[NGW Magazine] Canadian LNG needs a helping hand

Although Canada’s first LNG export terminal is nearing FID, it is not yet in the bag. Additional incentives and sharper cost-cutting will help ensure competitiveness, particularly compared with those in the US.

Western Canadian LNG can be competitive in Asian markets with rival supplies from the US Gulf of Mexico, but only if developers and governments take additional steps to lower landed costs, according to a recent study by the Canadian Energy Research Institute (Ceri).

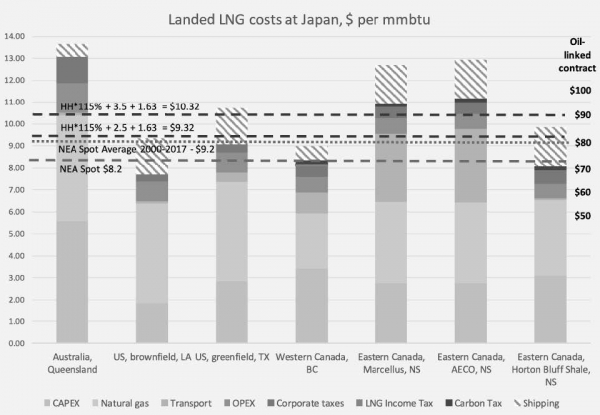

In May, when Ceri prepared its study, LNG from a “proxy” west coast LNG project, without accounting for additional government incentives or cost-cutting steps by proponents, would land in Japan at a cost $0.80/mn Btu higher than the prevailing Japanese spot price, which in May this year was about $8.20/mn Btu.

The “proxy” LNG project, Ceri said, was modelled on the 13mn metric tons/year (mt/yr) LNG Canada facility planned for Kitimat, BC, but differed in that the study assumed the plant would use gas to generate all required electricity (LNG Canada will use grid electricity for all auxiliary needs to keep the carbon footprint smaller). LNG Canada will also send extracted gas liquids, primarily condensate, back to Alberta for marketing.

Led by Anglo-Dutch major Shell, the C$40bn ($31bn) LNG Canada project is widely expected to take a positive final investment decision (FID) in late September.

The Ceri study, which compares the competitiveness of Canadian LNG projects on both coasts with similar export terminal projects on the US Gulf Coast, found that a Louisiana terminal carried a landed cost in Japan some $0.30/mn Btu higher than the BC project, while a Texas terminal would land LNG in Japan priced some $1.70/mn Btu higher.

The difference, Ceri said, is accounted for by reduced shipping costs (about $1.0/mn Btu) and cheaper gas supply provided by the integrated model (about $2/mn Btu). An east-coast plant, using either Marcellus or western Canadian gas, would not enjoy a cost advantage in Europe, landing there at some $4/mn Btu higher than the $7.40/mn Btu UK spot price. The “proxy” used by Ceri is LNG Limited’s Bear Head LNG project, an 8mn mt/yr facility proposed for Cape Breton in Nova Scotia.

Still, the study said, “Canadian integrated projects on both coasts, with additional incentives of government and certain cost-savings, are not only competitive and can outperform not only US greenfield and brownfield projects, but also can reach destination market price levels in Europe and Asia.”

Examples of government measures that could be taken include: exemption from fabricated steel duties and countervailing duties on imported LNG modules, which would reduce capital costs by 4.2% and further incentives such as an increased capital cost allowance.

“Beyond regulating import duties, the federal government could improve the capital allowance for the LNG industry,” the study says, noting that the federal government has already increased the capital allowance for LNG projects to 25.8% from 5.7% to help accelerate capital payback.

US projects, however, still hold an edge, by virtue of changes last year that allow developers to claim 100% capital allowance in the first year and the ability to carry forward the unused amount.

Helping themselves

Project sponsors meanwhile can enhance their own competitiveness by expanding plant capacity to achieve economies of scale; extracting additional revenues from high-value natural gas liquids entrained in their feed gas supplies, or by seeking contract terms from downstream buyers that are more attractive than the oil-linked formula (at 11.5% of Brent) used in the study.

Credit: Canadian Energy Research Institute

Spreading the cost of supporting infrastructure – jetty, land, storage, pipeline, utilities – and other elements across larger export volumes, Ceri said, could impact overall costs by as much as $0.77/mn Btu – “a significant incentive that drives LNG expansion projects all over the world.”

Monetising surplus natural gas liquids in the LNG feed gas stream, Ceri said, is particularly inviting for west coast LNG projects, many of which will source their gas from the liquids-rich Montney play.

“Ceri estimates that the additional revenue from NGLs (primarily condensate) will help reduce natural gas feedstock cost by 10%,” the study says. “The effect of these measures is estimated at $0.25/mn Btu in increased cost-competitiveness.”

Finally, a sales contract with the 11.5% of Brent formula, Ceri suggested, requires Brent crude to average $80 over the life of the sales contract for LNG exports to break even and provide a return to the investor; increasing the ratio to 12.5% would imply a break-even price for Brent of just $65. “Overall, if all measures are applied, an LNG project’s landed costs to Japan could decrease from $8.99/mn Btu to $7.55/mn Btu, or by 16%,” CERI said. “The resulting landed cost can be recovered by an LNG project with a market Brent crude oil price under $65.”

Alex Munton, principal analyst, LNG Research for consultancy Wood Mackenzie, is bullish on the LNG Canada moving forward, noting in a July 26 Gastalk Webinar hosted by Gastech Insights that the “industry’s eyes are on LNG Canada right now.”

In the two years since LNG Canada first delayed a final investment decision, LNG market conditions and the project’s economics have both improved, Munton said.

“We’ve already discussed how confidence has returned to the LNG market in recent months, and that’s reflected in the fact that developers are now more bullish on the need for new capacity, especially from 2022 onwards, which means that new projects need to start construction very soon,” he said.

At the same time, he added, the LNG Canada project specifically has become more competitive: new government incentives announced this past March have helped, as have a new, competitively-priced EPC contract (with a joint venture of Fluor and Japan’s JGC) and “big improvements” surrounding upstream economics.

“As a consequence of those things, momentum around the project is building, and has built quite quickly since the start of this year,” Munton said, citing the selection of Fluor/JGC as EPC contractor; the acquisition by Malaysia’s Petronas (which holds substantial Montney gas reserves through its subsidiary, Progress Energy Canada) of a 25% interest in the project; and the selection of contractors for Coastal GasLink, the pipeline that will carry feed gas from the Montney fields to the west coast.

“The decision is one that ultimately rests with the boards of the five joint venture partners, but it is looking very likely that it will be approved,” Munton said. Some uncertainty, however, has been injected with a jurisdictional challenge related to the project's feed gas pipeline.

East Coast needs local gas

An east coast LNG project, Ceri’s study said, could become competitive in Europe if it is able to access local shale gas supplies from Nova Scotia. Both high-profile projects in Nova Scotia, Pieridae Energy’s Goldboro LNG project and LNG Limited’s Bear Head LNG project, plan to use either Marcellus gas imported from the US or western Canadian gas priced at the Aeco hub in Alberta, neither of which, Ceri said, are viable options.

US Gulf Coast projects, on the other hand, are significantly more cost-competitive, Ceri said. Exports from Louisiana would land in Europe at a price $3.00/mn Btu less than from Nova Scotia, while a Texas plant could deliver LNG to Europe for $2.80/mn Btu less.

“Ceri has not found a viable path to lower eastern Canada projects’ landed cost below the European market price if the project sources gas from Aeco-C or Marcellus,” the study said. “The final optimised landed cost is $8.80/mn Btu, while the market price is $7.40/mn Btu. To make these projects cost competitive, more solutions than those modelled are required.”

If local shale gas were available in Nova Scotia, the study said, the optimised cost for a project using local gas would reduce the landed cost to $7.35/mn Btu, “making such an option viable under current spot prices.” A fracking ban in Nova Scotia, however, suggests such an option would not be open for either of that province’s planned projects.

Dale Lunan