[NGW Magazine] The unstoppable rise of shale

Shale oil has a bright outlook, was the headline from CERAWeek in Houston early March: stable and strong oil prices guarantee continuing production and associated gas is in some cases freely produced.

The main conclusion drawn by the International Energy Agency (IEA) in its Oil 2018 report was that shale oil would continue to transform economies in the countries that produced it, as well as those further away.

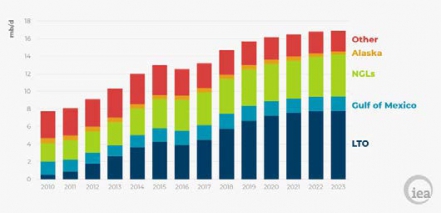

A major new wave of hydraulic fracturing means that US oil and gas are in the process of transforming global energy markets yet again. More oil and gas production in the US is the result of growing global demand. According to the IEA, US oil production will go up to 17mn barrels/day by 2023 (Figure 1), covering four fifths of new demand within three years. And the US president Donald Trump is claiming the credit.

Figure 1: IEA: US oil supply between 2010 to 2023

Source: IEA

During CERAWeek, Republican Senator Dan Sullivan said “There’s never been a more exciting time in the American energy sector…The American energy renaissance that so many of you in this room are responsible for is now in full swing.”

This is having major implications for global energy markets but also geopolitics, for example driving Saudi Arabia and Russia into closer energy co-operation. It is giving Opec a hard time, but the US is also increasingly competing in Russia’s natural gas markets. Unexpectedly, this was made possible by the cuts in oil production by Opec, with the support of Russia, which have pushed oil prices up.

This upbeat mood was driven home by ConocoPhillips CEO, Ryan Lance, who said at CERAWeek in early March: "The growth in the US is coming. It'll probably consume most of the incremental demand. So Opec is needed to show restraint in order to continue to balance that market." And it may be going that way, with Opec appearing to be choosing to watch and wait, hoping that oil demand growth will be even stronger. In any case, its options appear to be limited.

A major contributor to this shale success is the Permian Basin in West Texas and New Mexico, with recoverable oil still in place estimated to be 60bn-70bn barrels. This can be produced quite cheaply, making it profitable even at lower oil prices. In fact, oil prices are now quite favourable, driving fast growth, with internal rates of return in some areas estimated to be in the range of 35% to 40%.

Oil companies have now driven down production costs significantly and can quickly start and shut production from shale wells, giving them flexibility as and when oil prices go down. But as long as prices remain above $50/barrel, shale oil production is expected to remain resilient, driven by improved logistics, cash and technology.

One company that has committed to the Permian in a big way is ExxonMobil. Last year it doubled its Permian holdings through a $5.6bn acquisition. The company said during CERAWeek that it is aiming to triple its oil and gas production there to 600,000 barrels of oil equivalent (boe)/day by 2025, for refining and export. This is an important component of its plan to increase investment in the US by more than $50bn during the next 5 years.

Associated natural gas

ExxonMobil plans to use the cheap associated gas from these operations as feedstock for its chemical and petrochemical plants in Texas and Louisiana. In fact last year the company said it would invest $20bn in new chemical, refining, lubricant and liquefied natural gas facilities along the US Gulf coast.

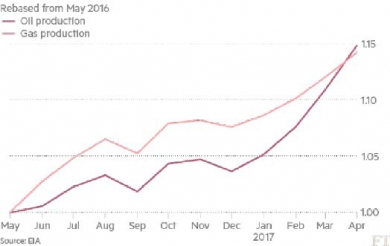

But the US Energy Information Administration (EIA) says that what makes the Permian even more important is the increasing production of associated natural gas (Figure 2).

Figure 2: Permian Basin associated gas output rises with oil

Pioneer Natural Resources recently reported a rise in gas-to-oil ratios (GOR), which would lead to even higher associated gas production.

Permian gas production reached 6.2bn ft³/day in 2017 and it is expected to increase by another 1bn ft³/day this year. It is estimated that Permian gas production may eventually reach 20bn ft³/day. If it does, it will surpass the giant Marcellus shale. But there are also others. Haynesville Basin gas production is now about 7.5bn ft³/day and it is expected to exceed 10.7bn ft³/day by 2021.

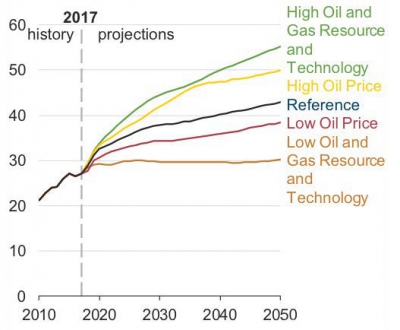

Based on these large associated gas resources, the EIA forecasts in its 2018 Outlook, AEO2018, that in the ‘reference case’ total US natural gas production will increase by about 60% between 2017 and 2050 (Figure 3).

Figure 3: US natural gas production 2017 to 2050, in tn ft³/yr

Source: EIA

Permian operators can give the gas away and still make acceptable returns on the oil. They cannot flare the gas and they are constrained in producing more oil, unless they are able to evacuate the gas.

Jeff Welch, with pipeline developer Namerico Partners, said they are drilling for “what brings the most bang for the buck. They’re focusing on oil…yet on the associated gas side, there’s a pretty robust story as well.”

What is needed is additional pipeline infrastructure to get this cheaper gas to the markets and to LNG terminals. In fact, a number of such pipelines are either being built or close to final investment decisions.

All this cheaper gas will lower the cost of electricity and also make the US petrochemical industry even more competitive, as well as bring down the cost of US LNG. It has encouraged US industry to invest billions of dollars on greenfield and brownfield manufacturing facilities that use gas to make plastics and other products.

The EIA says that gas from two of the largest shale fields in the US, the Marcellus and Utica formations, is among the cheapest in the country. Lack of pipeline capacity has stunted their development but the new pipelines should allow gas output to increase from both by about 50% in the next two years.

As a result of this, Shell announced last year that it will build a multibillion-dollar petrochemical complex near Pittsburgh to be close to the source of the Marcellus and Utica gas.

With the US domestic gas market having limited uptake capacity, and gas production expected to soar, the most promising way to exploit Permian and other shale gas is to export it to global markets as LNG.

US LNG exports

With US gas prices expected to remain low, the competitiveness of US LNG will improve. Based on current futures trading on the New York Mercantile Exchange, gas prices are expected to stay generally below $3/mn Btu through at least 2023.

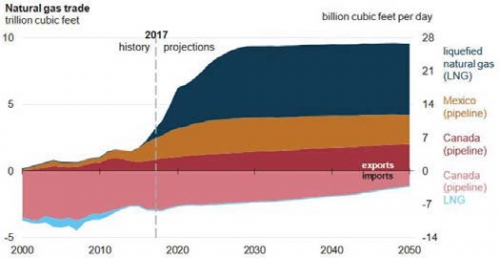

Cheap prices and abundant supply of gas, combined with an expected increase in global LNG demand, are motivating US companies to build more LNG export facilities. These, and increasing gas exports to Mexico, enabled the country to become a net exporter of gas last year for the first time since 1957 (Figure 4).

Figure: 4 US natural gas export forecast

Source: EIA

The US started exporting LNG in 2016 and five additional export terminals are expected to start operations by 2020, making the country the third largest LNG exporter in the world.

During CERAWeek, US LNG developer Tellurian presented its proposal to build two additional natural gas pipelines to move increasing output of associated gas from the Permian and Haynesville shale plays to the US Gulf Coast. These will increase access to cheap gas for its planned Driftwood LNG export terminal in southwest Louisiana, thus making it easier to compete in the Asian LNG markets. This is part of Tellurian’s strategy to convince investors and LNG buyers that its planned facility will be low cost, enabling it to keep to its plan to close funding of phase-1 in 2018, for 11mn metric tons/yr.

It estimates variable and operating costs to be around $3/mn Btu free on board (FOB). The company expects its 3.4bn ft³/d Driftwood LNG export terminal in Louisiana to start operations in 2022. During the last two years there has been a dearth of final investment decisions by LNG developers. There is still uncertainty about how much LNG will be needed globally and buyers want flexibility. The preference appears to be for shorter contract terms and smaller amounts of supply.

But that does not seem to concern Tellurian’s CEO Charif Souki, who while at Cheniere turned a giant white elephant, the Sabine Pass LNG import terminal, into an export terminal. He said that Tellurian is talking to 120 potential LNG buyers to sign on to the Driftwood project. He added "They all want $8/mn Btu or less delivered to their home…. I'm sitting next to very cheap gas and I know how to build liquefaction capacity."

US LNG is helping to accelerate a shift towards a more flexible, liquid, global market. Ensuring that gas remains affordable and secure is critical for its long-term prospects, helping US LNG producers make substantial inroads into these markets.

The big demand growth is predicted to come from Asia, notably China which is expected to account for 40% of that, driven by government policies to tackle air pollution in cities. India would lead growth in the rest of Asia.

The rise in gas demand in Asia and China last winter was unexpected and surprised the market. This is pushing LNG suppliers to respond faster than they expected. US LNG exporters, including Cheniere, see huge potential in this, expecting to export 3.6 bn ft³/day in 2018, and rising to 10-12bn ft³/day gas by the early 2020s and beyond after that.

Kevin Brown, research analyst at Tortoise Capital Advisors, one of the largest shareholders of Cheniere, said: "In the US we have a low-cost, abundant, diverse resource base with large growth that we see coming down the pipeline… we've been building out these gas-processing facilities, these pipelines and all the infrastructure that's required to really support the big LNG boom that we expect to see in the second wave of LNG.”

The IEA forecasts the US would generate almost 40% of the rise in global gas output by 2022. The increase in cheaper US shale gas production over the next five years, similar to the oil revolution, will cause another revolution through LNG where the US will play a similar role. The view at CERAWeek was that coal is too dirty, oil is too messy and renewables are too intermittent. But natural gas is just right. It is abundant, cheap and transportable and produces less carbon emissions than coal or oil.

However, there were also words of caution. Shell’s CEO Ben van Beurden said climate was the biggest challenge facing the energy sector and "The energy landscape is changing fast. So we must change, where change is what the world needs.

But the oil and gas industry is upbeat that demand will not disappear soon. Despite the fast-changing global energy landscape, and the inevitable shift to lower-carbon energy, oil and gas is still expected to provide about half the global energy demand even by 2040.

Charles Ellinas