[NGW Magazine] Testing the Southern Corridor

As the Southern Gas Corridor prepares to be put through its paces, the question arises: what will be the next sources of gas for the pipeline, and how will the gas be fed into it.

Testing the initial links of the Southern Gas Corridor (SGC) from the offshore Shah Deniz gas field (SD2) in the Caspian Sea to the town of Eskisehir in western Turkey has either been started; or preparations are in hand to start testing by the end of January. They are due to be completed entirely by March 2018 using gas from the first phase of Shah Deniz, Azerbaijan’s state-run oil company Socar told NGW.

The company had told NGW January 12 that the gas flow to this route would start in fall, perhaps September.

SGC, composed of BP-led SD2, South Caucasus pipeline extention (SQPX), Trans Anatolian Pipeline (Tanap) phase zero (1350-km from Georgia's border to Eskisehir) as well as the Trans Adriatic pipeline (TAP), is to carry 16.18bn m³/yr gas to Turkey (6bn m³/yr) and the EU by early 2021.

“As of now, testing the five completed wells, the two platforms at SD2, the 500-km underwater pipelines and the Sangacahal ternimal on the coast as well as SQPX has been started and the tests of Tanap and two gas compressors in Georgia will start by the end of this month,” Socar told NGW.

A BP source told NGW earlier that in 2019 SD2 is expected to produce 2bn m³ which would all go to Turkey. “Azerbaijan’s total gas export to Turkey (SD1&2) is expected to reach 8.5bn m³ in 2019, compared with 6.5bn m³ in 2017 and to reach its contractual 12.5bn m³ in 2021."

Socar said that as of now five wells of SD2 are connected to platforms, another nine have been drilled and a further 12 wells are projected to be drilled by 2019.

“The productivity of each well (1.78mn m³/d) in SD2 is half that of SD1 as there is less pressure, but the reserves are 400bn m³, which is double SD1. In total the recoverable reserves of the three layers (SD1,2,3) stand at 1.2 trillion m³,” it said. By the end of 2017, Tanap and TAP were 87.4% and 60.8% complete respectively. Azerbaijan had spent three-quarters of its $11.5bn share of the costs of SGC by January 1.

Socar told NGW that the production level of SD1 is projected to rise by 11% to 11bn m³ in 2018 as well. “After completion of the tests on the Sangachal terminal on the Caspian coast in the near future, it will become one of the world’s biggest facilities with 60mn metric tons/yr oil and 30bn m³/yr gas injection into the grid. The consortum is also preparing to test two new gas compressors in the Georgian sector of SQPX in near future,” it said.

Azerbaijan’s gas in 2017

Socar said that 61 of its 81 fields are active including seven which are associated gas, 14 are a mix of oil and gas- condensate and two are dry gas.

condensate and two are dry gas.

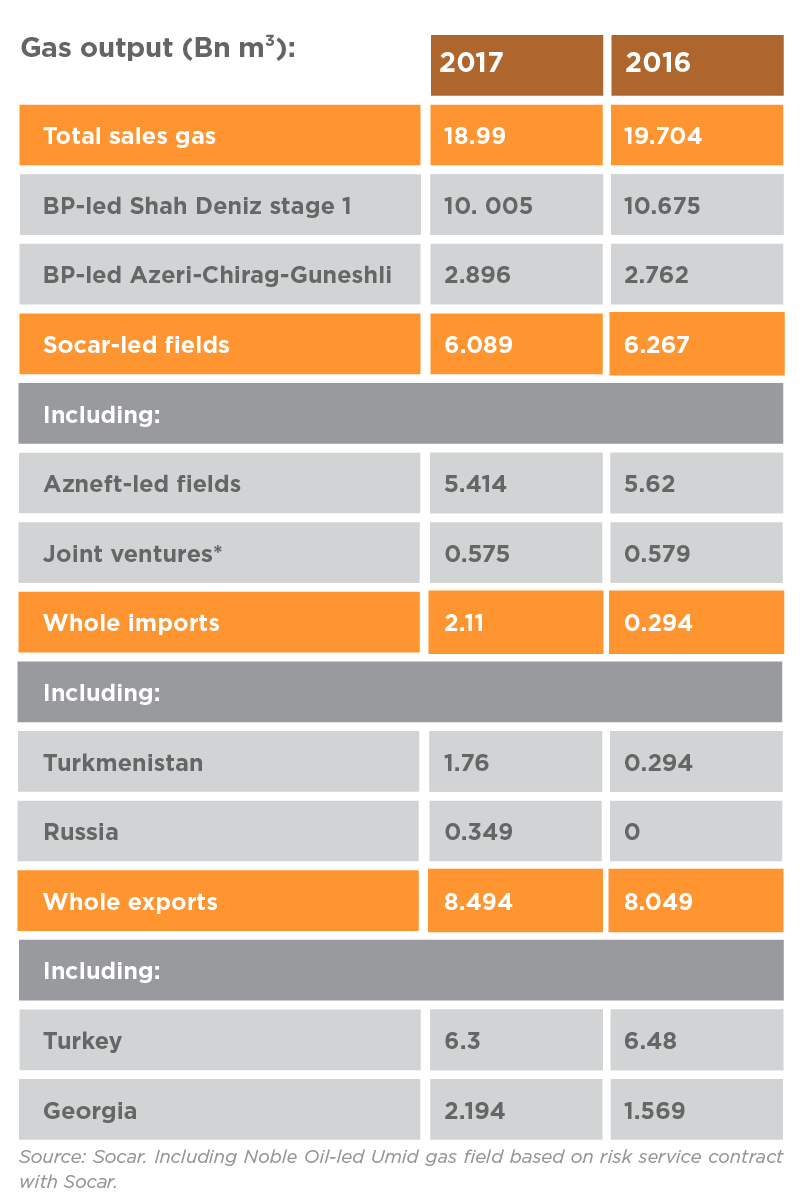

During last year, the country produced 18.99bn m³ sale gas, 3.6% less than 2016, but this year the volume will go up 4.9%.

Azerbaijan started gas imports from Turkmenistan and Russia in October 2016 and November 2017 respectively.

Possible participants in SGC expansion

The ramp-up of work in the SGC has already encouraged suppliers such as Turkmenistan and Kazakhstan as well as gas importers such as Bulgaria to join this project.

Last month, Azerbaijan and Kazakhstan established a joint -commission to evaluate LNG transit to Baku. Turkmenistan, which stopped flowing gas to Russia and Iran and now only exports gas to China, is also investigating LNG or compressed natural gas transit to Azerbaijan, although these plans have yet to prove their economic sense. (NGW Vol.3, Issue 1).

And Bulgaria which has a 1bn m³/yr gas purchase deal with the SD consortium, has requested Socar to sell its own gas to it as well.

The five Caspian littoral states have reached an agreement on the generalities of the legal status of sea, which can pave the way for construction of the 300-km Trans-Caspian pipeline from east to west, although both Russia and Iran have been opposed to letting Turkmen gas into Europe.

Dalga Khatinoglu, Ilham Shaban

.png_f1920x300q80.jpg)