on top of the basic 7% and the bonus payment, and on bid day the regulator announces the winners.

There is a ceiling on the additional royalty: if it is too high, it will be difficult to find buyers once the original winner decides to leave and the assets remain in the ground, Molina said. However, the size of the bonus payment can compensate for that if bidders are keen to have a block. The average overall tax take is 72%.

While the bid round is open, commissioners are banned from meetings with the prospective bidders, who must conduct their investigations online, which are also visible to third parties. All in all, Molina said, it was among the most transparent systems that he knew of anywhere in the world.

Practically the last country in the world to liberalise its upstream, formerly the monopoly of state Pemex, the country has been able to learn from the mistakes and best practices elsewhere.

The CNH is even enshrined in the constitution as an independent licensor and regulator, which he said was unique. This makes it very difficult for any new government to wrest back control. That said, the finance ministry has been able to influence CNH a little.

“We have gone through the learning curve,” he said. “Since round two, we have given more weighting to the work commitment.” He said that was the work of the finance ministry and the process now works very well.

“It is very unlikely that a single political party could reverse the reform process,” he said, referring to the elections next July. The lead candidate, Andres Obrador, or Amlo, is a leftist nationalist with a messiah complex who wants to return Mexico to the past, according to the FT. But it is a two-horse race: the other candidate, Jose Meade, comes from the ruling PRI and lagging with 20% in the polls, to Obrador’s 30%.

Jim Bentein, William Powell