[NGW Magazine] Canada's East Coast offers LNG potential

Shell’s high-profile project is not the only LNG game in Canada: east coast LNG projects are also on the table, and western producers are eager to get in on the action there and also in small scale projects.

The centre of Canada’s LNG world now rests on the west coast, where the Anglo-Dutch Shell-led LNG Canada is expected to announce a final investment decision on its C$40bn ($31bn) export project within a few months.

But LNG in Canada is more than just LNG Canada: other proponents are pursuing major liquefaction projects on the country’s west coast – emanating out from BC’s Lower Mainland is a growing network of smaller scale LNG export developments, shore-side marine bunkering operations, medium and heavy-duty transportation initiatives and remote power installations fueled by LNG instead of diesel.

And in the Western Canadian Sedimentary Basin, producers not already connected to integrated LNG export proposals like LNG Canada or the Chevron-Woodside Kitimat LNG project are examining their options to monetise what is the world’s fifth large accumulation of proved gas reserves.

In BC's Lower Mainland surrounding Vancouver, utility FortisBC late last year shipped the first exports of Canadian LNG to China, using ISO containers, and earlier this year sent another 20 containers to China Energy Reserve and Chemicals Group. More exports are planned throughout 2018, Calvin Xu, CEO of True North Energy, which facilitated the export, told the mid-May Canada Gas & LNG Conference in Vancouver.

“By using ISO containers, we can ship LNG from here all the way directly to the end-user in China,” Xu said. “At peak times, when the market price approaches US$30/mn Btu, small-scale LNG exports to China can certainly be attractive.”

LNG for the ISO exports to China is being produced at FortisBC's small-scale Tilbury facility, which can liquefy some 37mn ft³/day of natural gas.

Tilbury is also supporting FortisBC's efforts to bring LNG to the marine and transportation markets: it supplies all the fuel for three LNG-powered ferries being operated by BC Ferries, and for the Spirit of British Columbia, the largest vessel in the BC Ferries fleet, which was recently converted to dual-fuel capabilities and placed back in service on June 6. And it has been marketing LNG and CNG to the commercial transportation sector in BC for several years. While BC may be the epicentre of LNG activity, other projects are active in Nova Scotia, some 5,500 km to the east. Pieridae Energy Canada is proposing the development of Goldboro LNG, a 10mn mt/yr facility in Guysborough County, adjacent to the Maritimes & Northeast Pipeline (M&NP), which brings gas into Canada from the Marcellus fields in the northeastern US, while Liquefied Natural Gas Limited (LNG Limited), based in Perth, Australia, is proposing a similar-sized facility some 60 km to the northeast, at Point Tupper on Nova Scotia's Cape Breton.

FortisBC's small-scale Tilbury LNG facility (Credit: FortisBC)

The 8mn mt/yr Bear Head LNG terminal is only half the distance to major European markets that cargoes from Gulf Coast export terminals must travel, and it is ideally positioned to ride the next wave of North American LNG development, president Greg Vesey told the Vancouver conference.

“Between 2016 and 2035, North America will go from being an importer of 3mn mt/yr of LNG to being an exporter of perhaps as much as 158mn mt/yr,” Vesey said. “And I do mean North America – Canada and the US Gulf Coast.”

Globally, he said, all major LNG markets will see imports rise: Europe to 121mn mt/yr in 2035 from 28mn mt/yr in 2016; Asia to 315mn mt/yr from 136mn mt/yr.

But even with all of the major liquefaction projects at various stages of front-end engineering and design or nearing final investment decisions all around the world, global import demand in 2035 will still exceed global export capacity by 20mn mt/yr, which suggests, Vesey said, that “LNG development on the US Gulf Coast and in Canada is very important in the LNG mix of the world going forward.”

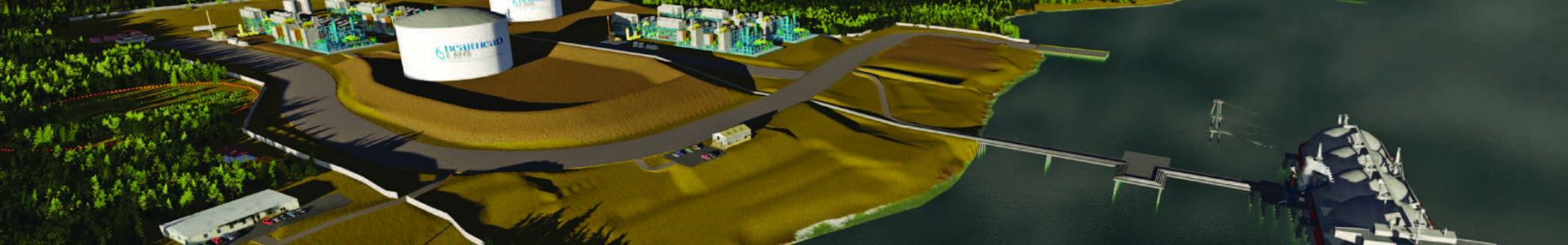

Artist rendering of the Bear Head LNG Terminal (Credit: Liquefied Natural Gas Limited)

When LNG Limited acquired a brownfield LNG import site on Nova Scotia’s Cape Breton in 2014 with a view to redeveloping it as an export facility, the plan was to draw feed gas from the Marcellus and Utica fields of the northeastern US via Kinder Morgan’s proposed Constitution Pipeline, Vesey said.

“When I started with LNG Limited in April 2016, that was the plan. Two weeks later, Kinder Morgan cancelled their project, and we were left to figure out what we were going to do for our gas supply,” he said.

Bear Head’s business model is as a tolling facility: producers with LNG customers would ship their gas to the facility, for liquefaction and loading on to tankers. Liquefaction costs will be in the US$2.45-US$2.75/mn Btu range, on top of pipeline shipping costs of between US$2.40-US$3.05/mn Btu.

With Montney production costs in the US$1.50-US$2.50/mn Btu range, according to estimates by RBC Capital Markets, LNG would be handed back to the producer free on board at between US$6.35/mn Btu and US$8.28/mn Btu, he added.

Standing in the way of Bear Head moving forward, however, is a lack of secure shipping capacity from western Canada to the east coast. Technically, and provided capacity is available along the full route, molecules can be shipped on existing pipelines: on TransCanada’s Mainline to Quebec, on the Trans-Quebec & Maritimes system through Quebec, on Portland Natural Gas Transmission from the Quebec-New Hampshire border, then up to Nova Scotia on the M&NP system.

Ideally, however, Bear Head would like to attract sufficient producer commitment to justify building a pipeline from the TransCanada Mainline at North Bay, Ontario across Quebec and into New Brunswick, where it could tie in to the M&NP system, Vesey said. The proposed Bear Paw pipeline would make the final 62 km connection from M&NP to Point Tupper.

“I think what will get it going is if we can get some big producers behind us,” Vesey told NGW on the sidelines of the conference. “They aren’t going to do it for little Bear Head, but if we get some of those big producers behind us saying this is where we want to go, then it will happen – and that is what we hope to map out this year.”

Vesey would not identify which producers Bear Head is talking to, but he did say that discussions have been held with all the major independent producers active in western Canada. Presumably, that would include Seven Generations Energy, which holds more than 2.5 trillion ft³ of gross proved reserves of shale gas.

A relatively new producer – its initial public offering was in 2014 – Seven Generations grew quickly, and in 1Q 2018 it reported average gas production of more than 470mn ft³/day, Charlotte Raggett, vice-president, market access, told conference delegates.

"We have a lot of volume that we need to find markets for, and LNG is certainly a space we would like to work in,” she said, noting that the company holds a minority investment position in Steelhead LNG – which is developing the 24mn mt/yr Kwispaa LNG project on Vancouver Island – and has looked at virtually every liquefaction market in North America, including opportunities on Canada’s east coast and in the US.

Canadian producers, she said, are willing to accept price volatility in their LNG marketing initiatives – they’ve been doing so in the Aeco market for at least the last couple of years – and the potential for price volatility, whether in Asian spot LNG markets or in Brent crude or even at Henry Hub, is not a major concern.

And while gas monetisation opportunities exist across North America – whether pipeline exports or LNG – netbacks are low and not expected to increase much, given the vast volumes of shale gas now flooding markets in both Canada and the US, Raggett said.

“We can go west into some of the BC LNG projects; we can go south to Jordan Cove in Oregon,” she said. “Eastern Canada has some LNG projects on the books, the Gulf Coast has many projects. There are pipelines that access those markets from western Canada today. But the real challenge is what do those netbacks look like.”

Most US options, she said, would generate netbacks for Canadian producers of less than US$1/mn Btu, while even the Jordan Cove project, offered a netback of only US$1/mn Btu.

That leaves only western Canada as a viable target market for producers eager to tap global LNG markets, Raggett said. Shell’s LNG Canada project, for example, would provide producers with netbacks in the neighbourhood of US$1.50/mn Btu, but as an integrated project, it offers little opportunity for other western Canadian producers.

“LNG Canada and Kitimat LNG are both integrated LNG projects – their partners all have natural gas supply and there is less of a role that Canadian producers can play in those projects,” she said, noting that both the Woodfibre project at Squamish and the Kwispaa project on Vancouver Island, could be potential market outlets. “We are really looking to the west coast of Canada as our best option for LNG, especially for those projects in which producers can participate and bring LNG development to Canada.”

Dale Lunan