[NGW Magazine] Majors show more interest in Greece

This article is featured in NGW Magazine Volume 2, Issue 12

By Charles Ellinas

The majors have been slow to invest in the waters around Greece but they are now waking up to the possibilities on offer.

Greece first attracted the interest of international oil companies (IOCs) last October, in its second licensing round. A joint venture of Total (operator, with 50%), French-owned Edison and Hellenic Petroleum (with 25% each) won block 2 offshore Corfu in western Greece.

The exploration rights deal was eventually signed in March. This has now been followed up, on June 1, by a joint venture of ExxonMobil, Total and Hellenic Petroleum submitting an official application of interest to explore for hydrocarbons in two blocks south of Crete. But it has been a tortuous path getting to this stage, following a number of disappointing attempts over more than 50 years of trying.

Historical review

The first attempt to license exploration concessions in Greece was made in 1960, attracting IOCs such as BP, Exxon, Texaco and Chevron. More than 40 wells were drilled onshore and offshore, but they had limited success, except for the discovery of the Prinos oilfield and South Kavalla gasfield offshore north Greece. These are now operated by Energean.

In 1995, following enactment of Greece’s Hydrocarbon Law 2289/95, 24 concessions were awarded to Greek state companies. As many as 73 exploration wells were drilled, but again with little success, including the discovery of an oilfield at Katakolon offshore western Greece and a natural gasfield in Epanomi, Thessalonica.

Greece’s first offshore licensing round took place in 1996 with three onshore blocks and three offshore blocks in western Greece offered for open bidding.

Four concessions were awarded, including two to Enterprise Oil, but again success proved to be elusive and all companies had pulled out by 2001. In 2007 all concessions were withdrawn, except for those in the Prinos area.

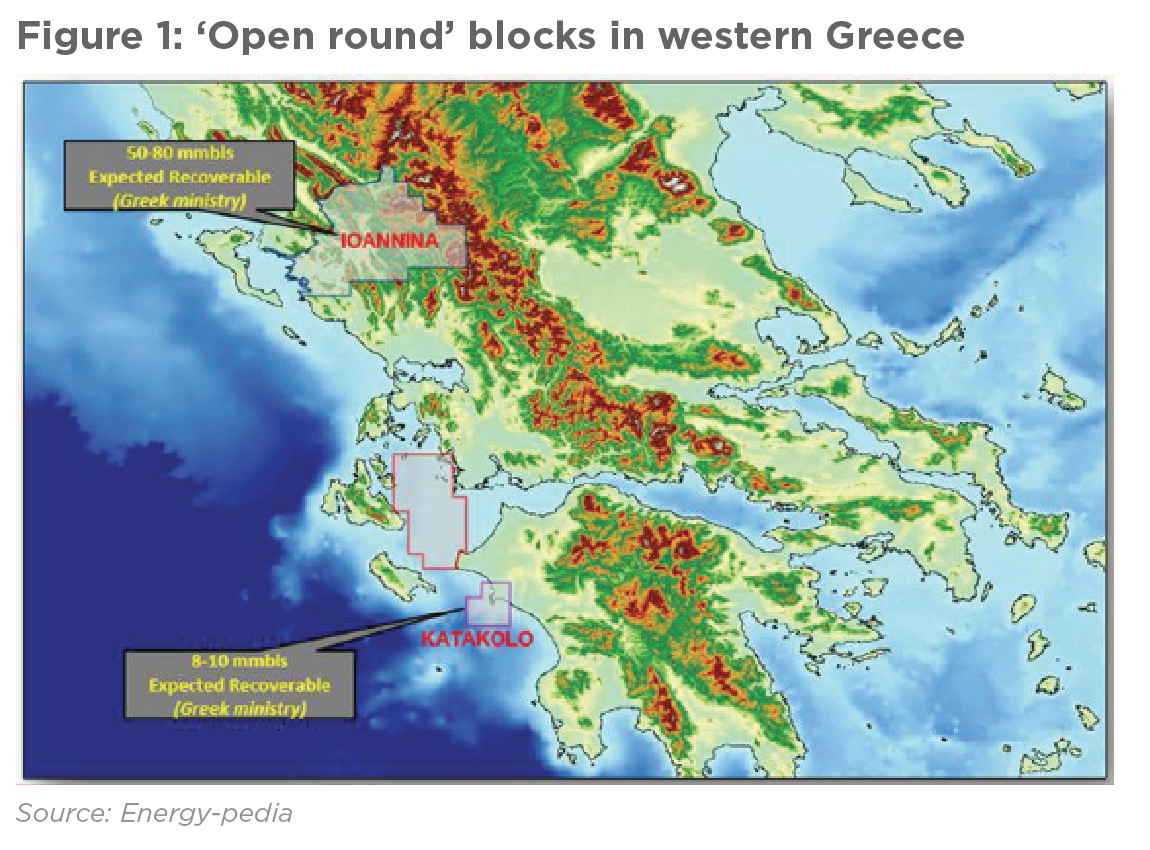

A new ‘open door’ licensing round was launched in January 2012, which included three blocks in western Greece (Figure 1). In July 2013 Energean was awarded a license agreement for the Ioannina onshore block in Epirus. Energean expects that around 100mn barrels of oil or 2 trillion ft³ of natural gas could be discovered in the block, which covers 4,187 km².

This was followed up in March 2014 by the award of Katakolon block, with expected oil reserves of 10mn barrels, which was successfully converted into a 25-year production licence in November 2016.

In the meanwhile, encouraged by gas discoveries offshore Egypt, Israel and Cyprus, Greece decided to go for new licensing rounds. It started preparations in 2012 with new, and extensive, 2-D seismic surveys in west Greece and south of Crete. This enabled the energy ministry to put together an extensive database covering 220,000 km2.

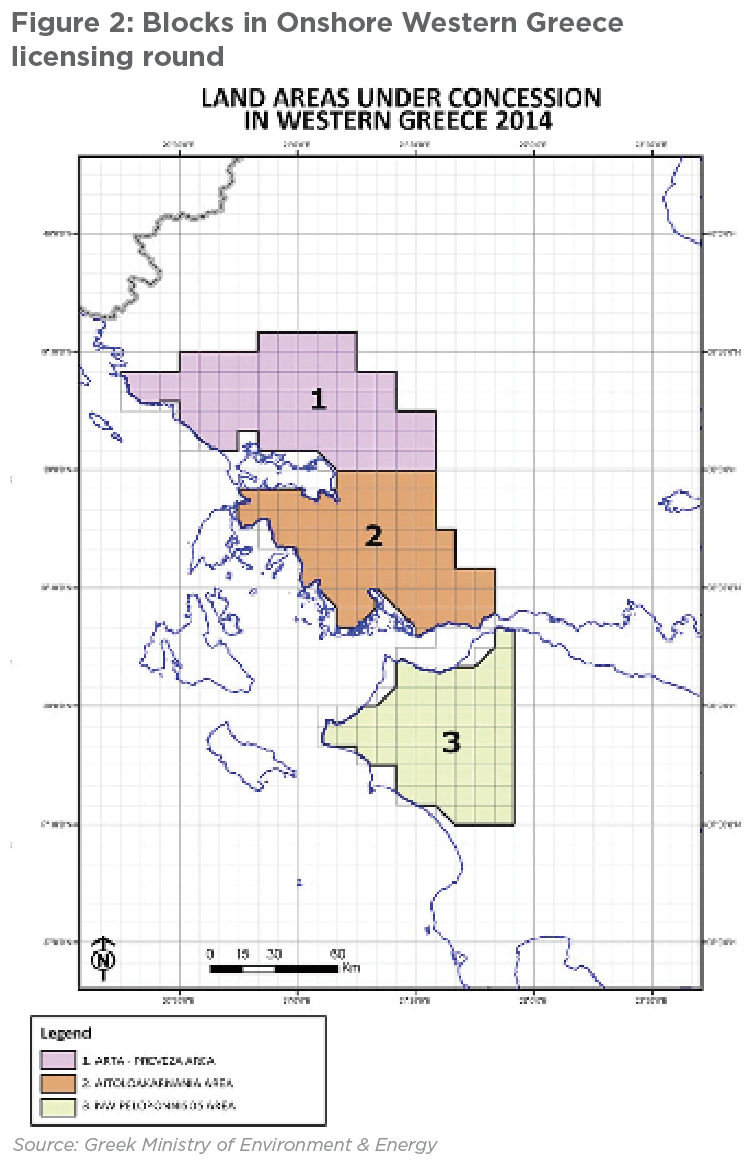

The next attempt was made November 5, 2014, when an international call was published in the EU Official Journal inviting tenders for three blocks onshore western Greece (Figure 2). The deadline for submission of tenders was February 6, 2015.

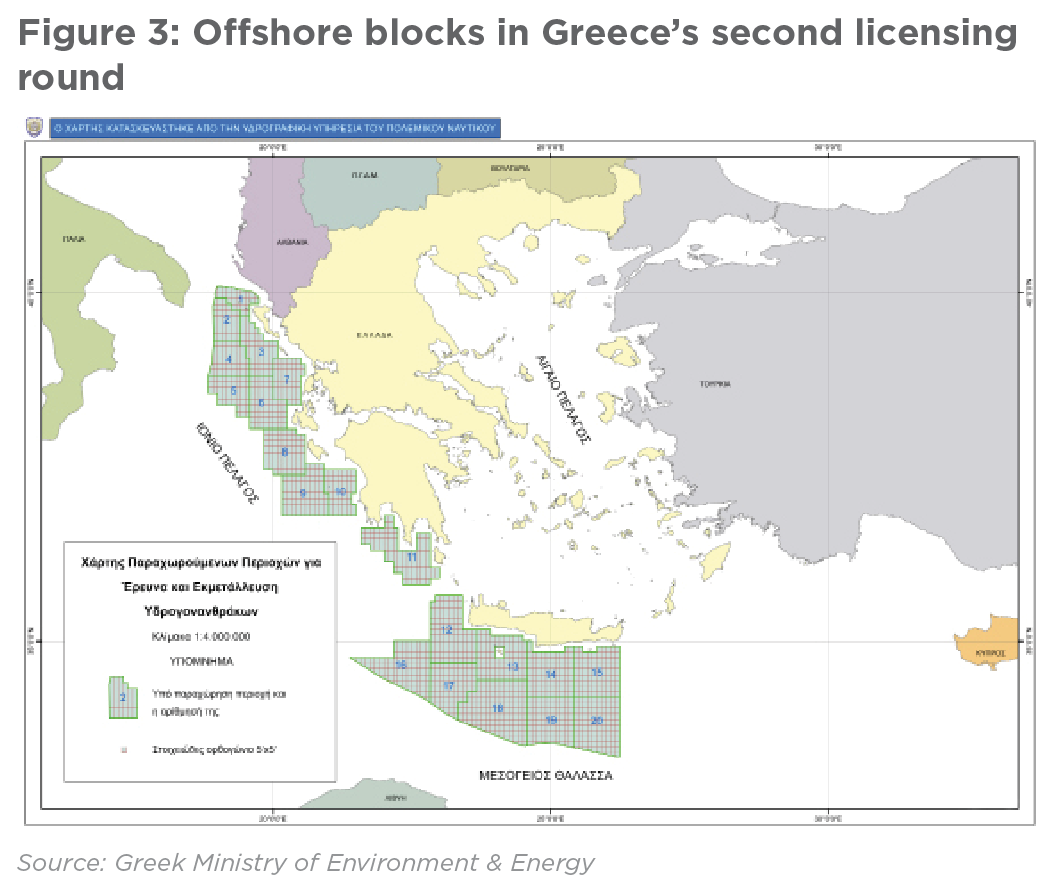

Following that, Greece’s second offshore licensing round was announced formally November 13, 2014, when a call for tenders was published in the EU Official Journal. This included 11 blocks in west Greece and 9 south of Crete (Figure 3). The deadline for submission of tenders was May 14, 2015.

Onshore western Greece

The onshore western Greece licensing round did not attract any IOC interest, even though rumours circulated that the drive for one came from initial interest by Total, Shell, Repsol and Enel. Among the possible deterrents were the low oil price environment, tax and other regulatory risk and the political and economic volatility of the country.

However, Energean submitted a bid for the Aitoloakarnania block and Hellenic Petroleum submitted bids for blocks Arta-Preveza and northwest Peloponnese. The energy ministry set up a committee to assess these bids over a three months period.

It was reported at the time that Greece’s debt crisis prompted the country to step up its efforts to develop its oil and gas reserves, but nothing was announced until March 31, 2017 when Energean agreed to farm-out a 60% interest in its Ioannina and Aitoloakarnania blocks, onshore western Greece, to Repsol, with Repsol becoming the operator.

The Ioannina and Aitoloakarnania blocks, covering 8,500 km² in all, are priority exploration targets for Energean, and now for Repsol. They are part of the Hellinide fold belt, which hosts the prolific Ionian basin and Apulian platform and are on trend with recent large discoveries made in Albania. In total over 10bn barrels of oil and 30 trillion ft³ of gas have been discovered throughout this region primarily in Albania, Italy and Croatia.

Two years and three months after the tender submission deadline, Energean confirmed May 25 that it signed a lease agreement with the Greek government for the Aitoloakarnania block onshore Greece, described as a geological continuation of the Ioaninna block, which Energean has been exploring since 2014. On the same day the government signed lease agreements for the Arta-Preveza and northwest Peloponnese blocks with Hellenic Petroleum.

Energean and Repsol have already submitted an application to the Greek government to approve Repsol’s farm-in and undertake a 2-D seismic survey over Ioannina in 2017-18 and conduct a full tensor gravity and 2D seismic survey over the Aitoloakarnania in 2018-19.

Second international offshore licensing round

For similar reasons to the onshore western Greece licensing round, an equally poor IOC response to the second international offshore licensing round forced the government to extend the deadline from May 2015 to July 14, 2015.

By July the outlook did not change. The default on the loan repayment to the IMF, the closure of the banks and another expected default on a European Central Bank payment, did not bode well for Greece’s wish to attract international interest to its embryonic hydrocarbon industry. It took until May 15, 2016 for the energy ministry to announce that it intended to conclude the evaluation of the offshore exploration bids in the following weeks and name the preferred bidders soon after.

But it took a lot longer. It announced October 25, 2016 that the preferred bidder for block 2, west of Corfu, was Hellenic Petroleum in a joint venture with Total as operator and Edison. The exploration rights deal was signed March 17, but it still has to be approved by Greece’s Court of Auditors and the parliament.

On December 6, 2016 the energy ministry announced Hellenic Petroleum as the preferred bidder for block 10 in the Kyparissiakos Gulf offshore western Greece. Hellenic Petroleum also made an offer for block 1. The final results from the evaluation of Greece’s second international offshore licensing round are still awaited.

International interest grows

In the meanwhile, exploring for gas in the Mediterranean has become more attractive since Eni discovered the Zohr gasfield offshore Egypt in 2015 in a carbonate formation. This is the biggest gasfield discovered in the Mediterranean and estimated to contain 850bn m³ of gas.

This may be what attracted ExxonMobil to the region, having already tendered for and won block 10 offshore Cyprus. It has been attracted by the prospect of making a significant gas discovery in a stable region, within the EU, with established regulatory, taxation and fiscal systems. It may also have contributed to Total’s heightened interest in the region, given its active involvement in the exclusive economic zones of Egypt and Cyprus.

On May 21 the energy ministry said that the minister held talks with representatives of ExxonMobil, Total and Hellenic Petroleum about gas exploration opportunities south of Crete. These concerned the remaining 17 blocks in the Ionian Sea and south of Crete which were unsuccessfully offered in 2014. In addition, it was reported that ExxonMobil was in discussions with Hellenic Petroleum to participate in its offshore blocks in western Greece.

On June 1, ExxonMobil and Total announced that they will bid, in co-operation with Hellenic Petroleum, for offshore rights for two blocks covering 20,000 km2 in Greek waters south of Crete. The aim is to start surveying before the end of the year. According to Hellenic Petroleum, the companies expressed their willingness to explore in these frontier areas, anticipating that the Greek government will accept the application and release an international tender, as per the Greek Hydrocarbons Law.

The president of Hellenic Petroleum, E Tsotsoros, said: “If indeed the existence of exploitable hydrocarbons is verified, it is certain that our country will enter a new era, with obvious benefits for the national economy and the local communities, and will contribute to the geopolitical and energy upgrade of Greece.”

The spending could be large. It has been reported that the boards of ExxonMobil and Total have agreed to spend as much as €5bn ($5.6bn) each on exploration and production offshore Greece – and other bidders are waiting in the wings.

ExxonMobil actually bought the seismic data offered in Greece’s second offshore licensing round in 2014. Interestingly the geological formations south of Crete are considered to be similar to those of Zohr and of block 10 offshore Cyprus.

Good shows

In an interview with NGW in April 2016 executive vice-president of Flow Energy Athens, Elias Konofagos, expanded on the possibility that Greece holds major hydrocarbon reserves south of Crete, similar to Zohr. He based this assertion on the evaluation of geological and geochemical data acquired since 1985 by scientists working on the Libyan Sea.

He said that potentially strategically significant gas reserves may be present in Greek waters south of Crete in the range of 3-4 trillion m³ and possibly as much as 1.5-4 bn barrels of oil. This is supported by USGS which estimated that the Mediterranean, east of Italy, may hold as much as 10 trillion m³ of gas.

He urged that Greek exploration gets off the ground as soon as possible, taking into account the new knowledge and interest coming out of discoveries in the East Med, both in the Levantine Basin and Zohr.

New tender

There are signs that this may be about to be given a boost. In February this year it was reported that the energy ministry and Greek hydrocarbon management company (EDEY) were working on legal framework revisions, in a bid to make it more attractive for investors to participate in a new international tender to offer offshore exploration licenses in the Ionian Sea, western Greece, and south of Crete.

The energy minister Giorgos Stathakis confirmed at an energy forum in Athens in February that the ministry was working closely with Cyprus’ energy ministry to gain from its hydrocarbon sector experience. He then went on to say that a new hydrocarbon tender was under preparation and that it could be expected during his tenure.

On May 29, the head of EDEY Yiannis Bassias confirmed that Greece will start opening new onshore oil and gas blocks for exploration in 2018. He said: “As of next year, and perhaps earlier, we will begin announcing that we are opening the door to whoever is interested in onshore sites.” He also went on to say that higher oil prices and a more stable political landscape in Greece could now attract companies to sign up to explore the remaining 17 blocks, out of 20, in the Ionian Sea and south of Crete, for which no bidders competed in the 2014 tender.

Evidently Greece believes that the reasons which led to the poor IOC interest to its 2014 tenders are no longer applicable and have now been overcome. Increasing international interest in its offshore blocks is probably reinforcing this. But if the delays in conducting and evaluating the previous tenders, and awarding concessions, are repeated, the Greek economy will suffer further.

The government appears to be turning to offshore oil and gas as a potential source of revenues. Greece has limited oil and gas production, but it still holds out hope of large potential reserves located offshore, especially south of Crete.

Charles Ellinas