[NGW Magazine] SA gas-to-power programme gearing up/ Private Equity Enters S Africa

South Africa is busy removing political obstacles to the launch of two pioneering independent power producer (IPP) projects, and tenders are expected to be awarded next year.

This was revealed at an energy conference in Cape Town by Karen Breytenbach, who heads the IPP Office in Pretoria – the division of the energy ministry that will be managing the tender process.

The projects are at the ports of Coega and Richards Bay, and were originally announced in March 2016. However, the process ground to a halt, and is only now being dusted off under energy minister Jeff Radebe, who was appointed this year by the president, Cyril Ramaphosa.

The original plan envisaged for each project:

• LNG procurement and delivery

• Floating LNG storage and regasification facilities (or equivalent LNG regasification and storage technology)

• Port infrastructure, including fixed maritime structures and modifications

• Gas transmission pipelines to connect the FSRU (or equivalent LNG regasification and storage technology) with the new power generation facility

• LNG and or gas distribution hub(s) for third party offtake

• A power plant, including a high-voltage connection to the power grid; and

• Arrangements for independent delivery of LNG, and the sale of a modest percentage of gas and LNG to external users.

The revamped programme is expected to retain these parameters. “We are going to start next year with the gas programme,” Breytenbach told the conference. “Gas can make a massive difference in the economies of countries which have gas, but also their neighbours – it will be a win-win for everybody.

“We are not bringing in gas only for electricity. It is also for the economy, for industrial use, for the transport sector.”

“We are not bringing in gas only for electricity. It is also for the economy, for industrial use, for the transport sector.”

A renewed request for proposals by the government is expected soon, as the first stage of identifying suitable developers of the projects.

She said that the new procurement process will require careful thought on how the gas will be deployed for transport and industrial development.

“We have great ideas, but haven’t finalised anything,” said Breytenbach. “In two years, a lot has happened. We need to brush it up and will come to the market hopefully next year. We will bring in LNG and will take it further downstream.”

The head of energy lobby group South African Oil & Gas Alliance (Saoga) Niall Kramer said that he looks forward to “two import terminals operating in South Africa, with social benefits of gas to power. It will be gas to power to people, not a technically driven programme.”

Radebe said the gas-to-power programme and other backlogged energy issues are being tackled one step at a time, but with expedition.

He said SADC ministers have adopted a gas master plan for regional co-operation. “The decision includes the private sector. There is a lot of interest there,” he said.

He was preparing to travel to Mozambique later in September, ”to see how to enhance this agreement in the context of new finds in the Rovuma basin. “Going forward, the SA government will expand the relationship with Mozambique. There are finds of gas in Tanzania, Mozambique and Namibia. I think there is a lot of gas in southern Africa.”

He said that the South African Department of Energy is reviewing the gas regulatory framework – to draft a bill to support and facilitate infrastructure development. ”This will allow the minister of energy to support the development of infrastructure for imported LNG - storage, pipelines and so on. Natural gas is finding a place at the heart of energy discussions worldwide.”

Kramer said that the idea of creating a gas economy in South Africa was gaining momentum: ”Minister Radebe has brought policy certainty. South Africa is on the cusp of something big. There is pent-up interest,” he said.

Private Investment needed

Radebe said that the private sector will need to drive investment in gas development, but he is “very optimistic about financing. In June, the meeting of energy ministers of SADC was preceded by a meeting with social partners and financial institutions. I was so impressed to see so many commercial banks who are keen on the masterplan for gas in Southern Africa. There is a bright future for gas in South African Development Committee and in Southern Africa.”

In another development, Radebe announced that he expects ministerial oversight of shale gas licensing in South Africa’s promising Karoo region to be transferred to himself, from mining minister Gwede Matashe.

This could tackle another bottleneck in the development of gas in South Africa, as it is possible that once exploration licenses have been allocated and substantial work has begun, a commercially viable shale gas industry could be developed in South Africa.

The Pretoria government has recently released a strategy for the country’s future energy mix, which would see substantial increases in gas, along with renewable, as a feedstock for power generation.

Said Kramer: “It is envisaged that 16% of feedstock for power generation will be gas, and it has to come from somewhere.

“Initially, we can import it as LNG. There will be billions of dollars of investment to unleash opportunities for SA –at Coega and Richards Bay. The impact can be catalytic.”

PRIVATE EQUITY ENTERS S AFRICA

PRIVATE EQUITY ENTERS S AFRICA

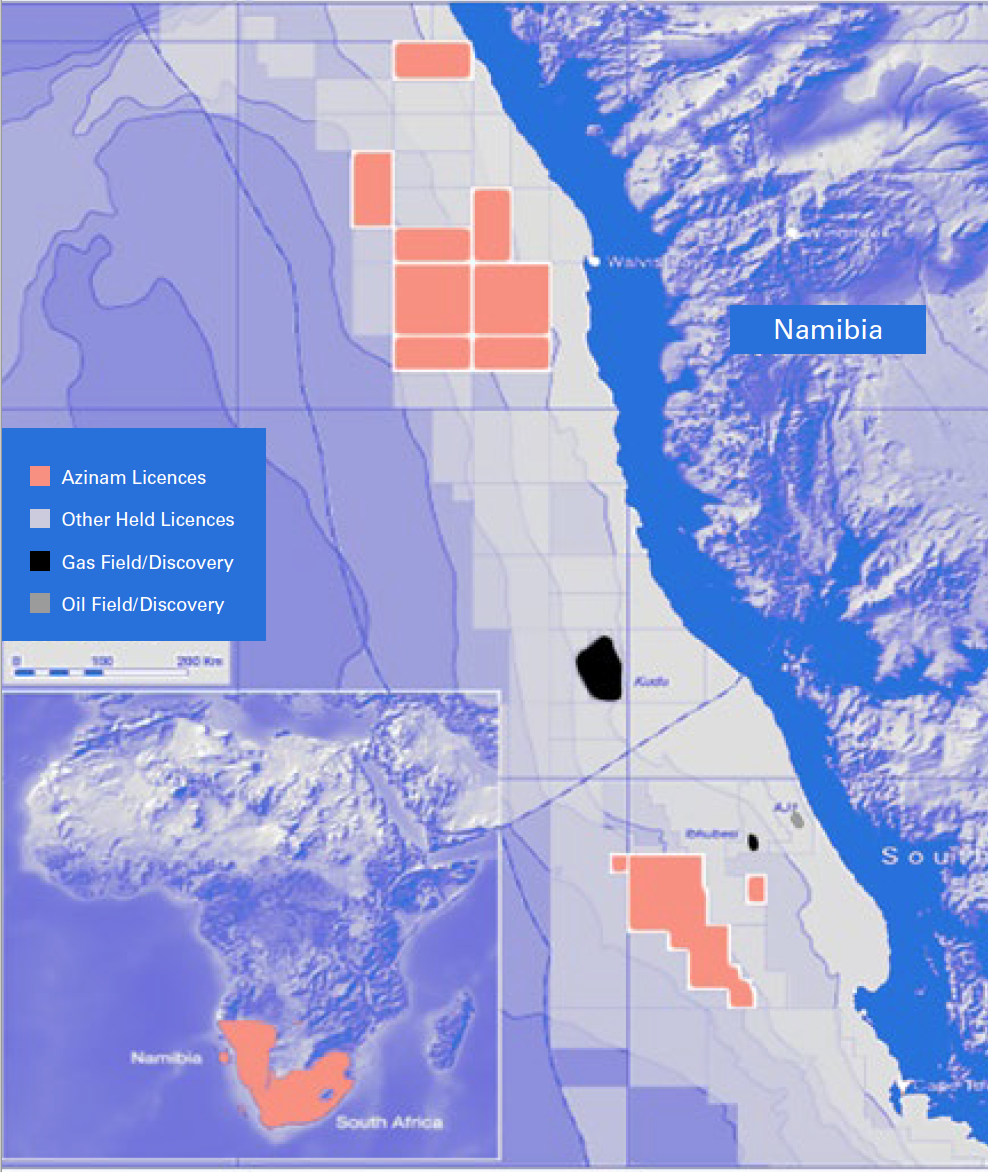

Azinam, the Seacrest Capital-backed African oil explorer, has acquired operating interests in two licences offshore South Africa. They are a 40% stake in Block 3B/4B and a 51% stake in nearshore Block 3B/4B in the Orange

Basin. Existing South African owner Ricocure will retain 60% and 49% in the blocks respectively. Both farm-ins are subject to government approval and other conditions. The licences were previously held by Ricocure under technical co-operation permits.

Exploration right applications have already been submitted for both Block 3B/4B and Nearshore Block 3B/4B – an application which both partners expect to be completed and approved by the beginning of 2019.

Azinam is already active offshore neighbouring Namibia: it recently brought ExxonMobil into one of its licences there (PEL44), while in another (Chariot-operated PEL 71) a well is to be drilled in 4Q.

South Africa will be a new country entry for Azinam. The two new blocks cover 18,530 km. in aggregate, with Block 3B/4B some 120 to 250 km offshore South Africa (see map). The Block 3B/4B licence was previously held by BHP Billiton who acquired a 10,000km. 3D seismic survey in 2012 which Azinam plans to reprocess.

Azinam says, following the acquisition, it will have one of the largest portfolios offshore southwest Africa – totalling 80,530 km. – possessing world class prospects within attractive fiscal regimes. It did not specify whether net or gross to Azinam.

Managing director Daniel McKeown said of its planned move offshore South Africa: “We see this as a natural expansion of our existing offshore Namibia operation and we will be developing our Windhoek [Namibia] office further under the guidance of our vice president of exploration, Uaapi Utjavari, who was instrumental in sourcing, evaluating and securing this exciting opportunity.”

— Mark Smedley