[NGW Magazine] Angola Improves Tax Terms

A number of gas projects offshore Angola now look more likely thanks to a law that improves the tax regime and relieves investors of some onerous obligations – changes that could spark new interest upstream.

Upstream investors have responded positively to the enactment of a new law by Angola to incentivise natural gas exploration and development. Joao Lourenco, Angola’s president since late 2017, enacted the law by decree on May 18. It imposes competitive tax obligations on investors who are also no longer obliged to deliver some of their gas to the state oil producer Sonangol for free.

President of Angola Joao Lourenco (Credit: Twitter/Joao Lourenco)

The CEO of Johannesburg-based upstream practice Centurion Law Group, NJ Ayuk, said although the law does not indicate specifically the economic circumstances that can justify tax benefits, it offers important flexibility in cases of market fluctuations.

The fact that the legislation was adopted by presidential decree, he said, is a strong statement by Angola that it wants to develop its estimated 11 trillion ft³ (312bn m³) of reserves.

"The tax framework for natural gas is more attractive than for oil," he said.

"Setting up a 5% royalty (compared with 10% to 20% for crude oil), a 25% petroleum income tax (compared with 50% for crude oil), and exempting companies from the petroleum production tax clearly indicate Angolan authorities' willingness to incentivise developments in the natural gas sector. In addition, the petroleum income tax can be further reduced to 15% for non-associated gas projects whose proven reserves are below 2 trillion ft³, which is an incentive for developing even smaller gas discoveries," Ayuk added.

Prior to May 18, there was no regulatory framework, particularly for tax terms applicable to natural gas. As a result, oil majors were unable to commercialise their gas discoveries. For example, BP a year ago was forced to write off $750mn exploration costs incurred in relation to its major Katambi gas discovery in offshore Kwanza basin and to give up its 50% stake in block 24/11 to Sonangol.

The latter had said in April 2016 that Katambi contained gross “in place resources” of 8 trillion ft³ gas plus 280mn barrels condensate, for a grand total of 1.7bn barrels of oil equivalent (boe).

Sonangol in mid-2016 also announced the Zalophus find, with 2.8 trillion ft³ gas and 313mn barrels of condensate in place, totalling 813mn boe, on block 20/11 from which US operator Cobalt has subsequently exited.

In terms of the old law, associated gas in excess of that used by oil companies in their operations was to be made available free to the national concessionaire. Also, non-associated gas discovered within a contract area had to be developed by the oil firm and Sonangol, although if no agreement was reached the national concessionaire could develop the assets alone.

Now, with the new law in place, companies will no longer be obliged to deliver gas to Sonangol free of charge. They can still use the resource for their activities without charge but if they do not want to use it or they decide to sell any surplus they deliver it to Sonangol on a cost-recovery basis.

While the new natural gas regulatory framework is a big step forward for the development of the sector, Ayuk said, Angola needs to take immediate steps to establish a natural gas value chain.

“Guidelines for investing in, and developing, gas-to-power and gas-fed downstream industries like petrochemicals and fertilisers would give additional incentives for investors and operators that their gas will be finding buyers and off-takers,” he said.

Norwegian producer Equinor’s country president in Angola, Marc Courtemanche, told The Oil and Gas Year: “We believe that the country has quite significant, yet-to-find and undeveloped resources in the Congo Basin. The recent review of the fiscal and regulatory framework for the industry is making some of those volumes potentially economically viable.” Equinor (formerly Statoil) is a partner in several Angolan offshore blocks.

Speaking just before the decree was published, Courtemanche added: “Gas requires specific and longer terms compared to oil production sharing contracts, which average around 25 years. Getting the full value out of gas requires 30-40 years. Angola has proved resources when it comes to gas, and we are investigating ways to be able to monetise these resources.”

Floating LNG a possibility

Some of the Angolan gas fields may now be candidates for eventual development as floating liquefaction (FLNG) projects.

Goncalo Falcao, a partner at American law firm Mayer Brown, told NGW that a number of gas discoveries that lay idle offshore Angola can now be developed.

"There are new and clear rules, notably tax, that allow investors to construe economic models and decide on natural gas investment. In a nutshell, knowing the rules investors may come in and, consequently, monetise these resources for their own benefit and of Angola."

He said the lower tax thresholds for gas compared with oil are justified because the gas market value is lower, while development expenditure is high, if the gas reserves are offshore.

"Whether these terms are competitive, it depends of the exact profile of each development area, that the quantities of gas found, production costs and market prices," he said.

Angola has had a four-year gap when not even offshore oil projects were sanctioned. That means its post-2019 oil production volumes could decline significantly, reducing revenues for public spending.

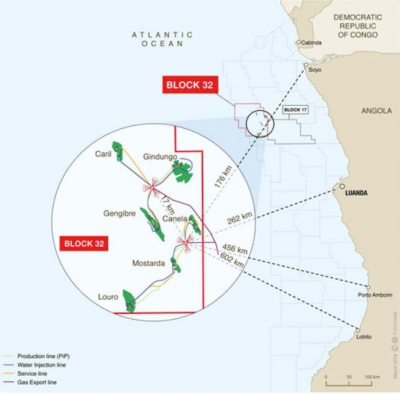

That four-year hiatus ended in late May when Total took the final investment decision (FID) on its $1.2bn Zinia-2 oil development. This summer the French major expects to start producing from its Kaombo deep offshore oil project on Block 32 – the last such Angolan oil project on which a FID was taken, in April 2014.

Elsewhere offshore west Africa where fiscal terms for gas have been friendlier, Cameroon is now looking to develop its second FLNG project – having inked fiscal terms in early June with Jersey-based independent NewAge – for possible start-up in 2023. Cameroon and West Africa’s first FLNG venture, operated by Perenco and Golar, exported its first cargo in mid-May. Equatorial Guinea and project developer Ophir, however, have yet to take FID on that country’s first FLNG, having missed several target dates to complete financing and sanction the venture.

Credit: Total

Such projects vary in size from 1mn to about 3mn mt/yr. In addition, NewAge is also mulling possible 1mn mt/yr FLNG schemes offshore Congo-Brazzaville and Nigeria for start-up around 2023-25.

Chevron-operated Angola LNG is the world's first liquefaction complex to run solely on associated gas, received from oilfields operated by various producers. The 5.2mn mt/yr unit cost at least $10bn, started exports mid-2013, shut for two years of repairs in April 2014, but has now operated normally for two years.

Thulani Mpofu