[NGW Magazine] Turning the oil tanker around

The move from oil to gas and thence to renewable, or low-carbon, energy is gathering momentum among the majors, as they start to wheel their businesses about to address the demands of the future.

Last year the international oil companies saw their coffers fill up thanks to a combination of higher oil and gas prices and still low costs yielding healthy amounts of free cash flow. Higher prices also allowed reserves additions.

This wealth gives them a number of options, such as investing more upstream; returning more value to shareholders; investing in green energy or New Technologies; and paying down debt. Senior vice-president for corporate research at Wood Mackenzie, Tom Ellacott, told NGW: "There is a lot of free cashflow at current prices so we expect shareholder distribution will be on the agenda; and Total's planned $5bn buyback is one example.

"The majors have taken advantage of the higher price but they are still accessing opportunities that are low down on the cost curve and building more resilience to operate at lower prices," he said.

"We are starting to see more high-grading, and also reducing carbon intensity as shareholders want less exposure to that. This is one reason why Shell is pulling out of tar sands. Others though have yet to sell down, and the biggest by far is ExxonMobil, for which it [tar sands] is a material part of the portfolio."

Different companies have differentiated portfolios, resulting in differentiated strategies. Chevron is concentrating on an advantaged position in tight oil in the [US] Permian for example. Chevron expects production to grow by 4%-7%, thanks mainly to Australian LNG and the Permian “where investment economics continue to improve,” according to CEO Michael Wirth at the results conference call.

But there is a move to lower carbon and more gas, which is moving up the strategic pecking order, Ellacott said.

ExxonMobil, in common with some other companies with US production, also benefited from the federal government's tax change there. The US major said it would invest "over $50bn there over the next five years to increase production of profitable volumes."

Compatriot ConocoPhillips began 2018 by paying down $2.25bn of additional debt, raising the quarterly dividend rate by 7.5% and hiking planned 2018 share buybacks to $2bn. Last year it saw free cash flow of $2.5bn and paid off $7.6bn in debt and bought back $3bn of shares, or 5% more year on year.

New technologies

Investing in new technologies typically takes the form of stakes in little-known companies while they are still cheap. A common feature is that it offers some competitive advantage through better use of green technology that helps the buyer to carry out its core functions better, rather than merely add to its acreage of solar panels and wind farms. For example BP bought a $5mn stake in FreeWire which offers fast charging of car batteries, initially on petrol station forecourts, but further afield in the future. That is a tiny portion of the $500mn earmarked for annual spending in low carbon technology, including advanced mobility, bio and carbon management products.

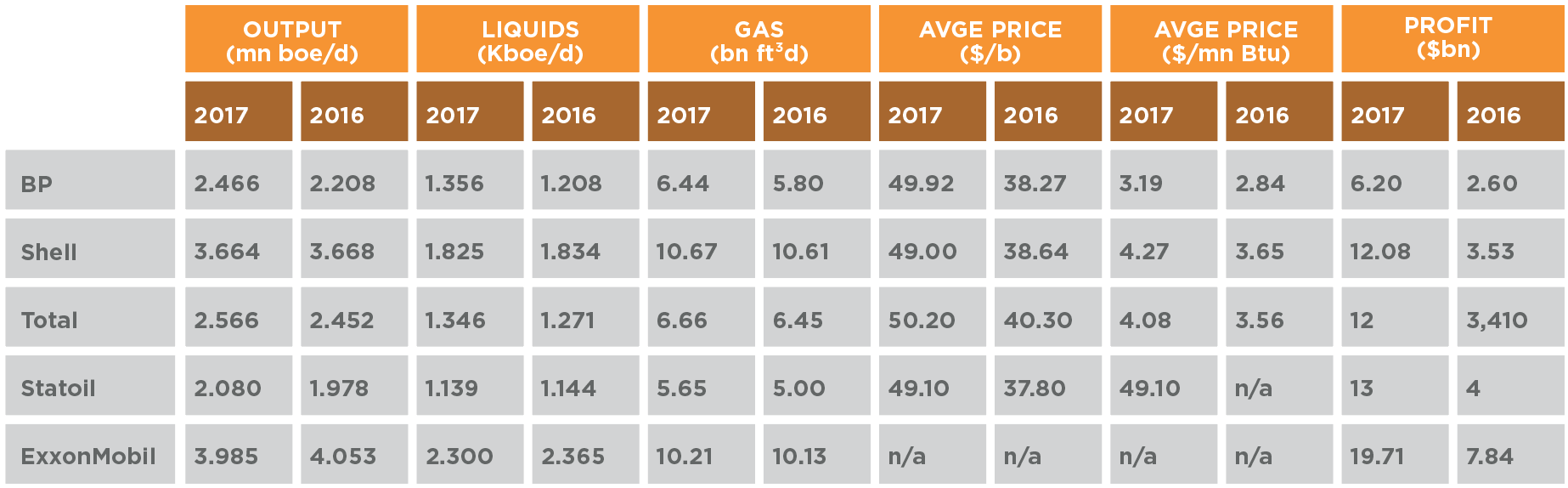

Full-year results from selected companies 2017 vs 2016

Source: Companies

On a larger scale, it is also using solar rather than gas to generate power at some sites, something Eni is also doing in North Africa, which frees up more gas for exports.

Ellacott said: "The majors are looking for opportunities in which there are synergies with a company's existing upstream business. But they are not likely to stray far beyond their core competencies and where they already have expertise; upstream will dominate portfolios for many years to come." But he said the move from hydrocarbons to renewables "is a slow process, especially as capital has been scarce. The European majors are starting to make initial steps in areas like wind, solar and power, although nobody knows what technology will bring."

So the extreme "harvest and quit" approach - recommended as the end-game by economist Dieter Helm, in a world of ever-cheaper oil prices - is still a challenge if Helm is right, although even he did not suggest it would be a problem for some decades.

Shell, BP, Statoil and Total, among the ten founders of the originally Asian and European-backed Oil & Gas Carbon Initiative, until Petrobras joined last month - have all paid lip-service to those aims in the past and are now beginning to put money into achieving them - $100mn apiece to create a $1bn fund to tackle projects such as carbon capture and storage.

Additionally, Statoil has also set a goal of spending a fifth of its capex on renewables by 2030. But now it is only focusing on value of production, according to its CEO Eldar Saetre, indifferent to whether it is an oil or a gas asset. Statoil also has a reputation for supplying low-carbon onshore power to offshore platforms.

Focus on cheap oil

Across the board however the hunt is still on for the cheapest barrels - what BP calls 'advantaged oil' - while the obvious virtues of gas seem to make its cost only of secondary importance. Upstream, the costs of drilling wells have fallen, new technology has cut downtime and output has risen, with no let-up in the companies' determination to maintain their discipline even as the oil price rises.

ExxonMobil has divested $21bn-$22bn of assets over the past five years as part of its high-grading programme, so about $4bn/yr. This year's divestments were lower, but still include Norway assets. In Norway, phase 1 of Statoil has reduced Johan Sverdrup field capex by 30% since it took final investment decision in 2015, taking breakeven to below $15/b. Statoil reached a record for gas output in the quarter, primarily thanks to higher flexible gas production from the Troll field to capture higher prices. Production was 1.12mn b/d liquids, down 4%, and 1.013mn boe/d gas, up 9% on the year-before quarter. Overall, output was up 6%.

Whereas in 2013 its new projects were required to break even at $70/b, that breakeven target had been slashed to $27/b in February 2017, and now has been reduced further to $21/b.Saetre, a former CFO, said Statoil “had used the downturn well, but the real test is happening now as prices recover… We are determined not to allow this.”

He said Statoil’s return on average capital employed (Roace) is forecast at above 10% in 2018, while Total's CEO Patrick Pouyanne said his company was already offering the best returns among the majors, also above 10%. BP's is well below that, but on the other hand it has been paying off a $65bn settlement in the US and is expecting to beat that return this year. Shell is still digesting the BG acquisition, but even so at 5.8% last year it almost doubled its 3% Roace of 2016.

Shell holds deep-water growth: Jefferies

Shell underspent its 2017 capex and opex targets but declared full-year profits up 184% at $13bn, helped by its ongoing $30bn disposal programme now four-fifths concluded. CEO Ben van Beurden said Shell's capital expenditure (capex) in 2017 at $24bn came in $1bn below its original $25bn target for that year, while operating expenditure of $38bn was some $2bn lower than its original 2017 $40bn target.

Upstream average production was 2.77mn boe/d for the full year 2017, flat year on year. One barrel in every eight came from Brazil in Q4, much of it from former BG assets. Integrated Gas sales were 981,000 boe/d in 4Q, up 8% year on year, and 887,000 boe/d in full year 2017 (flat year on year).

Also within Integrated Gas, LNG sales volumes were up 16% in full year 2017 at 66mn mt, of which half was equity - up 8%. Higher volumes from Gorgon in Australia particularly boosted numbers, with Prelude due on stream soon. Integrated Gas alone made $5.3bn earnings in 2017, up from $3.7bn the year before, despite the partial shutdown of the Pearl 140,000 b/d gas-to-liquids plant in Qatar.

Van Beurden said the glut of LNG was "conspicuously absent... China is very strong in both gas import growth, and stronger again in LNG demand." Shell says about 70%-80% of its equity LNG is indexed to oil," suggesting a limited application at Shell of spot LNG assessments for these sales.

BP had a similar story, the large majority of its gas output being sold at oil prices or at fixed price, such as its Oman and Egyptian output.

Jefferies Bank analysts said that despite Shell’s soft cash flow generation in 4Q17, they still believed the growth in the deep water, shales and chemicals businesses will lead to cash-flow from operations in excess of $55bn by 2020. This growth, combined with strong capital discipline, will lead to free cash flow in excess of $25bn, a 10% yield based on the current market capitalisation."

Shell also outlined planned capex of $1bn-$2bn/yr in New Energies - of which gas is the backbone, for power-generation, backing up renewables, out to the end of this decade.

Van Beurden said future investments could be in North Sea wind, and in additional North American renewable capacity; and said he would "struggle to quote another company that is investing - as a newcomer - up to $2bn a year." He said the world needs to target a 40g carbon/MJ intensity by 2050, and net zero by 2070, and the investment was part of Shell's programme to halve its existing 80g/MJ sales portfolio by 2050.

Statoil juggles green energy and Arctic

Statoil also said it would step up in New Energies spending, while simultaneously drilling in the Arctic. Of its core activities, its pre-tax adjusted earnings from E&P Norway were up from $2bn in 2016 to $3bn in 2017, while E&P International was $438mn - a $1.1bn improvement from the $638mn loss in 2016.

Organic capital expenditure in 2017 was $9.4bn. Statoil expects this to go up to around $11bn this year. The rise in costs reflects a ramp up in spending at the big Johan Sverdrup oil development, plus smaller ramp-up in spend at Gina Krog (an oil and gas field which Total is now out of as it focuses on lower costs and lower carbon).

Saetre said Statoil was midway through an exploration campaign in the southeast Barents Sea, above the Arctic Circle in Norway, in contrast to Shell, which said it had quit the Arctic. Statoil said four or five wells are targeted there in 2018, after which it would review results. The drilling yielded little in 2017 and there are legal challenges ongoing to Arctic exploration over awards made by the government to all operators in its 2016 licence round.

He also said that Statoil is now free cashflow positive above $50, such that last year with the average Brent price of $54.2/b (up 24% on 2016) it realised $3.4bn free cash flow. At $70/b, it could generate $12bn in free cash flow from 2018 to 2020. He also said that Statoil expects to invest 15%-20% of total capex in new energy solutions by 2030.

A bank's view

Commenting on the sector generally to NGW, analyst Jason Gammel of Jefferies said: "The majors have reduced their cost structure to balance dividends at $50/b, and I think it could go significantly higher in the medium term. So they are in a good position to get good cash flow compared with 2015-16.

"Their capital investment in renewables is increasing year on year as a percentage; but it is still very small compared with their total, which is flattish in 2018 compared with 2017. About 80% of it goes on the upstream. The narrative is that the demand for gas is growing faster than demand for oil which is conducive to gas; but it all comes down to rates of return, and which generate the best. Oil still gives a better rate of return than investments in renewables. Today's price or above $60/b, is good for buyers and sellers, the buyers have a better balance sheet to fund acquisitions, but only if it is a strategic fit. Despite the high oil prices, there were some misses. These were mainly in downstream, and more pronounced for the US companies."

William Powell