[NGW Magazine] Indonesia adds at both ends

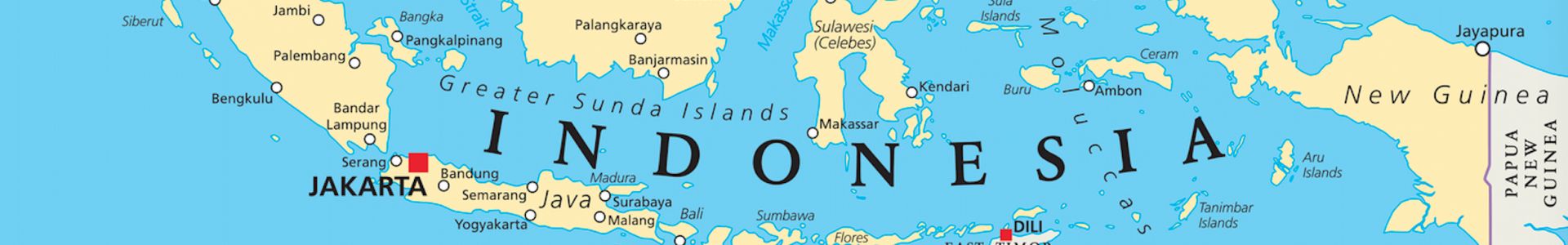

Indonesia is looking for gas at home and abroad, partly to enable further economic growth based on cleaner power rather than coal; but also to expand its LNG-based trading business as new markets come into sight.

Indonesia's state-owned Pertamina has entered into LNG supply deals with Pakistan and Bangladesh worth an estimated $10.4bn in total, although at the other end of the chain it is also boosting its LNG purchasing and production.

The state-owned oil and gas company expects to start supplying Bangladesh in the fourth quarter of this year, an official said in February.

Pertamina and Bangladesh Oil and Gas Corporation Petrobangla signed a binding letter of intent January 28. Under the 10-year agreement, Pertamina will supply 10mn mt in all, for an estimated $4bn.

Meanwhile Pertamina is planning to supply Pakistan with LNG as well, following the signing of an inter-governmental agreement on energy business by Indonesia’s minister of energy and mineral resources, Ignasius Jonan, and Pakistan’s state minister for oil, Jam Kamal Khan. This was during a recent visit by Indonesia’s president Joko Widodo to that country.

The companies will discuss an LNG sale and purchase agreement expected to total 1.5mn mt/yr over 10 years with an option for a five-year extension, worth an estimated $6.4bn, according to Pertamina.

Pertamina has a number of LNG deals with producers such as Woodside and Italy's Eni (at the Bontang terminal); US' ExxonMobil; and a liquefy-or-pay contract with the Texas-based company Cheniere.

The company has been trying to secure as much LNG as possible to meet domestic demand and its export portfolio. This is on top of the UK major BP's decision mid-2016 to expand Tangguh LNG, which will add another 3.8mn mt/yr of production some time around the middle of 2020.

Eni is to supply LNG from the Muara Bakau block, totalling 1.4mn mt/year for seven years, over 2017-2024. Cheniere is to supply 1.52mn mt/year free on board, under a 20-year contract from an under-construction LNG plant that is near Texas’ Corpus Christi. The price is indexed to the monthly Henry Hub price plus a fixed component for liquefaction. Deliveries from Train 2 are expected to start in 2019 but the contract may be extended by a decade.

Pertamina has a contract as well with Woodside to buy 600,000 mt/year over 2022-2034 which may be increased up to 1.1mn mt/year over 2024-2038. Besides that Pertamina signed a head of agreements with ExxonMobil on LNG sales. Pertamina plans to buy 1mn mt/year of LNG under a 20-year contract starting by 2025.

Pertamina estimates that Indonesia's gas demand will increase by 4.8%/year over 2015-2025. Previously the company estimated gas demand would only go up by 3.9%/yr, reaching 7.2bn ft³/day in 2025.

Pertamina sees gas demand growth influenced by infrastructure availability, particularly transmission and distribution pipelines but also regasification terminals. Therefore Pertamina will change its LNG and gas business orientation to meet domestic demand while maintaining export contracts. An early example was the reversal of Arun LNG, which is now an import terminal.

Pertamina targets raising gas production every year. It wants to increase gas output by 51% to 3.069bn ft³/day this year compared with 2.036bn ft³/day achieved last year; and reaching 5.71bn ft³/day of gas in 2025, of which just under a third, 1.48bn ft³/day, is expected to come from its overseas assets. The company is aggressively expanding its business to Iran, Algeria and Russia.

Block Tender

Meanwhile the government plans to hold a 25 oil and gas blocks auction to investors very shortly. The blocks are lower compared with the initial plan of 40 blocks, as the remaining blocks are considered to be unattractive for investors, the energy and mineral resources deputy minister Arcandra Tahar said.

Previously the government had planned to invite bids for 43 conventional and unconventional oil and gas blocks as part of its effort to boost the country's production. The blocks include some oil and gas blocks offered in 2015 and 2016 which failed to attracted investors; some new oil and gas working areas; and blocks where the current contracts are set to expire this year. The government will apply the gross split mechanism in the new oil and gas production contracts, replacing the previous cost recovery scheme.

The ministry has said that the country's oil and gas proven reserves stand at 3.7bn barrels of oil and 101.54 trillion ft³ of gas, and an additional 574 trillion ft³ of shale gas resource – much more, possibly, than coalbed methane and conventional gas potential resources of 453.3 trillion ft³ and 334.5 trillion ft³, respectively.

Indonesia failed to meet its 2017 production target of 815,000 b/day by pumping only 803,800 b/day. Meanwhile its gas production reached 6.386bn ft³/day compared with its target of 6.44bn ft³/day. Combined crude and gas production last year was 1.944mn barrels of oil equivalent/day, just missing the target of 1.965 million boe/day.

Meanwhile the government has also announced the winner of last year's block auction. Some foreign companies such as Abu Dhabi's Mubadala Petroleum and Premier Oil participated in the tender. The government will receive $23.57mn of investment commitment in the first three years and $3.25mn in signature bonuses, the ministry's spokesman Agung Pribadi said.

Indonesia appointed Mubadala Petroleum to develop the Andaman I block in offshore Sumatra, where it is committed to spending $2.15mn exploring the block and paying a $750,000 signature bonus. Mubadala was also awarded another block, namely Andaman II, which it will develop in a consortium with Premier and Kris Energy, on condition of a $7.55mn investment commitment and a $1mn signature bonus.

Indonesia's company's Tansri Madjid Energi won the right to develop the Merak-Lampung block in Lampung province with an investment commitment of $1.325mn and a $500,000 signature bonus. The subsidiary of Indonesia's state-owned gas distribution and transmission Perusahaan Gas Negara, namely Saka Energi, won the rights to explore not only the Pekawai block, offshore and onshore East Kalimantan, but also the West Yamdena block in offshore and onshore Maluku. This took a total investment commitment of $12.55mn and a $1mn signature bonus.

However, Agung said the government failed to attract investors to bid for five conventional blocks: South Tuna, Kasuri III, Tongkol, East Tanimbar and Memberamo. Last year the government offered 10 oil and gas blocks through a mix of direct awards and regular tenders. Indonesia is actively improving its policy to attract investors. The state energy and mineral resources agency has revoked 54 regulations in all, in the oil, gas, mining, power, and renewable energy sectors. The government is also simplifying another 51, reducing them to 29 in order to help attract fresh investment, according to energy minister Ignasius Jonan speaking in early February.

But so far this plan is not proving successful: while it is planning to spend $50bn/yr on energy, last year it scraped together barely half that sum: $26bn.

Not all the investment has brought the expected results: for example, the Mahakam block has underperformed: however, it believes it can slow down the decline rate that the previous owners reported. Pertamina bought the block back from operator French Total and Japanese Inpex with effect from Janary 1 this year at a cost of some $600mn, and is committed to spending $1.8bn on it. The gas is liquefied at Bontang.

Staff